"Summary of High Technology Developments Affecting Real Estate Financing" is a American Lawyer Media form. This form is a summary booklet of High Technology affecting real estate financing.

Vermont Summary of High Technology Developments Affecting Real Estate Financing

Description

How to fill out Summary Of High Technology Developments Affecting Real Estate Financing?

Are you presently in a place where you need documents for either enterprise or personal reasons nearly every day? There are a variety of legal papers web templates available online, but getting kinds you can depend on is not straightforward. US Legal Forms provides thousands of form web templates, just like the Vermont Summary of High Technology Developments Affecting Real Estate Financing, that happen to be composed to fulfill state and federal needs.

Should you be presently acquainted with US Legal Forms web site and possess a free account, just log in. Following that, you are able to obtain the Vermont Summary of High Technology Developments Affecting Real Estate Financing web template.

Should you not come with an account and wish to begin using US Legal Forms, abide by these steps:

- Get the form you will need and ensure it is to the correct metropolis/area.

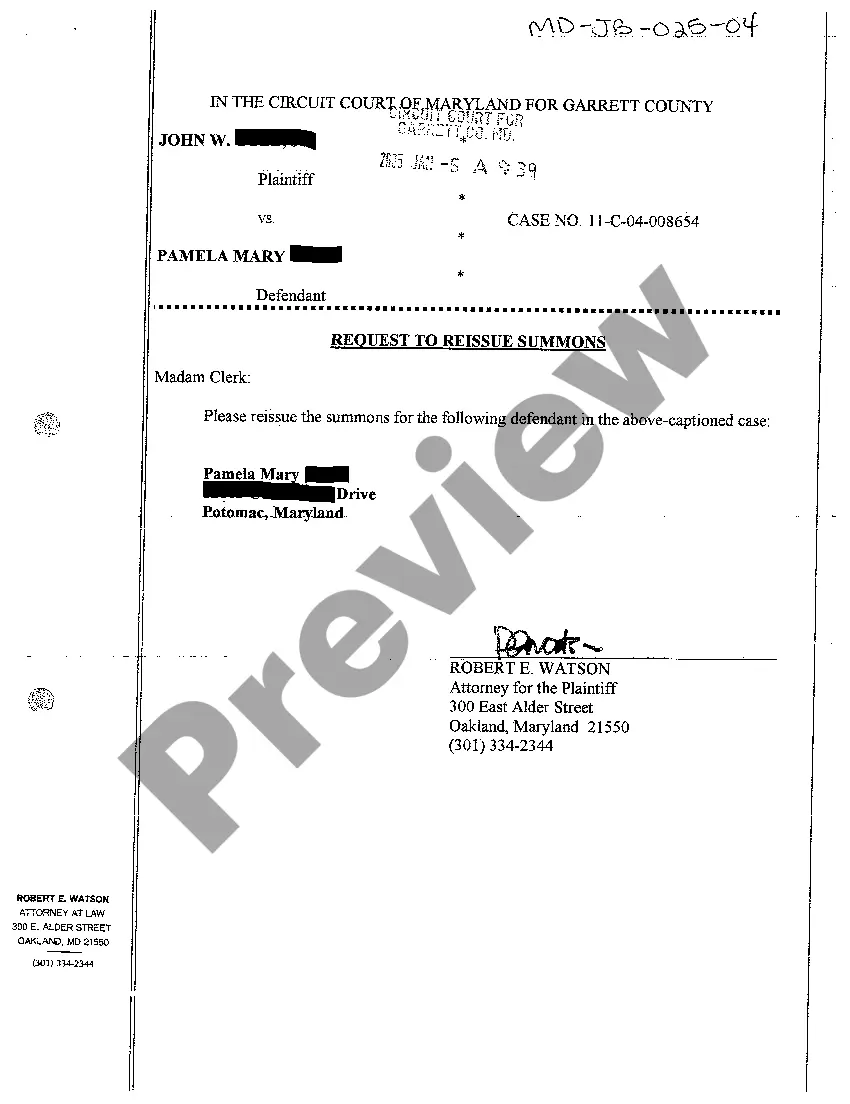

- Use the Review option to analyze the form.

- Browse the explanation to actually have chosen the proper form.

- If the form is not what you are searching for, utilize the Look for industry to obtain the form that meets your needs and needs.

- Once you discover the correct form, click Acquire now.

- Pick the rates prepare you would like, fill in the desired info to generate your account, and pay for the order using your PayPal or bank card.

- Decide on a practical document file format and obtain your copy.

Find all of the papers web templates you possess purchased in the My Forms menu. You can aquire a further copy of Vermont Summary of High Technology Developments Affecting Real Estate Financing whenever, if necessary. Just click on the essential form to obtain or printing the papers web template.

Use US Legal Forms, one of the most substantial assortment of legal varieties, to save some time and stay away from errors. The service provides expertly created legal papers web templates which you can use for an array of reasons. Generate a free account on US Legal Forms and start generating your daily life easier.

Form popularity

FAQ

CALIFORNIA: The legal rate of interest is 10% for consumers; the general usury limit for non-consumers is more than 5% greater than the Federal Reserve Bank of San Francisco's rate.

Chapter 113 : Judgment Lien (c) Interest on a judgment lien shall accrue at the rate of 12 percent per annum. (d) If a judgment lien is not satisfied within 30 days of recording, it may be foreclosed and redeemed as provided in this title and V.R.C.P.

Usury laws set a limit on the amount of interest that can be charged on different kinds of loans. While most states have usury laws, national banks can charge the highest interest rate allowed in the bank's home state ? not the cardholder's.

Vermont Interest Rate Laws When considering a personal loans in Vermont, the statutory interest rate for these types of unsecured, consumer loans is 12 percent. This is the maximum interest that can be charged on any personal, consumer loan in the State of Vermont.

VERMONT: The legal rate of interest and judgment rate of interest is 12%. On retail installment contracts, the maximum rate is 18% on the first $500, 15% above $500. The general usury limit is 12%.

Usury occurs when money is lent at a rate that is higher than the rate permitted by law or at a rate that is considered unreasonably high. All States and the District of Columbia have laws governing the legal interest rate permitted, including what constitutes usurious lending.