Vermont Waiver of the Right to be Spouse's Beneficiary

Description

How to fill out Waiver Of The Right To Be Spouse's Beneficiary?

US Legal Forms - one of many biggest libraries of legitimate kinds in the United States - gives a wide array of legitimate papers layouts you can acquire or print. Using the site, you may get thousands of kinds for company and specific functions, categorized by types, claims, or keywords and phrases.You can find the most recent types of kinds much like the Vermont Waiver of the Right to be Spouse's Beneficiary within minutes.

If you already possess a subscription, log in and acquire Vermont Waiver of the Right to be Spouse's Beneficiary from your US Legal Forms catalogue. The Obtain option will appear on each form you look at. You have access to all earlier saved kinds from the My Forms tab of your respective account.

If you would like use US Legal Forms for the first time, listed here are easy guidelines to help you get started:

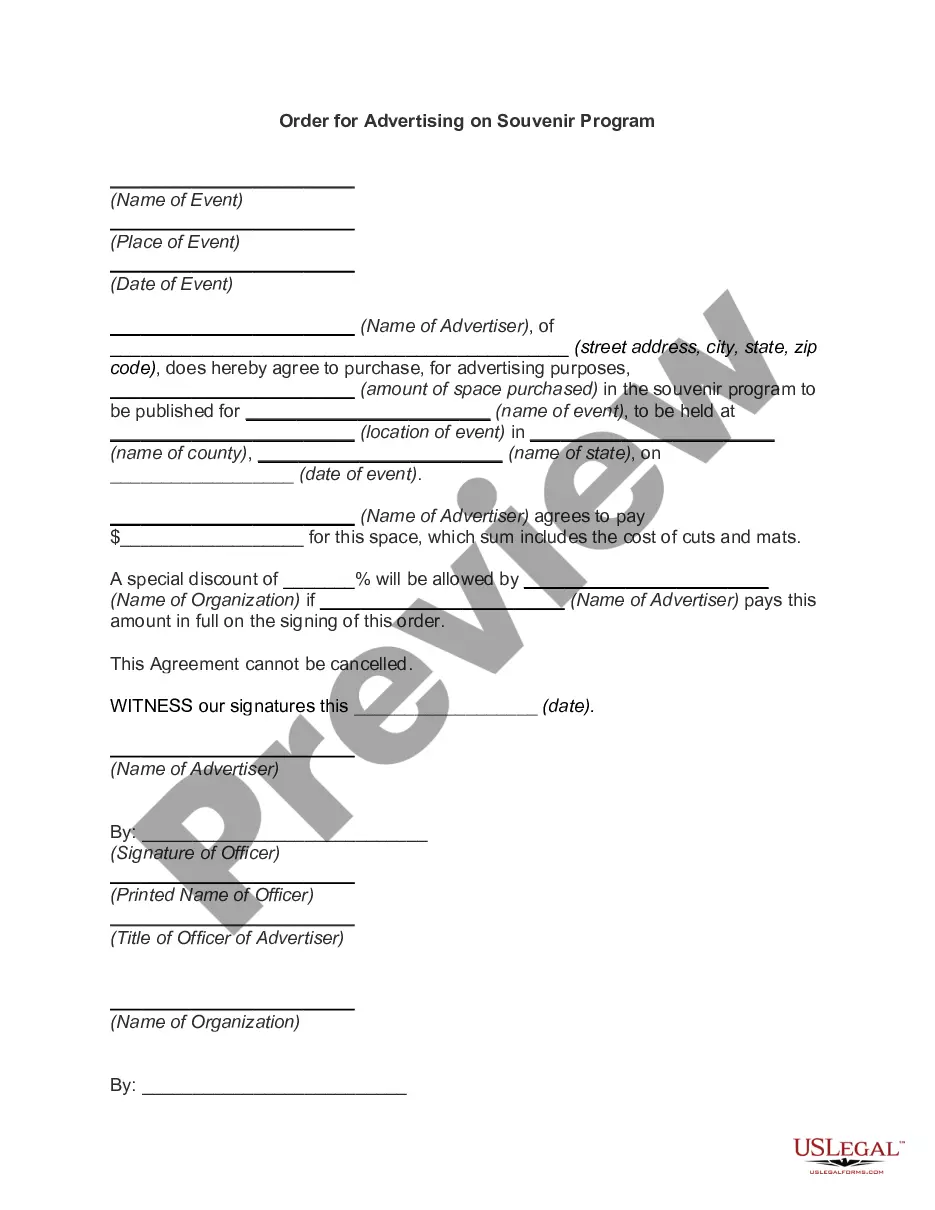

- Make sure you have chosen the correct form for your area/region. Go through the Preview option to review the form`s content. Read the form information to ensure that you have selected the correct form.

- If the form does not fit your demands, utilize the Search field at the top of the monitor to discover the the one that does.

- If you are content with the shape, affirm your selection by clicking on the Buy now option. Then, pick the prices plan you favor and supply your credentials to sign up on an account.

