Vermont Nonqualified Stock Option Plan of MNX Carriers, Inc.

Description

How to fill out Nonqualified Stock Option Plan Of MNX Carriers, Inc.?

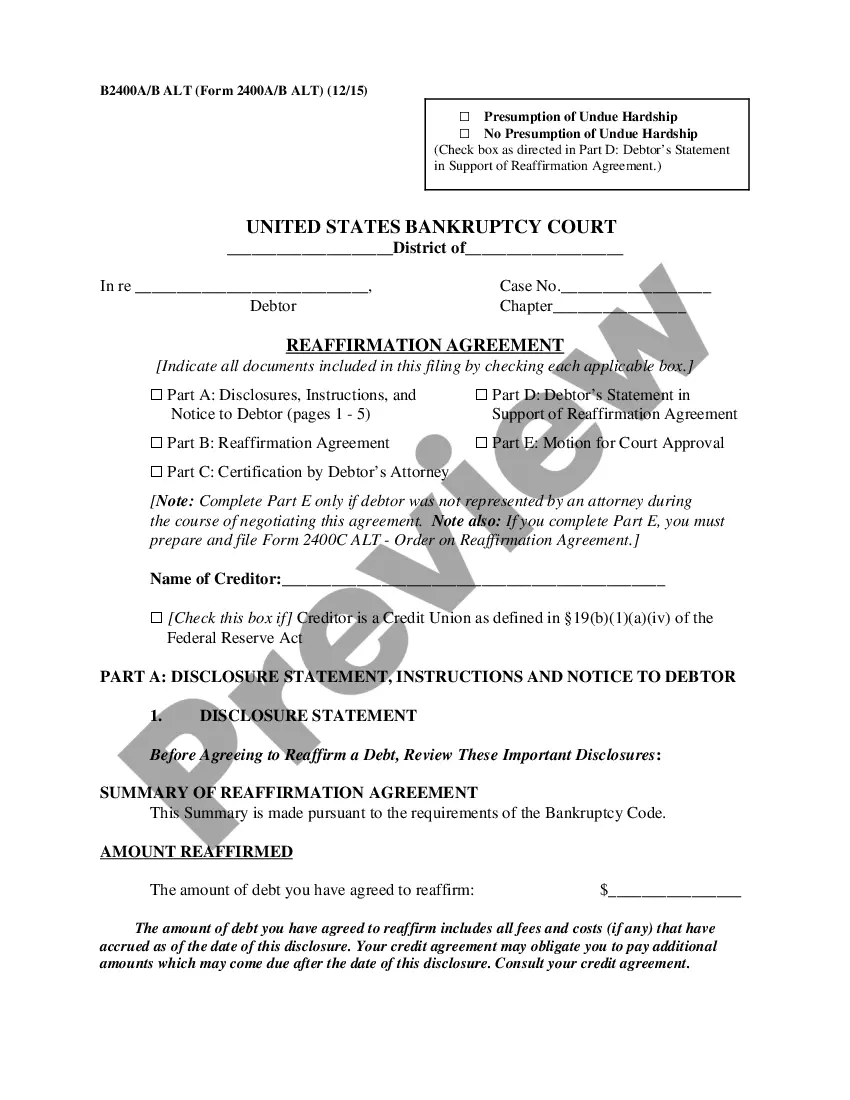

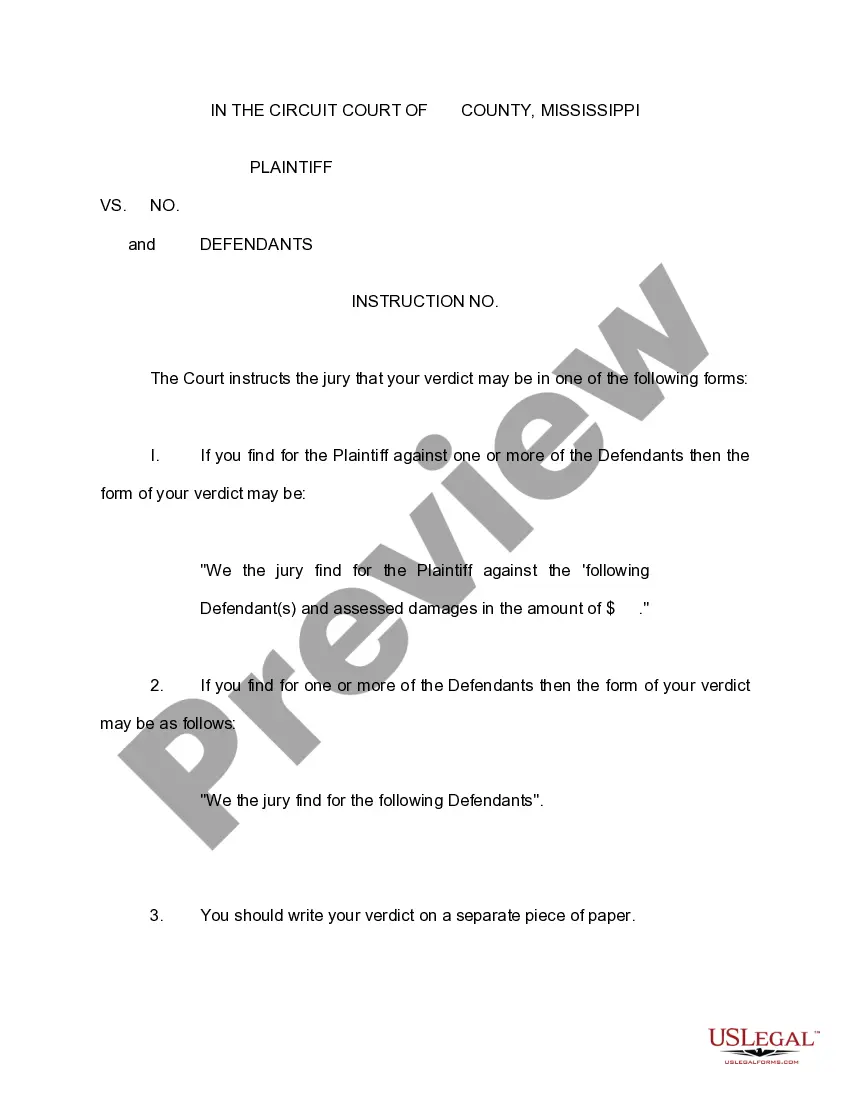

You may commit hrs on-line attempting to find the authorized record design which fits the state and federal specifications you will need. US Legal Forms supplies 1000s of authorized forms that are evaluated by specialists. You can easily obtain or print the Vermont Nonqualified Stock Option Plan of MNX Carriers, Inc. from the service.

If you already have a US Legal Forms accounts, you may log in and then click the Obtain switch. Afterward, you may total, edit, print, or indicator the Vermont Nonqualified Stock Option Plan of MNX Carriers, Inc.. Every authorized record design you purchase is yours for a long time. To acquire another duplicate for any purchased kind, go to the My Forms tab and then click the related switch.

If you are using the US Legal Forms web site initially, keep to the straightforward guidelines beneath:

- Very first, make certain you have selected the proper record design to the area/metropolis of your choosing. Read the kind outline to make sure you have picked out the proper kind. If readily available, make use of the Review switch to look throughout the record design also.

- If you would like locate another variation from the kind, make use of the Research industry to obtain the design that meets your requirements and specifications.

- After you have discovered the design you want, simply click Buy now to continue.

- Choose the rates strategy you want, enter your accreditations, and sign up for your account on US Legal Forms.

- Comprehensive the transaction. You may use your bank card or PayPal accounts to purchase the authorized kind.

- Choose the file format from the record and obtain it in your system.

- Make adjustments in your record if necessary. You may total, edit and indicator and print Vermont Nonqualified Stock Option Plan of MNX Carriers, Inc..

Obtain and print 1000s of record web templates making use of the US Legal Forms Internet site, which offers the greatest collection of authorized forms. Use skilled and condition-particular web templates to tackle your small business or person needs.

