Vermont Acceptance of Election in a Limited Liability Company LLC

Description

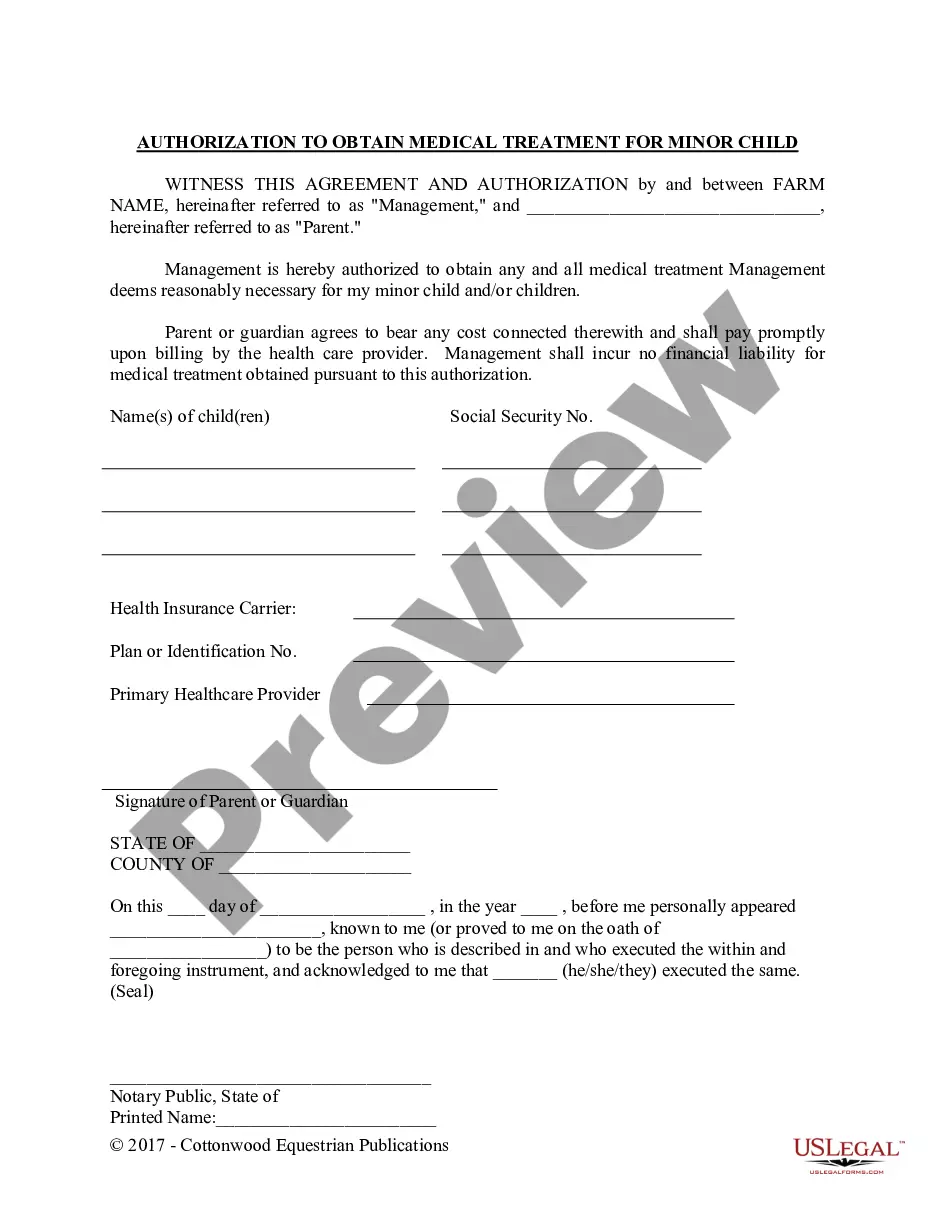

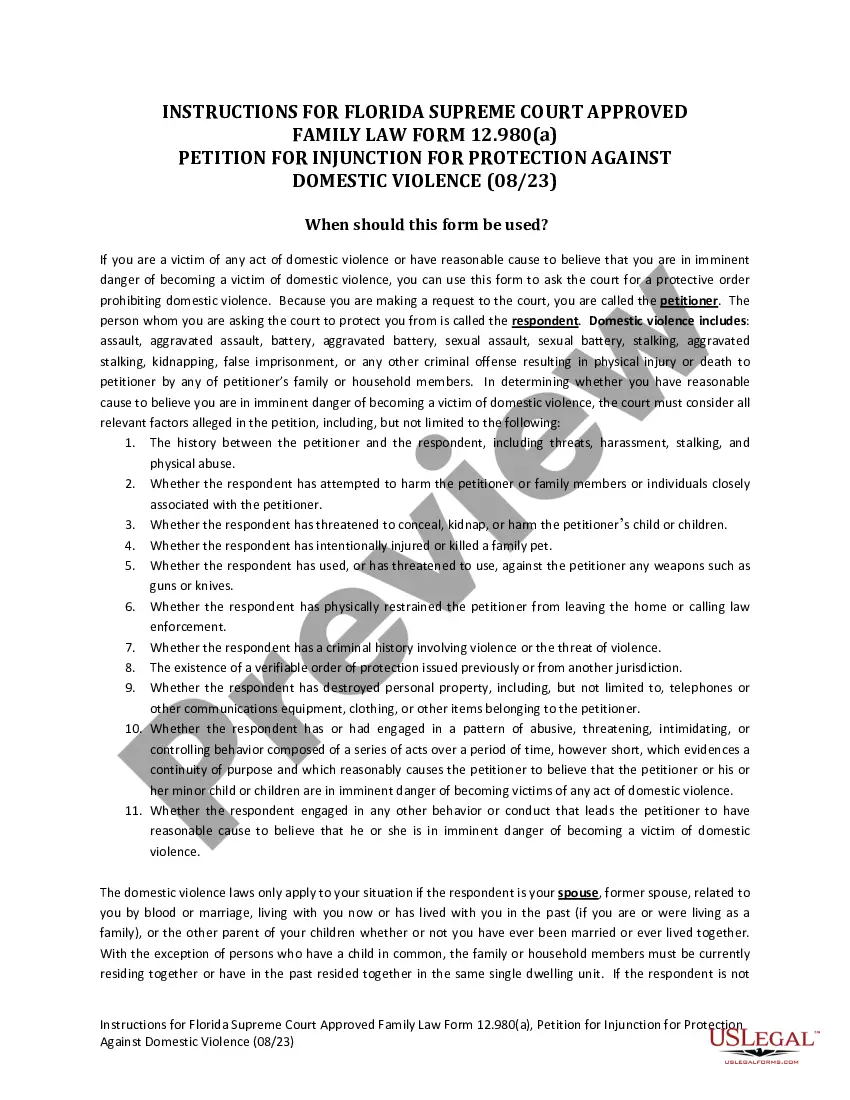

How to fill out Acceptance Of Election In A Limited Liability Company LLC?

Choosing the best legitimate record design might be a struggle. Needless to say, there are a lot of layouts available on the Internet, but how do you obtain the legitimate form you need? Use the US Legal Forms web site. The services delivers thousands of layouts, including the Vermont Acceptance of Election in a Limited Liability Company LLC, which you can use for enterprise and personal requirements. Each of the kinds are checked by experts and meet state and federal needs.

In case you are presently registered, log in to the bank account and click on the Download key to get the Vermont Acceptance of Election in a Limited Liability Company LLC. Make use of your bank account to check through the legitimate kinds you may have bought formerly. Go to the My Forms tab of the bank account and acquire an additional duplicate from the record you need.

In case you are a new user of US Legal Forms, here are easy instructions that you should adhere to:

- First, be sure you have selected the correct form to your city/state. It is possible to check out the form using the Preview key and read the form explanation to make sure it will be the right one for you.

- In the event the form fails to meet your needs, take advantage of the Seach discipline to get the correct form.

- Once you are certain that the form is acceptable, select the Acquire now key to get the form.

- Opt for the costs plan you need and enter in the essential information. Make your bank account and pay money for your order making use of your PayPal bank account or charge card.

- Pick the document formatting and download the legitimate record design to the product.

- Full, revise and print out and indicator the received Vermont Acceptance of Election in a Limited Liability Company LLC.

US Legal Forms is the most significant catalogue of legitimate kinds where you can discover numerous record layouts. Use the service to download expertly-made files that adhere to express needs.

