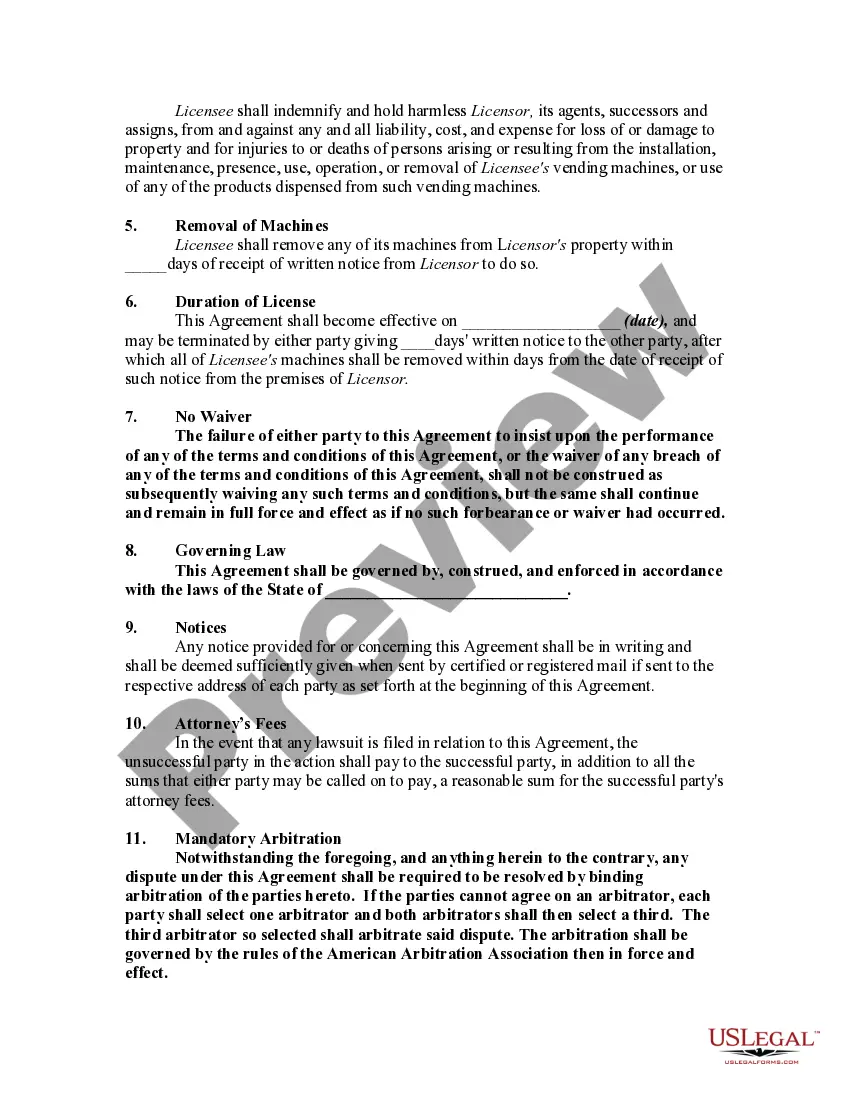

Generally, a license in respect of real property (since it is a mere personal privilege), cannot be assigned or transferred by the licensee. A license does not pass with the title to the property, but is only binding between the parties, expiring upon the death of either party. This form is an example of such.

Vermont License to Operate Vending Machines on Real Property of Another

Description

How to fill out License To Operate Vending Machines On Real Property Of Another?

If you need to complete, obtain, or print legal document templates, utilize US Legal Forms, the most significant collection of legal forms available online.

Employ the site's straightforward and user-friendly search to find the documents you require. Various templates for business and personal purposes are organized by categories and keywords.

Utilize US Legal Forms to acquire the Vermont License to Operate Vending Machines on Real Property of Another within just a few clicks.

Step 5. Process the payment. You can use your credit card or PayPal account to complete the purchase.

