Vermont Chapter 7 Individual Debtors Statement of Intention - Form 8 - Post 2005

Description

How to fill out Chapter 7 Individual Debtors Statement Of Intention - Form 8 - Post 2005?

Finding the right legitimate papers design can be a have difficulties. Of course, there are plenty of web templates available on the Internet, but how will you obtain the legitimate kind you require? Take advantage of the US Legal Forms website. The assistance offers thousands of web templates, for example the Vermont Chapter 7 Individual Debtors Statement of Intention - Form 8 - Post 2005, which can be used for organization and personal demands. Each of the types are inspected by professionals and satisfy federal and state requirements.

If you are already listed, log in for your bank account and click the Down load key to obtain the Vermont Chapter 7 Individual Debtors Statement of Intention - Form 8 - Post 2005. Utilize your bank account to search through the legitimate types you may have acquired previously. Proceed to the My Forms tab of your own bank account and have one more copy from the papers you require.

If you are a whole new user of US Legal Forms, listed below are simple directions so that you can adhere to:

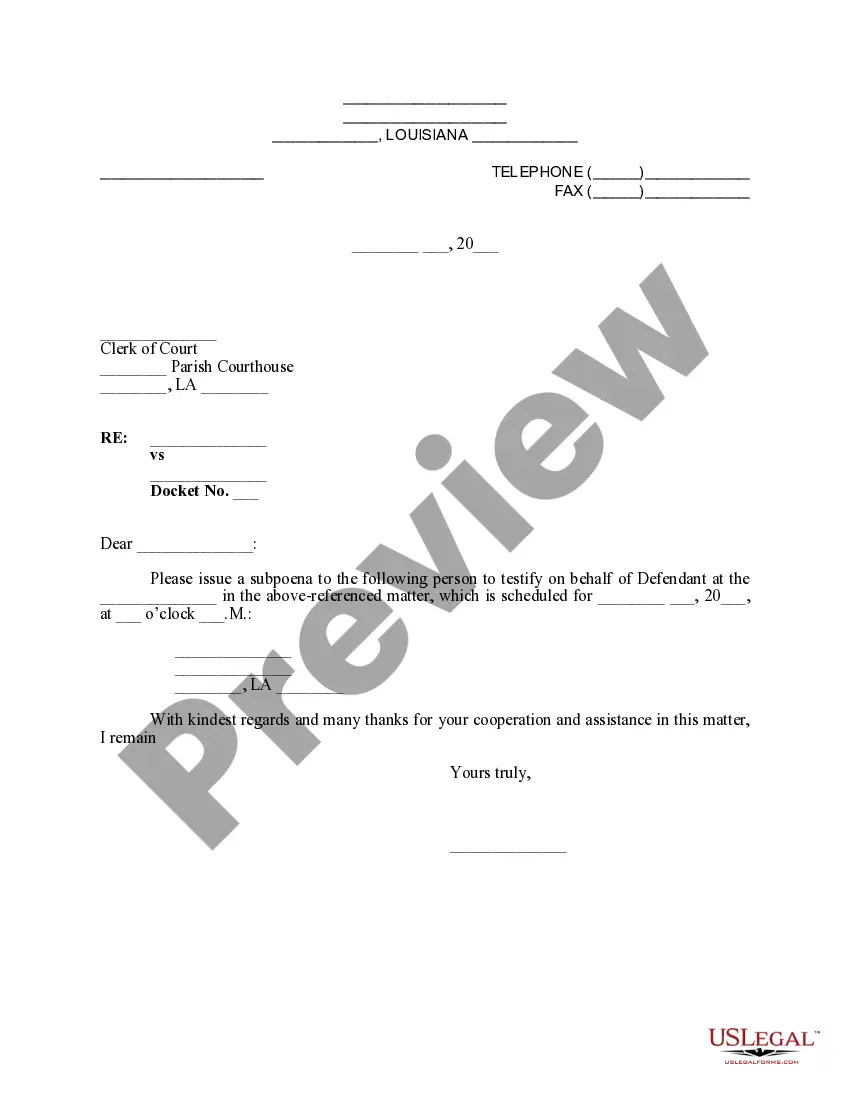

- Initially, ensure you have chosen the proper kind to your area/county. You may examine the shape making use of the Review key and study the shape information to guarantee it will be the right one for you.

- If the kind does not satisfy your requirements, take advantage of the Seach industry to get the proper kind.

- Once you are certain the shape is suitable, click on the Acquire now key to obtain the kind.

- Opt for the rates plan you would like and enter the required information and facts. Design your bank account and purchase an order making use of your PayPal bank account or bank card.

- Select the data file format and down load the legitimate papers design for your system.

- Comprehensive, edit and print and indicator the attained Vermont Chapter 7 Individual Debtors Statement of Intention - Form 8 - Post 2005.

US Legal Forms may be the most significant catalogue of legitimate types where you can find various papers web templates. Take advantage of the service to down load expertly-manufactured files that adhere to status requirements.

Form popularity

FAQ

In a chapter 7 case, however, a discharge is only available to individual debtors, not to partnerships or corporations. 11 U.S.C. § 727(a)(1). Although an individual chapter 7 case usually results in a discharge of debts, the right to a discharge is not absolute, and some types of debts are not discharged.

A Chapter 7 bankruptcy will generally discharge unsecured debts, including credit card debt, unsecured personal loans, medical bills and payday loans. The court discharges all of these remaining eligible debts at the end of the bankruptcy process, generally about four to six months after you start.

When you file for Chapter 7 bankruptcy, you will have to complete a form called the Statement of Intention for Individuals Filing Under Chapter 7. On this form, you tell the court whether you want to keep your secured and leased property?such as your car, boat, or home?or let it go back to the creditor.

Debts Never Discharged in Bankruptcy Alimony and child support. Certain unpaid taxes, such as tax liens. However, some federal, state, and local taxes may be eligible for discharge if they date back several years. Debts for willful and malicious injury to another person or property.

Another exception to Discharge is for fraud while acting in a fiduciary capacity, embezzlement, or larceny. Domestic obligations are not dischargeable in Bankruptcy. Damages resulting from the willful and malicious injury by the debtor of another person or his property, are also not dischargeable in Bankruptcy.

Chapter 7 is a ?liquidation? bankruptcy that doesn't require a repayment plan but does require you to sell some assets to pay creditors. Chapter 11 is a ?reorganization? bankruptcy for businesses that allows them to maintain day-to-day operations while creating a plan to repay creditors.

Filing for Chapter 7 bankruptcy will wipe out your mortgage obligation. Still, if you aren't willing to pay the mortgage, you'll have to give up the home because your lender's right to foreclose doesn't go away when you file for Chapter 7.

With the exempt assets and encumbered assets removed from the pool, there are usually no assets available to the unsecured creditors who, in many cases, will be banks holding credit card accounts. The end result will be that these unsecured creditors will receive nothing, and the debts they are owed will be discharged.