Vermont Term Sheet - Convertible Debt Financing

Description

How to fill out Term Sheet - Convertible Debt Financing?

Discovering the right lawful record format could be a have a problem. Obviously, there are a lot of layouts available on the Internet, but how will you get the lawful kind you need? Make use of the US Legal Forms site. The assistance gives a large number of layouts, such as the Vermont Term Sheet - Convertible Debt Financing, which you can use for enterprise and personal needs. Each of the types are checked by specialists and meet up with federal and state requirements.

In case you are presently signed up, log in to your profile and then click the Acquire key to obtain the Vermont Term Sheet - Convertible Debt Financing. Make use of your profile to search throughout the lawful types you possess ordered formerly. Proceed to the My Forms tab of your own profile and get one more version of the record you need.

In case you are a brand new end user of US Legal Forms, allow me to share straightforward directions that you should comply with:

- Initially, ensure you have selected the right kind for your personal town/area. You are able to examine the shape while using Review key and study the shape explanation to ensure this is basically the right one for you.

- When the kind fails to meet up with your requirements, utilize the Seach area to discover the proper kind.

- When you are positive that the shape is proper, go through the Acquire now key to obtain the kind.

- Opt for the rates prepare you need and enter in the necessary info. Create your profile and pay money for an order making use of your PayPal profile or Visa or Mastercard.

- Pick the submit file format and acquire the lawful record format to your system.

- Total, edit and print out and sign the attained Vermont Term Sheet - Convertible Debt Financing.

US Legal Forms will be the biggest catalogue of lawful types where you will find various record layouts. Make use of the company to acquire professionally-produced papers that comply with express requirements.