Form popularity

FAQ

The income related to the option exercise should be included in the Form W-2 you receive from your employer or 1099-NEC from the company if you are a non-employee. Any capital gain or loss amount may also be reportable on your US Individual Income Tax Return (Form 1040), Schedule D and Form 8949 in the year of sale.

What Is a Non-Qualified Stock Option (NSO)? A non-qualified stock option (NSO) is a type of employee stock option wherein you pay ordinary income tax on the difference between the grant price and the price at which you exercise the option.

Non-qualified stock options require payment of income tax of the grant price minus the price of the exercised option. NSOs might be provided as an alternative form of compensation. Prices are often similar to the market value of the shares.

NSOs vs. RSUs NSOs give you the option to buy stock, but you might decide to never exercise them if the company's valuation falls below your strike price. In comparison, restricted stock units (RSUs) are actual shares that you acquire as they vest. You don't have to pay to exercise RSUs; you simply receive the shares.

Incentive stock options (ISOs) are a form of equity compensation that allows you to buy company shares for a specific exercise price. ISOs are a type of stock option?they are not actual shares of stock; you must exercise (buy) your options to become a shareholder.

Examples of NSOs If you had the option to purchase 100 shares, you could pay $1,000 to exercise those options at $10 per share. If the stock price rose to $20 per share, you could exercise the options for $1,000, then sell the 100 shares for $20 per share, or $2,000. You'd make $1,000 in profit.

Stock options grant employees the right to purchase shares, but it's not an obligation for them to do so. ISOs have the potential for favorable tax treatment. If a stock option isn't an ISO, it's typically referred to as a nonqualified stock option. NQOs don't qualify for special tax treatment.

A major difference is that the NSO tax is withheld at the point of exercise whereas the potential AMT on ISOs isn't due until you file taxes next April. You won't know if you are even subject to AMT until after your taxes have been calculated.