This form is a generic sample of a receipt for an installment payment for an owner financed real estate sale/purchase.

Vermont Receipt for Payment Made on Real Estate Promissory Note

Description

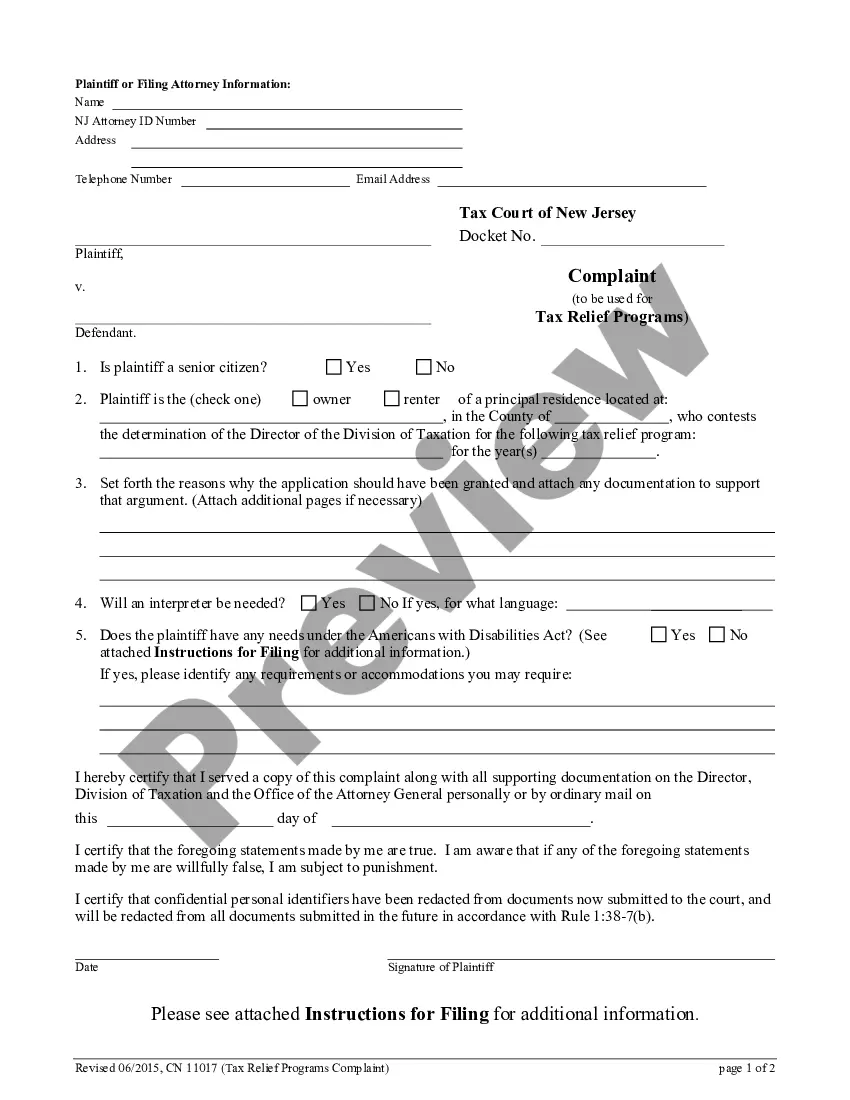

How to fill out Receipt For Payment Made On Real Estate Promissory Note?

Are you in a situation that requires documentation for business or particular functions on a regular basis? There are numerous valid document formats available online, but obtaining templates you can rely on is challenging.

US Legal Forms offers thousands of form templates, including the Vermont Receipt for Payment Made on Real Estate Promissory Note, which can be printed to meet state and federal regulations.

If you are already acquainted with the US Legal Forms website and have an account, simply Log In. Then, you can download the Vermont Receipt for Payment Made on Real Estate Promissory Note template.

- Locate the form you need and ensure it is for your specific city/county.

- Utilize the Preview button to review the form.

- Examine the description to confirm you have selected the correct form.

- If the form is not what you seek, use the Lookup field to find the form that suits your requirements.

- Once you find the appropriate form, click Purchase now.

- Select the pricing plan you prefer, complete the required information to create your account, and pay for your order using PayPal or credit card.

- Choose a convenient file format and download your copy.

