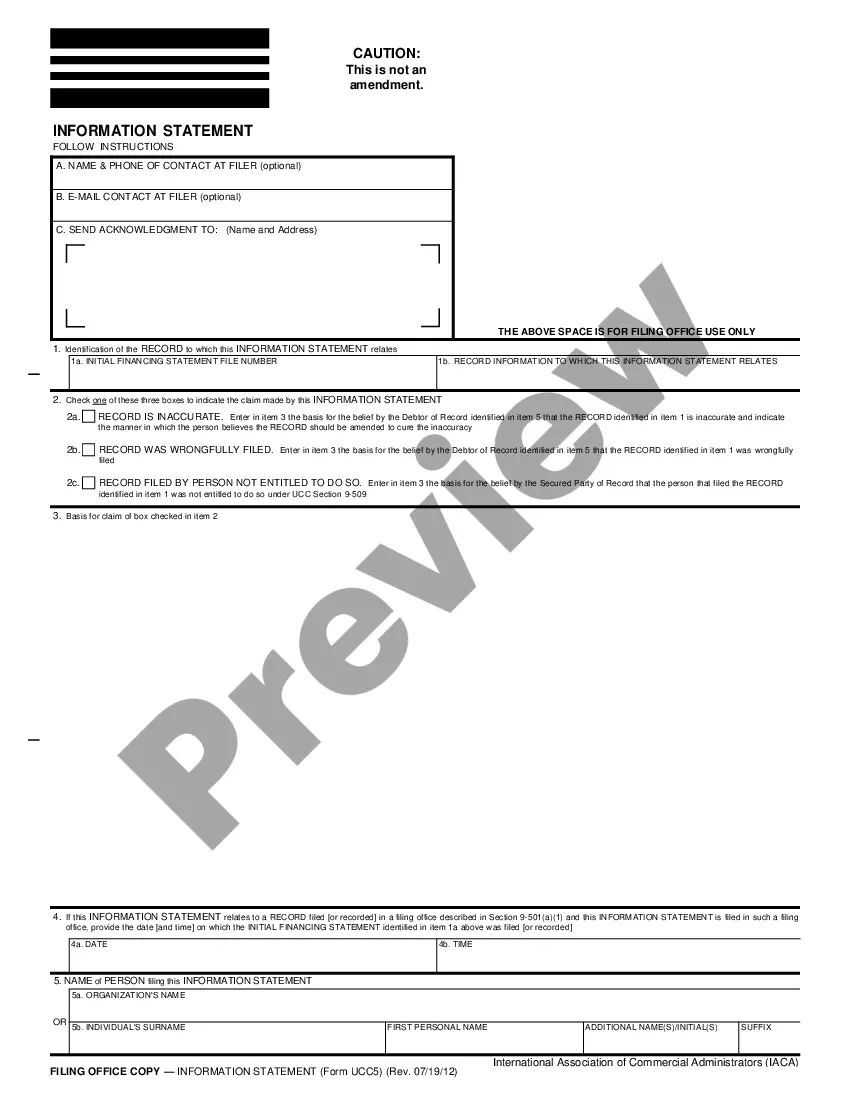

Vermont Sample Letter regarding Information for Foreclosures and Bankruptcies

Description

How to fill out Sample Letter Regarding Information For Foreclosures And Bankruptcies?

If you want to complete, down load, or print authorized record layouts, use US Legal Forms, the greatest selection of authorized varieties, which can be found online. Take advantage of the site`s simple and easy hassle-free search to obtain the papers you want. Numerous layouts for enterprise and personal reasons are categorized by classes and says, or keywords. Use US Legal Forms to obtain the Vermont Sample Letter regarding Information for Foreclosures and Bankruptcies in just a few mouse clicks.

When you are currently a US Legal Forms buyer, log in in your accounts and click the Download button to find the Vermont Sample Letter regarding Information for Foreclosures and Bankruptcies. You can even gain access to varieties you previously downloaded from the My Forms tab of your own accounts.

If you use US Legal Forms initially, refer to the instructions beneath:

- Step 1. Be sure you have chosen the form for the correct area/land.

- Step 2. Take advantage of the Review option to look over the form`s content. Do not forget about to see the explanation.

- Step 3. When you are unhappy with all the develop, use the Search area at the top of the display screen to locate other types from the authorized develop template.

- Step 4. After you have found the form you want, go through the Purchase now button. Pick the prices program you favor and add your credentials to sign up for the accounts.

- Step 5. Process the purchase. You should use your bank card or PayPal accounts to complete the purchase.

- Step 6. Select the file format from the authorized develop and down load it in your product.

- Step 7. Full, edit and print or indication the Vermont Sample Letter regarding Information for Foreclosures and Bankruptcies.

Each authorized record template you purchase is your own property forever. You might have acces to each develop you downloaded with your acccount. Click the My Forms section and decide on a develop to print or down load once more.

Remain competitive and down load, and print the Vermont Sample Letter regarding Information for Foreclosures and Bankruptcies with US Legal Forms. There are many skilled and express-certain varieties you can utilize to your enterprise or personal requirements.

Form popularity

FAQ

The mortgage exposes the real estate to claim by the mortgagee and is the document that gives the creditor the right to sue for foreclosure.

Redemption Period In most cases, it is about six months. If the property being foreclosed is not your primary residence, the court may give you less than six months. To redeem your property, you can pay the full amount that you owe the bank and avoid a foreclosure sale.

Judicial Foreclosure. All states allow this type of foreclosure, and some require it. The lender files suit with the judicial system, and the borrower will receive a note in the mail demanding payment. The borrower then has only 30 days to respond with a payment in order to avoid foreclosure.

Notice of Default ? Foreclosure starts when your lender records a Notice of Default against your property with the Registrar Recorder's office. The Notice of Default tells you the total amount you owe including missed payments and foreclosure fees.

The right of redemption gives mortgagors the opportunity to reclaim their property and stop a foreclosure sale from happening, or, in some cases, even repurchase their property after a sale has occurred.

In Vermont, lenders can use a judicial or strict foreclosure process to foreclose on Vermont-based property. Either way, the lender has to file a lawsuit in state court. Vermont law allows strict foreclosures if the value of the property is less than the debt amount.

A power of sale clause in a deed of trust allows lenders to foreclose on a property and sell it if the borrower defaults on their monthly mortgage payments. This allows the lender to recoup the outstanding loan balance on the home.

Security instrument, is the document that creates the lien on the property. The mortgage exposes the real estate to claim by the mortgagee and is the document that gives the creditor the right to sue for foreclosure.