Vermont Acoustical Contractor Agreement - Self-Employed

Description

How to fill out Acoustical Contractor Agreement - Self-Employed?

Selecting the appropriate legal document format can be a challenge. Of course, there are numerous templates available online, but how can you find the legal form you need? Utilize the US Legal Forms website. This service offers a vast selection of templates, including the Vermont Acoustical Contractor Agreement - Self-Employed, suitable for both business and personal requirements. All documents are reviewed by experts and comply with state and federal regulations.

If you are already registered, Log In to your account and click the Download button to retrieve the Vermont Acoustical Contractor Agreement - Self-Employed. Use your account to access the legal forms you have previously acquired. Visit the My documents section of your account and obtain another copy of the documents you need.

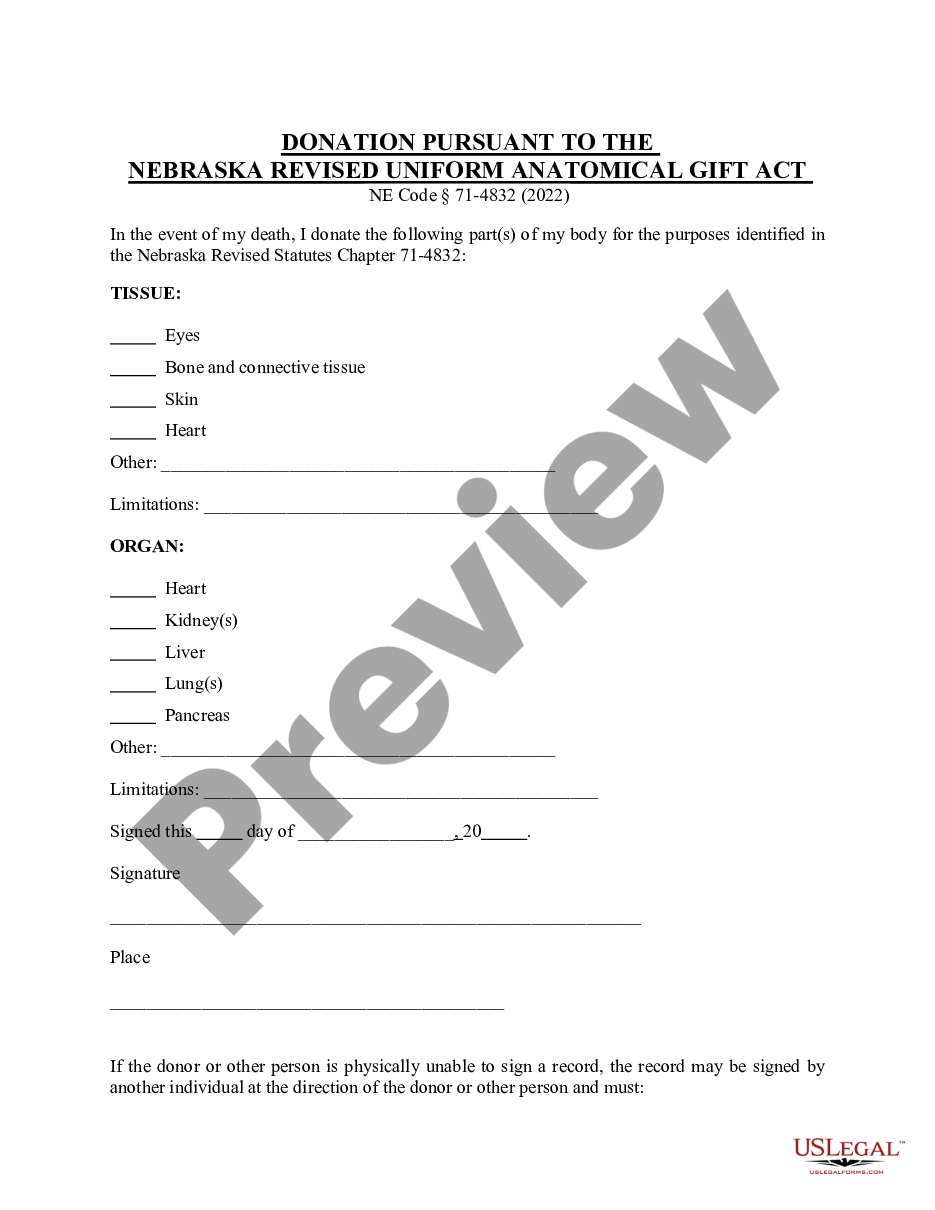

If you are a new user of US Legal Forms, here are simple steps you should follow: First, ensure you have selected the correct form for your city/state. You can review the form using the Review option and read the form description to confirm it is suitable for you. If the form does not meet your needs, use the Search field to find the right document. Once you are confident that the form is appropriate, select the Purchase now button to obtain the document. Choose the pricing plan you prefer and enter the necessary information. Create your account and pay for the order using your PayPal account or credit card. Select the document format and download the legal document format to your device. Complete, edit, print, and sign the downloaded Vermont Acoustical Contractor Agreement - Self-Employed.

Take advantage of the resources available on US Legal Forms to simplify your legal document needs.

- US Legal Forms is the largest repository of legal forms where you can find a variety of document templates.

- Utilize the service to obtain properly crafted paperwork that adhere to state requirements.

- Ensure you have chosen the right document before proceeding.

- Use the review feature to understand the document before purchase.

- Access previous forms easily through your account.

- Download, complete, and sign your documents as needed.

Form popularity

FAQ

To be an independent contractor, you need a clear understanding of your skills and the market. You must also have the necessary licenses and permits for your specific trade. A Vermont Acoustical Contractor Agreement - Self-Employed is essential for formalizing the terms of your work and ensuring that you receive fair compensation for your services.

Setting yourself up as a contractor involves several steps. Start by choosing your business structure and registering your business name. Ensure you have the right licenses and permits for your field. A Vermont Acoustical Contractor Agreement - Self-Employed is vital for outlining your obligations and ensuring both you and your clients are clear on the scope of work.

