Vermont General Guaranty and Indemnification Agreement

Description

How to fill out General Guaranty And Indemnification Agreement?

If you require complete, download, or print legal document templates, utilize US Legal Forms, the largest variety of legal forms available online.

Leverage the site's straightforward and convenient search to find the documents you need.

Various templates for business and personal purposes are organized by categories and titles, or keywords.

Every legal document template you purchase is yours to keep for a long time.

You have access to all the forms you downloaded in your account. Browse the My documents section and select a form to print or download again. Compete and download, and print the Vermont General Guaranty and Indemnification Agreement with US Legal Forms. There are millions of professional and state-specific forms available for your business or personal needs.

- Employ US Legal Forms to locate the Vermont General Guaranty and Indemnification Agreement in just a few clicks.

- If you are already a US Legal Forms customer, sign in to your account and click the Obtain button to access the Vermont General Guaranty and Indemnification Agreement.

- You can also access forms you previously downloaded from the My documents section of your account.

- If you're utilizing US Legal Forms for the first time, consult the instructions provided below.

- Step 1. Ensure that you have selected the form for your specific region/land.

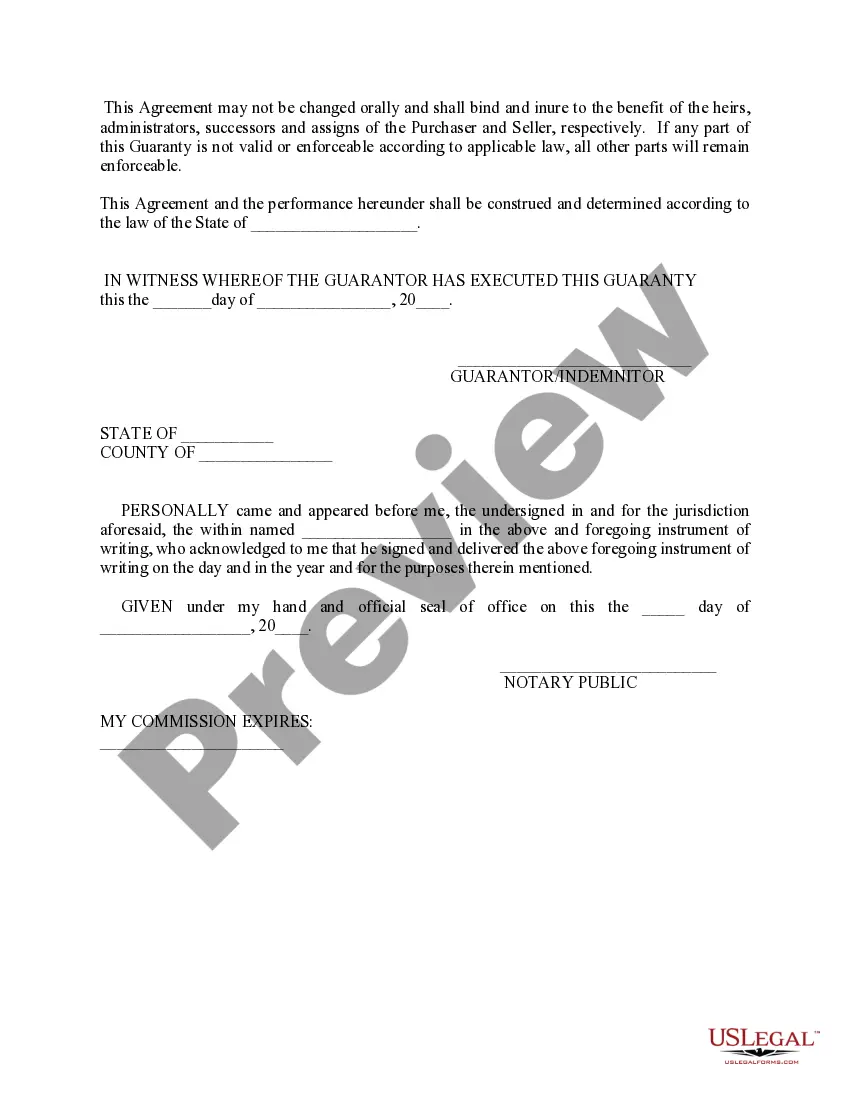

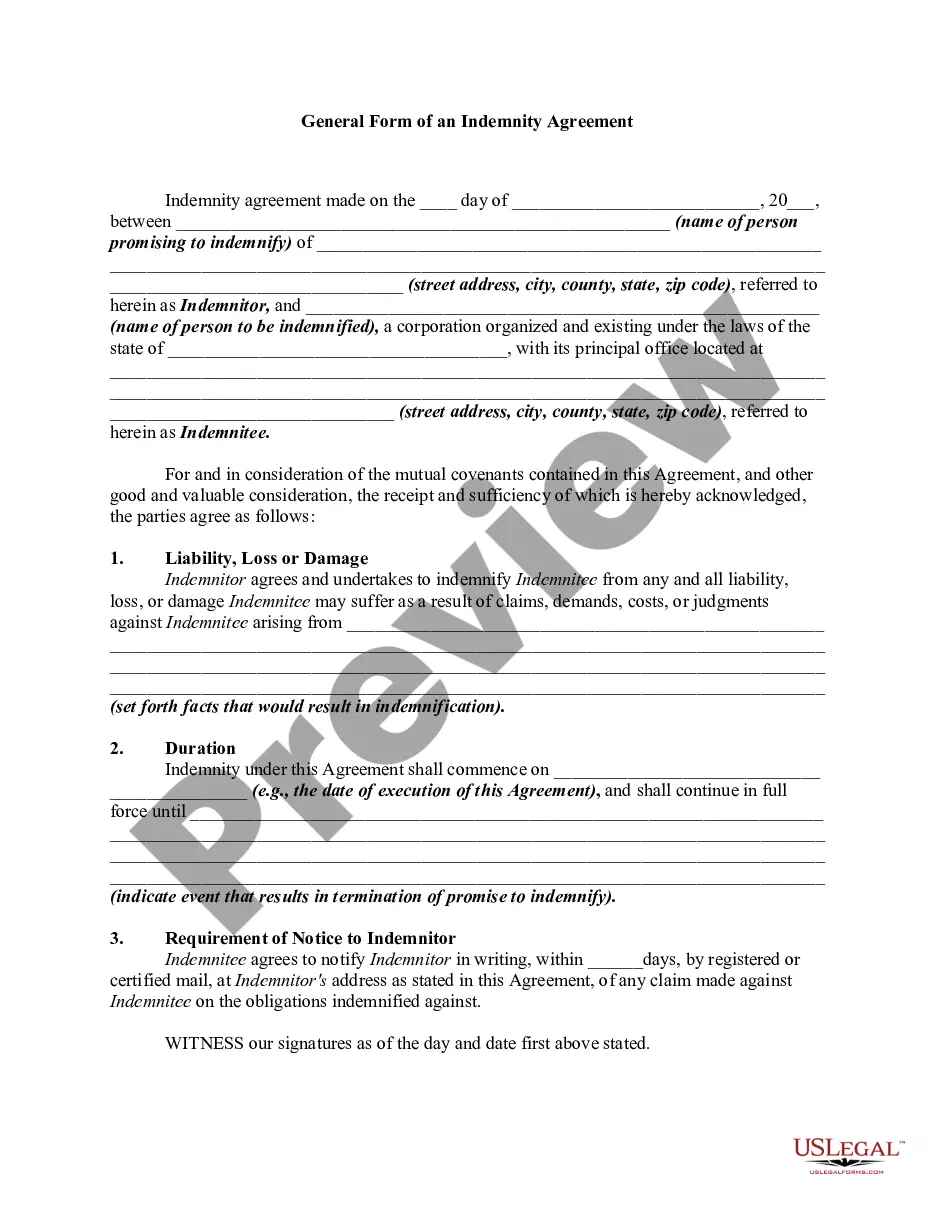

- Step 2. Use the Preview option to review the form's details. Don't forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have located the form you need, click on the Buy now button. Select the pricing plan you prefer and enter your information to register for an account.

- Step 5. Process the transaction. You can use your credit card or PayPal account to complete the transaction.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Fill out, modify, and print or sign the Vermont General Guaranty and Indemnification Agreement.

Form popularity

FAQ

An indemnity is a contract by one party to keep the other harmless against loss, but a contract of guarantee is a contract to answer for the debt, default or miscarriage of another who is to be primarily liable to the promisee .

