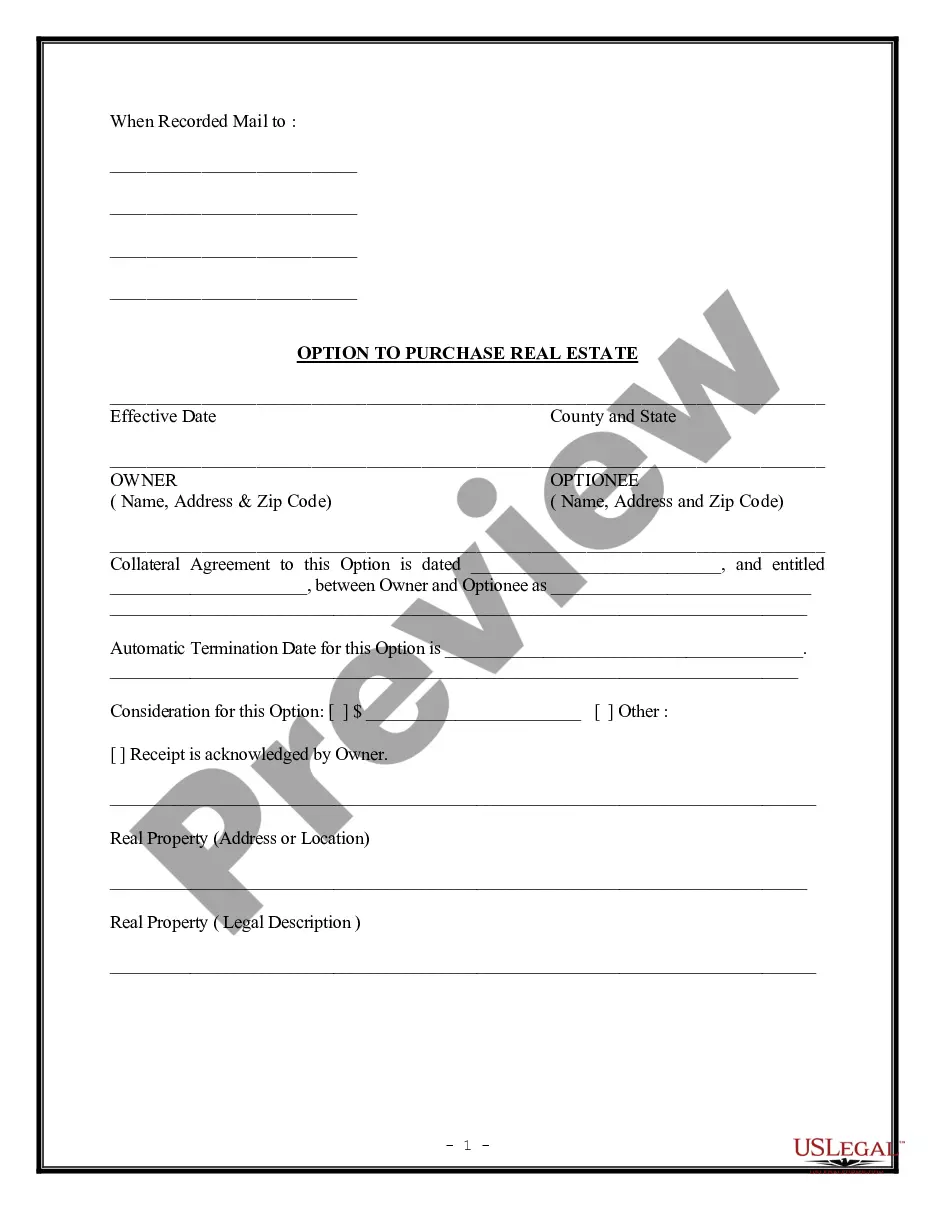

Vermont Option to Purchase - Short Form

Description

How to fill out Option To Purchase - Short Form?

