Vermont Medical Representative Agreement - Self-Employed Independent Contractor

Description

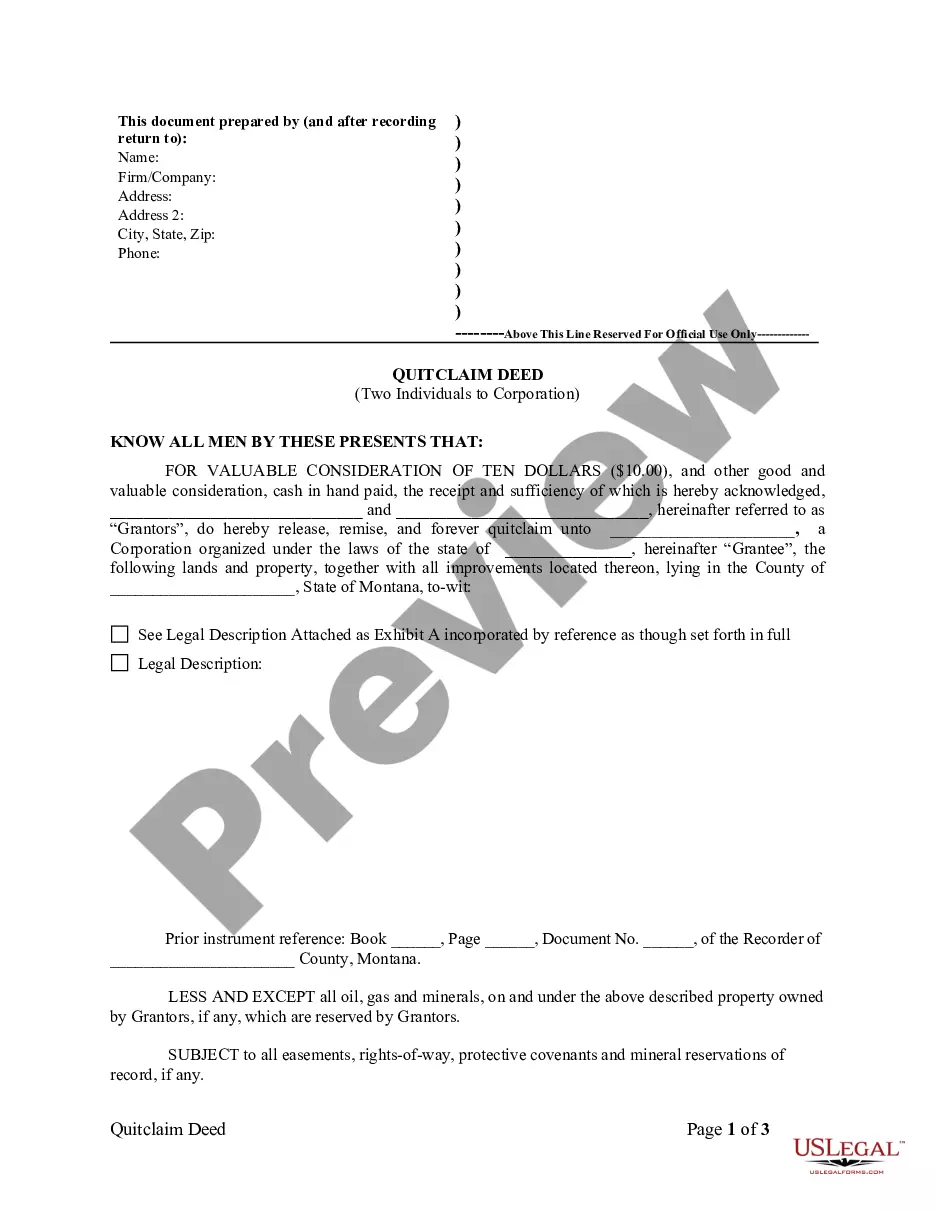

How to fill out Medical Representative Agreement - Self-Employed Independent Contractor?

US Legal Forms - one of the largest repositories of valid forms in the country - offers an extensive selection of valid document templates that you can download or print.

