Vermont Employee News Form

Description

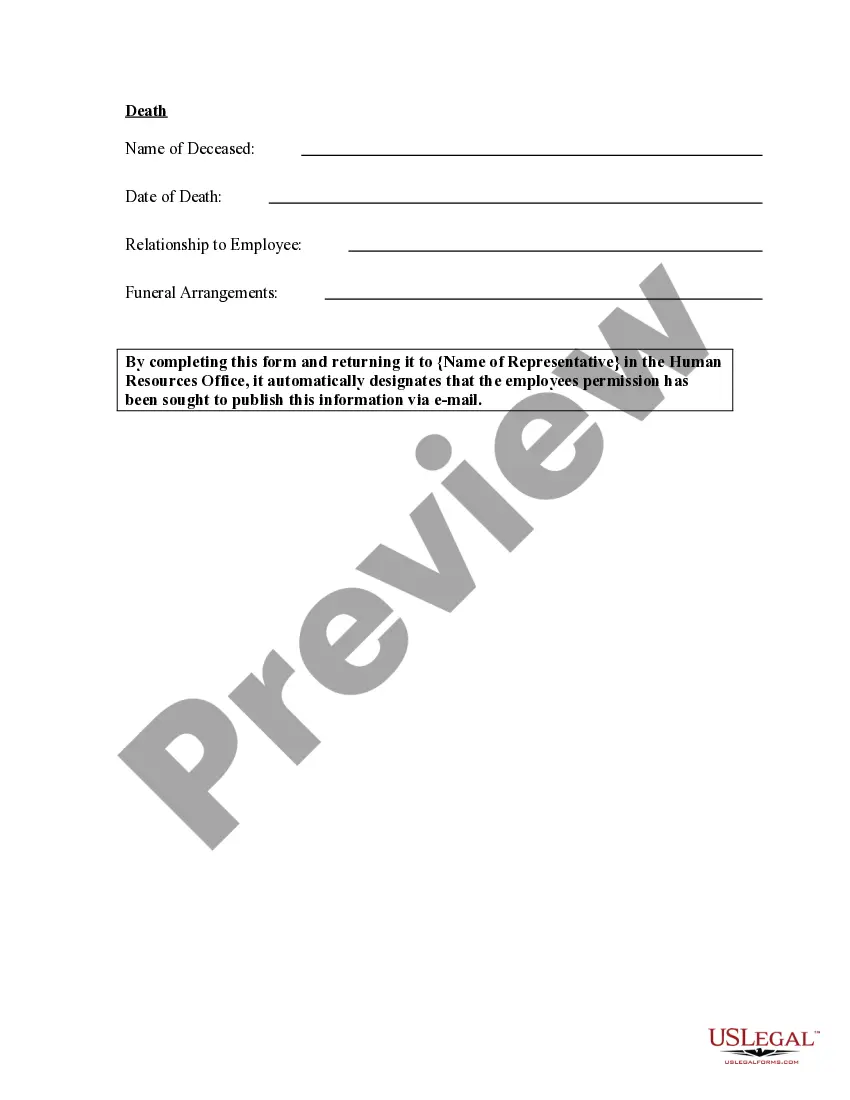

How to fill out Employee News Form?

You are capable of spending hours online trying to locate the legal document template that fulfills the state and federal requirements you need.

US Legal Forms offers a vast array of legal forms that are reviewed by professionals.

You can download or print the Vermont Employee News Form from their services.

If available, use the Preview button to view the document template as well.

- If you already possess a US Legal Forms account, you can Log In and then click the Obtain button.

- Subsequently, you can complete, modify, print, or sign the Vermont Employee News Form.

- Every legal document template you receive is yours permanently.

- To acquire another copy of any downloaded form, go to the My documents tab and click the corresponding button.

- If you are accessing the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for the region/town of your preference.

- Review the form description to verify you have chosen the right document.

Form popularity

FAQ

The non-resident tax form for Vermont is typically the Form PR-141, used by individuals living outside of Vermont but earning income within the state. This form allows non-residents to report their Vermont income and calculate the appropriate taxes owed. When completing this form, you might refer to the Vermont Employee News Form for specific instructions and updates relevant to non-resident tax obligations. Accessing these resources simplifies the process significantly.

The form for non-resident income tax in Vermont is typically the Form IN-114. This form is designed for individuals who earn income from Vermont sources but do not reside in the state. Completing this form accurately is important to ensure you meet your tax obligations correctly. The Vermont Employee News Form can keep you informed about tax laws impacting non-residents, making it easier to stay compliant.

Contact UsEstablish an Initial Claim: 1-877-214-3330.Claimant Assistance: 1-877-214-3332.File Weekly Claim: 1-800-983-2300.

How can claimants determine the status of their payments? The claimant can check on the payment status of their unemployment payment on-line ( Claimant Applications) or by calling the toll free Weekly Continued Claims Line at 1-800-983-2300 and selecting option 2.

You must be able to provide documentation to prove your income. The maximum for PUA benefits was $450 per week. To qualify, your net self-employment income for 2019 needs to have been more than $46,696. If you are not able to provide proof of income, we will not increase your payments.

INDIVIDUALS WHO HAVE NOT YET APPLIEDSTEP 1: Complete an initial application for unemployment insurance by calling (877) 214-3332 or online or learn more at 2: Read instructions on confirmation page.More items...

Initial hiring documentsJob application form.Offer letter and/or employment contract.Drug testing records.Direct deposit form.Benefits forms.Mission statement and strategic plan.Employee handbook.Job description and performance plan.More items...?

Before you can add an employee to your team, you are legally responsible for confirming the employee is eligible to work in the United States.Form I-9.Form W-4.State W-4.Emergency contact form.Employee handbook acknowledgment form.Bank account information form.Benefits forms.

If you need to contact the Department, please do so by phone.Vermont Department of Labor. Montpelier, 05601-0488.Unemployment Claims for Individuals: Establish Initial Claim: 1-877-214-3330.Employer Assistance (Unemployment Claims): Claims Line: 1-877-214-3331.Employer Services (Wage and Contribution Information):

The most common types of employment forms to complete are:W-4 form (or W-9 for contractors)I-9 Employment Eligibility Verification form.State Tax Withholding form.Direct Deposit form.E-Verify system: This is not a form, but a way to verify employee eligibility in the U.S.