Form popularity

FAQ

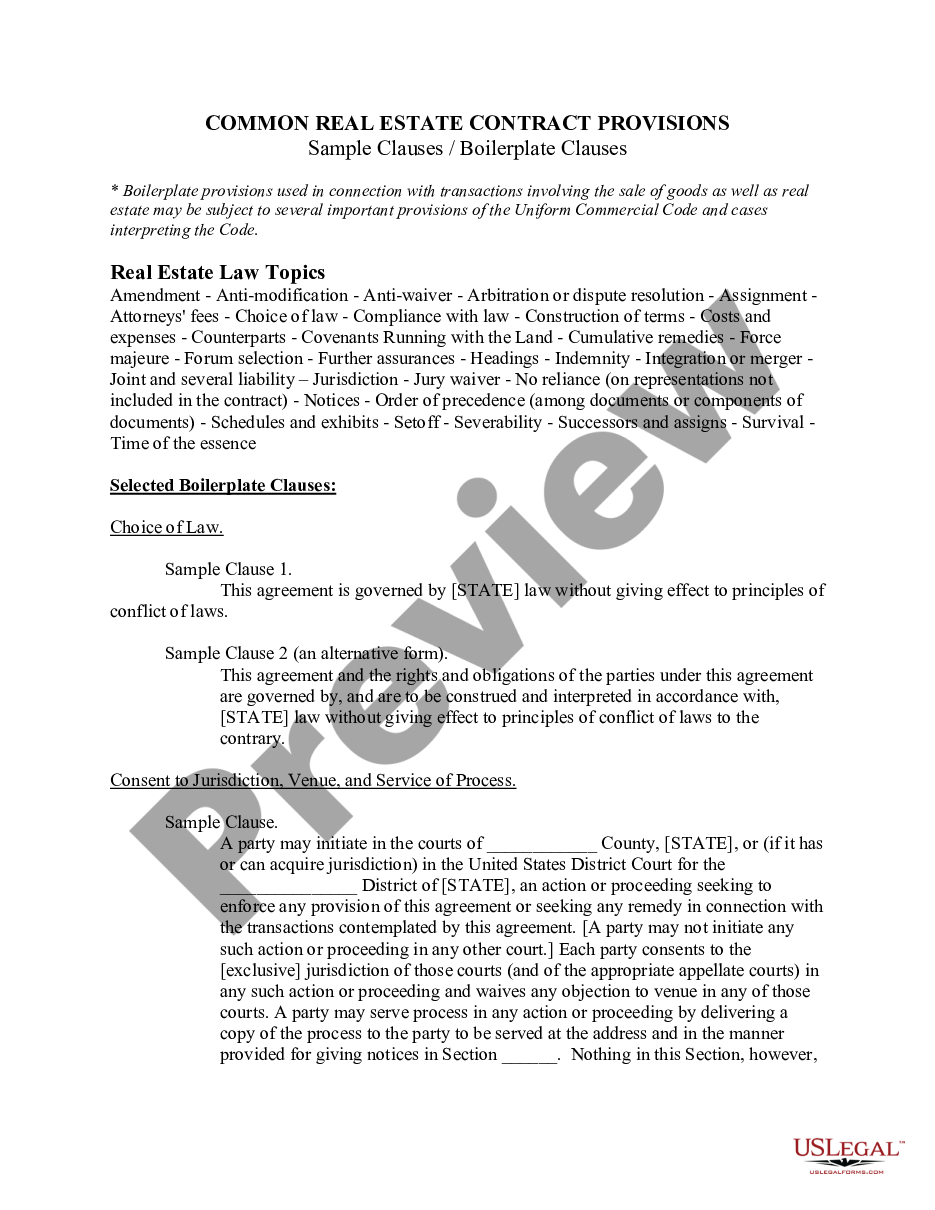

The primary difference lies in their structure and usage. A bond typically includes various terms, such as maturity date and interest rates, and can be traded in markets. A note, on the other hand, tends to be simpler and specific, like the Vermont Receipt for Payment Made on Real Estate Promissory Note, designed for straightforward lending scenarios, especially those involving real estate. This distinction informs how each instrument is utilized in financing.

No, a promissory note is not considered an expense. Instead, it represents a liability on your balance sheet. However, the interest payments made on the note can be classified as an expense. Understanding this distinction is vital for accurate financial reporting and compliance with accounting standards.

To effectively lower property taxes in Vermont, consider challenging your property assessment if you believe it is inaccurate. You can also explore tax credits or exemptions available to certain property owners, such as veterans or low-income individuals. Utilizing a Vermont Receipt for Payment Made on Real Estate Promissory Note might help document improvements or changes to your property that could justify a lower assessment.

One effective type of trust for avoiding estate tax is the irrevocable life insurance trust (ILIT). This trust removes life insurance from your estate, thereby reducing its taxable value. Incorporating a Vermont Receipt for Payment Made on Real Estate Promissory Note in your estate planning can also provide clarity on any property transactions associated with your trust.

To avoid Vermont estate tax, consider methods like gifting assets before death, utilizing joint ownership, or establishing irrevocable trusts. Each strategy has specific benefits and risks, so careful planning is crucial. A Vermont Receipt for Payment Made on Real Estate Promissory Note can aid in documenting these transactions properly to ensure compliance and effective estate management.