- Approach the deal. Utilize your Visa or Mastercard or PayPal account to finish the deal.

- Pick the structure and acquire the shape on the gadget.

- Make changes. Complete, revise and print and indicator the saved Vermont Waiver of the Right to be Spouse's Beneficiary.

Each and every format you included in your bank account does not have an expiration time and is the one you have for a long time. So, in order to acquire or print one more duplicate, just go to the My Forms area and click on on the form you need.

Gain access to the Vermont Waiver of the Right to be Spouse's Beneficiary with US Legal Forms, probably the most substantial catalogue of legitimate papers layouts. Use thousands of skilled and status-particular layouts that meet your business or specific requires and demands.

Form popularity

FAQ

In the overwhelming majority states, an inheritance is considered separate property, belonging exclusively to the spouse who received it and it cannot be divided in a divorce. That holds true whether a spouse received the inheritance before or during the marriage.

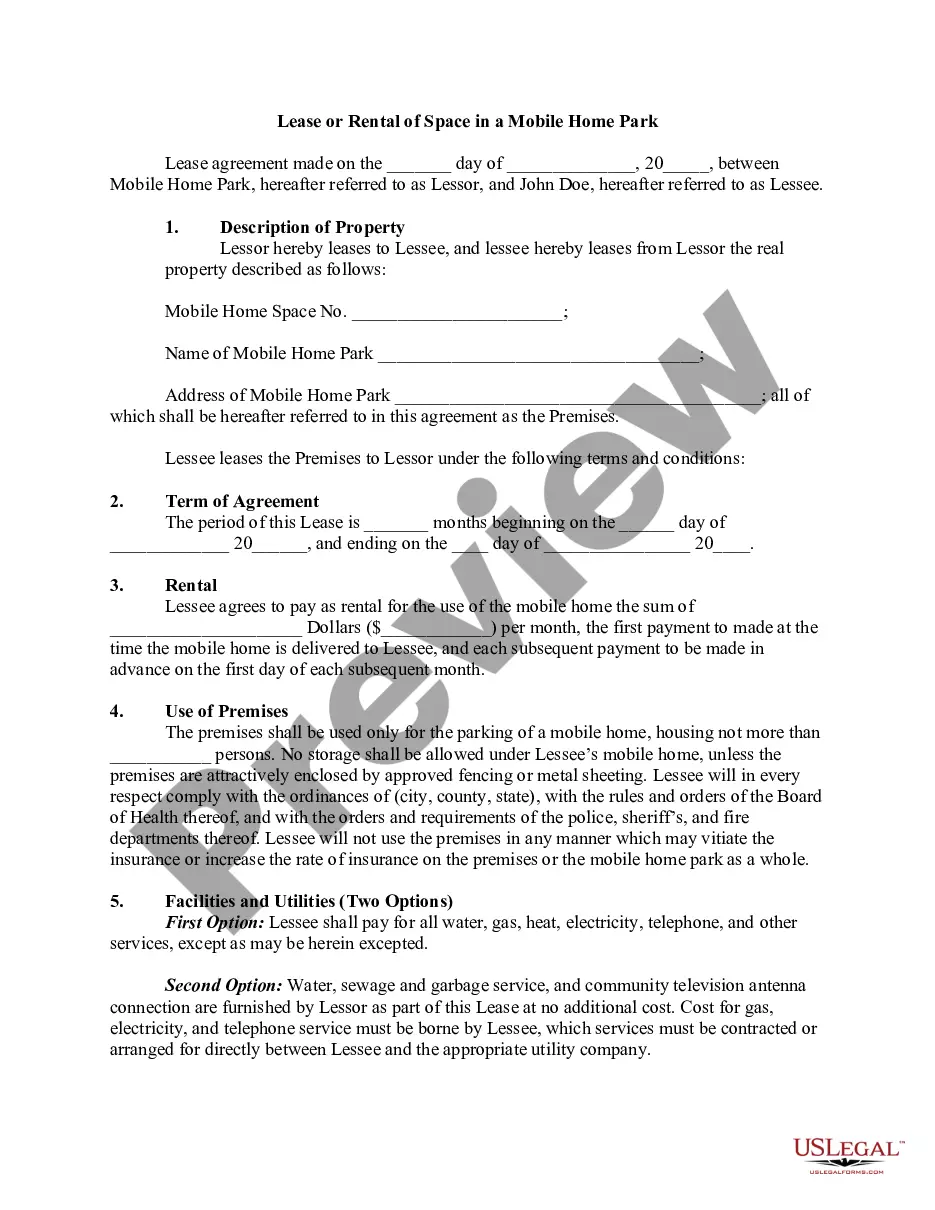

Vermont lets you register stocks and bonds in transfer-on-death (TOD) form. People commonly hold brokerage accounts this way. If you register an account in TOD (also called beneficiary) form, the beneficiary you name will inherit the account automatically at your death.

Next of kin in Vermont are generally the following people, in the following order: Surviving Spouse. Children or descendants. Parents.

