Vermont Exempt Survey

Description

How to fill out Exempt Survey?

US Legal Forms - one of the most important collections of legal forms in the United States - provides a vast selection of legal document templates that you can download or print.

By using the website, you can find thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can access the latest versions of forms such as the Vermont Exempt Survey in just seconds.

If you currently hold a monthly subscription, Log In and obtain the Vermont Exempt Survey from your US Legal Forms library. The Download button will appear on every form you view. You can access all previously downloaded forms in the My documents section of your account.

Process the transaction. Use your credit card or PayPal account to complete the transaction.

Select the format and download the form to your device. Make modifications. Fill in, edit, print, and sign the downloaded Vermont Exempt Survey. Every template you saved in your account has no expiration date and belongs to you indefinitely. So, if you wish to download or print another copy, just go to the My documents section and click on the form you need. Access the Vermont Exempt Survey with US Legal Forms, the largest collection of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- To use US Legal Forms for the first time, here are simple guidelines to help you get started.

- Ensure you have selected the correct form for your location/region.

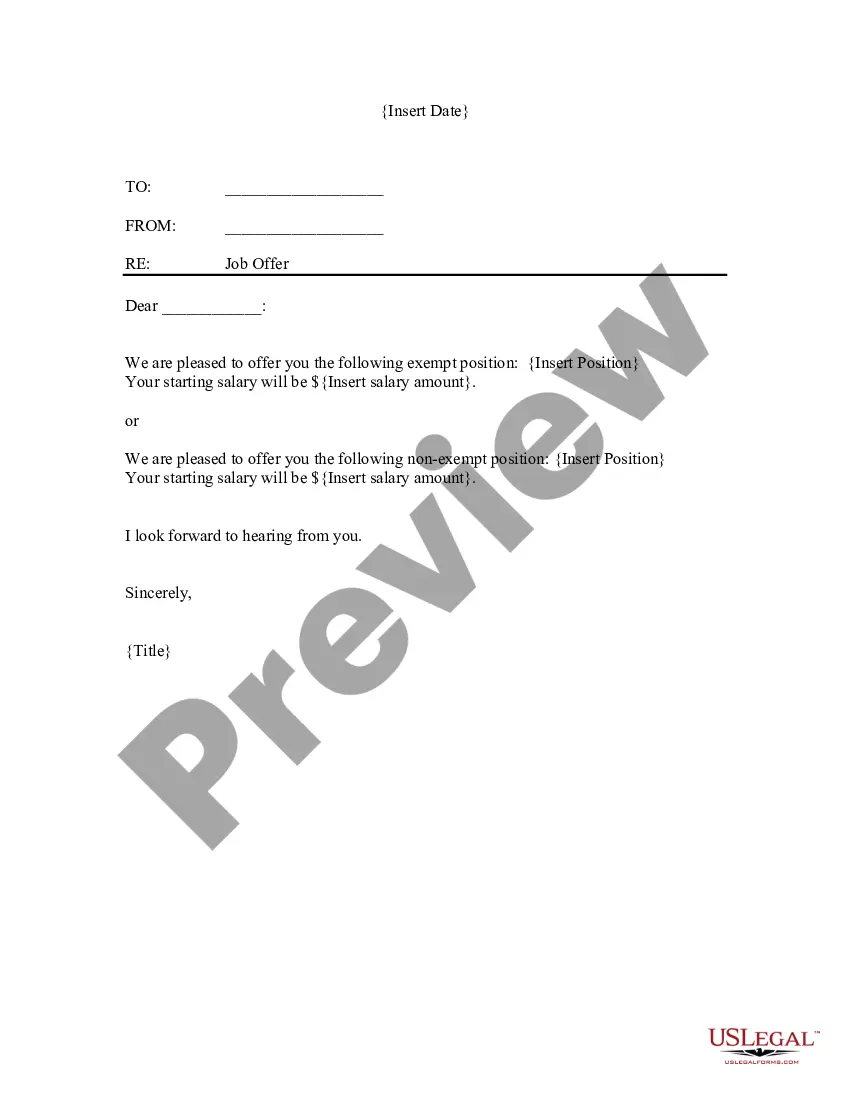

- Click on the Preview button to review the form's details.

- Read the form description to make sure you have chosen the right one.

- If the form does not meet your requirements, utilize the Search feature at the top of the screen to find the one that does.

- Once satisfied with the form, confirm your selection by clicking on the Purchase now button.

- Then, select your preferred payment plan and provide your details to register for an account.

Form popularity

FAQ

FOOD, FOOD PRODUCTS, AND BEVERAGES - TAXABLE Food, food products, and beverages are exempt from Vermont Sales and Use Tax under Vermont law 32 V.S.A. § 9741(13) with the exception of soft drinks.

What goods and services are considered taxable in Vermont?Sales of tangible goods at retail.Repairs or alterations of tangible personal property.Property rentals, leases, or licenses e.g. commercial, mini-warehouseSelling service warranty contracts.More items...

Military retirement pay based on age or length of service is considered taxable income for Federal income taxes, and most state income taxes. However, military disability retirement pay and veterans' benefits, including service-connected disability pension payments, are almost always fully excluded from taxable income.

The following items are deemed nontaxable by the IRS:Inheritances, gifts and bequests.Cash rebates on items you purchase from a retailer, manufacturer or dealer.Alimony payments (for divorce decrees finalized after 2018)Child support payments.Most healthcare benefits.Money that is reimbursed from qualifying adoptions.More items...?

Does Vermont have a Property Tax Reduction for Veterans? Yes for some disabled veterans and families.

An official document that gives someone special permission not to do or pay something: a medical/tax exemption certificate.

A tax exemption excludes certain income, revenue, or even taxpayers from tax altogether. For example, nonprofits that fulfill certain requirements are granted tax-exempt status by the IRS, preventing them from having to pay income tax.

There are several states that waive property taxes for 100% disabled veterans, including Florida, Texas, Virginia, New Mexico and Hawaii. These exemptions are available on principal residences only, not second or vacation homes. Often a surviving spouse who remains unremarried is also eligible for the benefits.

Goods exemptedAll goods manufactured for export are exempted from sales tax. Other goods which are specifically exempted include: Live animals, fish, seafood and certain essential food items including meat, milk, eggs, vegetables, fruits, bread. Books, magazines, newspapers, journals and periodicals.

Tax-exempt status may provide complete relief from taxes, reduced rates, or tax on only a portion of items. Examples include exemption of charitable organizations from property taxes and income taxes, veterans, and certain cross-border or multi-jurisdictional scenarios.