Form popularity

FAQ

Some goods are exempt from sales tax under Vermont law. Examples include some agriculture supplies, prescription drugs, and medical supplies.

No Vermont exclusion is available when a net capital loss is reported, even if the sale of farm or standing timber resulted in a capital gain. The general exclusion amount for tax year 2021 is $5,000 or the actual amount of net adjusted capital gains, whichever is less.

To revive or reinstate your Mississippi LLC, you'll need to submit the following to the Mississippi SOS: a completed Mississippi Application for Reinstatement Following Administrative Dissolution. a tax clearance letter from the Mississippi Department of Revenue. a $50 filing fee.

Vermont LLC Cost. The fee for forming a Vermont LLC is $125. You'll also need to pay $35 every year to file Vermont's Annual Report.

Vermont's personal exemption allowed for each taxpayer and dependent is: $4,500 for 2022. $4,350 for 2020 and 2021.

What does ?restored to good standing? mean? Being in good standing means that your business is up-to-date on filing your annual report, biennial report, other required forms, compliance paperwork and any other requirements from your company's home state.

Reinstatement means to bring a business (LLC or corporation) back into good standing with the state where the business was formed or registered to do business. If a business entity fallen behind on franchise taxes and annual reports, it may be administratively dissolved or suspended by the state.

Form 8832. An LLC that is not automatically classified as a corporation and does not file Form 8832 will be classified, for federal tax purposes under the default rules.

Form BI-471, Vermont Business Income Tax Return. For use by those entities not filing federally as a C Corporation to calculate Vermont business income tax liability.

Subchapter S Corporations, Partnerships and Limited Liability Companies engaged in activities in Vermont must file a Business Entity Income Tax return with the Commissioner of Taxes. This includes entities receiving income as a shareholder, partner, or member.