Vermont Security Agreement regarding Member Interests in Limited Liability Company

Description

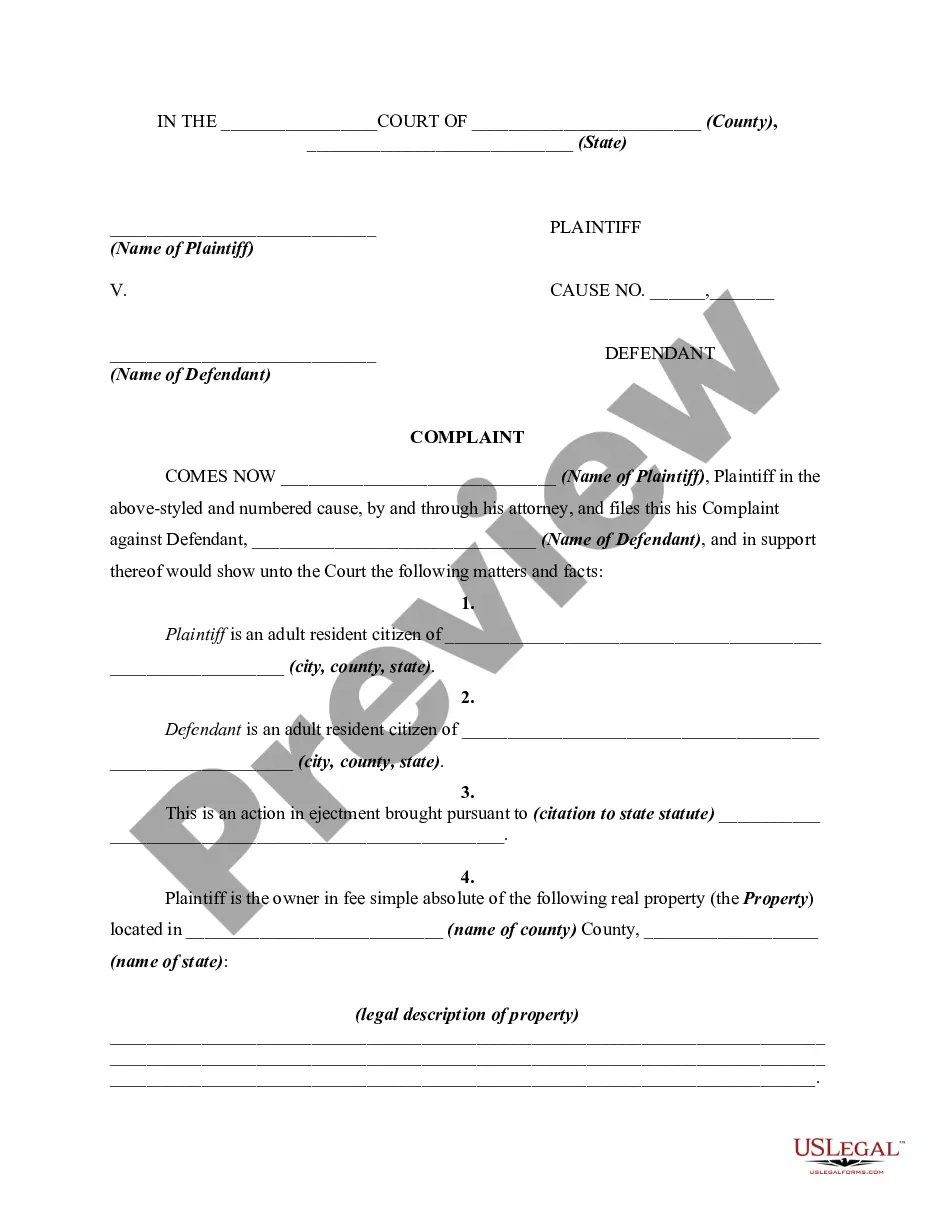

How to fill out Security Agreement Regarding Member Interests In Limited Liability Company?

Identifying the suitable legal document template can be quite a challenge.

Clearly, there are numerous templates available online, but how can you find the legal form you need.

