Vermont Revocable Trust for Minors

Description

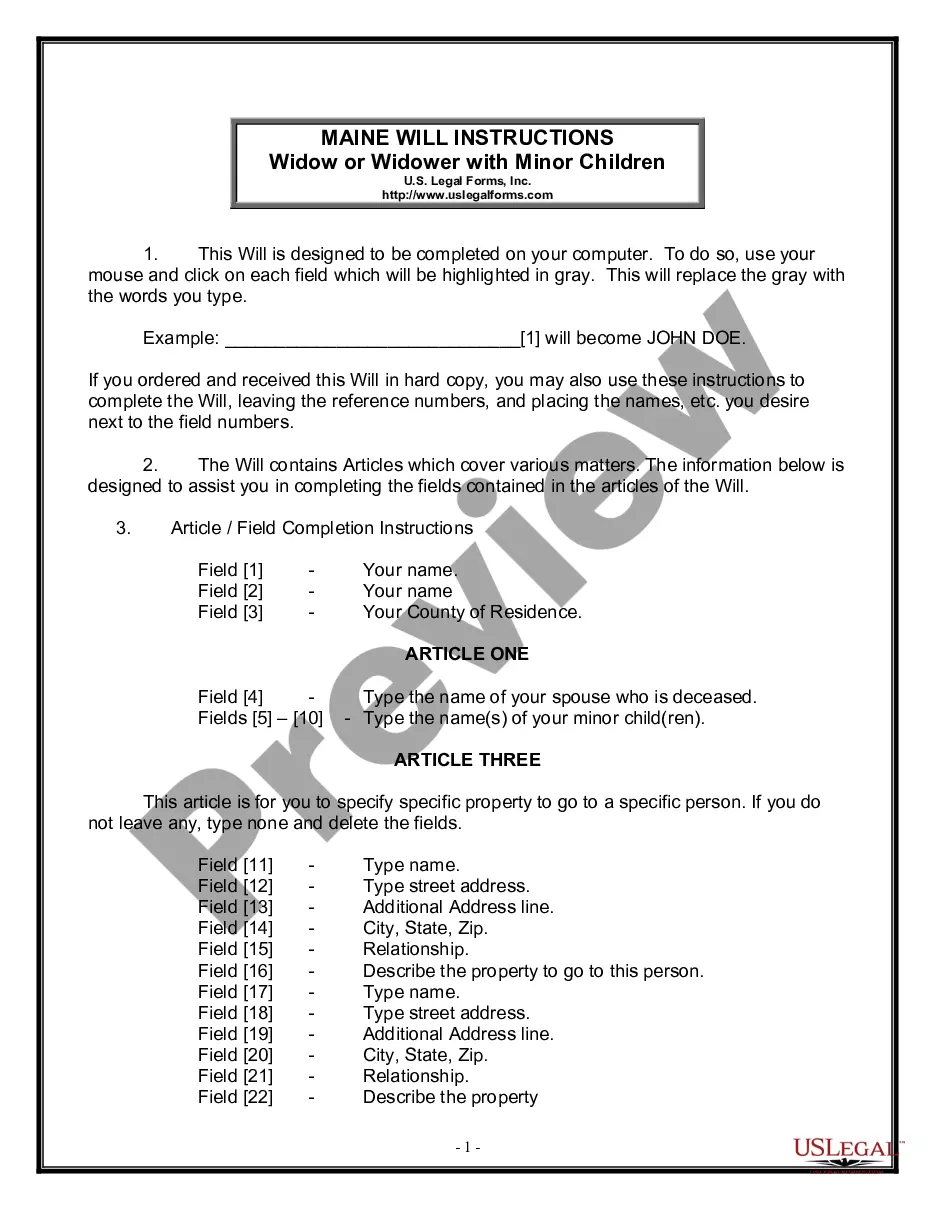

How to fill out Revocable Trust For Minors?

US Legal Forms - one of the largest repositories of legal documents in the United States - provides a broad selection of legal form templates that you can download or print.

By using the platform, you will find thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can locate the latest editions of forms like the Vermont Revocable Trust for Minors in just moments.

