Vermont Notice And Acknowledgment for deposit of Will by Client

Description

How to fill out Notice And Acknowledgment For Deposit Of Will By Client?

Are you in an environment where you consistently need to have paperwork for either business or personal purposes.

There are numerous legal document templates available online, but finding reliable ones can be challenging.

US Legal Forms offers a vast array of form templates, including the Vermont Notice and Acknowledgment for deposit of Will by Client, designed to meet state and federal regulations.

Once you find the right form, click Get now.

Choose the pricing plan you desire, complete the necessary information to create your account, and finalize your order using your PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Vermont Notice and Acknowledgment for deposit of Will by Client template.

- If you don't have an account and wish to start utilizing US Legal Forms, follow these steps.

- Find the form you need and ensure it corresponds to the correct area/state.

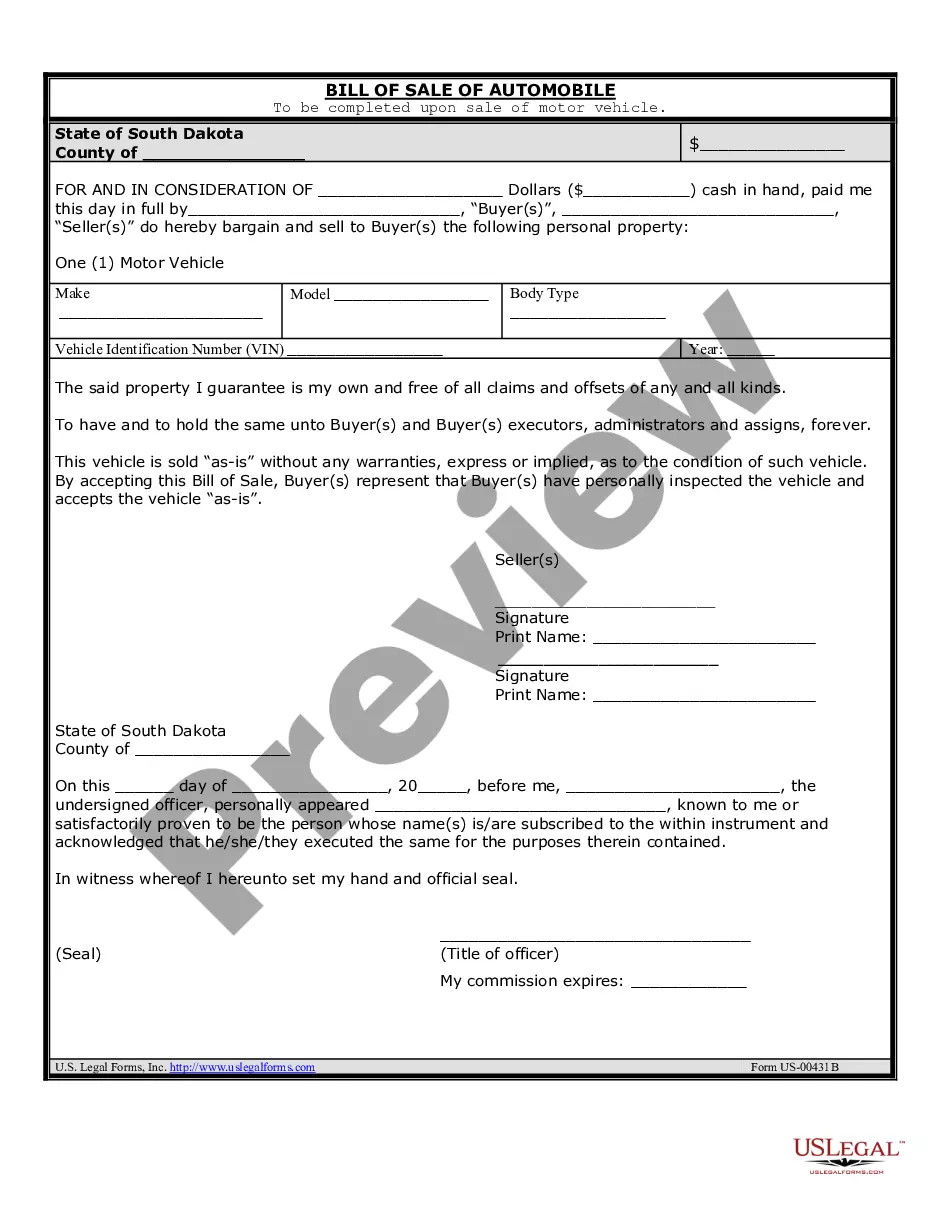

- Use the Preview button to examine the form.

- Read the description to confirm you have selected the correct form.

- If the form does not meet your requirements, utilize the Search field to locate the document that fulfills your needs.

Form popularity

FAQ

Inheritance laws in Vermont dictate how assets are distributed when someone dies without a will. Usually, intestacy laws favor close relatives, such as spouses and children. Understanding these laws is crucial for effective estate planning. The Vermont Notice And Acknowledgment for deposit of Will by Client can assist in ensuring your assets are distributed according to your wishes.

A deposit of will is the process by which a will is submitted for safekeeping, often with a court or designated repository. This can provide peace of mind knowing that your final wishes are protected until needed. By depositing your will, you ensure it's accessible when the time comes. Utilizing the Vermont Notice And Acknowledgment for deposit of Will by Client can facilitate this safeguarding process.

Rule 4 in Vermont probate law outlines the requirements for the service of process. This includes notifying interested parties about the probate case, ensuring they have the opportunity to participate. Proper notification is essential to uphold the legal process. Using the Vermont Notice And Acknowledgment for deposit of Will by Client can help you manage these notifications accurately.