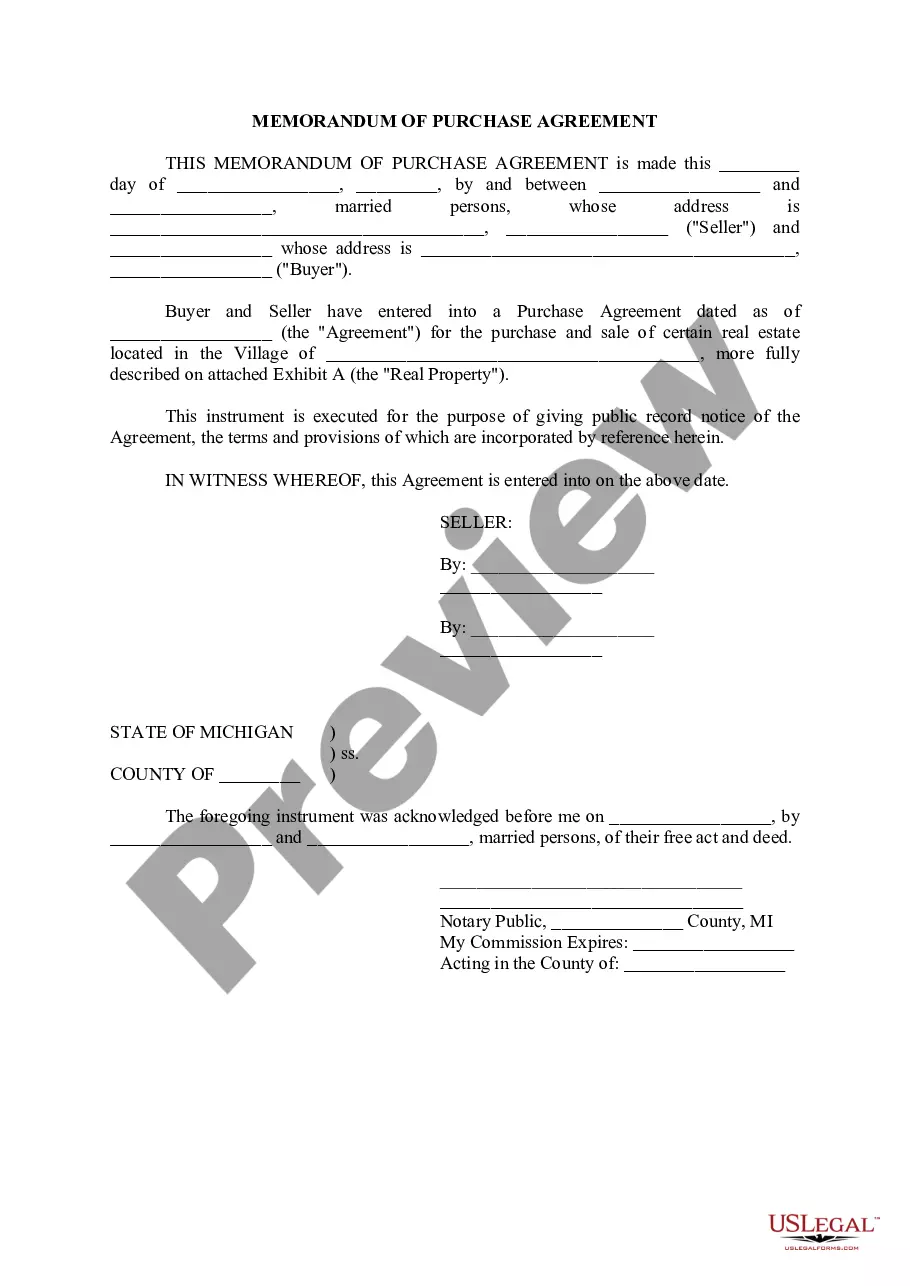

Utilize the US Legal Forms website. This service offers thousands of templates, including the Vermont Security Agreement regarding Member Interests in Limited Liability Company, applicable for business and personal purposes.

If the form does not meet your needs, use the Search field to find the appropriate template.

- All of the templates are reviewed by experts and comply with both federal and state regulations.

- If you are already registered, Log In to your account and click the Obtain button to acquire the Vermont Security Agreement regarding Member Interests in Limited Liability Company.

- Use your account to search through the legal forms you have previously purchased.

- Visit the My documents tab of your account to get another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions to follow.

- First, ensure you have selected the correct form for your city/region. You can examine the form using the Review button and read the form description to confirm this is suitable for you.

Form popularity

FAQ

Yes, LLCs possess membership interests, which represent ownership in the company. These interests determine the members' voting rights, profit distribution, and responsibilities within the LLC. Understanding membership interests is vital for effective management and decision-making. Explore how a Vermont Security Agreement regarding Member Interests in Limited Liability Company can help clarify these interests.

The main reason people form LLCs is to avoid personal liability for the debts of a business they own or are involved in. By forming an LLC, only the LLC is liable for the debts and liabilities incurred by the businessnot the owners or managers.

Limited liability protection means that if your company incurs legal liability, personal assets stay protected. The extent and nature of that protection varies from state to state, so you want to be sure to speak with an attorney to make sure that you get it right.

As a general rule, limited liability companies (LLCs) protect business owners' personal assets from liability for financial obligations, judgments, and other problems the business might experience.

What Type of Liability Protection Do You Get With an LLC? The main reason people form LLCs is to avoid personal liability for the debts of a business they own or are involved in. By forming an LLC, only the LLC is liable for the debts and liabilities incurred by the businessnot the owners or managers.

Limited liability is a form of legal protection for shareholders and owners that prevents individuals from being held personally responsible for their company's debts or financial losses.

Limited liability insurance is coverage for a partner in a business. This type of insurance provides protection for individuals, not a collective, and protects personal and private assets.

5 steps for maintaining personal asset protection and avoiding piercing the corporate veilUndertaking necessary formalities.Documenting your business actions.Don't comingle business and personal assets.Ensure adequate business capitalization.Make your corporate or LLC status known.

Limited liability - The company has its own legal entity so the liability of members or shareholders is limited and generally they will not be personally liable for the debts of the company.

The members of an LLC can decide how to operate the various aspects of the business by forming an operating agreement. An operating agreement is not required for an LLC to exist, and if there is one, it need not be in writing. LLC members should protect their interests by creating a written operating agreement.