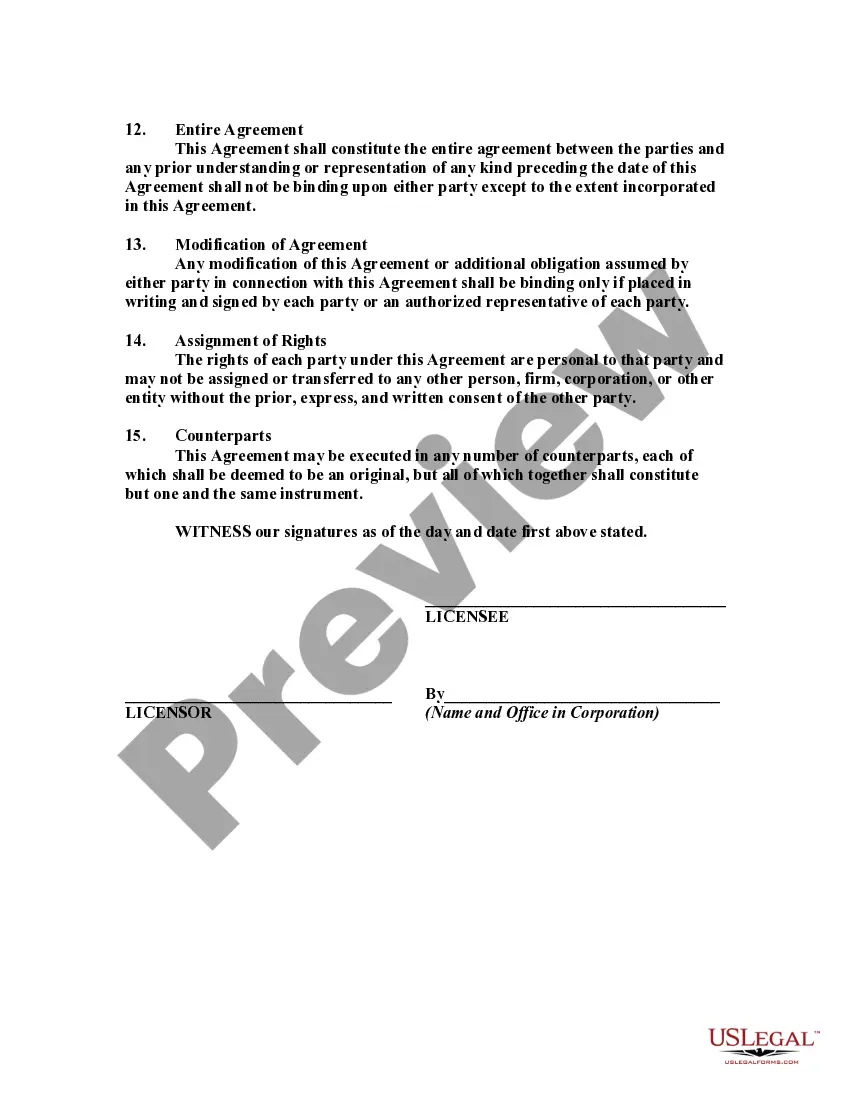

Step 6. Choose the format of the legal form and download it to your device. Step 7. Complete, modify, and print or sign the Vermont License to Operate Vending Machines on Real Property of Another. Each legal document template you acquire is yours indefinitely.

- If you are already a US Legal Forms customer, Log In to your account and click on the Download button to access the Vermont License to Operate Vending Machines on Real Property of Another.

- You can also access forms you previously obtained in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Utilize the Review option to go through the form’s details. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search area at the top of the screen to discover alternative versions of the legal form template.

- Step 4. After finding the form you desire, click the Buy now button. Select your preferred payment method and enter your credentials to register for the account.

Form popularity

FAQ

In Vermont, construction services are generally subject to sales tax, though there are exceptions depending on the nature of the work. If you are planning to enhance your vending machine locations, knowing these tax requirements will help you manage costs. A Vermont License to Operate Vending Machines on Real Property of Another may necessitate obtaining necessary permits for new constructions.

Vermont does not impose a sales tax on most food sold for home consumption, but prepared foods may be subject to sales tax. As you decide on the product offerings for your vending machines, consider how these regulations might affect your sales. Operating under a Vermont License to Operate Vending Machines on Real Property of Another means being informed of these important tax details.

The accommodations tax in Vermont is a tax imposed on lodging rentals and short-term rentals, typically collected from guests. Understanding this tax is important for vending machine operators, especially if your machines are situated near accommodations. Securing a Vermont License to Operate Vending Machines on Real Property of Another can facilitate your compliance with local tax obligations.

Vermont sales tax exemptions include specific goods like groceries and prescription medications, as well as some services. If you are operating a vending machine, knowing what items are exempt can significantly influence your inventory choices. Utilizing a Vermont License to Operate Vending Machines on Real Property of Another means staying compliant with these tax regulations.

In Vermont, a tax sale is a process where a municipality sells property to recover unpaid property taxes. If you are considering placing vending machines, ensure you know the implications of property taxes, especially if you lease land. A Vermont License to Operate Vending Machines on Real Property of Another may require understanding local tax regulations to operate smoothly.

In Vermont, certain items are exempt from sales tax, including most food products for home consumption, prescription drugs, and some medical devices. Businesses operating vending machines under a Vermont License to Operate Vending Machines on Real Property of Another should be aware of these exemptions to maximize profits and compliance. Understanding sales tax exemptions helps in planning product offerings for vending machines.

In Vermont, the hotel room tax applies to any lodging accommodation, including hotels, motels, and short-term rentals. This tax is typically around 9 percent, comprising both a state tax and a local option tax. If you are planning to operate vending machines on properties that offer accommodations, it is crucial to understand this tax. For those seeking a Vermont License to Operate Vending Machines on Real Property of Another, staying informed about tax obligations enhances compliance and avoids potential issues.

Yes, selling food in Vermont typically requires a license from the state, and specific licensing may apply depending on your business model. If your food sales involve vending machines, securing a Vermont License to Operate Vending Machines on Real Property of Another is crucial for your compliance. This license not only protects your business but also assures your customers of the quality and safety of your food products.

To run a food truck in Vermont, you’ll need several permits, including a food service license and local permits for where you plan to operate. Additionally, if you include vending machines in your operation, consider obtaining a Vermont License to Operate Vending Machines on Real Property of Another. This license can enhance your credibility and ensure you're serving customers safely and legally.

Yes, selling food usually requires a license in the US, varying by state and local regulations. If you're selling food via vending machines in Vermont, obtaining a Vermont License to Operate Vending Machines on Real Property of Another is essential to meet state requirements. This license not only helps you stay compliant but also builds trust with your customers.