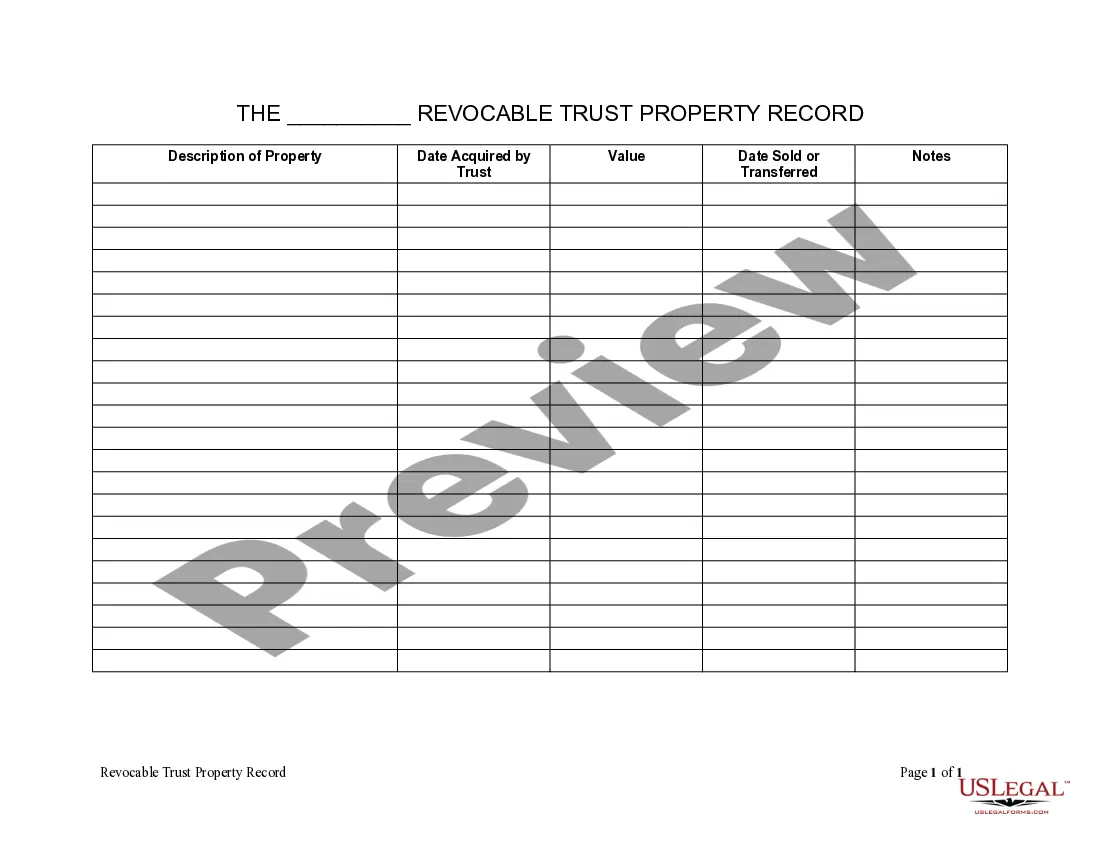

This is a Living Trust Property Inventory form. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form allows the Trustee to record a Description of Property, Date Acquired by Trust, Value, Date Sold or Transferred so that all property held by the trust can be accounted for including the real, personal or intellectual property.

Vermont Living Trust Property Record

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Vermont Living Trust Property Record?

Searching for a Vermont Living Trust Property Record on the internet can be stressful. All too often, you find documents that you think are alright to use, but discover later on they’re not. US Legal Forms offers more than 85,000 state-specific legal and tax forms drafted by professional attorneys according to state requirements. Have any document you’re looking for within minutes, hassle-free.

If you already have the US Legal Forms subscription, merely log in and download the sample. It’ll immediately be included to your My Forms section. If you do not have an account, you must sign-up and choose a subscription plan first.

