Massachusetts Accredited Investor Certification Letter

Description

To become an accredited investor the (SEC) requires certain wealth, income or knowledge requirements. The investor must fall into one of three categories. Firms selling unregistered securities must put investors through their own screening process to determine if investors can be considered an accredited investor.

The Verifying Individual or Entity should take reasonable steps to verify and determined that an Investor is an "accredited investor" as such term is defined in Rule 501 of the Securities Act, and hereby provides written confirmation. This letter serves to help the Entity determine status.

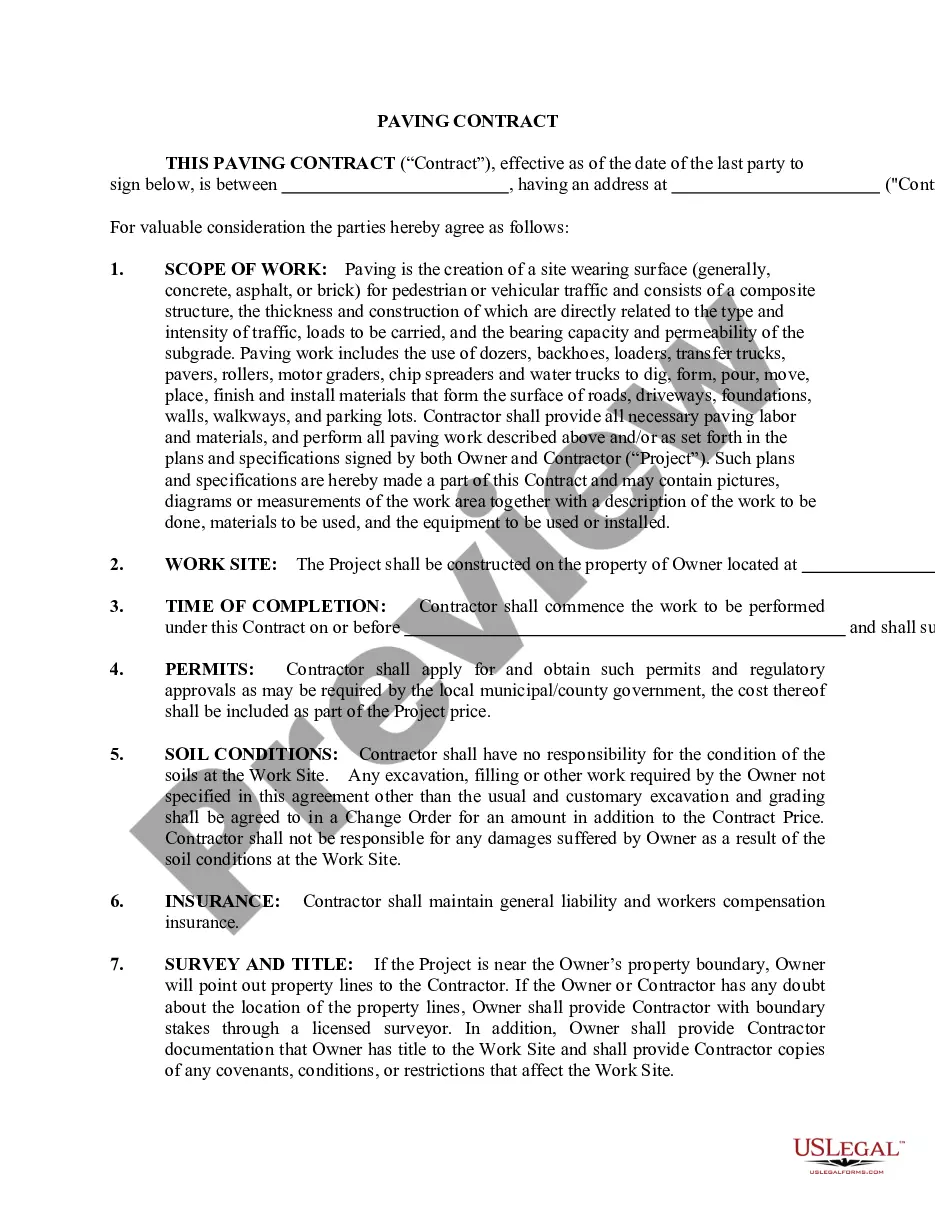

How to fill out Accredited Investor Certification Letter?

If you wish to comprehensive, acquire, or printing legal file layouts, use US Legal Forms, the most important collection of legal kinds, that can be found on-line. Take advantage of the site`s simple and easy handy search to discover the paperwork you will need. Various layouts for organization and specific purposes are categorized by classes and claims, or search phrases. Use US Legal Forms to discover the Massachusetts Accredited Investor Certification Letter within a few clicks.

If you are already a US Legal Forms customer, log in for your accounts and click the Acquire option to get the Massachusetts Accredited Investor Certification Letter. Also you can accessibility kinds you previously delivered electronically within the My Forms tab of your accounts.

If you work with US Legal Forms for the first time, follow the instructions beneath:

- Step 1. Be sure you have selected the form for the right city/region.

- Step 2. Make use of the Preview solution to examine the form`s information. Do not forget about to read the outline.

- Step 3. If you are unsatisfied using the type, take advantage of the Research industry towards the top of the monitor to find other versions of your legal type web template.

- Step 4. After you have found the form you will need, click on the Buy now option. Select the pricing prepare you favor and include your qualifications to register on an accounts.

- Step 5. Method the financial transaction. You should use your Мisa or Ьastercard or PayPal accounts to complete the financial transaction.

- Step 6. Find the formatting of your legal type and acquire it on your system.

- Step 7. Complete, modify and printing or indication the Massachusetts Accredited Investor Certification Letter.

Each legal file web template you acquire is yours permanently. You may have acces to each type you delivered electronically with your acccount. Go through the My Forms area and pick a type to printing or acquire once again.

Be competitive and acquire, and printing the Massachusetts Accredited Investor Certification Letter with US Legal Forms. There are thousands of professional and express-certain kinds you can utilize to your organization or specific demands.

Form popularity

FAQ

To confirm their status as an accredited investor, an investor can submit official documents for net worth and income verification, including: Tax returns. Pay stubs. Financial statements. IRS forms. Credit report. Brokerage statements. Tax assessments.

The simplest way to attain ?accredited investor? status is to ask for a 3rd party verification letter from a registered broker dealer, an attorney or a certified public accountant.

To confirm their status as an accredited investor, an investor can submit official documents for net worth and income verification, including: Tax returns. Pay stubs. Financial statements. IRS forms. Credit report. Brokerage statements. Tax assessments.

Individuals who want to become accredited investors must fall into one of three categories: have a net worth exceeding $1 million on your own or with a spouse or its equivalent; have earned an income surpassing $200,000 ($300,000 if combined with a spouse or its equivalent) during the last two years and prove an ...

Income and Net Worth Requirements for Accreditation In terms of income, earnings over $200,000 for individuals, or $300,000 when filing jointly with a spouse (together with a reasonable expectation that the level of income will be maintained in the current year) can qualify you as an accredited investor.

How can I be verified as an Accredited Investor as an Individual? You have a letter dated within the last 90 days from a third party licensed attorney, a CPA, an SEC-registered investment adviser, or a registered broker-dealer certifying that you are accredited.

VerifyInvestor.com is the leading resource for verification of accredited investors as required by federal laws.

The SEC's Rule 506 allows self-certification of investors in order for them to become accredited.