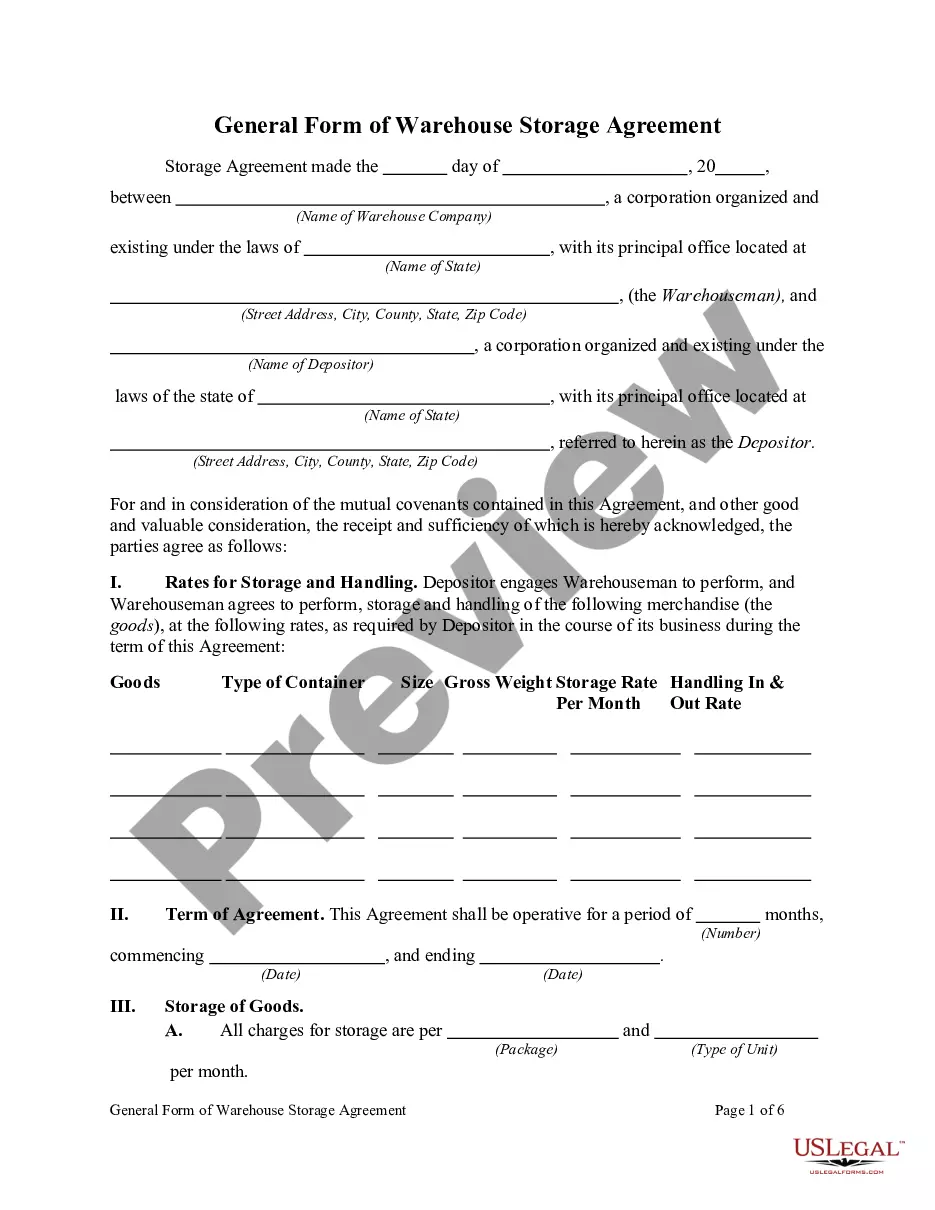

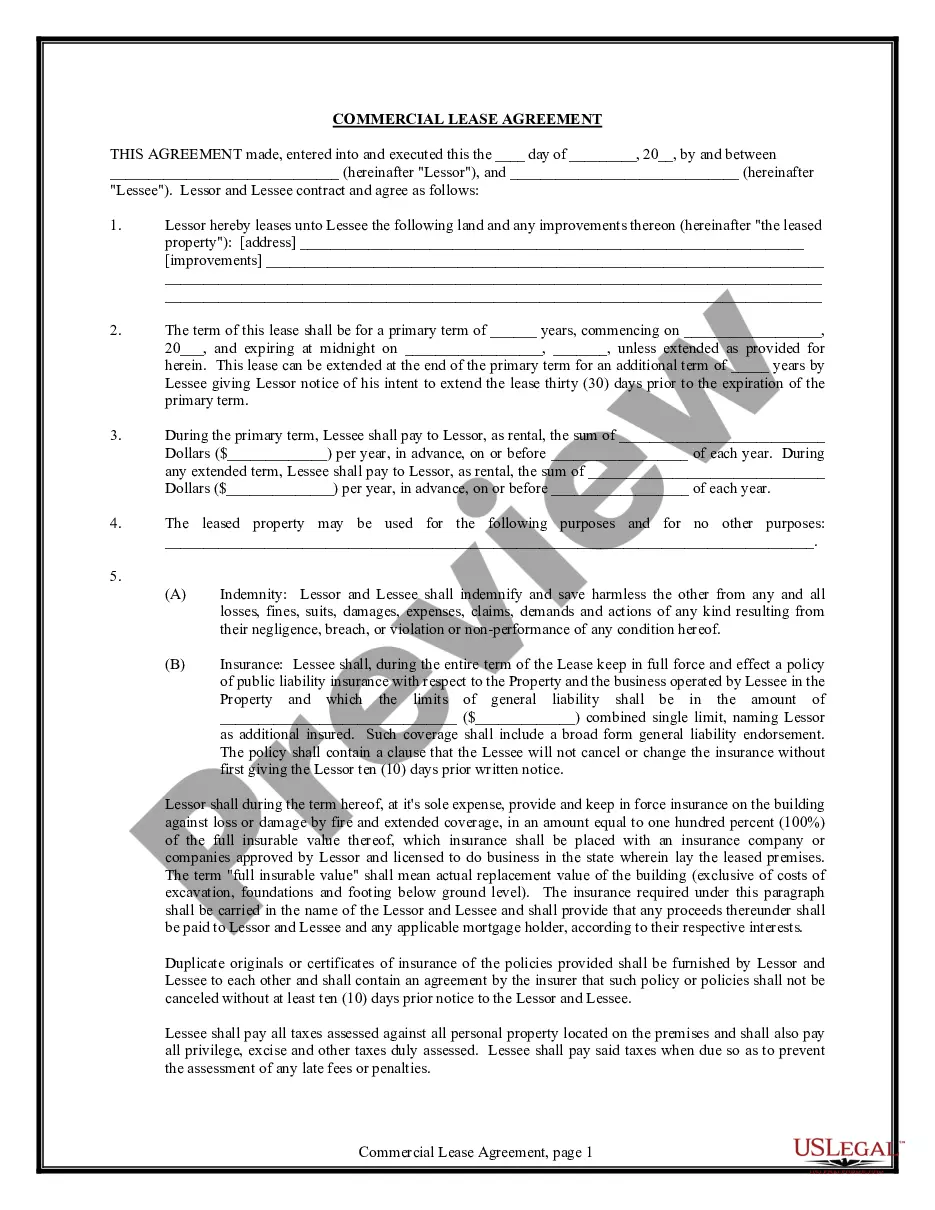

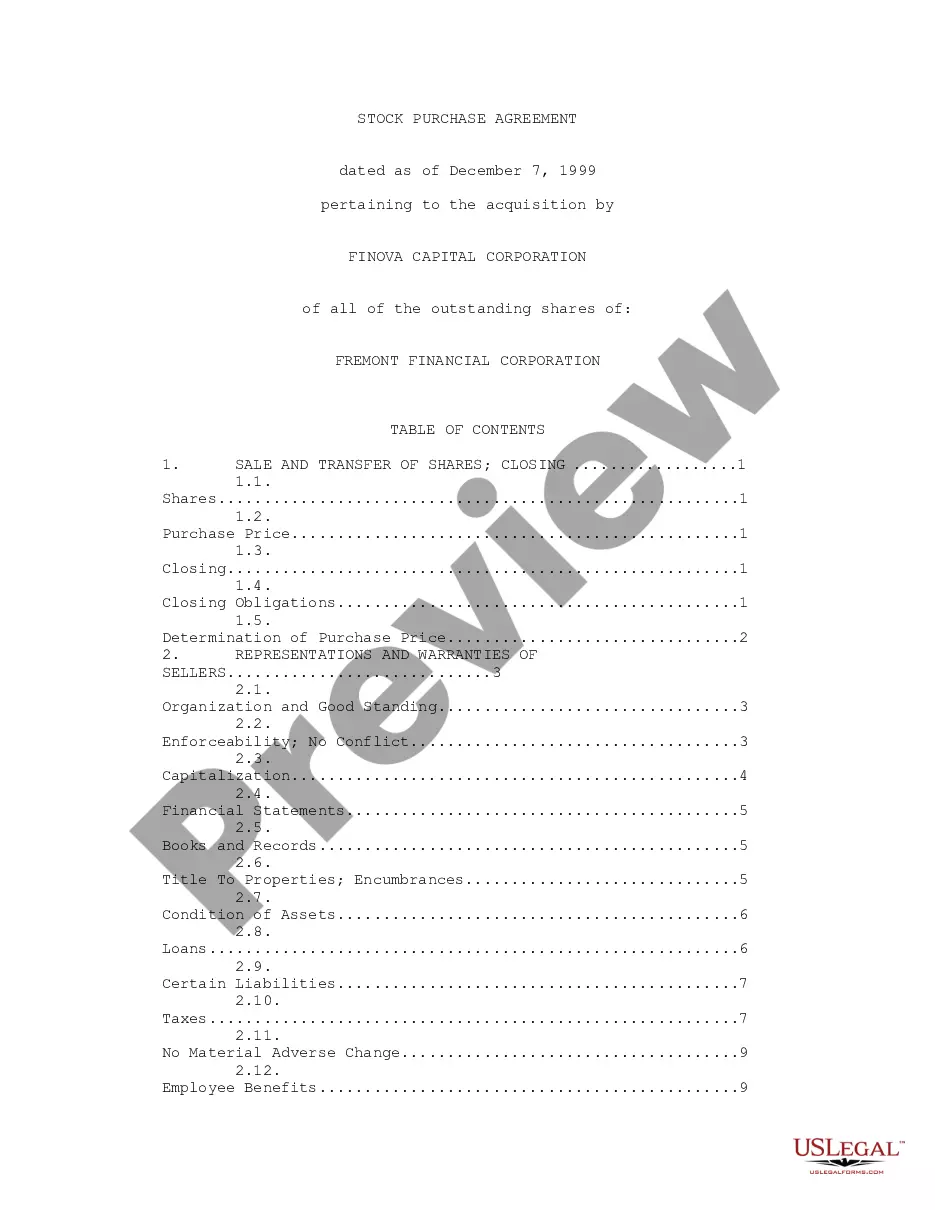

South Carolina Standard Terms and Conditions for Merchandise Warehouses

Description

How to fill out Standard Terms And Conditions For Merchandise Warehouses?

US Legal Forms - one of the largest collections of legal documents in the USA - provides a diverse selection of legal paper templates that you can download or print.

By using the site, you can find thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can access the most up-to-date versions of forms like the South Carolina Standard Terms and Conditions for Merchandise Warehouses in just moments.

If you already have a monthly membership, Log In to download the South Carolina Standard Terms and Conditions for Merchandise Warehouses from the US Legal Forms library. The Acquire button will be visible on every form you view. You can access all previously saved forms from the My documents section of your account.

Select the format and download the form onto your device.

Make edits. Fill out, modify, and print and sign the downloaded South Carolina Standard Terms and Conditions for Merchandise Warehouses.

- Make sure you have chosen the correct form for your city/county. Select the Review button to examine the form's content.

- Check the form details to ensure you have selected the right form.

- If the form doesn't meet your requirements, utilize the Search box at the top of the screen to find one that does.

