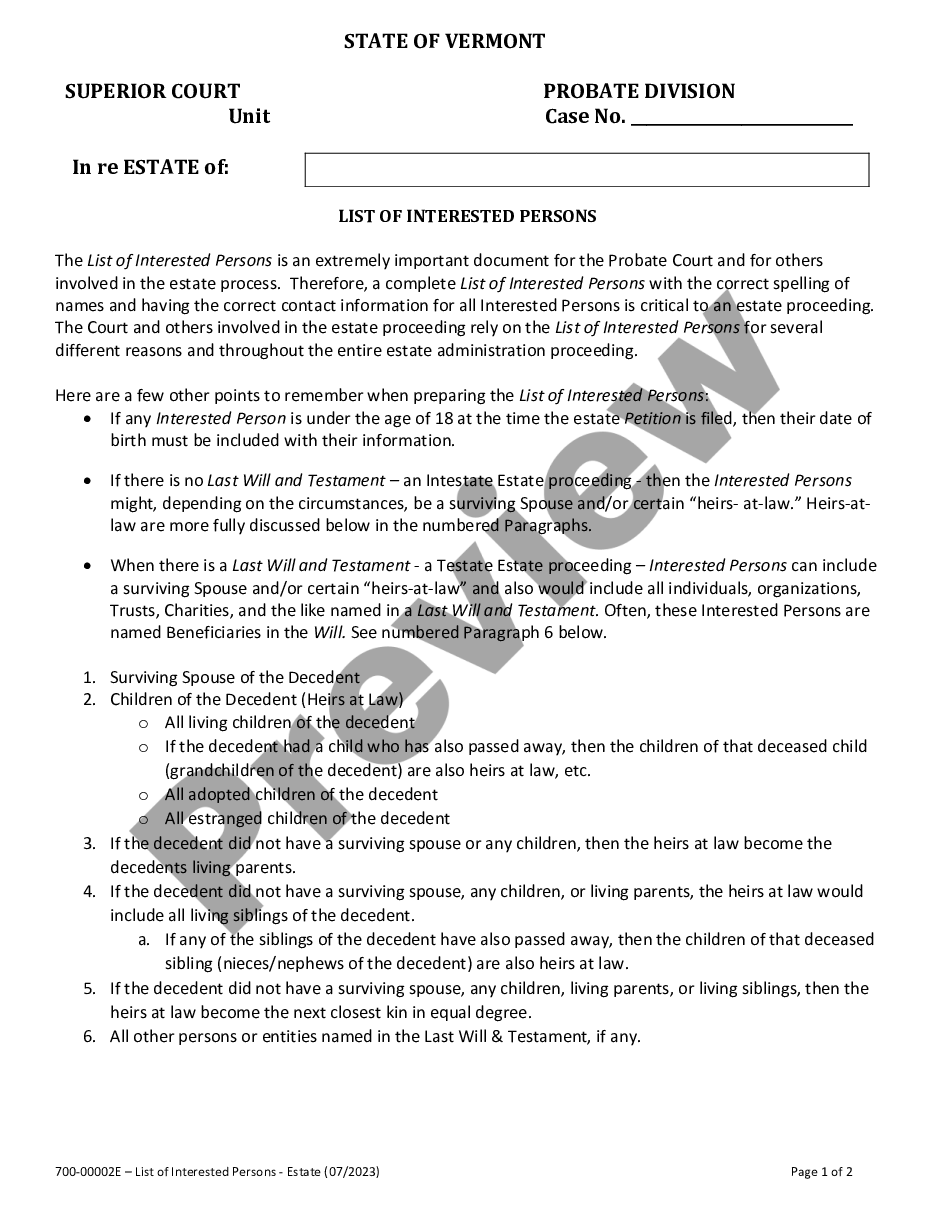

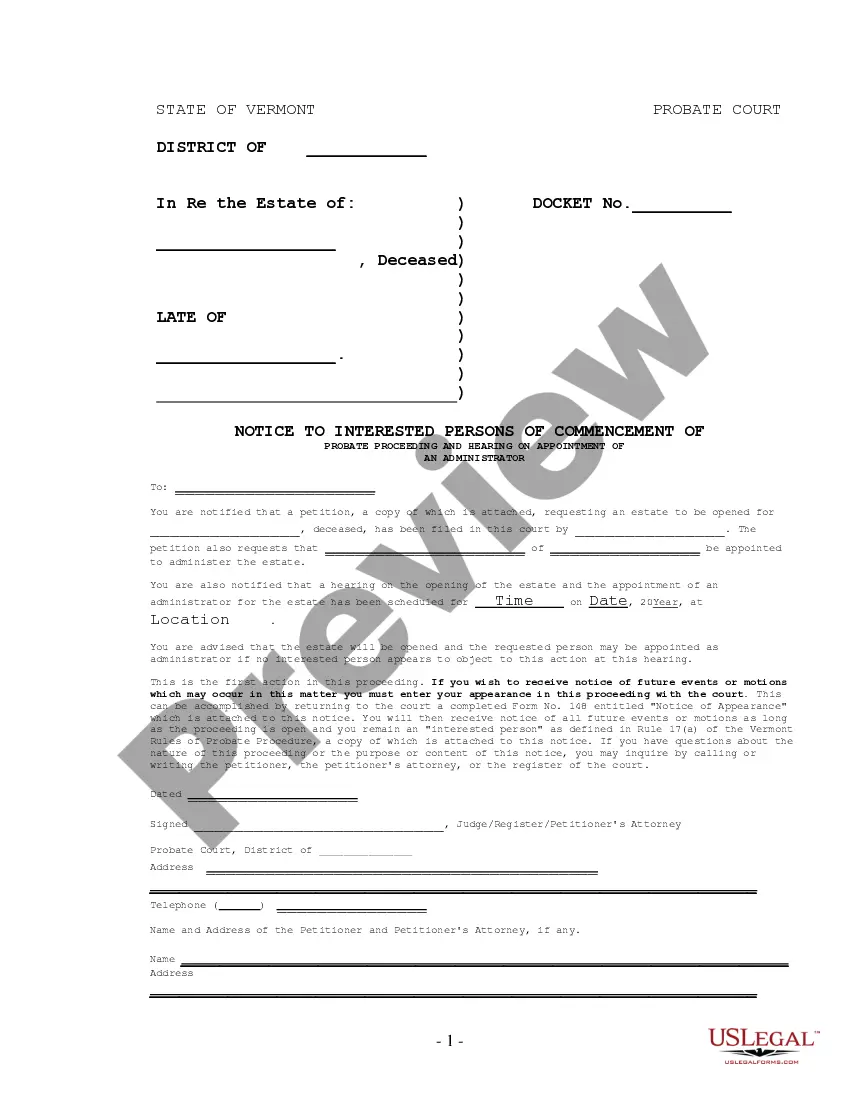

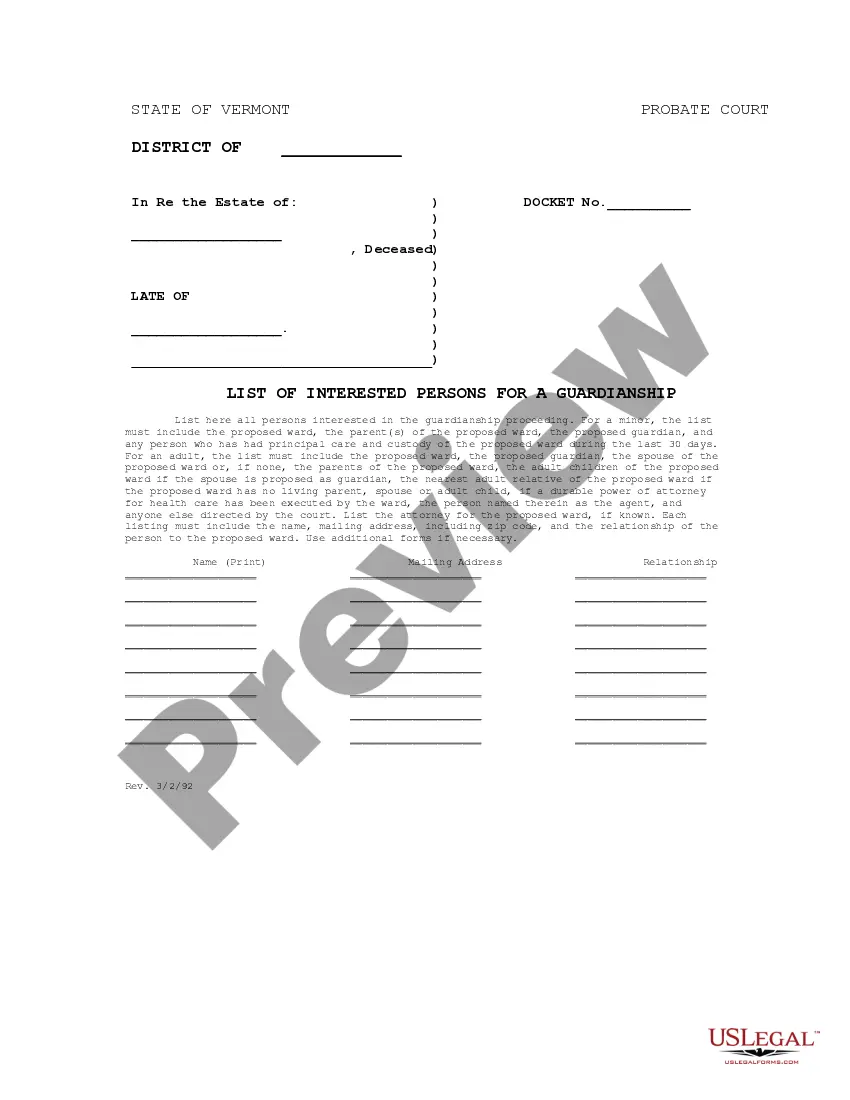

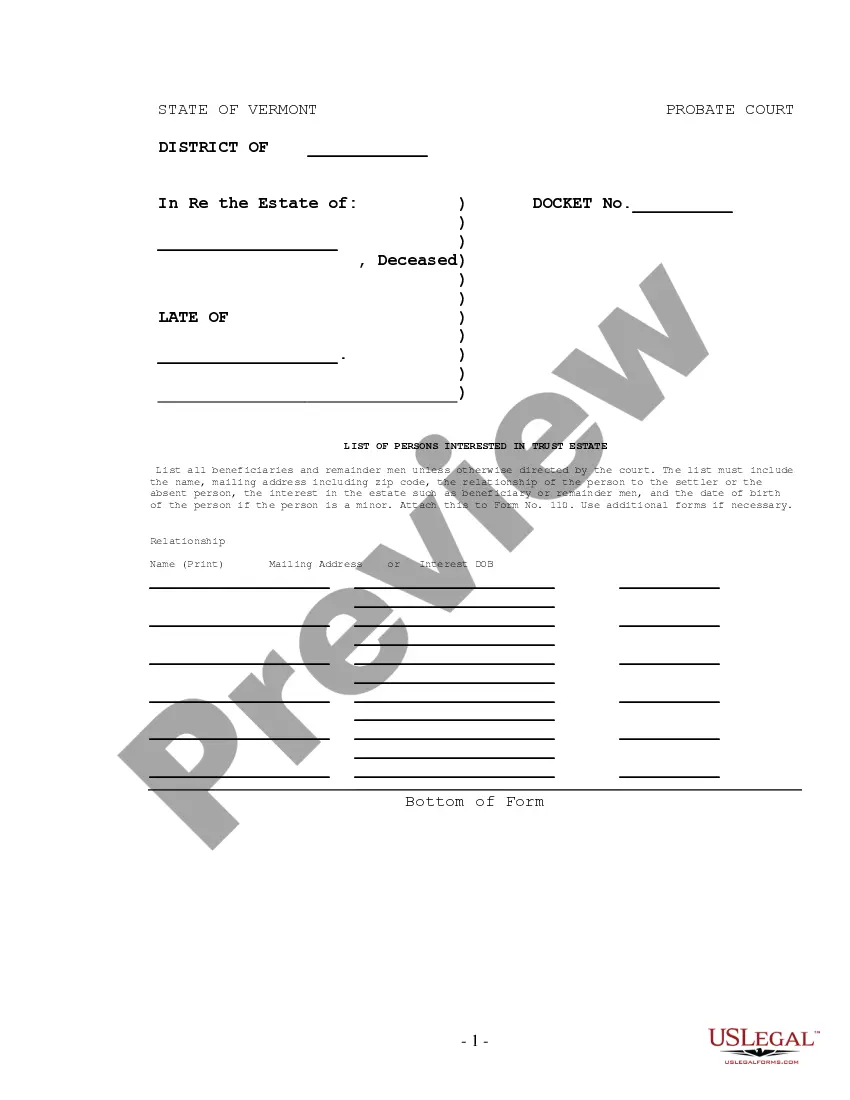

This form is a list of interested persons for an estate where the deceased dies with a valid will. This form is usually attached to a Petition to Open a Testate Estate (VT-004-P).

Vermont List of Interested Persons for a Testate Estate Petition

Description

How to fill out Vermont List Of Interested Persons For A Testate Estate Petition?

Searching for a Vermont List of Interested Persons for a Testate Estate Petition online can be stressful. All too often, you see documents which you believe are alright to use, but discover later they’re not. US Legal Forms offers more than 85,000 state-specific legal and tax forms drafted by professional legal professionals in accordance with state requirements. Have any document you are looking for in minutes, hassle free.

