Vermont Self-Employed Tailor Services Contract

Description

How to fill out Self-Employed Tailor Services Contract?

Are you in a situation where you require documents for both business or personal reasons almost every day? There are numerous valid document templates accessible online, but finding ones you can trust isn't easy.

US Legal Forms offers thousands of template forms, such as the Vermont Self-Employed Tailor Services Contract, designed to meet state and federal regulations.

If you are already familiar with the US Legal Forms website and have an account, simply Log In. After that, you can download the Vermont Self-Employed Tailor Services Contract template.

Choose a convenient document format and download your copy.

Find all the document templates you have purchased in the My documents section. You can obtain another copy of the Vermont Self-Employed Tailor Services Contract anytime, if needed. Just click on the desired form to download or print the document template.

- If you don't have an account and wish to start using US Legal Forms, follow these steps.

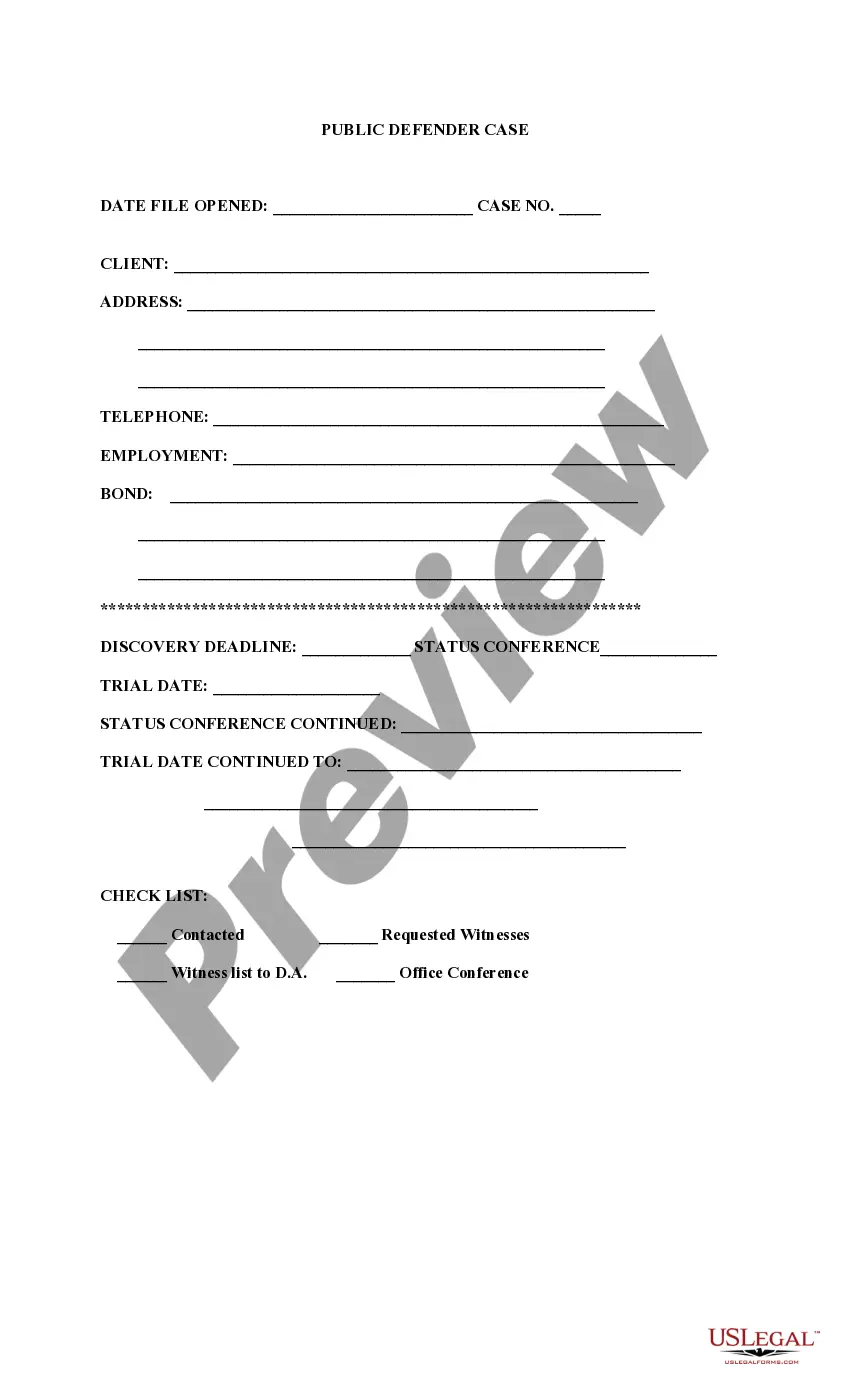

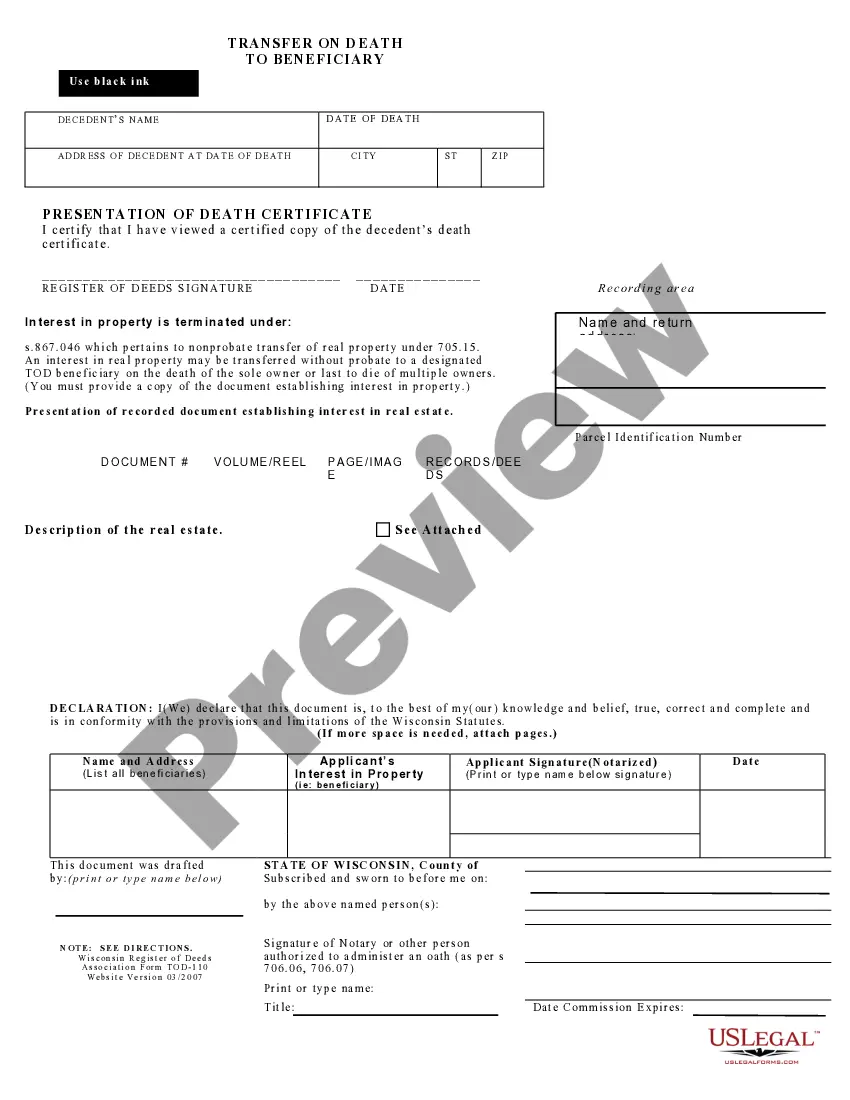

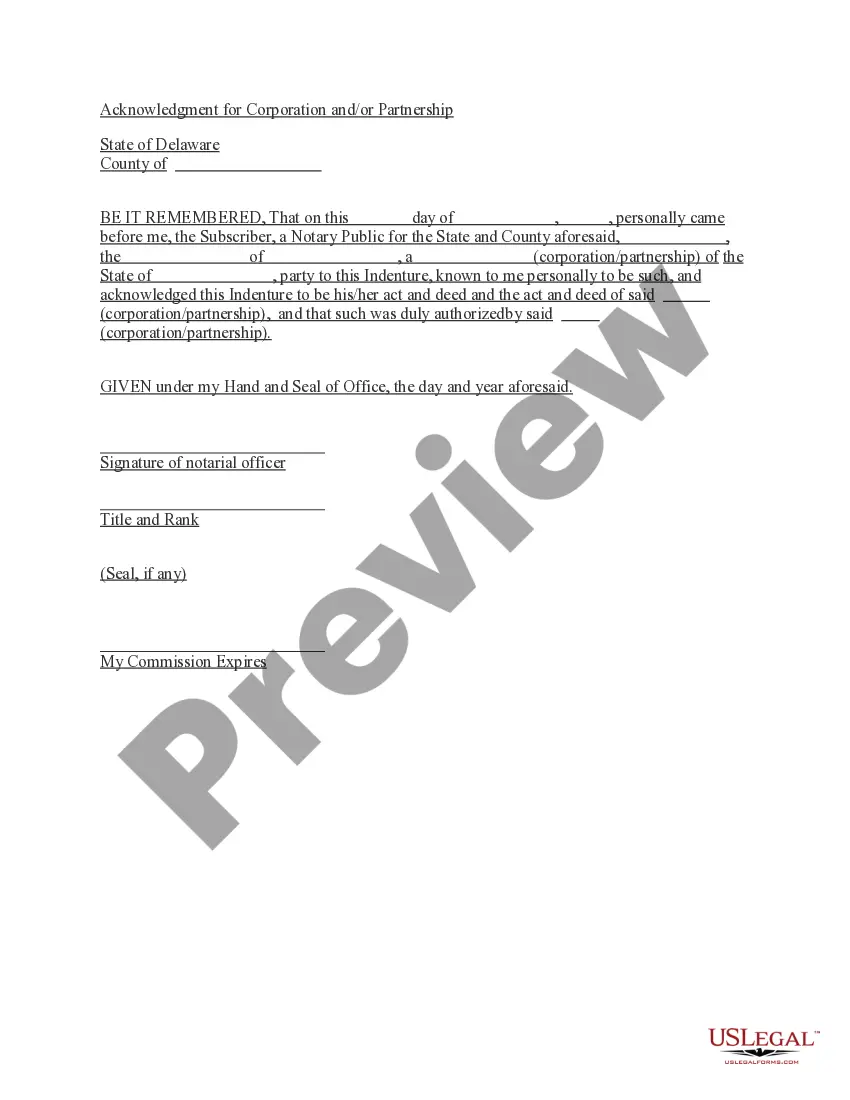

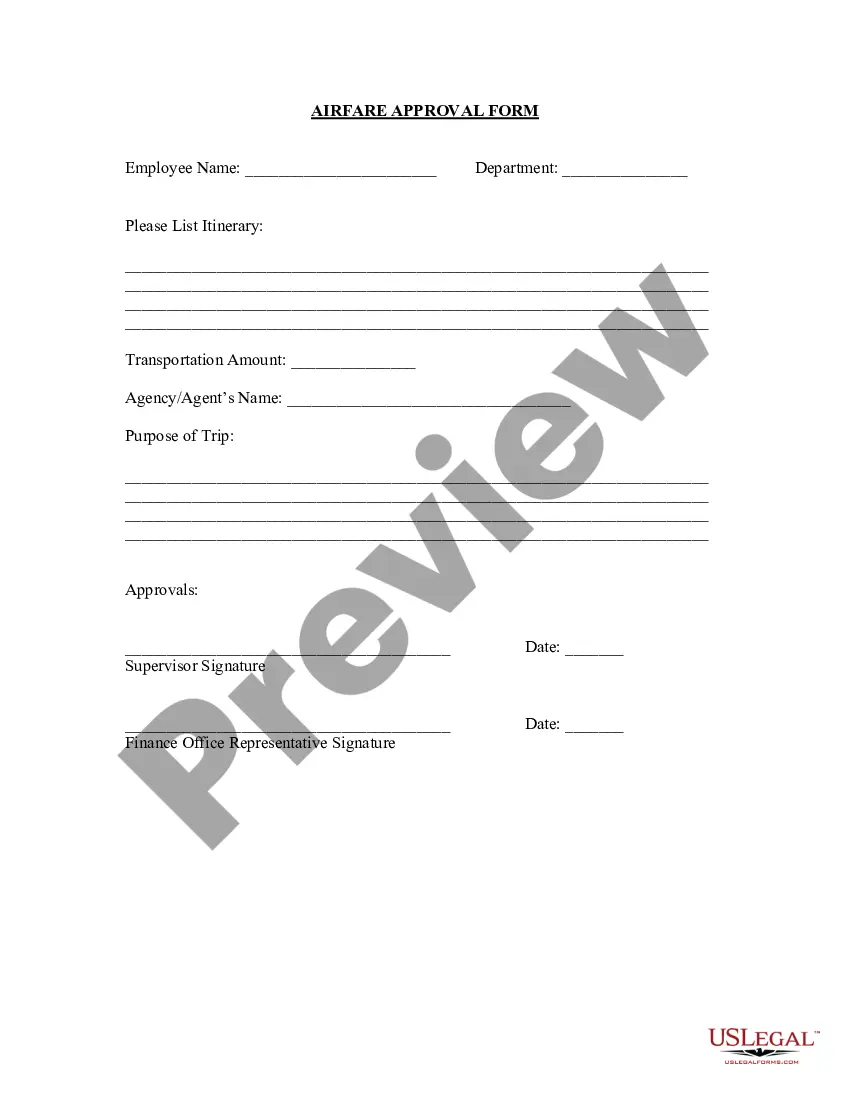

- Find the form you need and ensure it is for your correct area/county.

- Utilize the Preview feature to review the form.

- Check the description to confirm you have selected the right form.

- If the form isn't what you're looking for, use the Search field to locate the form that fits your needs and requirements.

