Vermont Agreement to Dissolve and Wind up Partnership with Sale to Partner and Disproportionate Distribution of Assets

Description

How to fill out Agreement To Dissolve And Wind Up Partnership With Sale To Partner And Disproportionate Distribution Of Assets?

Are you currently in a situation where you require documents for both business or personal purposes every single day.

There are numerous legal document templates accessible online, but finding ones you can trust is not straightforward.

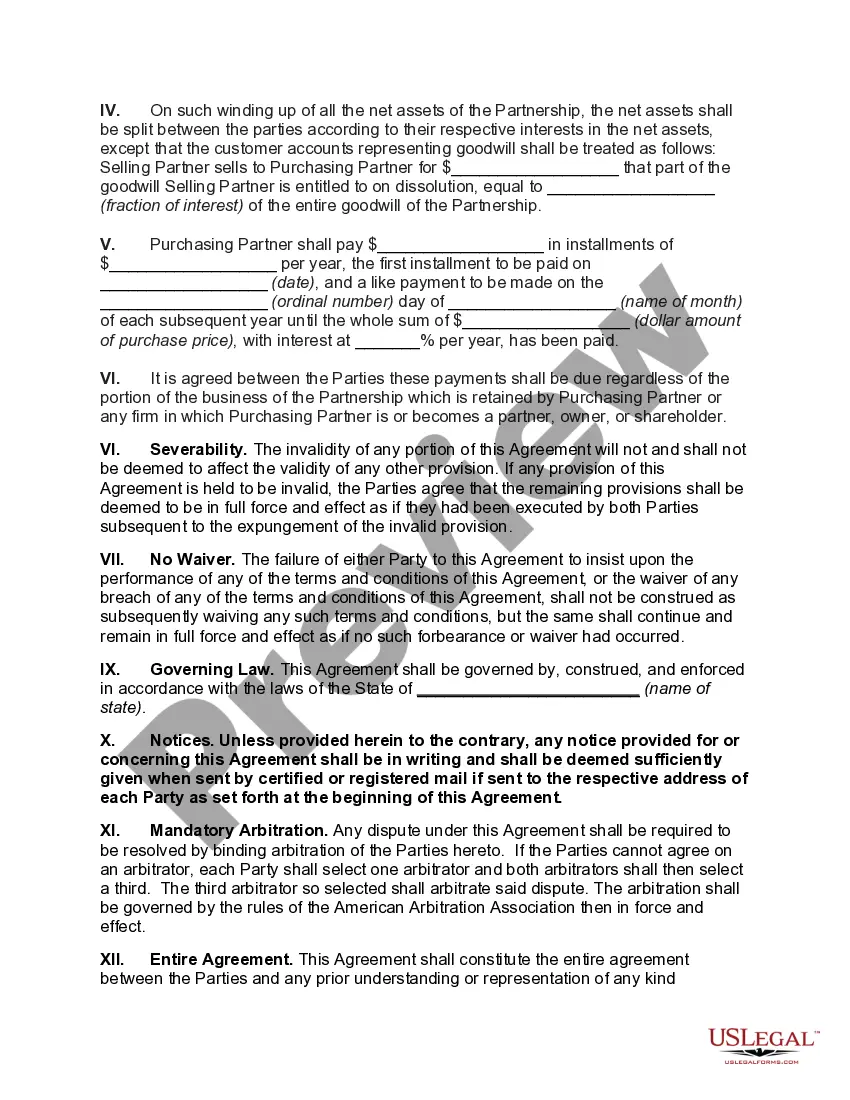

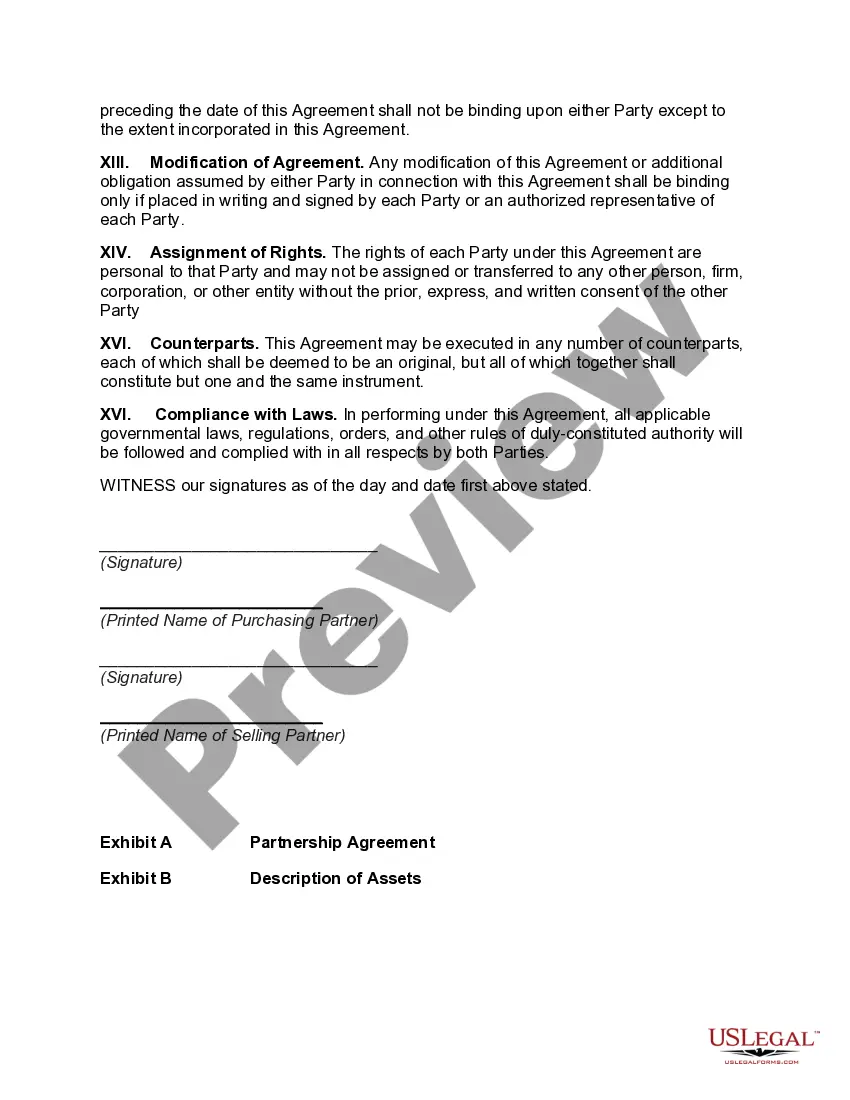

US Legal Forms offers a multitude of form templates, such as the Vermont Agreement to Dissolve and Wind Up Partnership with Sale to Partner and Disproportionate Distribution of Assets, which can be designed to meet state and federal criteria.

Once you find the correct form, click Get now.

Choose a convenient file format and download your copy.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Vermont Agreement to Dissolve and Wind Up Partnership with Sale to Partner and Disproportionate Distribution of Assets template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for the correct area/state.

