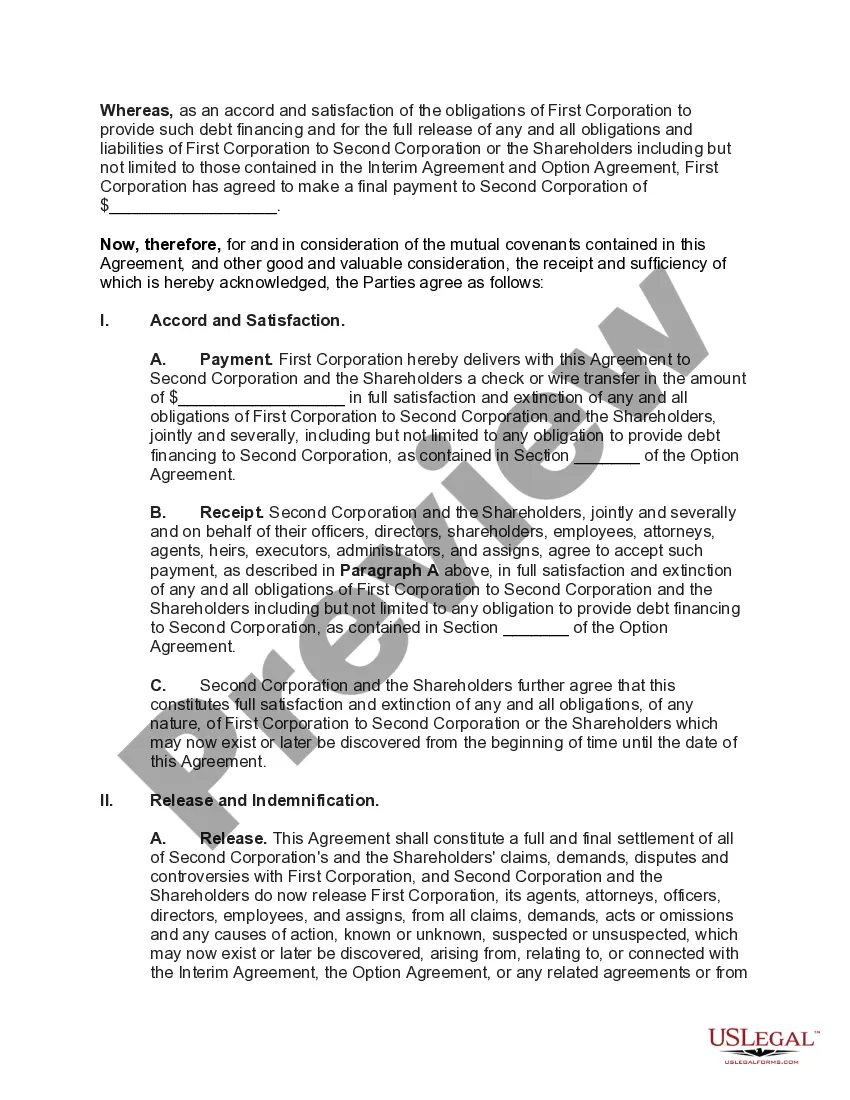

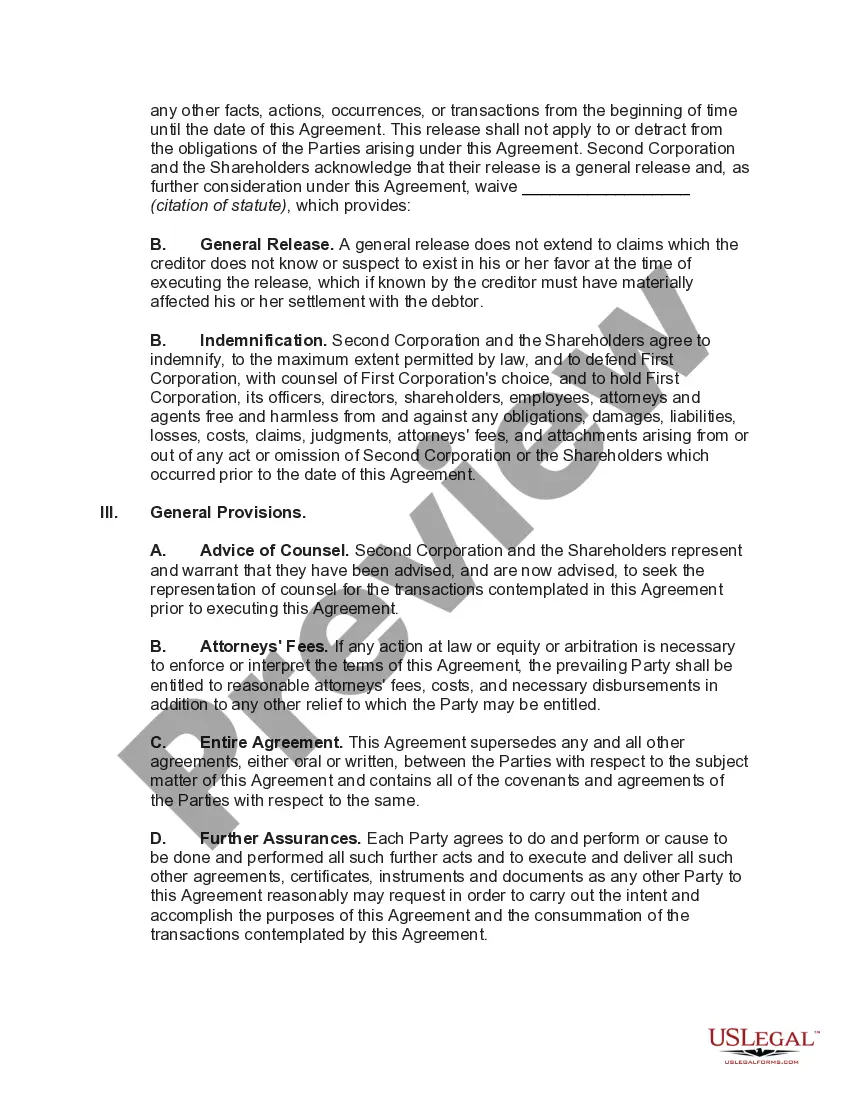

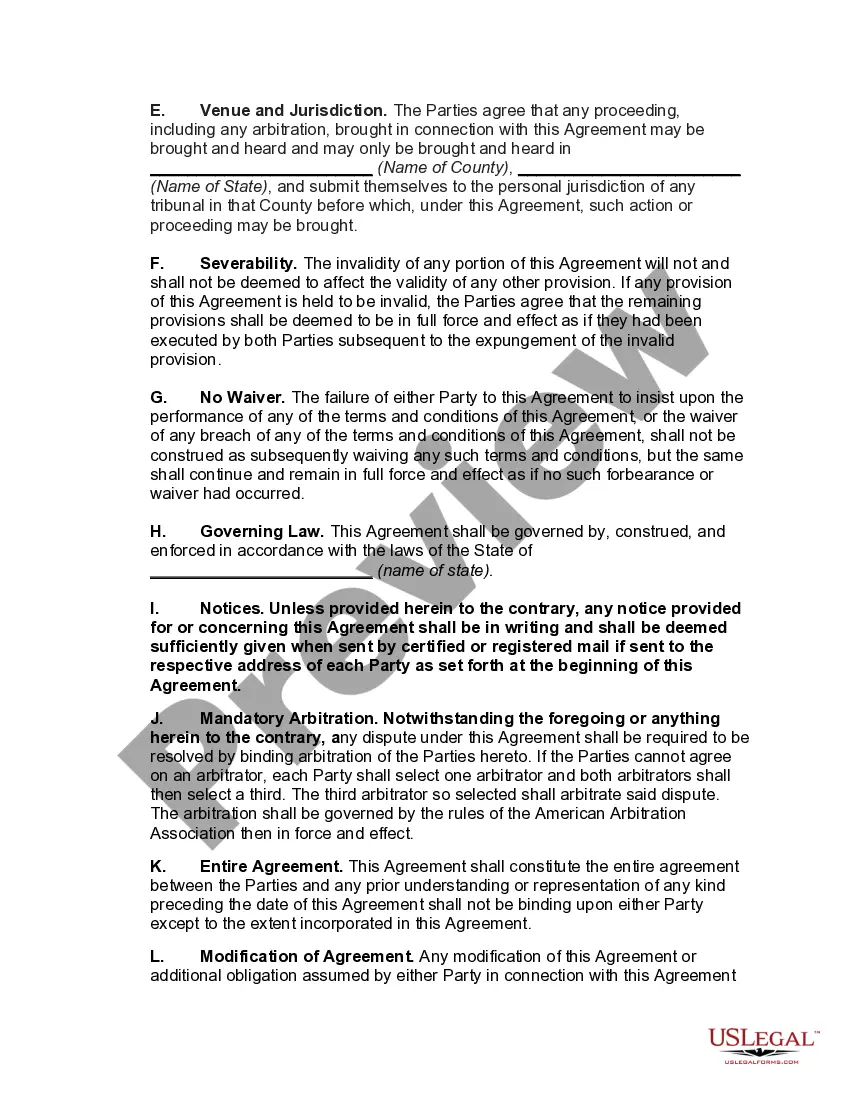

Vermont Accord and Satisfaction Release Agreement Regarding Dispute between Two Corporations and Shareholders Regarding Obligations under Stock Option Agreement

