Vermont Assessing the Primary Activities in the Value Chain

Description

How to fill out Assessing The Primary Activities In The Value Chain?

You have the ability to devote numerous hours online searching for the valid document template that satisfies the state and federal criteria you require.

US Legal Forms offers thousands of valid forms that have been reviewed by experts.

You can download or print the Vermont Evaluating the Main Activities in the Value Chain from our service.

If available, use the Preview button to review the document template as well.

- If you already have a US Legal Forms account, you can Log In and click on the Download button.

- After that, you can complete, modify, print, or sign the Vermont Evaluating the Main Activities in the Value Chain.

- Every valid document template you obtain is yours indefinitely.

- To get another copy of a purchased form, visit the My documents tab and click on the relevant button.

- If you are using the US Legal Forms website for the first time, follow the simple guidelines below.

- First, ensure that you have selected the correct document template for the region/city of your choice.

- Check the form description to confirm you have chosen the right form.

Form popularity

FAQ

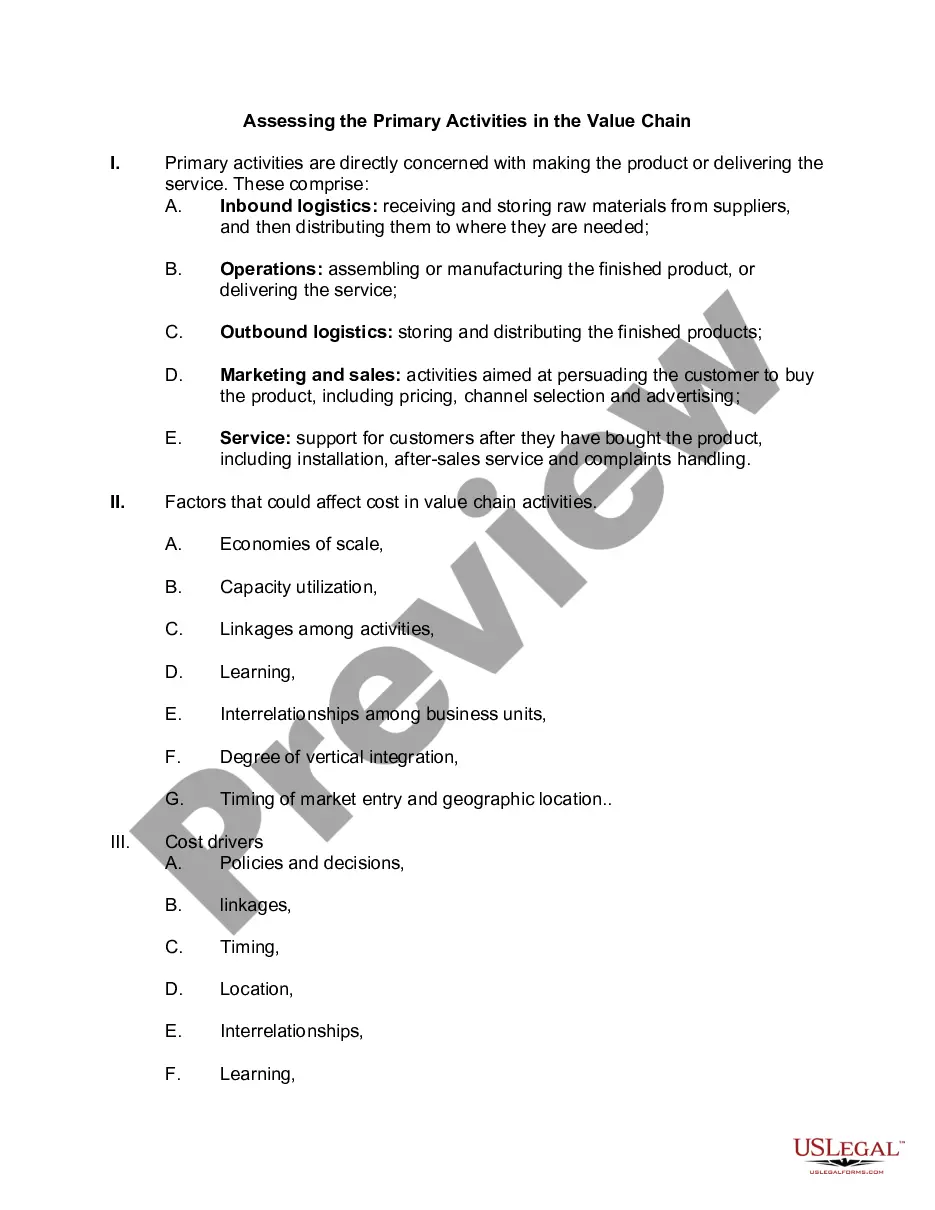

The primary purpose of value chain analysis is to provide a systematic approach to understanding how companies deliver their products and services. This insight leads to strategic improvements that can enhance customer satisfaction and boost profits. When applied in Vermont Assessing the Primary Activities in the Value Chain, it also reveals ways to streamline processes and eliminate waste. Consequently, businesses can benefit from a clearer roadmap for achieving their goals and increasing their competitive edge.

Porter's value chain serves as a framework for analyzing the specific activities within a company that add value to its products and services. By breaking down these activities, businesses can better understand their competitive position in the market. Vermont Assessing the Primary Activities in the Value Chain can leverage this analysis to optimize operations and drive greater value creation. This strategic approach aids in identifying unique advantages that distinguish a business from its competitors.