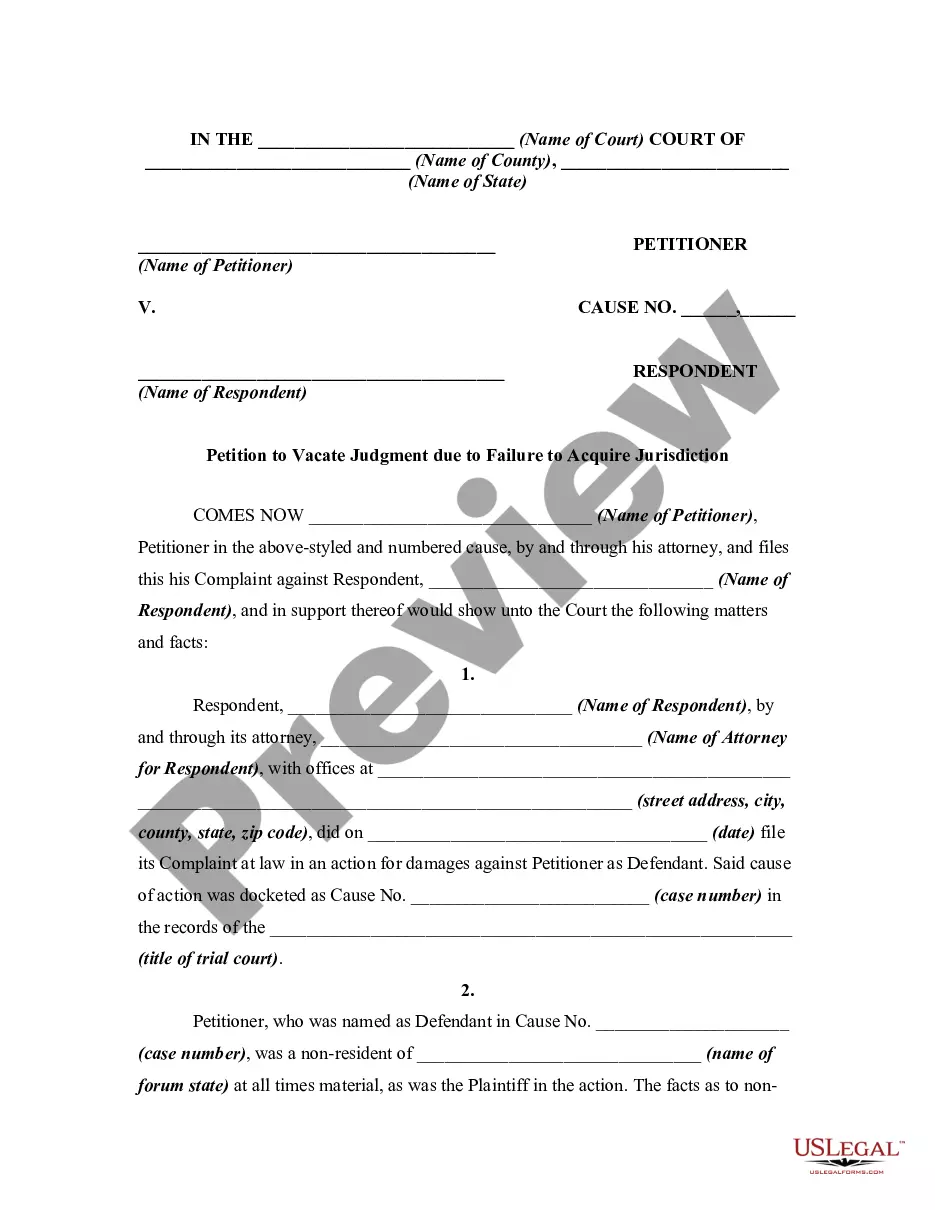

In case you need to finish, retrieve, or print approved document formats, utilize US Legal Forms, the largest assortment of legal templates that are accessible online.

Take advantage of the website's straightforward and convenient search function to locate the documents you require.

Different templates for corporate and personal purposes are organized by categories and jurisdictions, or keywords.

Step 4. Once you have found the necessary form, click the Order now button. Select your preferred payment plan and enter your details to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment.

- To acquire the Vermont Option to Purchase - Short Form with just a few clicks, use US Legal Forms.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to find the Vermont Option to Purchase - Short Form.

- You can also find documents you previously obtained in the My documents section of your account.

- If you are utilizing US Legal Forms for the first time, adhere to the following steps.

- Step 1. Ensure you have chosen the form for the suitable region/state.

- Step 2. Utilize the Review option to inspect the document's content. Remember to read the description.

- Step 3. If you are dissatisfied with the form, use the Search box at the top of the page to find alternate versions of the legal document template.

Form popularity

FAQ

To make yourself tax-exempt, you need to establish eligibility under Vermont tax law. This typically applies to nonprofits and government entities, and you'll need to complete an application with the Vermont Department of Taxes. Along with the application, attach any required documentation proving your tax-exempt status. Once recognized as tax-exempt, you'll enjoy benefits such as exemption from sales tax on qualifying purchases.

Getting a tax exempt number in Vermont requires you to submit an application to the Vermont Department of Taxes, providing proof of eligibility. This is usually applicable for nonprofits, educational institutions, and government agencies. The process generally involves filling out forms and submitting supporting documents. Once you have your tax exempt number, you can utilize it for qualifying purchases under Vermont's tax laws.

To obtain a sales tax exempt number in Vermont, you need to apply through the Vermont Department of Taxes. Typically, nonprofit organizations, government entities, and certain businesses qualify for tax-exempt status. You will need to provide documentation that proves your eligibility. Once approved, this number can be used to make purchases without incurring sales tax.

To obtain a Vermont tax ID number, you must complete an application through the Vermont Department of Taxes. You can apply online, by phone, or by mailing in a paper application. Ensure you provide all necessary documentation, as accuracy is key to a smooth process. Once approved, you will receive your Vermont tax ID number, which you will need for various tax-related purposes.

