Vermont Option For the Sale and Purchase of Real Estate - General Form

Description

How to fill out Option For The Sale And Purchase Of Real Estate - General Form?

Finding the appropriate legal document template can be challenging.

Of course, many templates can be found online, but how do you obtain the legal form that you require.

Visit the US Legal Forms website. This service offers a multitude of templates, including the Vermont Option for the Sale and Purchase of Real Estate - General Form, suitable for both business and personal needs.

First, ensure you have selected the correct form for your city/region. You can preview the form using the Preview button and read the form details to confirm it is the appropriate one for your situation.

- All templates are reviewed by experts and comply with state and federal regulations.

- If you are already registered, Log In to your account and click the Download button to access the Vermont Option for the Sale and Purchase of Real Estate - General Form.

- Use your account to search for the legal forms you have previously purchased.

- Go to the My documents section of your account to obtain another copy of the document you need.

- If you are a new user of US Legal Forms, follow these simple steps.

Form popularity

FAQ

To avoid Vermont estate tax, consider strategies like gifting assets during your lifetime. This can reduce the overall value of your estate. Consulting with a tax professional or estate planning attorney is beneficial for tailored advice. They can recommend specific steps to optimize your estate planning, helping you retain more wealth for your heirs.

Broadly, a real estate option is a specially designed contract provision between a buyer and a seller. The seller offers the buyer the option to buy a property by a specified period of time at a fixed price. The buyer purchases the option to buy or not buy the property by the end of the holding period.

Not directly, no. Transfer taxes aren't tax deductible, unless you're selling a rental or investment property, in which case they can be deducted as a standard business expense.

Broadly, a real estate option is a specially designed contract provision between a buyer and a seller. The seller offers the buyer the option to buy a property by a specified period of time at a fixed price. The buyer purchases the option to buy or not buy the property by the end of the holding period.

The Property Transfer Tax is a tax on the transfer by deed of title to real property in Vermont. A Property Transfer Tax Return must be filed with a Town Clerk whenever a deed transferring title to real property is delivered to them for recording.

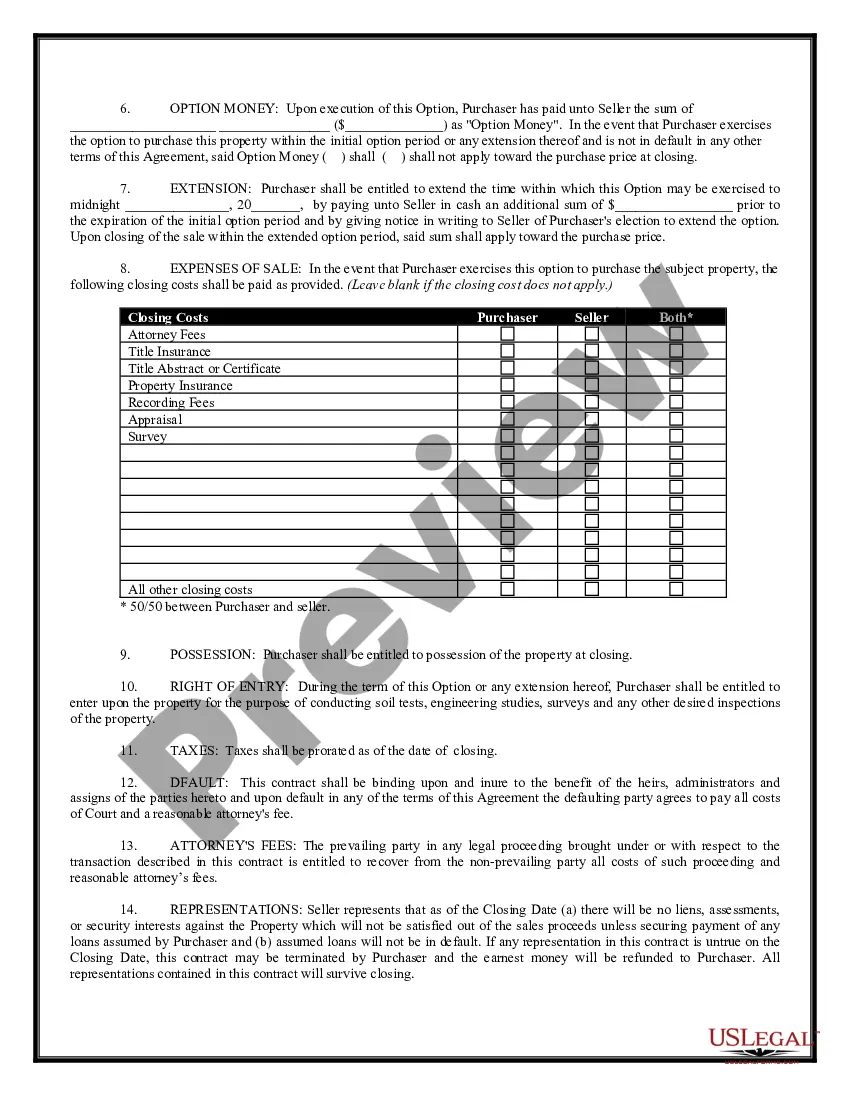

When a home purchase closes, the home buyer is required to pay, among other closing costs, the Vermont Property Transfer Tax. The buyer is taxed is at a rate of 0.5% of the first $100,000 of the home's value and 1.45% of the remaining portion of the value.

(a) Deeds and other conveyances of lands, or of an estate or interest therein, shall be signed by the party granting the same and acknowledged by the grantor before a notary public and recorded at length in the clerk's office of the town in which such lands lie.

The purpose of an options contract in real estate is to offer the buyer alternatives. Outcomes may vary according to the type of buyer, including early exercise, option expiration, or second-buyer sales. Real estate professionals use option contracts to provide flexibility on specific types of real estate transactions.

Overview of Vermont Taxes The average effective property tax rate in Vermont is 1.86%, which ranks as the fifth-highest rate in the U.S. The typical homeowner in Vermont can expect to spend $4,340 annually in property taxes.

Property Transfer Tax (PTT) is tax charged on transactions in which property is sold. This tax is a percentage of the realizable value from the property transaction. Realizable value is the free market value or contract price, whichever is the greater value of the property.