It is not uncommon to encounter a situation where a mineral owner owns all the mineral estate in a tract of land, but the royalty interest in that tract has been divided and conveyed to a number of parties; i.e., the royalty ownership is not common in the entire tract. If a lease is granted by the mineral owner on the entire tract, and the lessee intends to develop the entire tract as a producing unit, the royalty owners may desire to enter into an agreement providing for all royalty owners in the tract to participate in production royalty, regardless of where the well is actually located on the tract. This form of agreement accomplishes this objective.

Oklahoma Commingling and Entirety Agreement by Royalty Owners Where the Royalty Ownership Is Not Common

Description

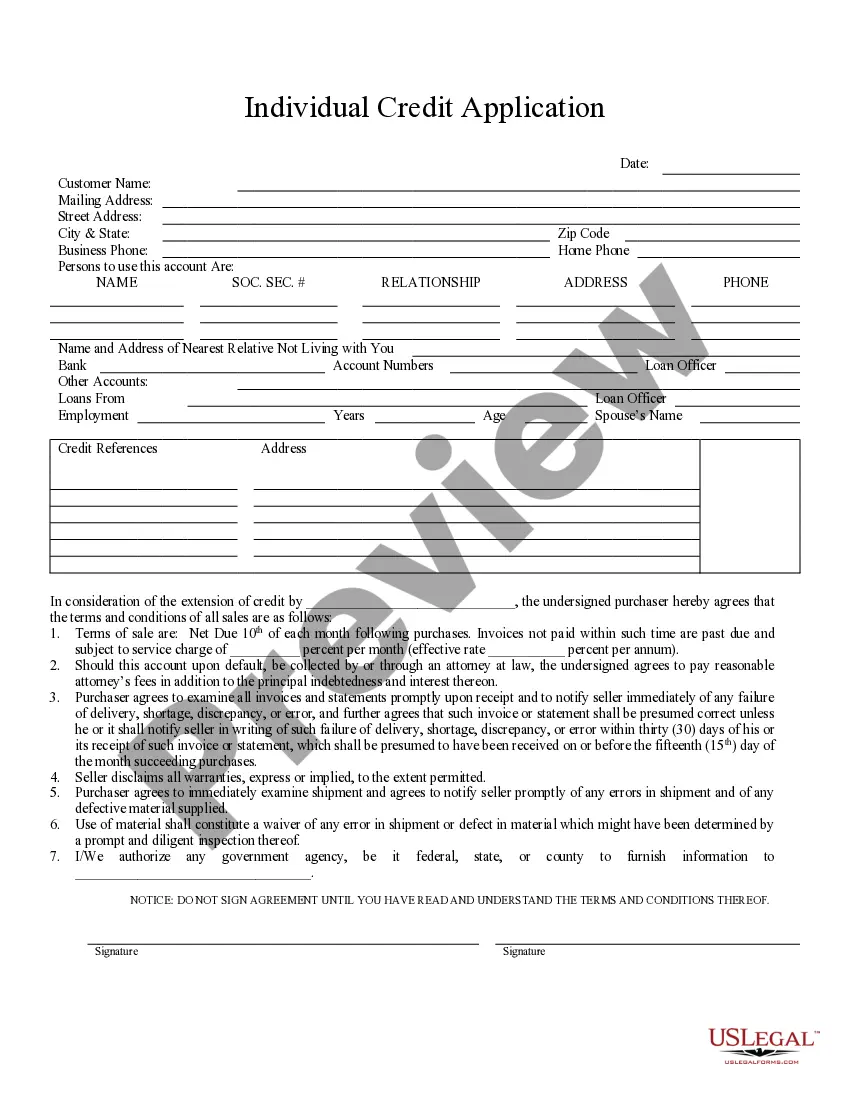

How to fill out Commingling And Entirety Agreement By Royalty Owners Where The Royalty Ownership Is Not Common?

Choosing the right authorized papers template can be a have difficulties. Needless to say, there are a lot of layouts available online, but how do you obtain the authorized develop you want? Take advantage of the US Legal Forms internet site. The service gives a large number of layouts, including the Oklahoma Commingling and Entirety Agreement by Royalty Owners Where the Royalty Ownership Is Not Common, which can be used for business and personal needs. Every one of the kinds are checked out by specialists and meet up with state and federal demands.

In case you are presently authorized, log in in your bank account and click the Down load key to have the Oklahoma Commingling and Entirety Agreement by Royalty Owners Where the Royalty Ownership Is Not Common. Make use of your bank account to check through the authorized kinds you may have acquired formerly. Go to the My Forms tab of the bank account and have one more copy from the papers you want.

In case you are a brand new user of US Legal Forms, listed here are easy directions that you should comply with:

- First, ensure you have selected the proper develop to your metropolis/county. You may check out the shape using the Review key and browse the shape outline to make sure it will be the right one for you.

- If the develop does not meet up with your requirements, make use of the Seach industry to discover the appropriate develop.

- When you are certain the shape is proper, click the Purchase now key to have the develop.

- Opt for the prices prepare you would like and type in the needed details. Make your bank account and pay money for the order utilizing your PayPal bank account or bank card.

- Choose the submit format and down load the authorized papers template in your device.

- Full, change and printing and indicator the acquired Oklahoma Commingling and Entirety Agreement by Royalty Owners Where the Royalty Ownership Is Not Common.

US Legal Forms may be the most significant catalogue of authorized kinds where you can discover numerous papers layouts. Take advantage of the company to down load skillfully-created files that comply with state demands.

Form popularity

FAQ

Mineral interests are defined by the Texas Property Tax Code as real property and are subject to taxes the same as all other real property. When do mineral interests become taxable? Mineral interests become taxable on January 1 of the year following the first production of the unit.

Mineral rights in Texas are the rights to mineral deposits that exist under the surface of a parcel of property. This right normally belongs to the owner of the surface estate; however, in Texas those rights can be transferred through sale or lease to a second party.

Whether mineral rights transfer with the property depends on the estate type. If it's a severed estate, surface rights and mineral rights are separate and do not transfer together. However, if it's a unified estate, the land and the mineral rights can be conveyed with the property.

Effect of Property Taxes on Mineral Rights Oklahoma has no inheritance tax. Capital gains tax must be paid on any sale of mineral rights and income generated from royalty streams. However, if the mineral rights have not been severed from the property, the county may not charge taxes beyond property taxes.

?To pay Lessor for gas (including casinghead gas) and all other substance covered hereby, a royalty of 3/16 of the proceeds realized by Lessee from the sale thereof.? This simply means the operator will pay a royalty of 3/16 of revenue generated from production on the property.

The record owner must: TITLE: Title the property "Transfer-on-death" by making a new deed. NAME: Name the person to get the land, home or mineral interest when the record owner dies on the new deed. This person is called the "beneficiary." SIGN: Sign the deed before two witnesses and a notary.

An attorney can create a deed or assignment that conveys the mineral rights to the new owners. The original deed will need to be recorded in the county where the minerals are located. If there are producing wells on the property, each operator will need to be notified of the change in ownership.

Yes, it can be beneficial to sell your mineral rights for a fair price, even producing rights. First, sellers must be aware of the different stages of the production process. They must also know the value their minerals and royalties command in every development stage.

The only way to determine mineral rights ownership in Oklahoma is to do a title search at the courthouse where the property is located. To do this, you must review all deeds and other legal conveyances pertaining to the subject tract back to 1907. Mineral ownership information is not available online from any website.