Heirs at law in Vermont are individuals who inherit under the state's laws when someone passes away without a will. Typically, this includes spouses, children, parents, and siblings, according to Vermont's intestacy laws. Recognizing who qualifies as an heir can impact how a will is structured. The Vermont Notice And Acknowledgment for deposit of Will by Client ensures you identify and acknowledge these important relationships.

In Vermont, a will typically must go through probate unless it meets certain criteria. If all assets are in a trust or if the estate qualifies for a simplified process, you may not need to go through the full probate proceedings. Understanding this can simplify the management of your estate. Consider utilizing the Vermont Notice And Acknowledgment for deposit of Will by Client to navigate the process effectively.

In Vermont, the value of an estate generally determines whether it must go through probate. If the total value of the estate exceeds $40,000, it will likely need to enter the probate process. This includes all assets owned by the deceased, as well as any real property. For a smoother experience, consider using the Vermont Notice And Acknowledgment for deposit of Will by Client to ensure proper handling of estate documents.

Generally, assets that do not go through probate encompass jointly owned property, accounts with payable-on-death designations, and trust-held assets. By ensuring these assets are properly assigned, your beneficiaries can receive them without the delay of probate. The Vermont Notice And Acknowledgment for deposit of Will by Client serves as an essential document in outlining these transactions.

Assets that typically do not go through probate include life insurance policies with named beneficiaries, retirement accounts, and trusts. These assets transfer directly to the designated parties upon your death. Utilizing the Vermont Notice And Acknowledgment for deposit of Will by Client can clearly document your wishes and help manage the distribution of your estate.

To set up an estate for a deceased person, start by locating the will and filing it with the probate court. You will also need to gather a list of the deceased's assets and liabilities, while potentially using the Vermont Notice And Acknowledgment for deposit of Will by Client to guide the process. This ensures that everything is managed according to their wishes.

Examples of non-probate property include assets held in a joint tenancy and retirement accounts with designated beneficiaries. These properties transfer directly to the named individuals upon your death, avoiding the probate process altogether. You may want to consider the Vermont Notice And Acknowledgment for deposit of Will by Client to ensure proper documentation of all your intents.