Vermont Stop Annuity Request

Description

How to fill out Stop Annuity Request?

US Legal Forms - one of the largest repositories of legal documents in the United States - provides a broad selection of legal form templates that you can download or print.

By using the website, you can access thousands of forms for business and personal purposes, categorized by types, states, or keywords. You can find the latest versions of forms such as the Vermont Stop Annuity Request within moments.

If you already have a subscription, Log In and download the Vermont Stop Annuity Request from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously acquired forms in the My documents section of your account.

Make modifications. Fill out, adjust, print, and sign the downloaded Vermont Stop Annuity Request.

Each template you added to your account has no expiration date and is yours permanently. Therefore, if you want to download or print another copy, simply go to the My documents section and click on the form you desire. Access the Vermont Stop Annuity Request with US Legal Forms, one of the most comprehensive libraries of legal document templates. Utilize thousands of professional and state-specific templates that fulfill your business or personal requirements and specifications.

- If you want to use US Legal Forms for the first time, here are simple steps to get started.

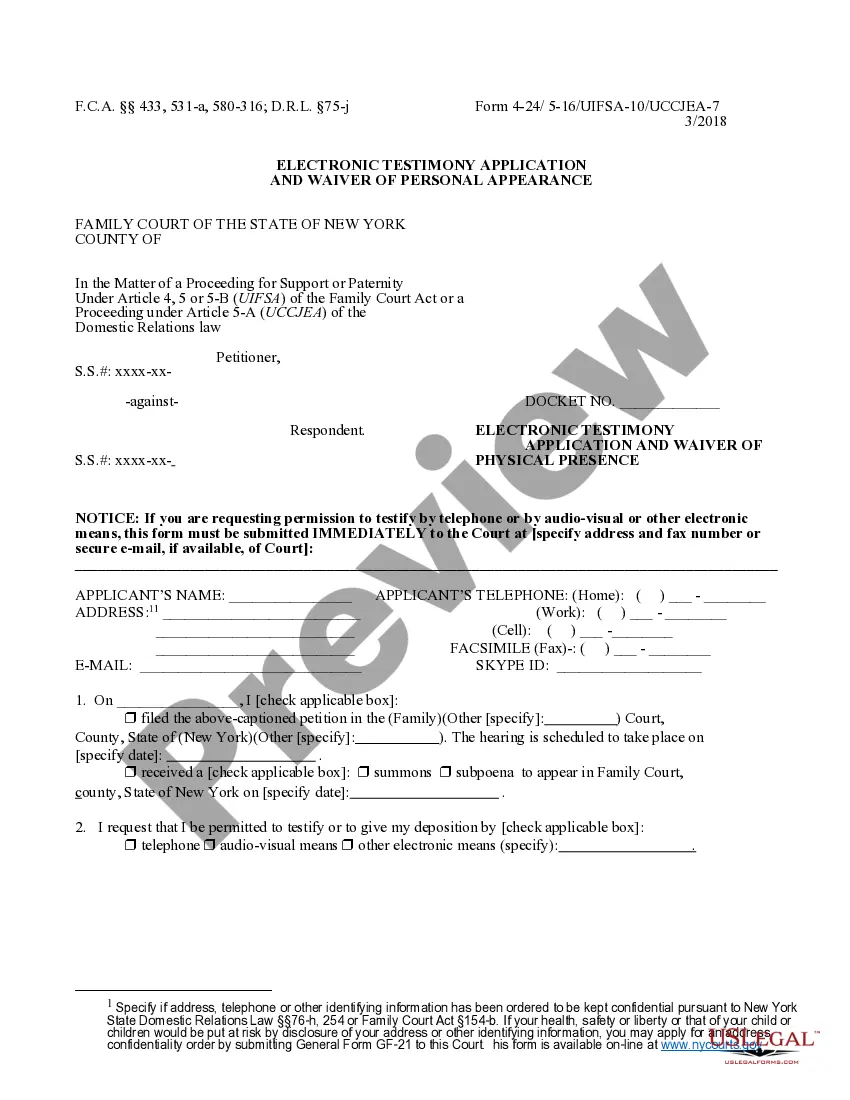

- Ensure you have selected the correct form for your city/county. Click the Preview button to review the form's details. Check the form description to confirm you have selected the accurate form.

- If the form doesn’t meet your needs, use the Search field at the top of the screen to find one that does.

- Once you are satisfied with the form, confirm your choice by clicking the Purchase now button. Then, choose the pricing plan you prefer and provide your information to register for the account.

- Process the transaction. Use your credit card or PayPal account to complete the transaction.

- Select the format and download the form to your device.

Form popularity

FAQ

If you want to change your withholding allowances, you'll need to find your own state's Employee's Withholding Allowance Certificate and complete the worksheet. You can use this form to claim an exemption from state taxes or to have additional tax withheld from your paycheck.

How do I change my voluntary withholdings? Use Services Online to: start, change, or stop Federal and State income tax withholdings; request a duplicate tax-filing statement (1099R);

By Vermont law, property owners whose homes meet the definition of a Vermont homestead must file a Homestead Declaration annually by the April filing deadline. If eligible, it is important that you file so that you are correctly assessed the homestead tax rate on your property.

If you got a huge tax bill when you filed your tax return last year and don't want another, you can use Form W-4 to increase your withholding. That'll help you owe less (or nothing) next time you file.

Taxpayers who are age 65 or older and/or blind may deduct an additional $1,000 when determining the Vermont Standard Deduction on Form IN-111, Vermont Income Tax Return. To be eligible, you must also have qualified and received the deduction at the federal level. The amount will be adjusted annually for inflation.

You can adjust your withholdings so that the correct amount is withheld. You can even request that extra money be withheld each pay period. This will save you the hassle of coming up with extra money at the end of the year to pay to the IRS.

Use the Tax Withholding Estimator on IRS.gov. The Tax Withholding Estimator works for most employees by helping them determine whether they need to give their employer a new Form W-4. They can use their results from the estimator to help fill out the form and adjust their income tax withholding.

You can adjust your W-4 at any time during the year. Just remember, adjustments made later in the year will have less impact on your taxes for that year.

The easiest way to close your business tax account online is to log in to your myVTax account at and select Close Account. If you have more than one type of business tax account, you must close each individually. If you do not have a myVTax account, you may file on a paper form using Form B-2, Notice of Change.

The Vermont exemption allows income-eligible taxpayers to subtract all or part of federally taxable Social Security benefits from their AGI. This means that the federally taxable portion of Social Security benefits is eliminated or reduced for Vermont income-eligible taxpayers receiving Social Security benefits.