Form popularity

FAQ

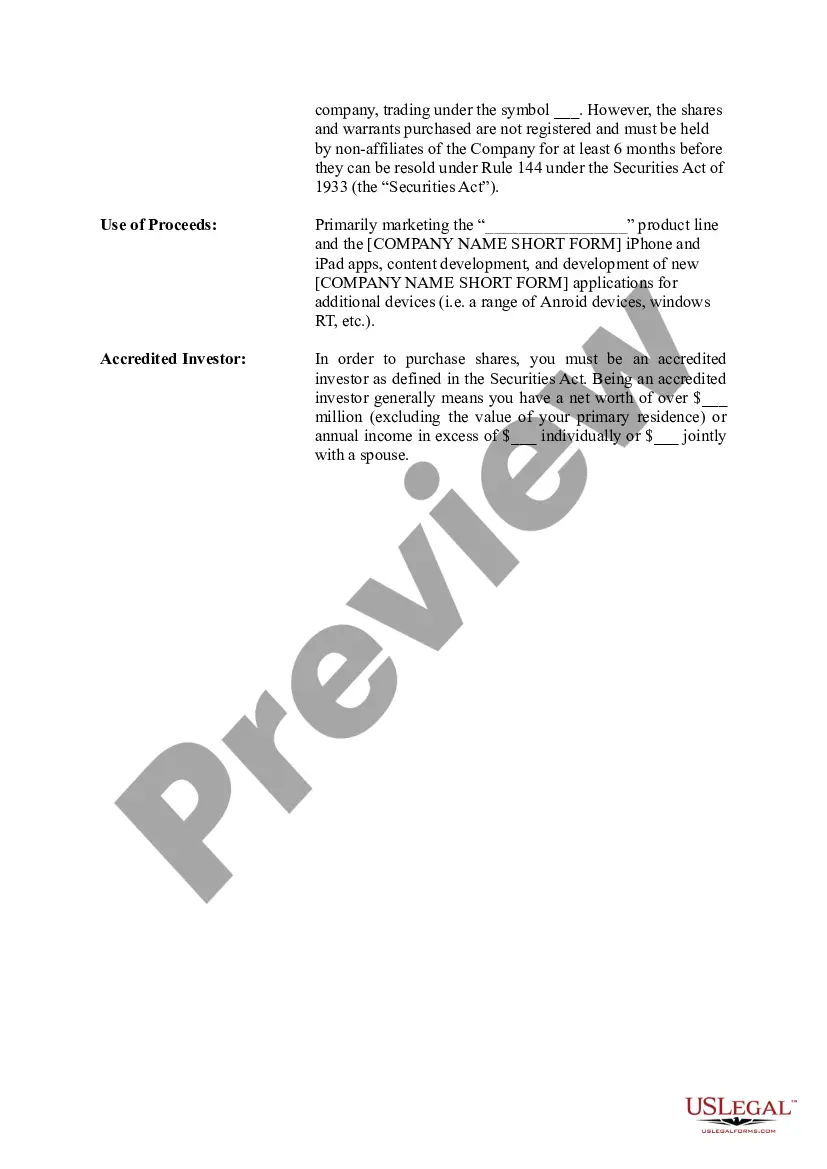

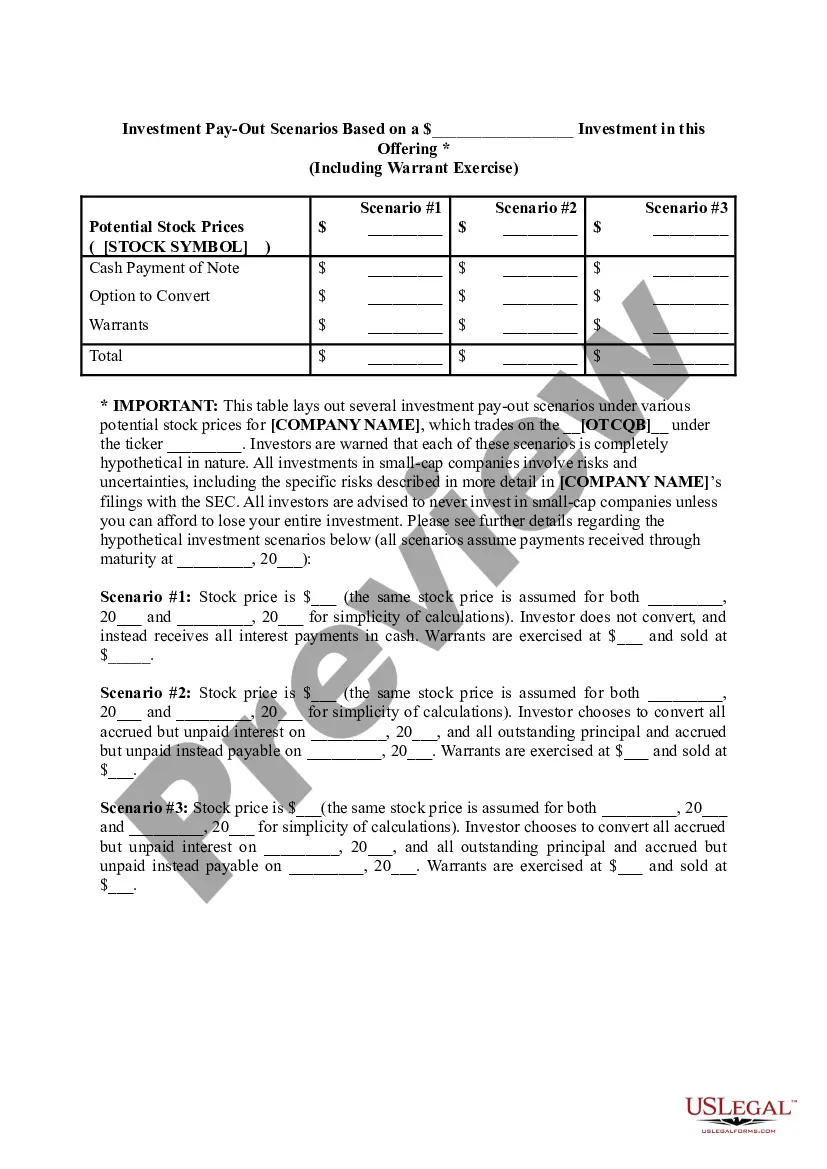

Convertible debt is a debt hybrid product with an embedded option that allows the holder to convert the debt into equity in the future. The ratio is calculated by dividing the convertible security's par value by the conversion price of equity.

Convertible debt is a debt hybrid product with an embedded option that allows the holder to convert the debt into equity in the future. The ratio is calculated by dividing the convertible security's par value by the conversion price of equity. Conversion Ratio: Definition, How It's Calculated, and Examples Investopedia ? ... ? Financial Ratios Investopedia ? ... ? Financial Ratios

For tax purposes, the tax basis of the convertible debt is the entire proceeds received at issuance of the debt. Thus, the book and tax bases of the convertible debt are different. ASC 740-10-55-51 addresses whether a deferred tax liability should be recognized for that basis difference.

The conversion price of the convertible security is the price of the bond divided by the conversion ratio. If the bonds par value is $1000, the conversion price is calculated by dividing $1000 by 5, or $200. If the conversion ratio is 10, the conversion price drops to $100. Conversion Price: Definition and Calculation Formula Investopedia ? ... ? Investing Basics Investopedia ? ... ? Investing Basics

Share. Convertible debt definition. With convertible debt, a business borrows money from a lender or investor where both parties enter the agreement with the intent (from the outset) to repay all (or part) of the loan by converting it into a certain number of its preferred or common shares at some point in the future. What is convertible debt? | BDC.ca BDC ? ... ? Glossary BDC ? ... ? Glossary

Convertible Notes are loans ? so they are recorded on the Balance Sheet of a company as a liability when they are made. Depending on the debt's maturity date, they can either be shown as a current liability (loans maturing within 12 months) or as a Long-term liability (loans maturing over 12 months).

Although it is customary to forego a term sheet, in some cases it may be required if the parties need to negotiate certain terms. It can be advantageous to use a term sheet for the company to easily summarize the terms of the notes for potential other investors purchasing a convertible note.

Value of convertible bond = independent value of straight bond + independent value of conversion option. Convertible Bond vs. Traditional Bond Valuations: What's the Difference? investopedia.com ? ask ? answers ? how-co... investopedia.com ? ask ? answers ? how-co...