As an independent contractor, you have the right to work on your own terms and decide how to complete your projects. You also have the right to receive payment for your work as outlined in your Vermont Acoustical Contractor Agreement - Self-Employed. Importantly, you can establish your own hours and choose the clients you wish to work with.

To set up as a self-employed contractor in Vermont, first, you need to choose a business structure. Most opt for a sole proprietorship, which is simple to set up. Next, register your business name and obtain any necessary permits. Finally, create a Vermont Acoustical Contractor Agreement - Self-Employed to outline the terms of your work.

Filling out an independent contractor agreement involves several steps, starting with detailing the parties involved and the nature of the work. Clearly articulate payment terms and deadlines to prevent misunderstandings. Remember to outline responsibilities and include clauses that safeguard both parties, such as confidentiality and dispute resolution. For efficiency, consider accessing templates through USLegalForms for a comprehensive approach to the Vermont Acoustical Contractor Agreement - Self-Employed.

An independent contractor should fill out various forms, including a W-9 for tax purposes and an independent contractor agreement, like the Vermont Acoustical Contractor Agreement - Self-Employed. Additionally, if applicable, you might need to provide invoices for work completed. Utilizing a resource like USLegalForms can ensure you have all the necessary documentation for a smooth working relationship.

To fill out an independent contractor form, you should start by entering your personal details, including name and address, followed by the contractor’s information. Next, specify the type of work being performed and the payment details, reflecting the Vermont Acoustical Contractor Agreement - Self-Employed. Lastly, sign and date the form to validate it. If you're uncertain, consider using online platforms like USLegalForms for guidance.

Writing an independent contractor agreement, such as the Vermont Acoustical Contractor Agreement - Self-Employed, requires outlining the scope of work, payment terms, and duration of the contract. Start by clearly defining the services you expect from the contractor. Also, include confidentiality clauses and termination conditions to protect both parties. Lastly, ensure that both parties review and sign the agreement to make it legally binding.

Yes, having a contract as an independent contractor is important and often necessary. A Vermont Acoustical Contractor Agreement - Self-Employed protects your rights by outlining the expectations for both you and your client. It helps clarify your role, payment schedule, and any project-specific requirements. Choosing to use an agreement not only fosters trust but also safeguards against potential legal issues down the road.

Creating an independent contractor agreement involves several key steps. First, detail the scope of work and identify the parties involved. Next, include payment terms and deadlines to avoid any confusion. Finally, you can streamline this process by using a Vermont Acoustical Contractor Agreement - Self-Employed template, available on platforms like US Legal Forms, making it easy to customize for your specific needs.