Vermont Agreement to Dissolve and Wind up Partnership with Settlement and Lump-sum Payment

Description

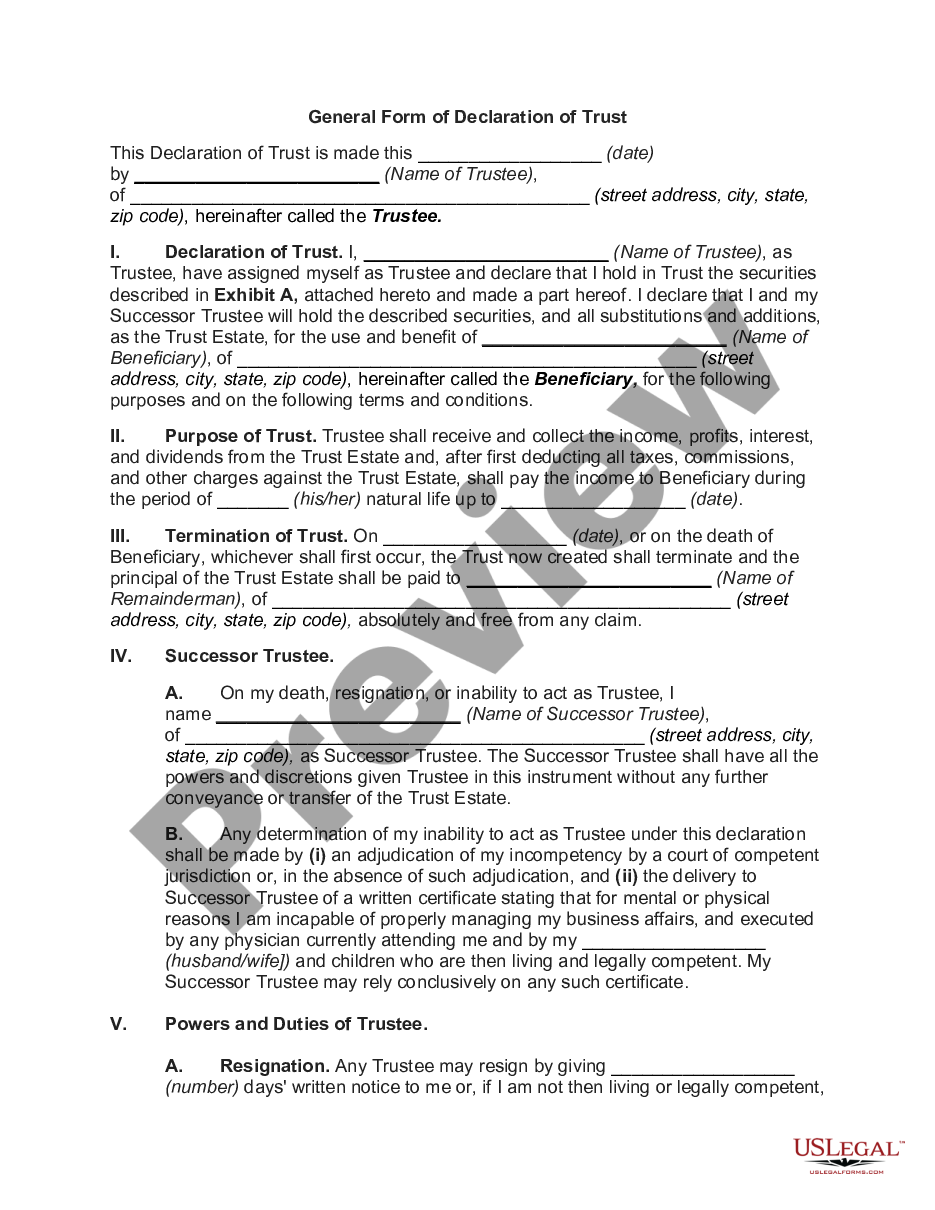

How to fill out Agreement To Dissolve And Wind Up Partnership With Settlement And Lump-sum Payment?