As of 2025, the Vermont estate tax exemption is expected to be $4,350,000 per individual. This means estates valued below this amount will not incur estate tax. Utilizing tools like a Vermont Receipt for Payment Made on Real Estate Promissory Note can assist you in navigating your estate's value to stay within the exemption limits.

There are several strategies to minimize or avoid estate tax in Vermont. One effective method is to utilize a Vermont Receipt for Payment Made on Real Estate Promissory Note to structure your transactions carefully. Consulting with a financial advisor can also help you explore options like gifting and setting up trusts to legally minimize your estate tax liability.

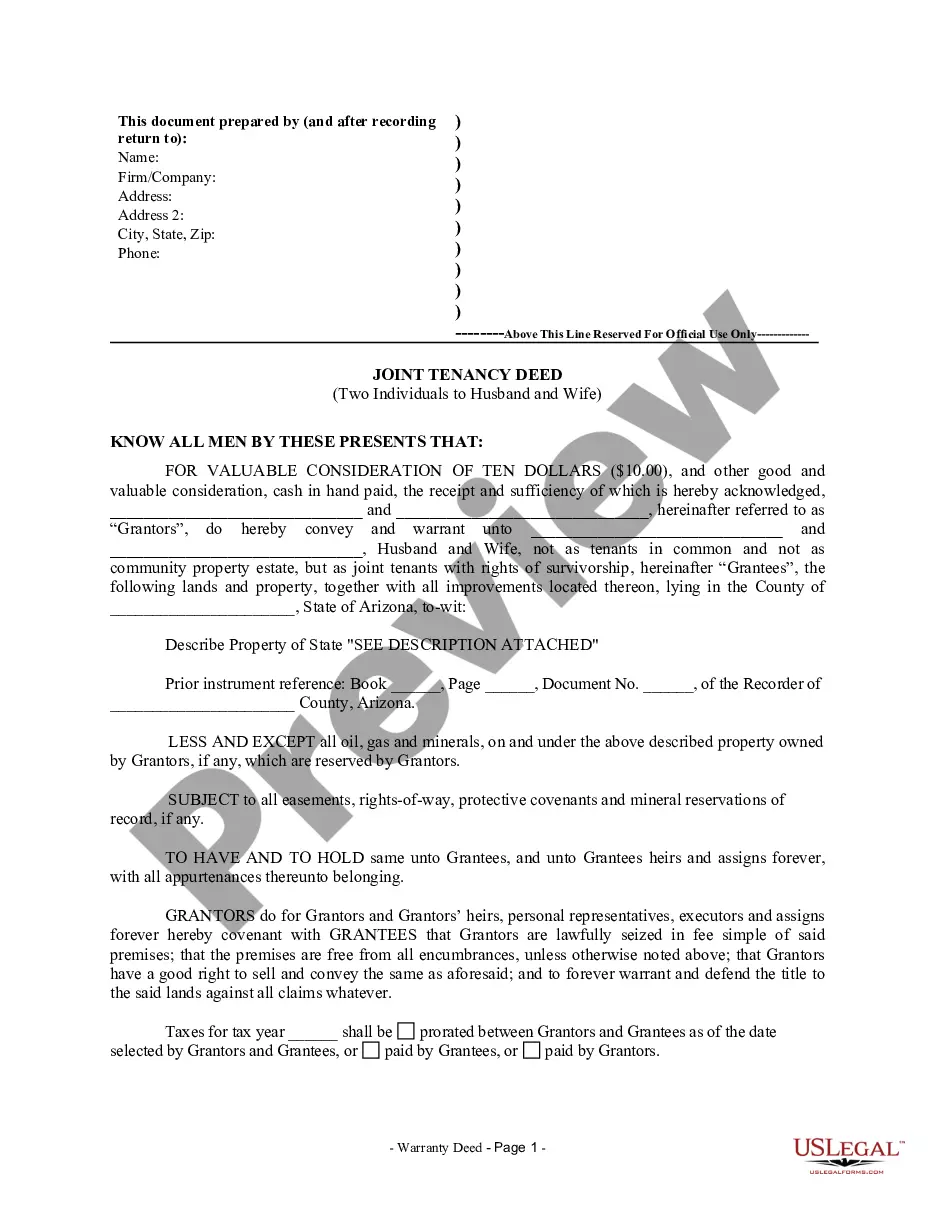

To write a simple promissory note, begin with the date and the amount being borrowed. Clearly state the repayment conditions, including the frequency of payments and the due date. Signature lines for both the lender and borrower are also important to validate the document. Using the Vermont Receipt for Payment Made on Real Estate Promissory Note further solidifies the transaction and provides evidence of payment.

Writing a promissory note for payment involves several key steps. Start by stating the principal amount, interest rate, and payment schedule. Include both parties' names, signatures, and the date of the agreement. After the payment is made, it is essential to issue a Vermont Receipt for Payment Made on Real Estate Promissory Note, ensuring both parties have a record of the completion of the payment.