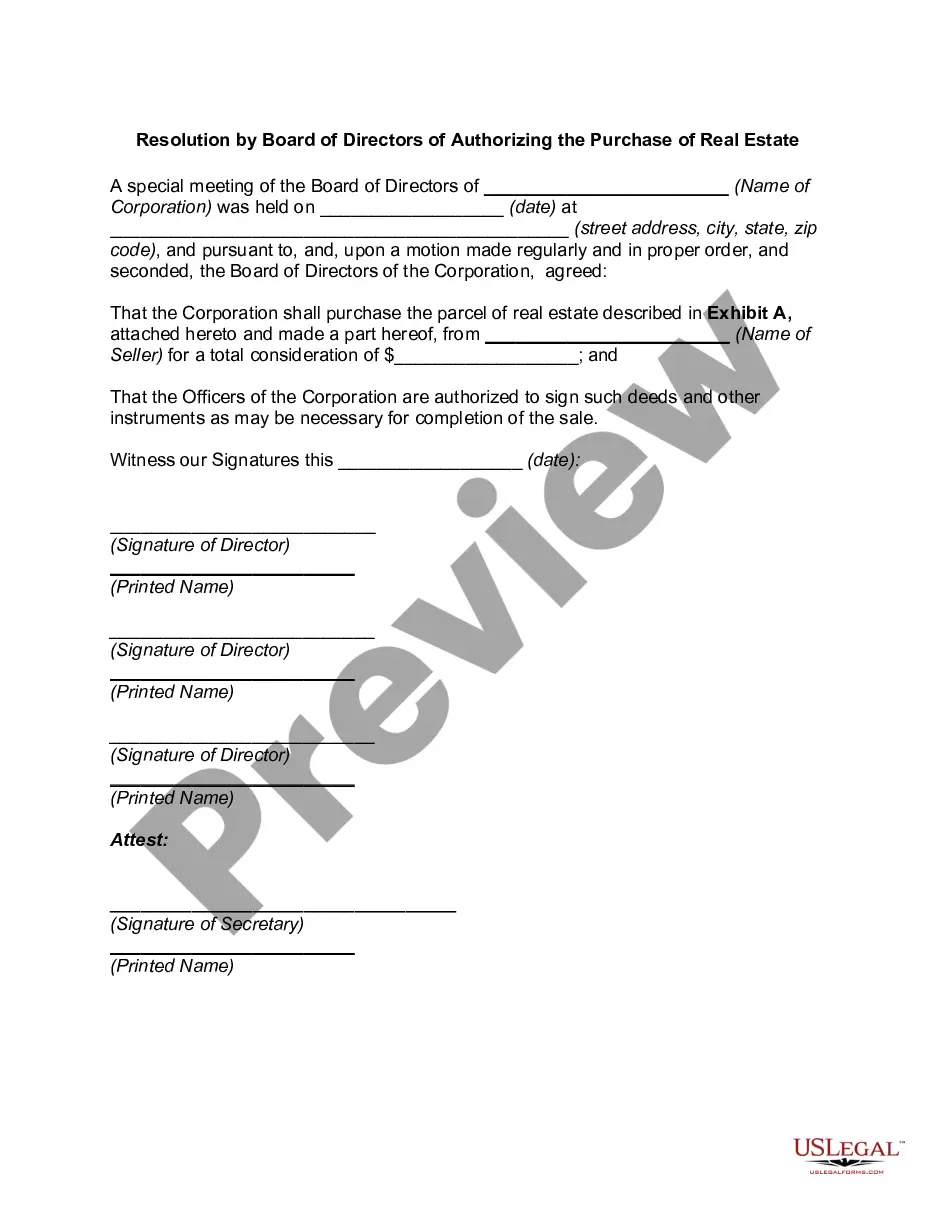

- Utilize the Review button to examine the form.

- Read the description to confirm that you have selected the right form.

- If the form isn’t what you’re looking for, use the Search section to find the form that meets your needs and specifications.

Form popularity

FAQ

Once the debts owed to all creditors are satisfied, the partnership property will be distributed to each partner according to their ownership interest in the partnership. If there was a partnership agreement, then that document controls the distribution.

Can one partner force the dissolution of an LLC partnership? The short answer is yes. If there are two partners, each holding a 50% stake in the business, one partner can force the LLC to dissolve.

When one partner wants to leave the partnership, the partnership generally dissolves. Dissolution means the partners must fulfill any remaining business obligations, pay off all debts, and divide any assets and profits among themselves. Your partners may not want to dissolve the partnership due to your departure.

Take a Vote or Action to Dissolve In most cases, dissolution provisions in a partnership agreement will state that all or a majority of partners must consent before the partnership can dissolve. In such cases, you should have all partners vote on a resolution to dissolve the partnership.

There are 4 steps to follow for changing the partnership deed:Step 1: Take the mutual consent of partners.Step 2: Prepare for making a supplementary partnership deed.Step 3: Executing supplementary partnership deed.Step 4: Do the filing with Registrar of Firm (RoF).14-Sept-2018

Upon the winding up of a limited partnership, the assets shall be distributed as follows: (1) To creditors, including partners who are creditors, to the extent permitted by law, in satisfaction of liabilities of the limited partnership other than liabilities for distributions to partners under section 34-20d or 34-27d;

Any partner can resign from the Limited Liability partnership by giving notice to firm and partners. The remaining partner will take suitable action on same keeping in mind the minimum number of partner would be left after resignation of one partner, capital contribution and so on.

The most common resolution is for one partner to offer to buy out the other. This will dissolve the partnership, but the business will continue. However, it is important that the offer is a fair price. Often the shareholders' agreement will state how this fair price is calculated.

There are only two ways in which a partner can be removed from a partnership or an LLP. The first is through resignation and the second is through an involuntary departure, forced by the other partners in accordance with the terms of a partnership agreement.

Removing a partner from a general partnership is the act of removing someone from your business that operates as a partnership. It can happen in several different ways, but the most common option is through a clause in the partnership agreement itself.