Description

How to fill out Accord And Satisfaction Release Agreement Regarding Dispute Between Two Corporations And Shareholders Regarding Obligations Under Stock Option Agreement?

Are you presently in a placement that you need papers for both business or personal uses almost every day? There are plenty of legitimate papers themes available on the net, but finding kinds you can trust is not easy. US Legal Forms delivers a huge number of develop themes, just like the Vermont Accord and Satisfaction Release Agreement Regarding Dispute between Two Corporations and Shareholders Regarding Obligations under Stock Option Agreement, that happen to be composed to fulfill state and federal demands.

If you are presently informed about US Legal Forms internet site and have a merchant account, simply log in. Following that, you are able to obtain the Vermont Accord and Satisfaction Release Agreement Regarding Dispute between Two Corporations and Shareholders Regarding Obligations under Stock Option Agreement format.

Unless you offer an account and would like to begin using US Legal Forms, adopt these measures:

- Find the develop you require and make sure it is for the right area/region.

- Take advantage of the Preview key to examine the form.

- Read the description to actually have selected the right develop.

- When the develop is not what you`re seeking, utilize the Look for discipline to get the develop that meets your requirements and demands.

- When you obtain the right develop, simply click Get now.

- Choose the pricing plan you need, fill in the specified information and facts to create your bank account, and purchase the order with your PayPal or Visa or Mastercard.

- Decide on a convenient data file format and obtain your duplicate.

Locate each of the papers themes you might have bought in the My Forms food selection. You can obtain a more duplicate of Vermont Accord and Satisfaction Release Agreement Regarding Dispute between Two Corporations and Shareholders Regarding Obligations under Stock Option Agreement whenever, if required. Just go through the essential develop to obtain or printing the papers format.

Use US Legal Forms, the most extensive selection of legitimate kinds, to save some time and avoid mistakes. The services delivers skillfully made legitimate papers themes that can be used for a range of uses. Create a merchant account on US Legal Forms and initiate creating your daily life easier.

Form popularity

FAQ

We have 5 steps. Step 1: Decide on the issues the agreement should cover. ... Step 2: Identify the interests of shareholders. ... Step 3: Identify shareholder value. ... Step 4: Identify who will make decisions - shareholders or directors. ... Step 5: Decide how voting power of shareholders should add up.

A mutual release permits both parties to stop pursuing their claims against each other, including both future and current claims. Depending on the agreement you draft and what conditions it includes, parties may reserve the right to file claims for issues that haven't yet arisen related to the current dispute.

Even though the law does not require shareholder agreements, every privately held corporation with more than one shareholder and every privately held limited liability company (?LLC?) with more than one member is well advised to have a formal ?partnership? agreement, preferably implemented at the onset of the business ...

The agreement can document key decisions of the company such as how shares can be sold, what happens if a shareholder dies, whether shareholders can work in competition with the company when they leave and whether any compulsory share transfers should take place if a shareholder has acted in contravention of the ...

A shareholders' agreement includes a date; often the number of shares issued; a capitalization table that outlines shareholders and their percentage ownership; any restrictions on transferring shares; pre-emptive rights for current shareholders to purchase shares to maintain ownership percentages (for example, in the ...

Since a shareholders' agreement establishes the relationship between the shareholders, without one, you are exposing both shareholders and the company to potential future conflict. This is particularly true in situations where the voting shares in a company are held equally (50% each) by just two people or companies.

The S corp shareholder agreement is a contract between the shareholders of an S corporation. The contents of the shareholder agreement differ from one S corporation to another. The shareholders are also able to decide what goes into the shareholder agreement, which is also referred to as the stockholder agreement.

A shareholders agreement is a contract between the shareholders of a company that determines how a company will be run. However, there is no legal requirement for the shareholders of a company to enter into a shareholders agreement.