Vermont Demolition And Disposal Contractor Agreement - Self-Employed

Description

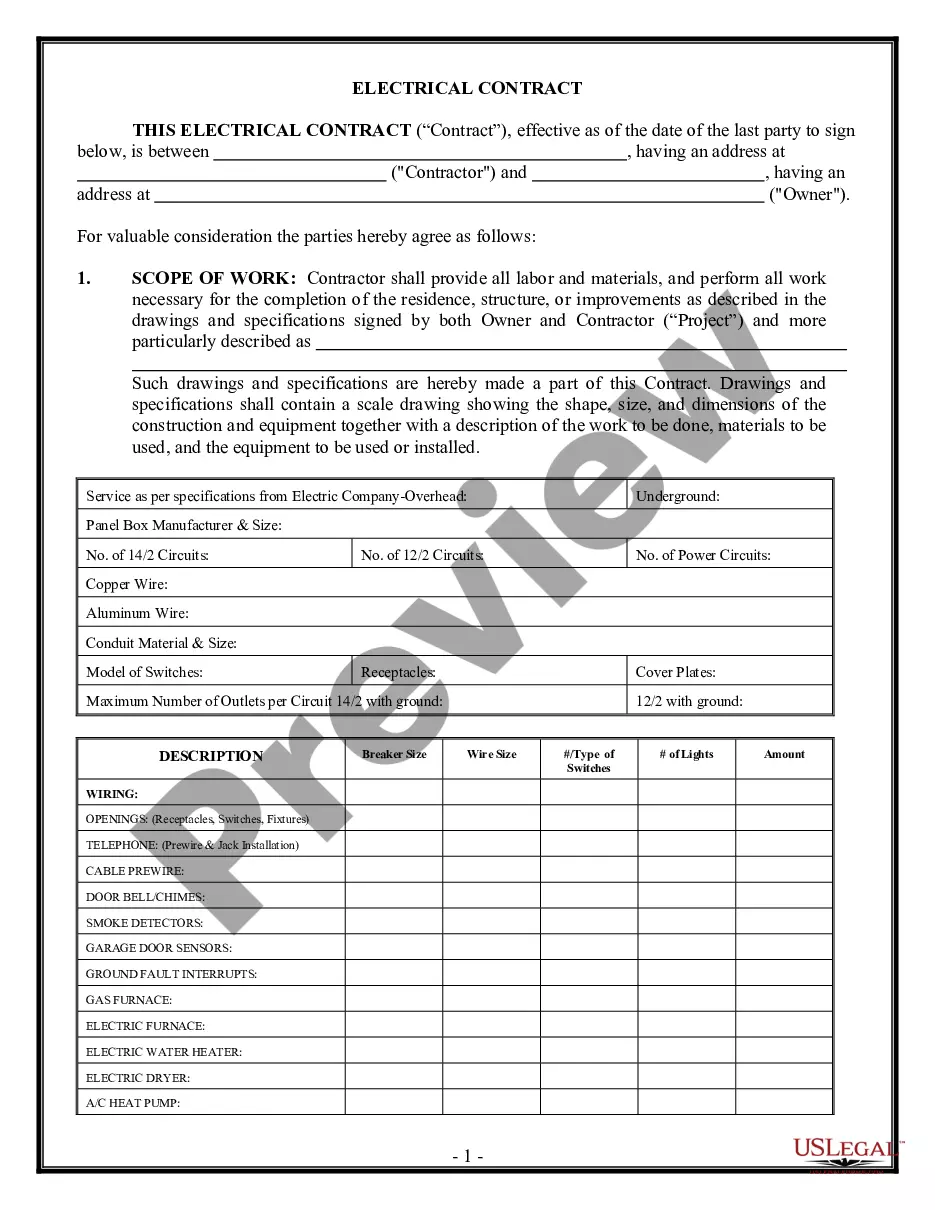

How to fill out Demolition And Disposal Contractor Agreement - Self-Employed?

Selecting the appropriate valid document format can be quite a challenge. Clearly, there are numerous templates available online, but how can you find the correct version you need? Utilize the US Legal Forms website. The service provides a vast array of templates, including the Vermont Demolition And Disposal Contractor Agreement - Self-Employed, that can be utilized for both business and personal purposes. All of the forms are reviewed by experts and meet state and federal requirements.

