Virgin Islands Clauses Relating to Preferred Returns

Description

How to fill out Clauses Relating To Preferred Returns?

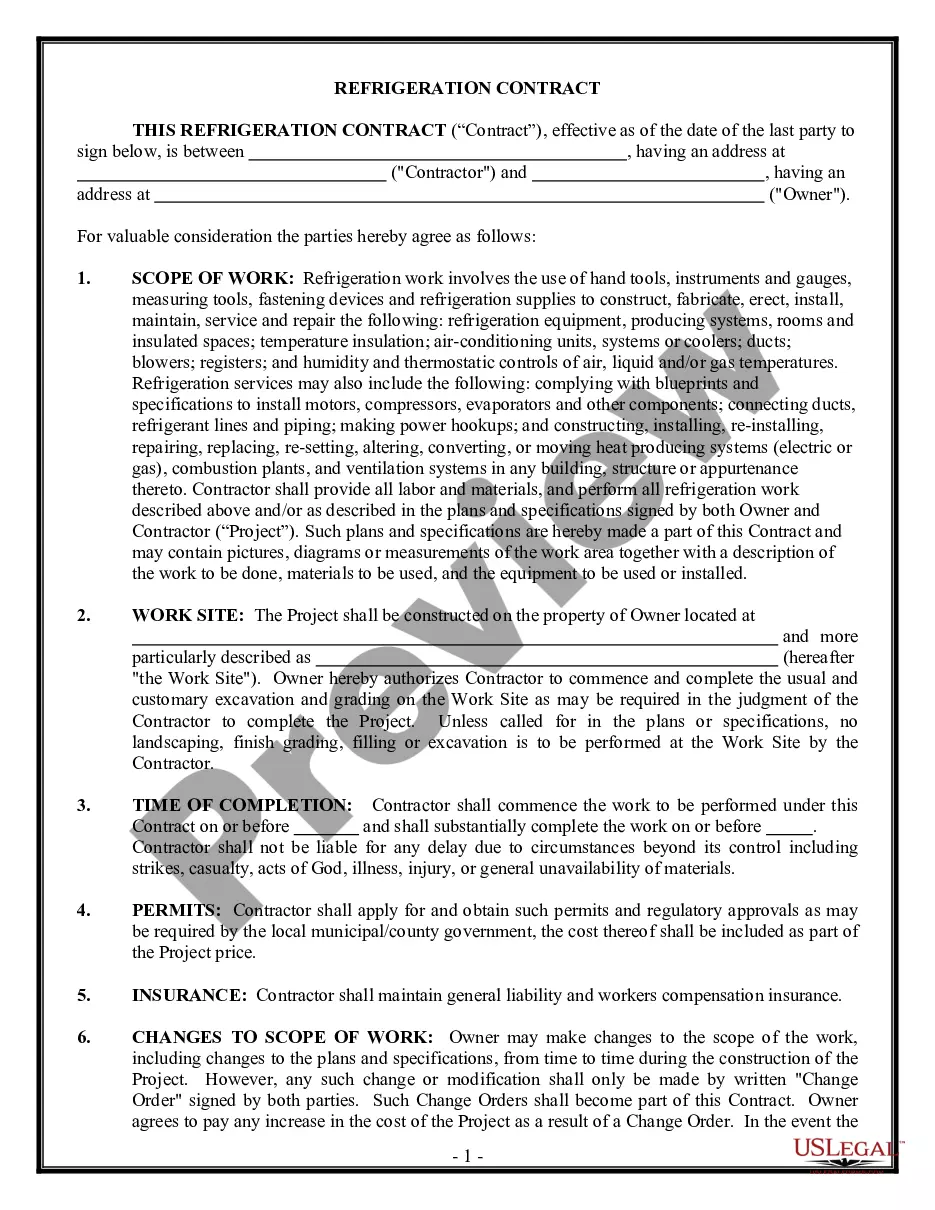

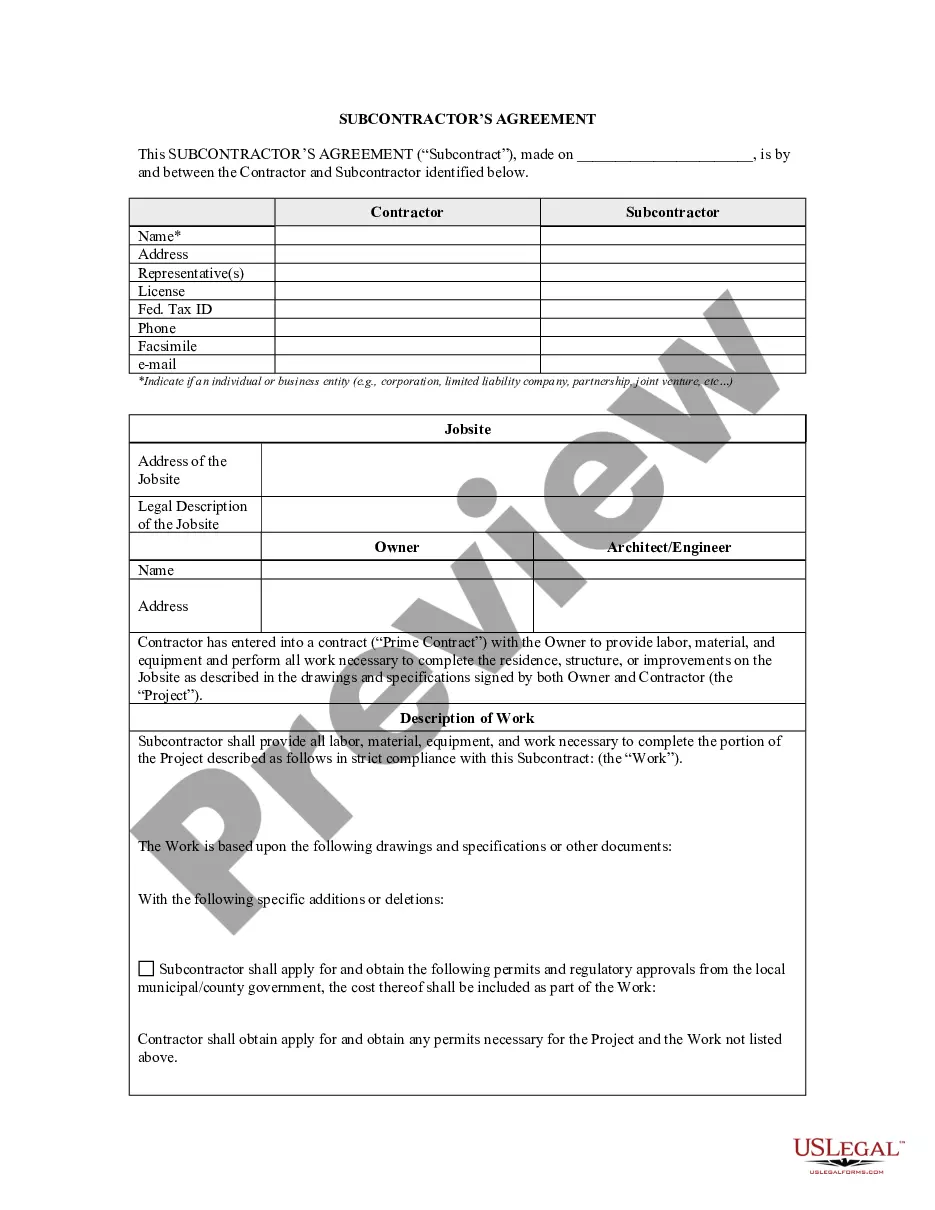

Are you currently in a situation that you require files for possibly organization or personal reasons just about every day? There are tons of legitimate record templates accessible on the Internet, but getting kinds you can depend on is not straightforward. US Legal Forms offers thousands of kind templates, just like the Virgin Islands Clauses Relating to Preferred Returns, which can be published to meet federal and state requirements.

Should you be previously knowledgeable about US Legal Forms internet site and possess your account, simply log in. Following that, you are able to obtain the Virgin Islands Clauses Relating to Preferred Returns format.

Unless you provide an profile and need to begin to use US Legal Forms, abide by these steps:

- Find the kind you want and make sure it is for your proper city/county.

- Utilize the Review button to review the form.

- Browse the explanation to ensure that you have selected the correct kind.

- When the kind is not what you`re seeking, make use of the Research area to find the kind that fits your needs and requirements.

- If you discover the proper kind, click on Acquire now.

- Select the prices strategy you desire, submit the specified details to create your bank account, and pay for the order utilizing your PayPal or charge card.

- Choose a handy file file format and obtain your backup.

Locate each of the record templates you may have bought in the My Forms food list. You can get a more backup of Virgin Islands Clauses Relating to Preferred Returns anytime, if necessary. Just click on the necessary kind to obtain or print out the record format.

Use US Legal Forms, by far the most comprehensive assortment of legitimate forms, in order to save some time and avoid blunders. The services offers professionally manufactured legitimate record templates which can be used for a variety of reasons. Generate your account on US Legal Forms and start producing your daily life easier.