- Once you find the correct form, click Get now.

- Select the pricing plan you want, complete the necessary details to create your account, and pay for your order using your PayPal or credit card.

Form popularity

FAQ

Writing a simple employment contract involves stating the job title, responsibilities, and payment terms. It should also cover the duration of employment and any benefits offered. Clarity is key, so avoid vague language and ensure all parties understand their obligations. Utilizing a Vermont Self-Employed Tailor Services Contract can streamline this process and provide a solid foundation for your agreement.

Yes, you can write your own legally binding contract, provided it meets specific legal requirements. Make sure to include clear terms, signatures from both parties, and consideration. To ensure your contract adheres to state laws, consider using a Vermont Self-Employed Tailor Services Contract template, which can help eliminate potential pitfalls and enhance clarity.

Writing a self-employment contract starts with outlining the services you will provide. Include details about payment, timelines, and any materials or tools you will use. It is also beneficial to address aspects like ownership of work and dispute resolution. A Vermont Self-Employed Tailor Services Contract can serve as a useful framework for ensuring all necessary elements are included.

Filling out an independent contractor agreement involves providing essential information about both parties, such as names and addresses. Specify the services to be rendered, payment details, and the duration of the contract. It is important to include terms regarding confidentiality and termination. Consider using a Vermont Self-Employed Tailor Services Contract template to guide you through this process, making it more straightforward.

To create a contract for a 1099 employee, start by clearly defining the scope of work. Include the payment terms, deadlines, and any specific requirements relevant to the project. Additionally, ensure the contract outlines the relationship between you and the independent contractor, emphasizing that they operate as a separate entity. Using a Vermont Self-Employed Tailor Services Contract template can simplify this process and ensure legal compliance.

Service contracts in Vermont are generally not taxable unless they relate to the sale of tangible personal property. Tailoring services, for example, typically fall under exempt services, which means your Vermont Self-Employed Tailor Services Contract would not be subject to sales tax. However, it’s wise to include detailed descriptions of your services to avoid any confusion. Using platforms like uslegalforms can help you create a compliant contract tailored to your specific services.

Yes, a self-employed person can absolutely have a contract. In fact, having a well-defined Vermont Self-Employed Tailor Services Contract is essential for outlining the terms of your services, payment, and responsibilities. Contracts provide legal protection and clarity for both you and your clients. If you need assistance in creating a contract that meets your needs, uslegalforms offers a variety of templates to help you get started.

In Vermont, services that are typically taxable include those related to tangible personal property, telecommunications, and certain utility services. However, many personal services, including most tailor services, are exempt from sales tax. When creating your Vermont Self-Employed Tailor Services Contract, it is beneficial to specify the nature of your services to ensure compliance with tax regulations. You can find helpful resources on uslegalforms for further guidance on drafting your contract.

In Vermont, contract labor is generally not subject to sales tax if it involves services rather than the sale of tangible goods. However, if you are providing services that include selling physical products, those products may incur sales tax. It's important to review your Vermont Self-Employed Tailor Services Contract to determine what applies specifically to your situation. For further clarity, consider consulting a tax professional or using a service like uslegalforms to draft your contract correctly.

If you are employed without a contract, you may face challenges related to payment and job expectations. A Vermont Self-Employed Tailor Services Contract helps clarify these aspects and protects your rights. Without it, you may struggle to enforce agreements or seek compensation in case of disputes.