- Once you are satisfied with the form, confirm your selection by clicking the Buy now button.

- Then, choose the pricing plan you want and provide your information to register for an account.

- Process the transaction. Use your credit card or PayPal account to complete the transaction.

Form popularity

FAQ

In South Carolina, maintenance services can be taxable, particularly in scenarios where they are bundled with tangible goods. If maintenance services are offered as stand-alone contracts, one must verify their tax status. Referring to the South Carolina Standard Terms and Conditions for Merchandise Warehouses helps clarify how such services may be taxed, ensuring you are well-informed.

Training services in South Carolina can be complex when it comes to taxation. Generally, educational training for specific skills may not incur sales tax, but it can depend on the nature of the training provided. Aligning your services with the South Carolina Standard Terms and Conditions for Merchandise Warehouses can mitigate any confusion regarding tax obligations.

Professional services are typically not subject to sales tax in South Carolina, with certain exceptions. Consulting, legal advice, and accounting services generally fall outside the taxable services category. However, always verify these details within the framework of South Carolina Standard Terms and Conditions for Merchandise Warehouses to ensure full compliance.

SC Procurement Code 11 35 1550 outlines the regulations related to the procurement processes in South Carolina. This code ensures transparent and fair bidding processes, which are vital for state contracting and services. Understanding this code can enhance your compliance when working with South Carolina Standard Terms and Conditions for Merchandise Warehouses.

Yes, painting services in South Carolina are generally considered taxable. This includes both residential and commercial painting services. If you are involved in merchandising, it’s beneficial to understand how the South Carolina Standard Terms and Conditions for Merchandise Warehouses may apply to your situation, since it can influence your tax obligations.

Certain services in South Carolina are exempt from taxation. For example, medical services, educational services, and some nonprofit activities do not incur sales tax. To get a comprehensive view of exemptions, consider reviewing the South Carolina Standard Terms and Conditions for Merchandise Warehouses, which can guide your compliance and financial planning.

In South Carolina, various services are subject to taxation under the state’s laws. For instance, services such as cleaning services, landscaping, and some repair services are taxed. However, it’s important to refer to the South Carolina Standard Terms and Conditions for Merchandise Warehouses for specifics related to merchandise warehousing services. Understanding what services are taxed can help you navigate the regulations effectively.