If you hold an account, Log In and download the Vermont Revocable Trust for Minors from the US Legal Forms library. The Download button will be visible on every form you view. You can access all previously purchased forms in the My documents section of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the purchase.

Select the format and download the form to your device. Edit. Fill out, modify, and print and sign the acquired Vermont Revocable Trust for Minors. Each format added to your purchase has no expiration date and belongs to you indefinitely. Therefore, if you wish to download or print another version, simply visit the My documents section and click on the form you need. Access the Vermont Revocable Trust for Minors with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that satisfy your business or personal requirements and criteria.

- If you are a new user of US Legal Forms, here are simple steps to help you get started.

- Make sure you have selected the correct form for your area/county.

- Click the Preview button to review the form’s details.

- Read the form description to ensure that you have chosen the right document.

- If the form does not meet your needs, utilize the Search field at the top of the screen to find one that does.

- Once you are satisfied with the form, confirm your choice by clicking the Buy Now button.

- Next, select your desired pricing plan and provide your credentials to register for an account.

Form popularity

FAQ

One significant mistake parents make is not clearly defining the trust's objectives and terms. They might overlook the importance of specifying how and when funds will be distributed to their children. In a Vermont Revocable Trust for Minors, clarity in the trust document can prevent disputes and misunderstandings in the future. It is wise to consult professionals, such as those at USLegalForms, to help you avoid common pitfalls and ensure that your trust serves your intended purpose.

To set up a trust in Vermont, you need to define your goals and select a trustee. You should draft a trust document that outlines the terms, including management and distribution of assets, which is where a Vermont Revocable Trust for Minors comes into play. It's advisable to seek legal guidance to ensure compliance with state laws and effectively protect your minor's interests. USLegalForms provides essential tools and guidance to help you navigate the trust setup process seamlessly.

A child trust fund is a long-term savings account opened for a child that provides funds once they reach maturity, typically when they turn 18. This account often benefits from tax advantages, making it a smart choice for parents planning for their child's future. A Vermont Revocable Trust for Minors can serve a similar purpose, ensuring critical financial resources are accessible for the child's needs over time. With proper planning, both can help secure the child’s financial future.

A minor trust is specifically designed to manage assets for a child until they reach legal adulthood. In the context of a Vermont Revocable Trust for Minors, this trust allows parents to ensure their children are financially supported while protecting the assets. Setting up the trust mitigates risks and ensures that funds are available for essential expenses like education or healthcare. It also helps ensure responsible management until the minor can handle the funds independently.

A simple trust is a type of trust that requires all income generated to be distributed to the beneficiaries. It does not accumulate income or make charitable distributions, which sets it apart from other trust types. Establishing a Vermont Revocable Trust for Minors can provide straightforward management of a child's inheritance by adhering to simple trust principles. This trust type ensures that the minor receives direct support without the complications of accumulated income.

A trust is typically categorized into revocable or irrevocable. A Vermont Revocable Trust for Minors allows the trustor to modify or dissolve the trust while they are alive. This flexibility makes it an appealing option for parents who wish to retain control over the assets until the minor reaches maturity. Trusts can also be family or charitable, depending on the purpose behind the trust.

You can set up a Vermont Revocable Trust for Minors at any age, but doing so early can be beneficial. Establishing a trust when your child is young ensures their future is financially secure and allows you to plan for their needs effectively. It's also a proactive step that can help manage assets and resources before they reach adulthood.

For most families, a Vermont Revocable Trust for Minors is one of the best options. It provides a secure way to manage assets intended for your child while allowing you to make changes as needed. This flexibility is beneficial in adapting to changes in family situations or financial circumstances.

The best type of trust for a child often depends on your goals, but a Vermont Revocable Trust for Minors is a popular choice. This trust offers flexibility and allows you to maintain control over assets while providing benefits to your child. It also enables you to outline specific conditions under which the child can access the assets.

A minor trust, often a Vermont Revocable Trust for Minors, is designed specifically for the benefit of a child. This trust allows you to hold and manage assets until the minor reaches adulthood or another specified age. The trustee manages the assets, ensuring they are used for the child's needs and welfare.