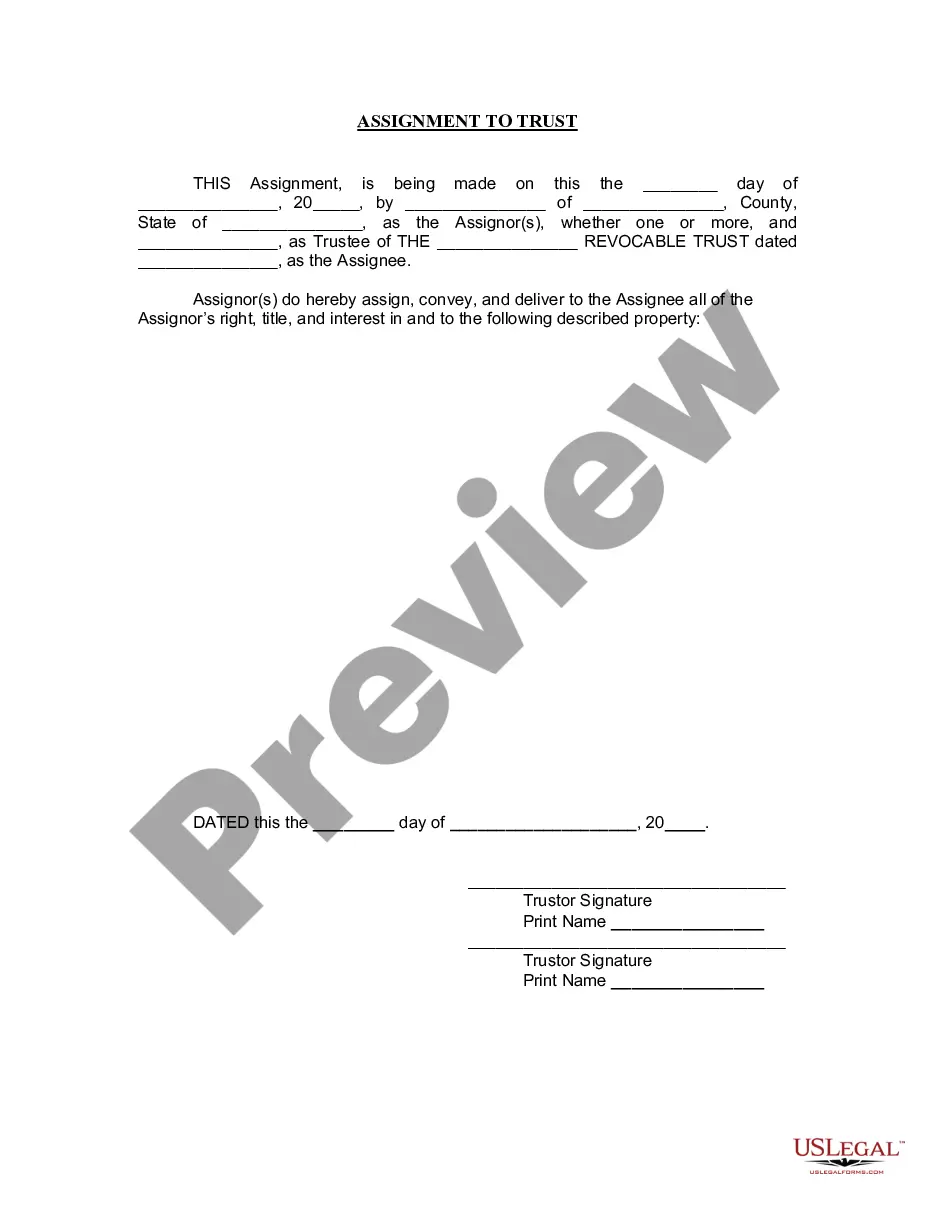

Follow the step-by-step instructions listed below to download Vermont Living Trust Property Record from our website:

- See the document description and hit Preview (if available) to verify if the form meets your expectations or not.

- If the form is not what you need, find others using the Search engine or the listed recommendations.

- If it’s right, click Buy Now.

- Choose a subscription plan and create an account.

- Pay via card or PayPal and download the document in a preferable format.

- After downloading it, it is possible to fill it out, sign and print it.

Obtain access to 85,000 legal forms straight from our US Legal Forms library. Besides professionally drafted samples, customers can also be supported with step-by-step guidelines concerning how to get, download, and fill out templates.

Form popularity

FAQ

Houses and other real estate (even if they're mortgaged) stock, bond, and other security accounts held by brokerages (but think about naming a TOD beneficiary instead) small business interests (stock in a closely held corporation, partnership interests, or limited liability company shares)

So, what are some of the assets that go into a trust. Clearly a house or any other real or commercial property should go into a trust that you own. Bank accounts, CDs, investment accounts, money markets, bonds, any assets that have your name on them should be transferred to your trust.

Property you put in a living trust doesn't have to go through probate, which means that the assets won't get tied up in court for months and maybe years. However, you don't have to put bank accounts in a living trust, and sometimes it's not a good idea.

Public RecordCalifornia law requires any deed transfer involving real estate property be recorded in the county clerk's or county recorder's office in the county where the property is located. The trust grantor must record the original trust document, real estate deed and appraisal report.

The trustee is the person who owns the assets in the trust. They have the same powers a person would have to buy, sell and invest their own property. It's the trustees' job to run the trust and manage the trust property responsibly.

The process of funding your living trust by transferring your assets to the trustee is an important part of what helps your loved ones avoid probate court in the event of your death or incapacity. Qualified retirement accounts such as 401(k)s, 403(b)s, IRAs, and annuities, should not be put in a living trust.

Sure you can write your own revocable living trust. In fact, you can do it better than a lot of the attorneys. First you have to ascertain that you really want a trust.

A living trust, specifically a revocable living trust, is a legal document that places your assetsinvestments, bank accounts, real estate, vehicles and valuable personal propertyin trust for your benefit during your lifetime, and spells out where you'd like these things to go upon your death.

When you set up a Living Trust, you fund the trust by transferring your assets from your name to the name of your Trust. Legally your Trust now owns all of your assets, but you manage all of the assets as the Trustee.