Vermont Packing Slip

Description

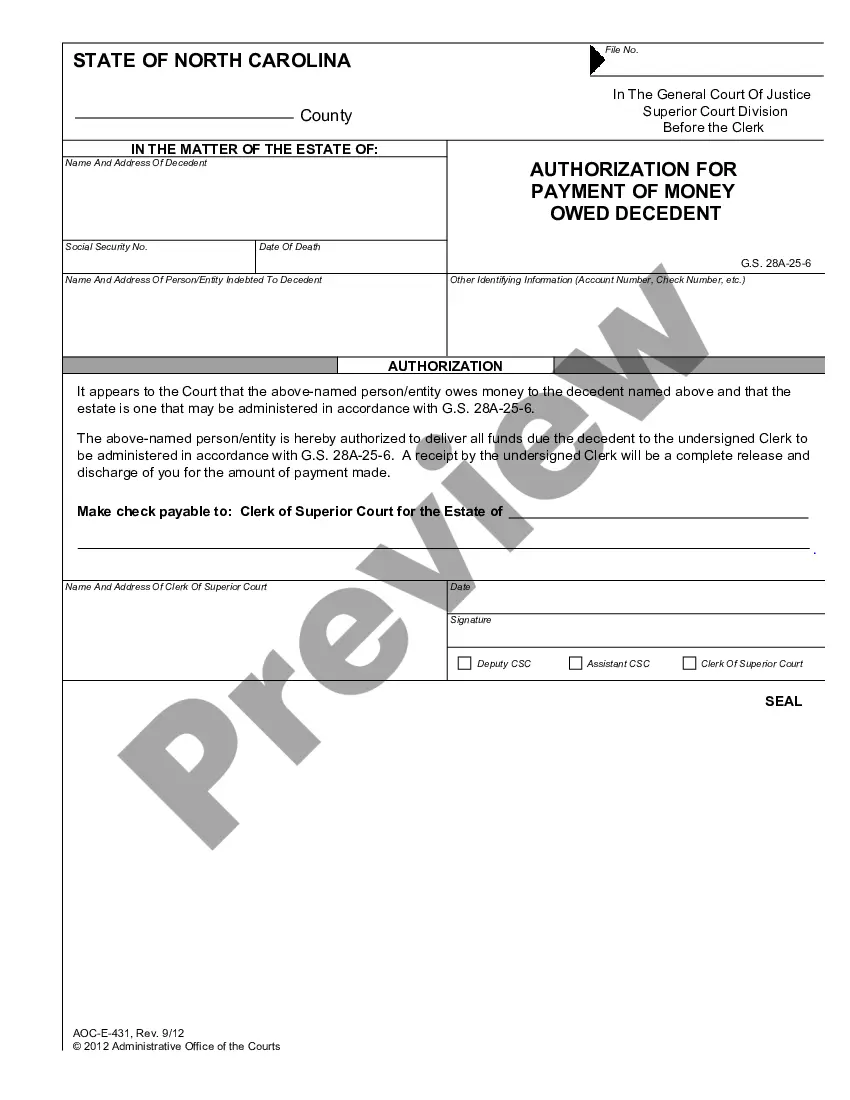

How to fill out Packing Slip?

You might utilize the internet trying to locate the legal document format that aligns with the federal and state requirements you seek.

US Legal Forms offers a wide array of legal documents that are assessed by professionals.

You can conveniently download or print the Vermont Packing Slip from my service.

To search for another version of the form, use the Lookup field to find the format that suits your needs and criteria.

- If you possess a US Legal Forms account, you can Log In and click on the Download button.

- Subsequently, you can complete, edit, print, or sign the Vermont Packing Slip.

- Each legal document format you purchase is yours indefinitely.

- To acquire another copy of the purchased form, visit the My documents section and select the appropriate button.

- If you are using the US Legal Forms site for the first time, follow the simple guidelines below.

- First, ensure you have selected the correct format for your chosen county/town.

- Review the form description to confirm you have selected the proper form.

Form popularity

FAQ

Non-residents generally need to use Form 1040NR to report their U.S. income. This form ensures that you meet your federal tax obligations. To make the process easier, consider using a Vermont Packing Slip to maintain a clear record of your income and any related expenses for your tax filing.

For non-residents working in Vermont, the withholding rate generally applies to income earned within the state. Employers are responsible for withholding these taxes from your paycheck. To keep track of the amounts withheld accurately, a Vermont Packing Slip can serve as an effective tool for your financial records.

The primary tax credit form in Vermont is Form CR. This form allows taxpayers to apply for various credits that can reduce their overall tax liability. Using a Vermont Packing Slip can aid in presenting your financial information clearly, which is especially useful when applying for these credits.

Yes, Vermont requires non-residents to file a tax return using Form 1040NR. This form allows non-residents to report income sourced in Vermont while claiming any applicable deductions. For organizing your tax-related documents, a Vermont Packing Slip is a valuable resource to keep your information clear and concise.

Form 1040 is used by residents to report their worldwide income, while Form 1040NR is specifically for non-residents reporting only their U.S.-sourced income. Understanding this distinction is crucial for compliance. A Vermont Packing Slip can help non-residents document their Vermont income correctly, ensuring no details are overlooked.

For non-residents in Vermont, the tax form you need is typically Form 1040NR. This form allows you to report your income earned in Vermont while also fulfilling your tax obligations. Utilizing a Vermont Packing Slip can help ensure that you track all relevant transactions accurately, making tax preparation smoother.

Vermont is known for its unique local shops and artisan markets, showcasing handmade crafts and local goods. From specialty food items to handcrafted furniture, the shopping experience captures the essence of Vermont culture. Having a Vermont Packing Slip can help you organize your purchases and keep track of local treasures as you explore the diverse shopping options.

The number one tourist attraction in Vermont is undoubtedly the stunning Green Mountains, which offer amazing hiking, skiing, and picturesque views. Many visitors also enjoy exploring local farms and markets for a taste of authentic Vermont. As you plan your visit, a Vermont Packing Slip can ensure you include all the right gear for your adventures.

Shoulder season refers to the periods between peak tourist seasons, commonly during spring and fall in Vermont. Travel during this time often means fewer crowds, allowing for a more relaxed experience of the state's natural beauty. Consider using a Vermont Packing Slip to plan your trip activities during the shoulder season effectively.

While not mandatory, sending a packing slip is recommended for clarity during the shipment process. It helps the recipient verify the items received against the order. Additionally, a Vermont Packing Slip strengthens your transaction by providing detailed information about the shipment, making the process smoother.