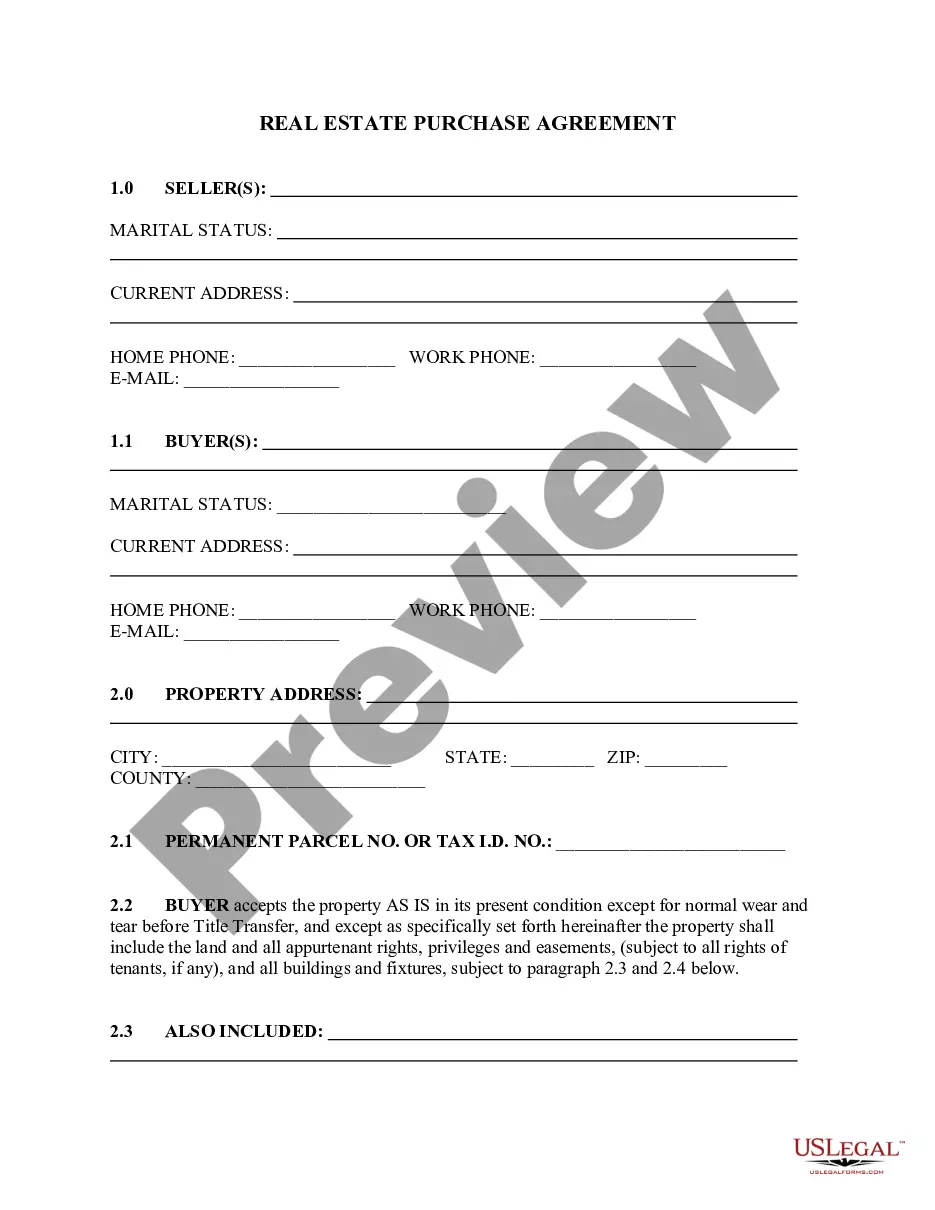

If you die intestate in Vermont, which is not a community property state, your spouse will inherit everything if you have no children, or if your only descendants are with your spouse. Descendants include children, grandchildren, and great-grandchildren.

In Vermont, you can make a living trust to avoid probate for virtually any asset you own -- real estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

More specifically, each person becomes the owner of half of their community property, but also half of their collective debt, according to California inheritance laws. The only property that doesn't become community property automatically are gifts and inheritances that one spouse receives.

Regardless of whether you are engaged or how long your relationship may have been, they would not be considered your spouse legally and therefore would only inherit if you named them in a will.

For example, if your home is titled in joint names with rights of survivorship with your spouse, then your spouse will inherit the home. However, if it is titled in your name alone, then your spouse may or may not inherit the home as determined by applicable state laws.

The surviving spouse generally stands to inherit first, followed by the decedent's children, their parents, their siblings and so forth. Under certain circumstances, stepchildren may have priority to inherit over other heirs.

Assets inherited by one partner in a marriage can be considered separate and owned only by that partner. However, inheritances can be ruled as marital property jointly owned by both partners and, therefore, subject to division along more or less equal lines in the event of a divorce.