If you are already registered, Log In to your account and click on the Download button to obtain the Vermont Demolition And Disposal Contractor Agreement - Self-Employed. Use your account to review the valid forms you have previously purchased. Go to the My documents tab of your account and retrieve another copy of the document you need.

If you are a new user of US Legal Forms, here are simple steps for you to follow: First, ensure you have selected the correct form for your city/county. You can view the form using the Preview button and read the form description to ensure this is the right one for you. If the form does not meet your needs, use the Search field to find the correct form. Once you are sure the form is suitable, click the Purchase now button to acquire the form. Choose the pricing plan you prefer and enter the necessary information. Create your account and complete the purchase using your PayPal account or credit card. Select the file format and download the valid document format to your device. Finally, edit, print, and sign the completed Vermont Demolition And Disposal Contractor Agreement - Self-Employed.

Utilize this platform to efficiently find and manage your legal documentation needs.

- US Legal Forms is the largest collection of legal forms.

- Find a variety of document templates.

- Use the service to obtain professionally created paperwork.

- Ensure compliance with state requirements.

- Access templates for various needs.

- Simplify the document selection process.

Form popularity

FAQ

To write a termination letter for an independent contractor, you should clearly state the reason for the termination, refer to the Vermont Demolition And Disposal Contractor Agreement - Self-Employed, and provide a final payment date. Keep the tone professional and direct, specifying any outstanding obligations that need to be fulfilled. Including a thank you for the work done can also help maintain a positive relationship for future opportunities.

As an independent contractor under the Vermont Demolition And Disposal Contractor Agreement - Self-Employed, you have the right to set your own schedule and select your clients. You also have the freedom to determine how to complete your projects, allowing for creativity in your work. Additionally, you can negotiate your fees and receive payment directly for the services you provide. It's important to understand these rights to protect your interests and ensure a successful freelance career.

To write an independent contractor agreement, begin with a clear introduction stating the purpose. Follow this with sections detailing payment, project scope, and termination clauses. The Vermont Demolition And Disposal Contractor Agreement - Self-Employed serves as an excellent resource, guiding you through the process of drafting an effective agreement tailored to your needs.

Filling out an independent contractor form involves providing your personal information, your business details, and the specific services you offer. Make sure to mention your payment details and any tax identification numbers. You can find a comprehensive Vermont Demolition And Disposal Contractor Agreement - Self-Employed form that streamlines this process for you.

To write a simple contract agreement, start by clearly stating the agreement's purpose. Include the terms of service, the payment structure, and the responsibilities of each party. A well-structured Vermont Demolition And Disposal Contractor Agreement - Self-Employed can help you write an effective contract that protects both you and your client.

Legal requirements for independent contractors vary by state, but generally include obtaining the necessary licenses and permits. In Vermont, it’s crucial to comply with local regulations that pertain to demolition and disposal. The Vermont Demolition And Disposal Contractor Agreement - Self-Employed outlines obligations that can help you stay compliant while working.

Filling out an independent contractor agreement involves identifying both parties, defining the scope of work, and specifying payment terms. You also need to include details regarding the duration of the agreement and any specific conditions. Utilizing the Vermont Demolition And Disposal Contractor Agreement - Self-Employed template can simplify this process and ensure all necessary elements are covered.

Becoming a contractor in Vermont involves registering your business, obtaining a contractor's license, and ensuring you meet local regulations. Start by drafting a Vermont Demolition And Disposal Contractor Agreement - Self-Employed to protect your rights and outline your responsibilities. You can also utilize services like USLegalForms, which provides valuable templates and resources for setting your business up for success. Make sure you stay informed about industry standards and requirements to thrive.

A key requirement for being classified as an independent contractor in Vermont is demonstrating control over your work. You must have the autonomy to decide how, when, and where to perform your tasks, rather than following strict instructions from a client. Having a Vermont Demolition And Disposal Contractor Agreement - Self-Employed can help clarify this relationship. This agreement defines the terms of your work and solidifies your status as an independent contractor.

To set up as an independent contractor in Vermont, you'll need to choose a business structure, register your business, and obtain any necessary licenses. As part of your setup, having a Vermont Demolition And Disposal Contractor Agreement - Self-Employed is crucial. This document will guide your operations and clarify your obligations to clients. Additionally, consider consulting platforms like USLegalForms to ensure you have everything you need to start successfully.