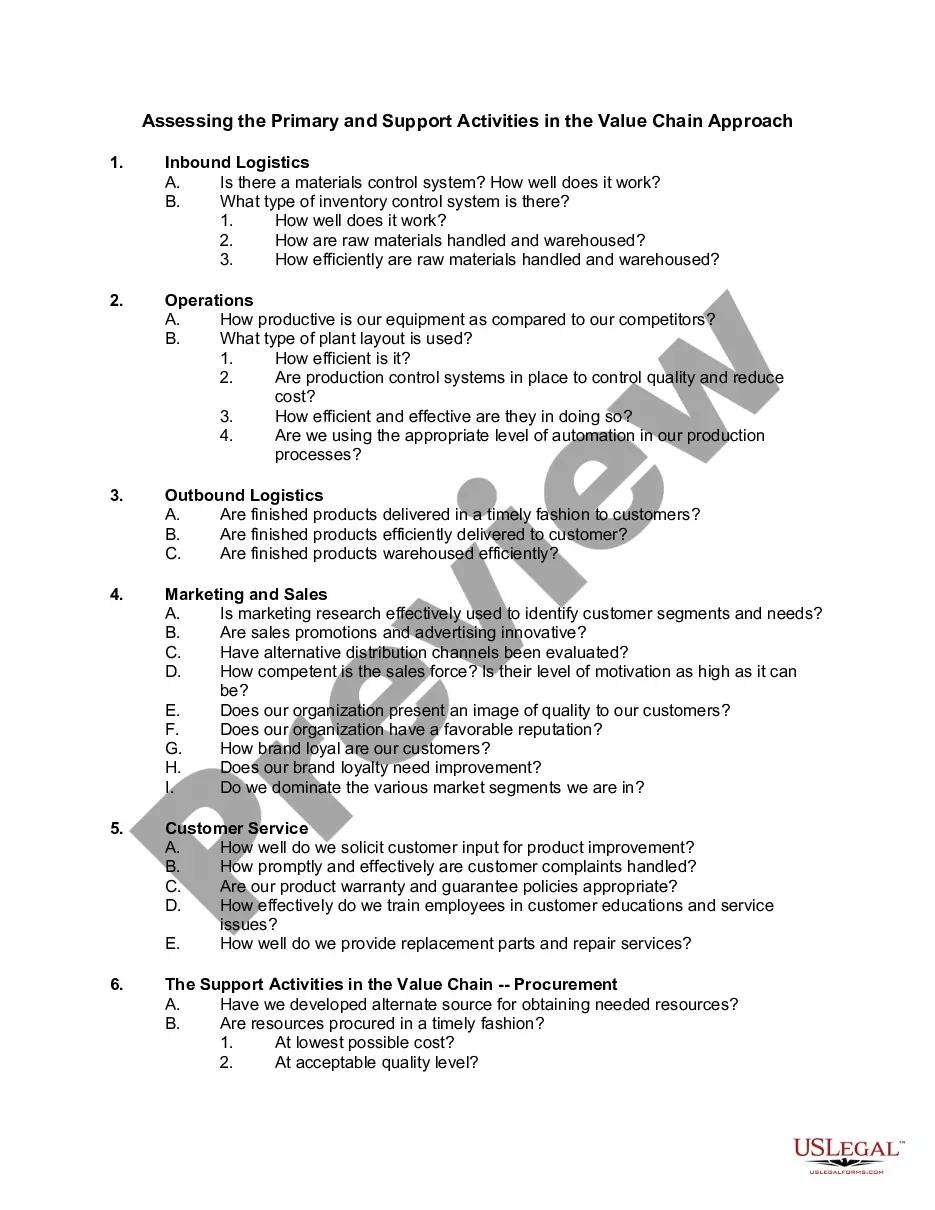

The five primary activities in the value chain aim to create value for a business while minimizing costs. Each activity, from inbound logistics to service, plays a pivotal role in enhancing the overall efficiency and effectiveness of operations. By understanding these activities, Vermont Assessing the Primary Activities in the Value Chain can lead to more informed decisions that improve profitability. Evaluating each component helps businesses identify strengths and weaknesses, allowing for continual growth and adaptation.

Vermont offers several tax benefits for retirees, including exemptions on Social Security income. Although property taxes can be higher, the state also provides tax credits and programs intended to ease the financial load for seniors. With a focus on Vermont Assessing the Primary Activities in the Value Chain, retirees can discover opportunities that foster financial wellness in their later years. It's advisable to consult with a tax professional to explore all available resources and benefits.

Property taxes in Vermont can be considered relatively high compared to some other states, but they vary significantly by town. The reasons behind these rates often include funding for local services such as education, public safety, and infrastructure. Evaluating Vermont Assessing the Primary Activities in the Value Chain helps in understanding how these funds are utilized for community development. Stay informed about your local tax structure to manage your planning efficiently.

Generally, towns like Burlington are known for having some of the highest property taxes in Vermont. These taxes often reflect service levels and community needs, so it’s important to consider what you receive in return. Understanding the implications of Vermont Assessing the Primary Activities in the Value Chain can guide residents in making informed decisions about their property investments. It is advisable to consult local resources for the most accurate and up-to-date tax information.

In Vermont, property taxes are typically assessed based on fair market value determined by town assessors. Factors such as location, property type, and improvements play key roles in this evaluation. Knowing how Vermont Assessing the Primary Activities in the Value Chain fits into this process can help property owners and buyers alike. You can appeal your assessment if you believe it does not accurately reflect your property's value.

Many variable factors contribute to property tax rates in Vermont; however, towns like Burlington and South Burlington often rank among those with higher tax rates. Understanding these rates is essential for anyone involved in Vermont Assessing the Primary Activities in the Value Chain. Always consider the context of local services and amenities when evaluating tax rates, as they can significantly impact community quality of life.

The Vermont Use Value Appraisal Program, commonly known as Current Use, assesses agricultural and forest land based on its current use rather than its market value. This program encourages land conservation and sustainable farming practices, aligning with Vermont Assessing the Primary Activities in the Value Chain. By participating, landowners can benefit from reduced property taxes while contributing to the preservation of the environment.

To find the assessed value of your home in Vermont, you can start by visiting your town’s official website. Most towns provide access to property records that detail assessed values and recent changes. This transparency supports Vermont Assessing the Primary Activities in the Value Chain by allowing homeowners to stay informed. Additionally, you might want to reach out directly to your local assessor's office for personalized assistance.