Virgin Islands Permission For Deputy or Agent To Access Safe Deposit Box

Description

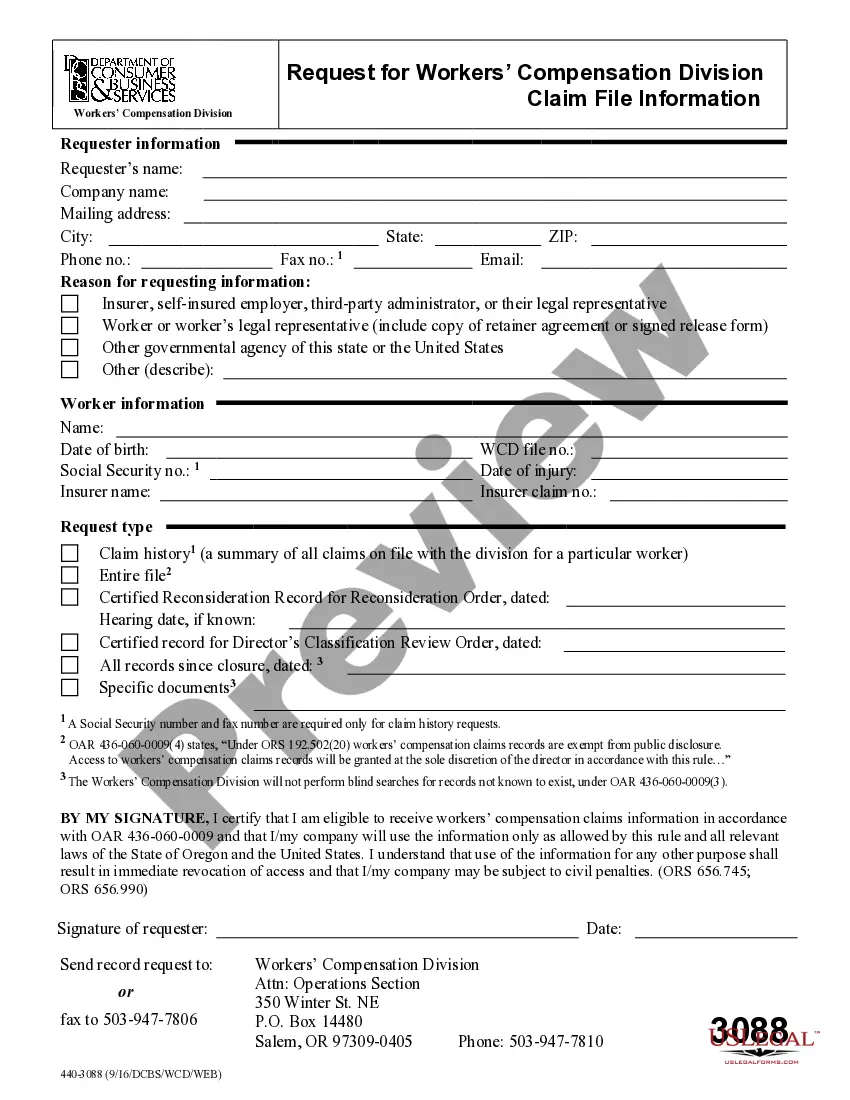

How to fill out Permission For Deputy Or Agent To Access Safe Deposit Box?

Finding the appropriate legal document template can be a challenge. Naturally, there are numerous designs available online, but how can you acquire the legal form you require? Utilize the US Legal Forms website. This service offers thousands of templates, including the Virgin Islands Permission For Deputy or Agent To Access Safe Deposit Box, which you can use for both business and personal purposes. All of the forms are reviewed by professionals and comply with state and federal regulations.

If you are already registered, Log In to your account and click on the Download button to obtain the Virgin Islands Permission For Deputy or Agent To Access Safe Deposit Box. Use your account to browse through the legal forms you have previously purchased. Navigate to the My documents section of your account and download another copy of the document you need.

If you are a new user of US Legal Forms, here are simple steps for you to follow: First, make sure you have selected the correct form for your city/county. You can review the form using the Review button and check the form description to ensure it is suitable for you. If the form does not meet your expectations, use the Search field to find the right form. Once you are confident that the form is appropriate, click on the Buy now button to purchase the form. Select the payment plan you prefer and enter the required information. Create your account and pay for the order using your PayPal account or credit card. Choose the document format and download the legal document template to your device. Finally, complete, modify, print, and sign the obtained Virgin Islands Permission For Deputy or Agent To Access Safe Deposit Box.

US Legal Forms is an invaluable resource for obtaining diverse legal documents that meet the necessary legal standards.

- US Legal Forms is the largest collection of legal forms.

- Find various document templates.

- Utilize the service to download properly crafted documents.

- Ensure compliance with state requirements.

- Access thousands of templates.

- Use for both business and personal needs.

Form popularity

FAQ

Certain exceptions allow for delayed notice or no customer notice at all. Prior to passage of the act, bank customers were not informed that their personal financial records were being turned over to a government authority and could not challenge government access to the records.

Federal law requires a person to report cash transactions of more than $10,000 by filing IRS Form 8300 PDF, Report of Cash Payments Over $10,000 Received in a Trade or Business.

For cash of $3,000-$10,000, inclusive, to the same customer in a day, it must keep a record. more to the same customer in a day, regardless of the method of payment, it must keep a record. a record. The Bank Secrecy Act (BSA) was enacted by Congress in 1970 to fight money laundering and other financial crimes.

Recordkeeping Requirements For each payment order in the amount of $3,000 or more that a bank accepts as an originator's bank, the bank must obtain and retain the following records ( 31 CFR 1020.410(a)(1)(i)): Name and address of the originator. Amount of the payment order. Date of the payment order.

For those transactions identified by issuers of money orders or traveler's checks from a review of clearance records or other similar records of money orders or traveler's checks that have been sold or processed, the threshold which triggers the reporting requirement is $5,000.

Examination Procedures NOTE: RFPA does not apply to prohibit or limit the FDIC's disclosure of financial information to state authorities, including banking, law enforcement and other state agencies such as appraisal certification boards.

It is also important to note that under the RFPA covered customers are individuals or partnerships of 5 or fewer individuals. Corporations, trusts, estates, unincorporated associations such as unions, and large partnerships are not covered by the RFPA.

Certain exceptions allow for delayed notice or no customer notice at all. Prior to passage of the act, bank customers were not informed that their personal financial records were being turned over to a government authority and could not challenge government access to the records.

1 The Recordkeeping Rule currently requires that financial institutions collect and retain certain information for funds transfers of $3,000 or more, such as the originator's name and address, the amount and date of the payment order, payment instructions, and the identity of the beneficiary's bank.

These exceptions include:Disclosure to any supervisory agency in the exercise of its supervisory, regulatory or monetary functions, including an examination.Disclosure of information that is not identifiable as belonging to a particular credit union member (12 U.S.C.More items...?