Vermont Utilization by a REIT of partnership structures in financing five development projects

Description

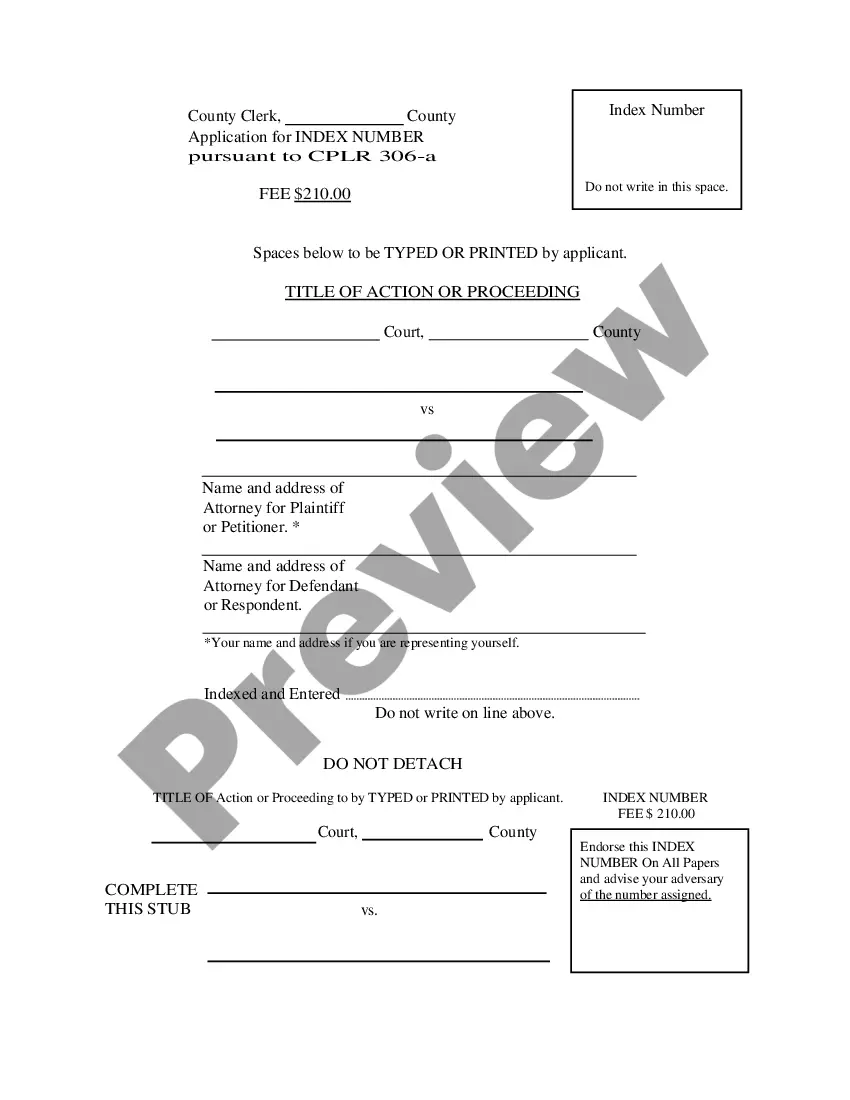

How to fill out Utilization By A REIT Of Partnership Structures In Financing Five Development Projects?

If you wish to total, acquire, or produce authorized document layouts, use US Legal Forms, the most important variety of authorized varieties, that can be found online. Use the site`s simple and convenient look for to get the documents you require. Numerous layouts for company and specific uses are sorted by groups and states, or search phrases. Use US Legal Forms to get the Vermont Utilization by a REIT of partnership structures in financing five development projects within a number of mouse clicks.

In case you are already a US Legal Forms buyer, log in to the account and click on the Obtain switch to find the Vermont Utilization by a REIT of partnership structures in financing five development projects. You may also gain access to varieties you in the past delivered electronically from the My Forms tab of your own account.

If you work with US Legal Forms initially, refer to the instructions under:

- Step 1. Be sure you have chosen the shape to the proper city/country.

- Step 2. Make use of the Review method to check out the form`s articles. Never overlook to see the outline.

- Step 3. In case you are unsatisfied using the develop, make use of the Research field near the top of the display screen to find other variations of the authorized develop template.

- Step 4. Once you have discovered the shape you require, click on the Acquire now switch. Pick the pricing plan you favor and put your qualifications to register to have an account.

- Step 5. Method the transaction. You can utilize your credit card or PayPal account to complete the transaction.

- Step 6. Select the file format of the authorized develop and acquire it on your own device.

- Step 7. Full, change and produce or signal the Vermont Utilization by a REIT of partnership structures in financing five development projects.

Each and every authorized document template you acquire is yours for a long time. You may have acces to every single develop you delivered electronically with your acccount. Click the My Forms area and decide on a develop to produce or acquire once again.

Remain competitive and acquire, and produce the Vermont Utilization by a REIT of partnership structures in financing five development projects with US Legal Forms. There are many professional and status-particular varieties you can use for the company or specific demands.

Form popularity

FAQ

Though they're different groupings, all REITs are structured as C-corporations for tax purposes that are allowed a special tax deduction for dividends paid from taxable income. For a REIT to receive a dividend paid deduction (DPD), they are required to make an election and adhere to certain rules and compliance.

There are three types of REITs: Equity REITs. Most REITs are equity REITs, which own and manage income-producing real estate. ... Mortgage REITs. ... Hybrid REITs.

The two main types of REITs are equity REITs and mortgage REITs, commonly known as mREITs. Equity REITs generate income through the collection of rent on, and from sales of, the properties they own for the long-term. mREITs invest in mortgages or mortgage securities tied to commercial and/or residential properties.

General requirements A REIT cannot be closely held. A REIT will be closely held if more than 50 percent of the value of its outstanding stock is owned directly or indirectly by or for five or fewer individuals at any point during the last half of the taxable year, (this is commonly referred to as the 5/50 test).

There are three types of REITs: Equity REITs. Most REITs are equity REITs, which own and manage income-producing real estate. ... Mortgage REITs. ... Hybrid REITs.

There are two main types of real estate investment trusts (REITs) that investors can buy: equity REITs and mortgage REITs. Equity REITs own and operate properties, while mortgage REITs invest in mortgages and related assets.

In a side-by-side structure, a REIT operates alongside other investment vehicles, such as private equity funds or other non-REIT structures. This arrangement allows investors to choose between traditional REIT investments and alternative investment strategies offered by the other vehicles.

Real estate fund strategies are often categorized into one or a combination of the following types. Real Estate Development Funds. Joint Venture Real Estate Funds. Structured Finance Real Estate Funds. Opportunistic/ Special Opportunity Funds. Distressed Asset Funds. Multi-Strategy Funds. Closed-End Structure.