By using the website, you can discover thousands of forms for business and personal purposes, categorized by type, state, or keywords. You can find the latest versions of forms similar to the Vermont Medical Representative Agreement - Self-Employed Independent Contractor in just a few moments.

If you are already a member, Log In to access and download the Vermont Medical Representative Agreement - Self-Employed Independent Contractor from the US Legal Forms library. The Download button will appear on every form that you view. You can access all previously downloaded forms in the My documents section of your account.

Select the format and download the form to your device.

Make modifications. Fill out, edit, print, and sign the downloaded Vermont Medical Representative Agreement - Self-Employed Independent Contractor. Every template you save to your account has no expiration date and is yours indefinitely. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you need.

- Ensure you have selected the correct form for your city/county. Click the Review button to examine the form's content.

- Read the form summary to make certain that you have selected the proper form.

- If the form does not meet your requirements, utilize the Search field at the top of the screen to locate one that does.

- If you are satisfied with the form, confirm your choice by clicking the Get now button.

- Then, choose the pricing plan you wish and provide your details to register for an account.

- Process the transaction. Use your credit card or PayPal account to complete the payment.

Form popularity

FAQ

Yes, an independent contractor is classified as self-employed. This classification means that they control their work, manage their schedule, and are responsible for their own taxes. If you are considering entering a Vermont Medical Representative Agreement - Self-Employed Independent Contractor, understanding this classification can help you navigate your responsibilities more effectively.

A real estate salesperson operating as an independent contractor typically receives compensation through commission on sales. Instead of a salary, they earn a percentage of the sales they close, which can lead to a variable income. When setting up a Vermont Medical Representative Agreement - Self-Employed Independent Contractor, it's crucial to understand the commission structure to optimize your earning potential.

The terms self-employed and independent contractor are often used interchangeably, but each carries a subtle distinction. 'Self-employed' broadly encompasses all individuals running their own business, while 'independent contractor' refers specifically to a person who contracts services to another entity. In the context of the Vermont Medical Representative Agreement - Self-Employed Independent Contractor, using 'independent contractor' adds precision and clarity to your role.

Writing an independent contractor agreement involves several key components. Start by outlining the scope of work, payment terms, and the duration of the agreement. For those entering into a Vermont Medical Representative Agreement - Self-Employed Independent Contractor, it’s essential to include specifics about the compensation structure and any relevant performance expectations to ensure clarity between both parties.

To qualify as self-employed, you must earn income through your own business, rather than from an employer. This could involve working as an independent contractor or running your own business. With a Vermont Medical Representative Agreement - Self-Employed Independent Contractor, your role and responsibilities are clearly defined, making your self-employment status explicit.

Receiving a 1099 form typically indicates that you are self-employed. If a company provides you with a 1099 for the services you rendered, it confirms that you are not an employee, but rather, working as an independent contractor. This is relevant when discussing the Vermont Medical Representative Agreement - Self-Employed Independent Contractor, as it outlines your status clearly.

Yes, an independent contractor is indeed considered self-employed. This means that they own their business and work for themselves, without a traditional employer-employee relationship. In the context of a Vermont Medical Representative Agreement - Self-Employed Independent Contractor, this structure allows agents to manage their own schedules and work independently.

Yes, a self-employed individual can certainly have a contract. This agreement outlines the terms of work and establishes clear expectations. The Vermont Medical Representative Agreement - Self-Employed Independent Contractor serves as an excellent template to ensure that both you and your clients have a mutual understanding of the work involved.

Writing an independent contractor agreement starts with identifying key information like the parties involved, the project details, and the duration of the agreement. Clearly outline expectations and responsibilities to avoid misunderstandings. Pairing your insights with the Vermont Medical Representative Agreement - Self-Employed Independent Contractor from uslegalforms will help you draft a professional and comprehensive document.

Filling out an independent contractor agreement involves detailing essential components such as the scope of work, payment terms, and confidentiality clauses. Be clear and precise with each section to protect both parties and ensure understanding. Using the Vermont Medical Representative Agreement - Self-Employed Independent Contractor template from uslegalforms can facilitate this process by providing a structured approach.