If you already have the US Legal Forms subscription, simply log in and download the sample. It will automatically be added in to your My Forms section. If you don’t have an account, you have to sign up and select a subscription plan first.

Follow the step-by-step recommendations listed below to download Vermont List of Interested Persons for a Testate Estate Petition from our website:

- Read the document description and hit Preview (if available) to check whether the template meets your expectations or not.

- If the form is not what you need, find others with the help of Search engine or the provided recommendations.

- If it is appropriate, click Buy Now.

- Choose a subscription plan and create an account.

- Pay with a card or PayPal and download the document in a preferable format.

- Right after getting it, you may fill it out, sign and print it.

Obtain access to 85,000 legal forms straight from our US Legal Forms catalogue. In addition to professionally drafted samples, customers can also be supported with step-by-step guidelines concerning how to get, download, and complete forms.

Form popularity

FAQ

The first step in probating an estate is to locate all of the decedent's estate planning documents and other important papers, even before being appointed to serve as the personal representative or executor.

As an aside, Vermont Statute Title 32 § 1143 states that executors may be paid $4 per day spent in court, but this is geared towards the court paying appointed agents, and that amount was set in 1866.

When calculating the value of an estate, the gross value is the sum of all asset values, and the net value is the gross value minus any debts: in other words, the actual worth of the estate.

Godoy. After someone dies, anyone who thinks they are owed money or property by the deceased can file a claim against the estate. Estate claims range from many different types of debts, such as mortgages, credit card debt, loans, unpaid wages, or breach of contract.

Your inventory should include the number of shares of each type of stock, the name of the corporation, and the name of the exchange on which the stock is traded. Meanwhile, you should note the total gross amount of a bond, the name of the entity that issued it, the interest rate on the bond, and its maturity date.

Determine Your State's Laws Regarding Inventory Forms. Review the Instructions Provided. Identify Real Property. Identify Personal Property. Identify Bank Accounts. Identify Retirement Accounts. Identify Non-Probate Assets. File the Form With the Court.

In Vermont, you can make a living trust to avoid probate for virtually any asset you own -- real estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

An inventory and appraisal is a required filing in California probate. The inventory and appraisal is a single document that (1) inventories the property in the decedent's estate and (2) contains an appraisal of the property in the inventory. California Probate Code § 8800(a).

In the claim, you'll state under oath that the debt is owed and provide details on the amount of the debt and any payments the decedent made. If you have written documentation, you can attach it to your claim.