Vermont Domestic Subsidiary Security Agreement regarding ratable benefit of Lenders and Agent

Description

How to fill out Domestic Subsidiary Security Agreement Regarding Ratable Benefit Of Lenders And Agent?

Are you in a placement the place you will need papers for either company or individual purposes almost every day time? There are a lot of legitimate record themes available online, but locating versions you can depend on is not straightforward. US Legal Forms delivers 1000s of develop themes, just like the Vermont Domestic Subsidiary Security Agreement regarding ratable benefit of Lenders and Agent, which can be published to meet state and federal specifications.

When you are already familiar with US Legal Forms web site and possess an account, merely log in. Following that, you can download the Vermont Domestic Subsidiary Security Agreement regarding ratable benefit of Lenders and Agent format.

If you do not provide an bank account and need to begin using US Legal Forms, abide by these steps:

- Get the develop you will need and make sure it is for the correct area/area.

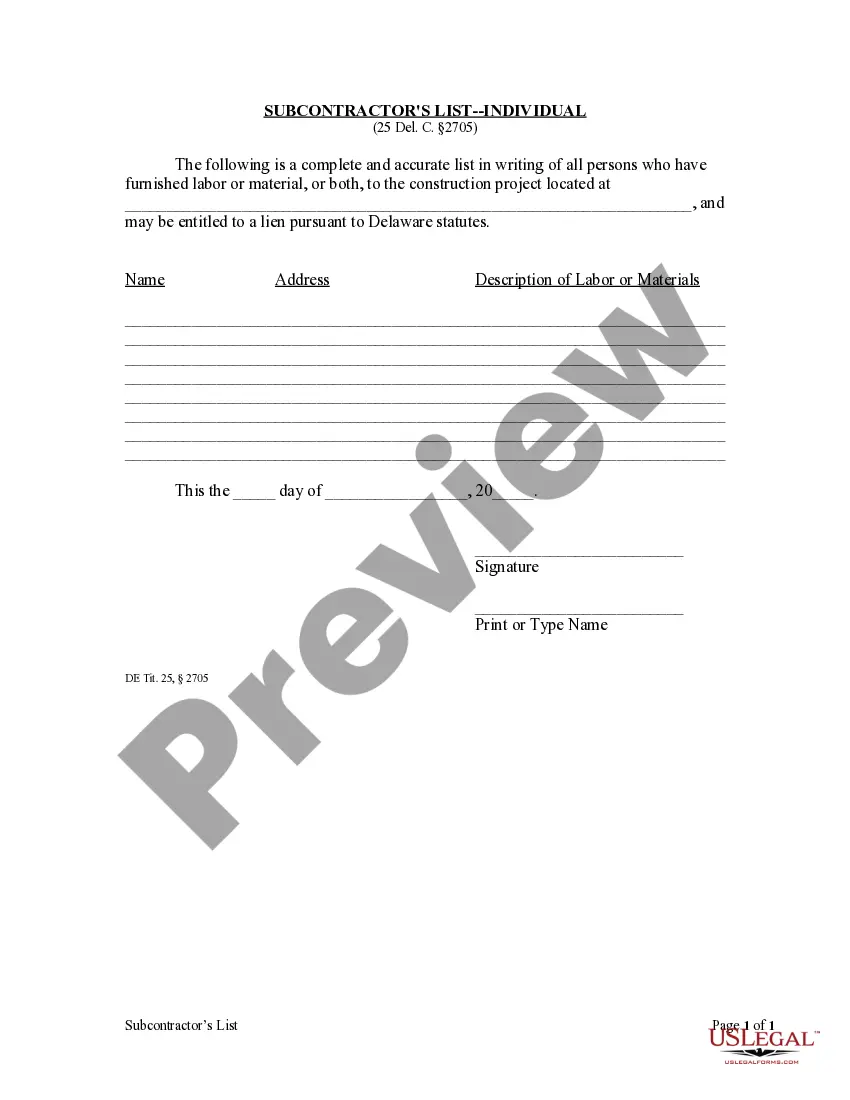

- Use the Preview key to analyze the form.

- See the explanation to actually have selected the appropriate develop.

- In the event the develop is not what you are looking for, take advantage of the Research field to get the develop that meets your needs and specifications.

- Whenever you obtain the correct develop, click Acquire now.

- Choose the pricing strategy you would like, fill out the specified information and facts to produce your money, and pay money for your order utilizing your PayPal or bank card.

- Select a handy document structure and download your backup.

Get all the record themes you may have purchased in the My Forms food list. You may get a additional backup of Vermont Domestic Subsidiary Security Agreement regarding ratable benefit of Lenders and Agent any time, if necessary. Just click the required develop to download or produce the record format.

Use US Legal Forms, one of the most considerable collection of legitimate types, in order to save time and avoid blunders. The assistance delivers appropriately manufactured legitimate record themes that can be used for a selection of purposes. Make an account on US Legal Forms and start generating your life easier.

Form popularity

FAQ

The main risks are that the borrower becomes insolvent and/or that the value of the collateral provided falls below the cost of replacing the securities that have been lent. If both of these were to occur, the lender would suffer a financial loss equal to the difference between the two.

This security is called collateral, which minimizes the risk for lenders by ensuring that the borrower keeps up with their financial obligation. The borrower has a compelling reason to repay the loan on time because if they default, they stand to lose their home or other assets pledged as collateral.

The securities lending agreement spells out the term of the loan, the fee that the lender receives and the amount and type of collateral to be posted, among other items. The collateral is generally between 102% and 105% of the fair value of the securities loaned.

From the lender's point of view, the benefits of securities lending include the ability to earn additional income through the fee charged to the borrower to borrow the security. It could also be viewed as a form of diversification. From the borrower's point of view, it allows them to take positions like short selling.

Mortgages, charges, pledges and liens are all types of security. The main types of quasi-security are guarantees and indemnities, comfort letters, set-off, netting, standby credits, on demand guarantees and bonds and retention of title (ROT) arrangements.

Several types of collateral can be used for a secured personal loan. Your options may include cash in a savings account, a car or a house. There are two types of loans you can obtain from banks or other financial institutions: secured loans and unsecured loans.

Collateral. Collateral is an asset you can pledge to the lender as an additional form of security, should you not be able to repay the loan. Collateral can help a borrower secure the financing they need and can help the lender recoup their investment if the borrower defaults on the loan.