Vermont Rejection of Goods

Description

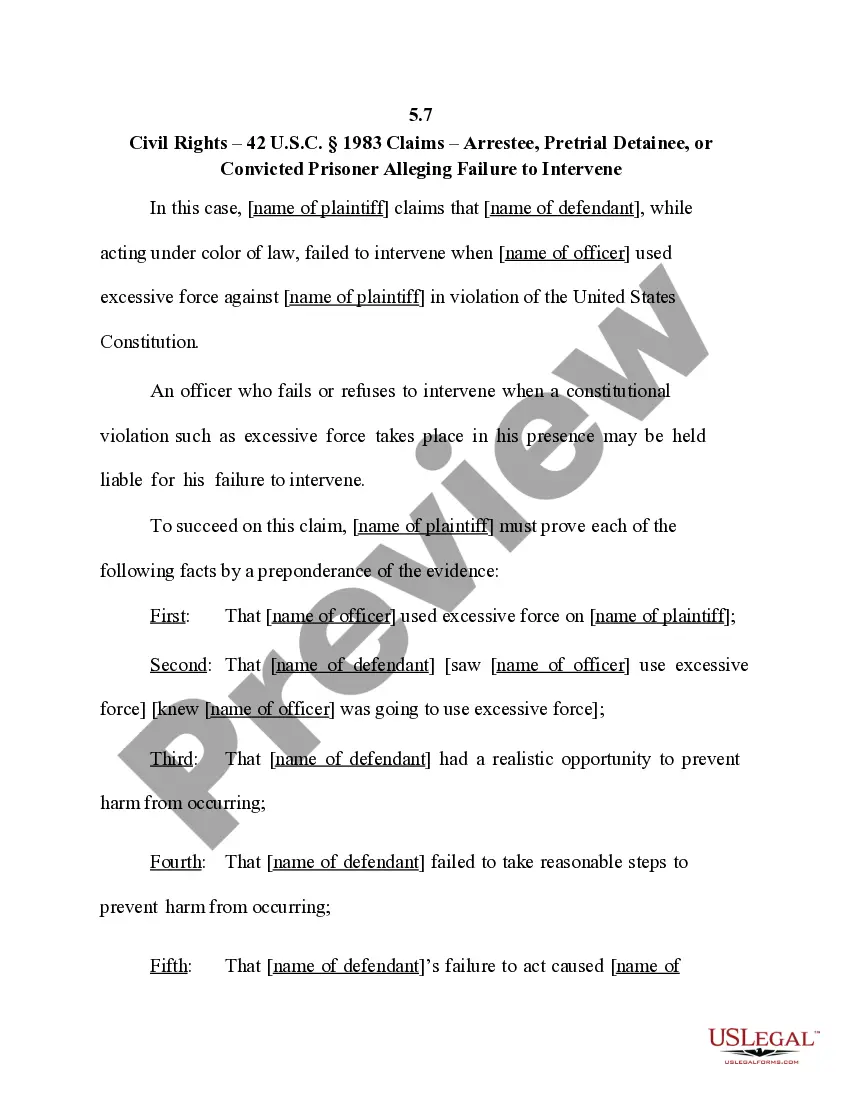

How to fill out Rejection Of Goods?

US Legal Forms - one of the largest collections of legal templates in the United States - offers a variety of legal document formats you can download or print.

By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest iterations of forms like the Vermont Rejection of Goods in just a few minutes.

If you have a subscription, Log In and download the Vermont Rejection of Goods from your US Legal Forms collection. The Obtain button will show up on each template you examine. You also have access to all previously saved forms from the My documents tab in your account.

Every template you add to your account has no expiration date and is yours indefinitely. Thus, to download or print another copy, simply go to the My documents section and click on the form you need.

Access the Vermont Rejection of Goods with US Legal Forms, the most extensive collection of legal document templates. Utilize a multitude of professional and state-specific templates that cater to your business or personal needs.

- Ensure you have selected the correct template for your area/county. Click the Review button to check the form's details. Look at the form description to ensure you've picked the right document.

- If the form does not meet your requirements, use the Search field at the top of the page to find one that does.

- If you are happy with the form, confirm your choice by clicking on the Buy now button. Then, select the pricing plan you want and provide your details to register for an account.

- Process the transaction. Use your credit card or PayPal account to complete the payment.

- Select the format and download the form to your device.

- Make changes. Fill out, edit, and print and sign the downloaded Vermont Rejection of Goods.

Form popularity

FAQ

Yes, Vermont does issue resale certificates, allowing businesses to buy items without paying sales tax. This certificate is essential for retailers who plan to resell products. Ensuring you have a valid resale certificate can help avoid complications associated with Vermont Rejection of Goods.

No, Vermont is not a Streamlined Sales Tax (SST) state. While it follows many practices aligned with SST, it does not participate in the full program. Understanding this distinction can help businesses navigate sales tax matters, especially concerning Vermont Rejection of Goods.

Yes, you typically need a resale certificate for each state where you make tax-exempt purchases. Each state has its own requirements for issuing these certificates, and non-compliance can lead to issues. Proper resale certificates help mitigate complications related to Vermont Rejection of Goods, ensuring smoother transactions.

Vermont’s voluntary disclosure program allows businesses to report uncollected taxes without facing penalties. This program encourages compliance while providing a pathway for tax amnesty. Engaging in this program can be beneficial if you've dealt with issues like Vermont Rejection of Goods.

Several states have specific restrictions regarding the acceptance of out-of-state resale certificates. States such as New York, New Jersey, and Virginia may not recognize these certificates without proper documentation. It is essential to check the regulations in each state to avoid complications, especially when dealing with Vermont Rejection of Goods.

The form 111 in Vermont is used for sales and use tax purposes. This form requires businesses to report tax collected from sales made in the state. Accurate reporting is crucial for compliance with Vermont tax laws, especially in relation to Vermont Rejection of Goods.

Certain items are exempt from Vermont sales tax, including groceries and prescription medications. Familiarizing yourself with these exemptions is essential when managing inventory and understanding your tax obligations. This knowledge can also be beneficial in cases of Vermont rejection of goods, as it helps clarify which items are subject to tax.

Yes, Vermont requires a resale certificate for businesses purchasing goods intended for resale. This certificate allows you to buy items without paying sales tax upfront. Understanding how this affects matters such as the Vermont rejection of goods can help you navigate tax responsibilities more efficiently.

When responding to correspondence regarding Vermont taxes, it's important to follow the instructions included in the letter. Make sure to include any necessary documentation to support your case. If your correspondence relates to Vermont rejection of goods, providing clear details will help expedite the resolution.

The VT state tax form IN-111 is a document specifically for individuals who must file personal income taxes in Vermont. Using this form correctly ensures compliance with state tax laws. If you encounter issues related to the Vermont rejection of goods, understanding this form may clarify your tax responsibilities.