Indemnity is when one party promises to compensate the loss occurred to the other party, due to the act of the promisor or any other party. On the other hand, the guarantee is when a person assures the other party that he/she will perform the promise or fulfill the obligation of the third party, in case he/she default.

Differences between guarantees and indemnitiesa guarantee is a secondary liability, which means that there will be another person who is primarily liable for the obligation; whereas, an indemnity imposes a primary liability.

An indemnification agreement provides additional protection for businesses by ensuring that they are not held liable for damages or losses that occur outside of their control. This agreement allows the company to continue its operations while protecting against lawsuits.

Company/Business/Individual Name shall fully indemnify, hold harmless and defend and its directors, officers, employees, agents, stockholders and Affiliates from and against all claims, demands, actions, suits, damages, liabilities, losses, settlements, judgments, costs and expenses (including but not

For example, in the case of home insurance, the homeowner pays insurance premiums to the insurance company in exchange for the assurance that the homeowner will be indemnified if the house sustains damage from fire, natural disasters, or other perils specified in the insurance agreement.

An indemnity agreement is a contract that protect one party of a transaction from the risks or liabilities created by the other party of the transaction. Hold harmless agreement, no-fault agreement, release of liability, or waiver of liability are other terms for an indemnity agreement.200c

A contract by which one party promises to save the other from loss caused to him by the conduct of the promisor himself, or by the conduct of any other person, is called a contract of indemnity. Illustration.

To have a guarantee and indemnity, you need three parties: Party One, Party Two, and a third party which can be a Guarantor and/or Indemnifier.

Letters of indemnity should include the names and addresses of both parties involved, plus the name and affiliation of the third party. Detailed descriptions of the items and intentions are also required, as are the signatures of the parties and the date of the contract's execution.