Form popularity

FAQ

A preferred return is a profit distribution preference whereby profits, either from operations, sale, or refinance, are distributed to one class of equity before another until a certain rate of return on the initial investment is reached.

A preferred return?simply called pref?describes the claim on profits given to preferred investors in a project. The preferred investors will be the first to receive returns up to a certain percentage, generally 8 to 10 percent.

In series A, a startup is positioned to develop and refine its offer and processes. During series B, the cash is needed to be able to scale up and reach a much wider market. The fundamental business is already in place at series B, with the barrier to reaching a wider market being the need for investment.

Series B financing is appropriate for companies that are ready for their development stage. They are companies that generate stable revenues, as well as earn some profits. Also, such companies generally come with solid valuations of more than $10 million.

In a true preferred return (also known as ?hard preferred return?), the operator only receives a portion of the profits from the cash flows or sale proceeds after you (the passive investor) receive your entire preferred return. This would be considered the first hurdle in the waterfall distribution schedule.

A Series B round is usually between $7 million and $10 million. Companies can expect a valuation between $30 million and $60 million. Series B funding usually comes from venture capital firms, often the same investors who led the previous round.

In Series B investors provide capital to a company in exchange for the latter's preferred shares. The majority of the deals include anti-dilution provisions like in the series A. This means that a company usually sells preferred shares that do not provide its holders with voting rights.

Founders should be prepared to give away 15-30% in equity at Series B. ?I always advise friends to aim for 15% and plan for 20%.