Are you currently in a situation where you need documents for either business or personal reasons daily? There are numerous legal document templates accessible online, but finding reliable forms can be challenging. US Legal Forms offers thousands of template options, including the Vermont Agreement to Dissolve and Wind up Partnership with Settlement and Lump-sum Payment, which are designed to meet federal and state criteria.

If you are already familiar with the US Legal Forms website and have an account, simply Log In. After that, you can download the Vermont Agreement to Dissolve and Wind up Partnership with Settlement and Lump-sum Payment template.

If you do not have an account and wish to start using US Legal Forms, follow these instructions.

Access all the document templates you have purchased in the My documents section. You can obtain an additional copy of the Vermont Agreement to Dissolve and Wind up Partnership with Settlement and Lump-sum Payment anytime if needed. Just click on the required form to download or print the document template.

Utilize US Legal Forms, the most comprehensive collection of legal templates, to save time and avoid errors. The service provides professionally crafted legal document templates that you can use for a variety of purposes. Create an account on US Legal Forms and start simplifying your life.

- Acquire the form you need and confirm it is for the correct city/area.

- Use the Review button to examine the form.

- Check the details to ensure you have selected the correct form.

- If the form isn’t what you’re looking for, use the Search box to find the form that matches your needs and specifications.

- Once you find the right form, click Purchase now.

- Choose the pricing plan you prefer, complete the necessary information to create your account, and finalize your order using PayPal or a credit card.

- Select a suitable file format and download your copy.

Form popularity

FAQ

How to Dissolve a PartnershipReview and Follow Your Partnership Agreement.Vote on Dissolution and Document Your Decision.Send Notifications and Cancel Business Registrations.Pay Outstanding Debts, Liquidate, and Distribute Assets.File Final Tax Return and Cancel Tax Accounts.Limiting Your Future Liability.

While it is legally possible to dissolve a partnership, ordinarily all partners must agree to do so while developing mutually acceptable terms for ending the business. The process of ending a partnership is known as dissolution and winding up.

There is no filing fee. Under California law, other people generally are considered to have notice of the partnership's dissolution ninety (90) days after filing the Statement of Dissolution.

When one partner wants to leave the partnership, the partnership generally dissolves. Dissolution means the partners must fulfill any remaining business obligations, pay off all debts, and divide any assets and profits among themselves.

Dissolution of partnership means putting an end to a business partnership between all the partners of the firm. Any partnership can be dissolved by the mutual consent of all the partners and is carried out by way of executing a written agreement, referred to as a Partnership Dissolution Agreement.

When a partnership dissolves, the individuals involved are no longer partners in a legal sense, but the partnership continues until the business's debts are settled, the legal existence of the business is terminated and the remaining assets of the company have been distributed.

How to Dissolve a PartnershipReview and Follow Your Partnership Agreement.Vote on Dissolution and Document Your Decision.Send Notifications and Cancel Business Registrations.Pay Outstanding Debts, Liquidate, and Distribute Assets.File Final Tax Return and Cancel Tax Accounts.Limiting Your Future Liability.

When one partner wants to leave the partnership, the partnership generally dissolves. Dissolution means the partners must fulfill any remaining business obligations, pay off all debts, and divide any assets and profits among themselves. Your partners may not want to dissolve the partnership due to your departure.

A partnership firm may be discontinued or dissolved in any of the following ways.Dissolution by Agreement. The easiest and the most hassle-free method to dissolve a partnership firm is by mutual consent or an agreement.Dissolution by Notice.Dissolution due to contingencies.Compulsory Dissolution.Dissolution by Court.

Winding up ends all outstanding legal and financial obligations of the partnership so that the business can be terminated. Winding up is a process and will be conducted according to the partnership agreement and according to applicable state laws. Once winding up is complete, the partnership is terminated.