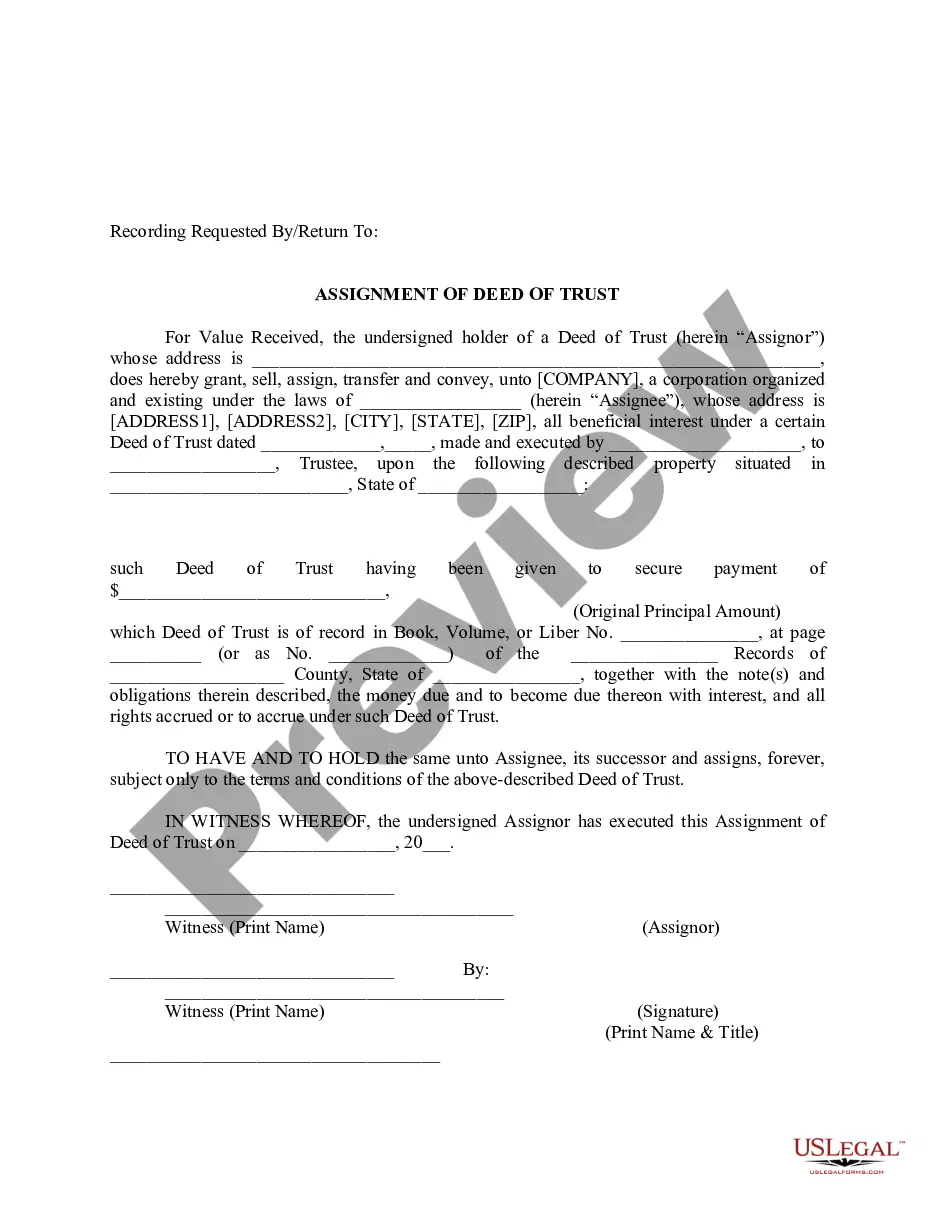

A Vermont rent-to-own agreement allows a tenant to lease property with the opportunity to buy at a specific point during the agreement term. This leasing arrangement is intended for prospective owners who wish to enter the real estate market but have poor credit or are otherwise unable to obtain a mortgage.

Are Verbal Contracts Enforceable or Not? Verbal agreements between two parties are just as enforceable as a written agreement, so long as they do not violate the Statute of Frauds. Like written contracts, oral ones just need to meet the requirements of a valid contract to be enforced in court.

In California, oral contracts are legally binding. However, in the event a dispute arises between the parties, the existence and terms of oral contracts are much more difficult to prove than with traditional written contracts.

If you take out a lease purchase agreement on a new car, you agree from the outset that at the end of the contract, you will purchase the vehicle. It enables you to eventually buy a new car, without having to find the entire amount up front. Where lease purchase differs is that it is a pure finance agreement.

toown home is also called a leasetoown home. This occurs when a potential buyer agrees to rent the home for a period of time (typically one to five years) before buying it from the homeowner. During this period, the buyer pays rent to bring down the overall cost to buy the house.

Rent-to-own car financing deals can be a good way for consumers with bad or no credit histories to enter the car-buying market if the deal is fair.