Virgin Islands Request for Loan Modification RMA Under Home Affordable Modification Program HAMP

Description

How to fill out Request For Loan Modification RMA Under Home Affordable Modification Program HAMP?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a range of legal document templates that you can download or print.

By using the website, you can find thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can access the latest versions of forms such as the Virgin Islands Request for Loan Modification RMA Under Home Affordable Modification Program HAMP in a matter of minutes.

Review the form summary to confirm that you have chosen the right form.

If the form does not meet your needs, utilize the Search field at the top of the screen to find the one that does.

- If you hold a membership, Log In and download the Virgin Islands Request for Loan Modification RMA Under Home Affordable Modification Program HAMP from your US Legal Forms collection.

- The Download button will appear on every form you view.

- You can find all previously downloaded forms in the My documents section of your account.

- If this is your first time using US Legal Forms, here are simple instructions to get started.

- Ensure you have selected the correct form for your city/state.

- Click the Preview button to review the contents of the form.

Form popularity

FAQ

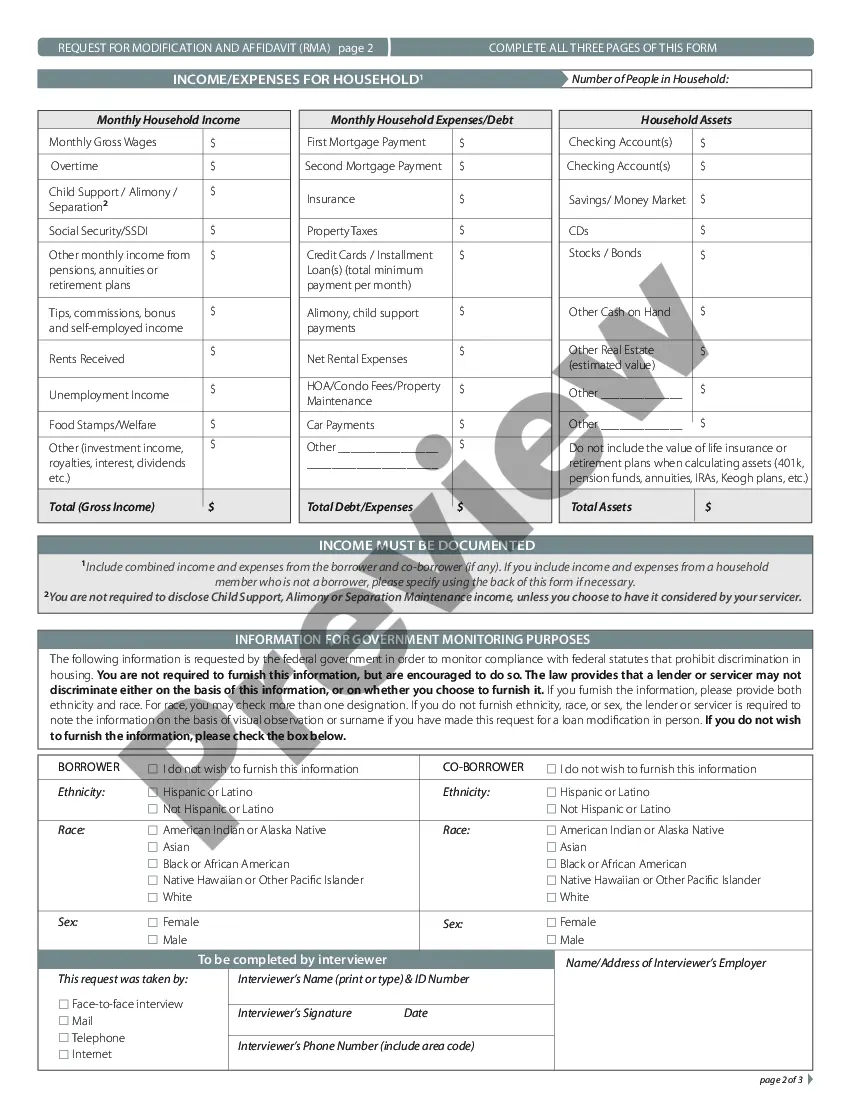

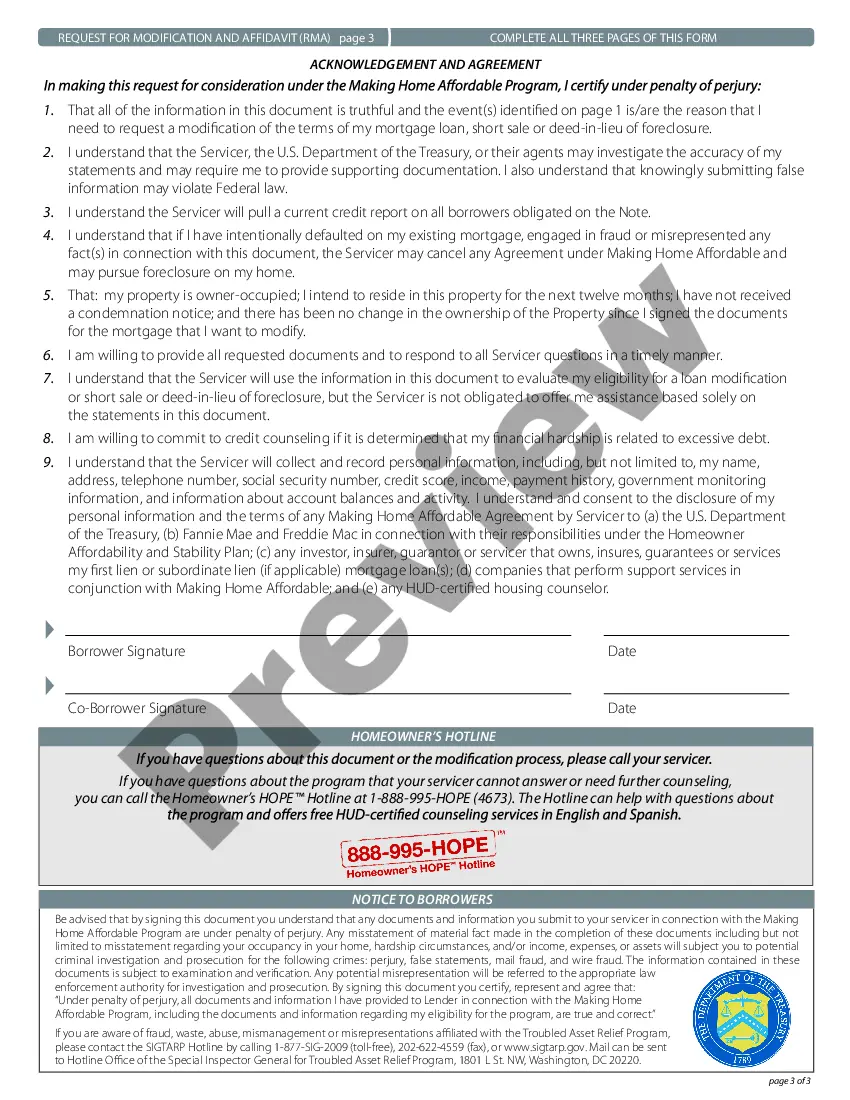

The HAMP loan modification program, or Home Affordable Modification Program, is designed to assist homeowners in avoiding foreclosure by making mortgage payments more affordable. Through this program, qualified borrowers may receive lower monthly payments or reduced interest rates. The Virgin Islands Request for Loan Modification RMA Under Home Affordable Modification Program HAMP is your path to accessing these vital resources. This program aims to help you regain financial stability and keep your home.

To apply for a loan modification, start by gathering your financial documents, including income statements and expenses. Reach out to your lender to express your interest in a modification and request the necessary forms. Additionally, you can benefit from using platforms like uslegalforms to find resources and templates related to the Virgin Islands Request for Loan Modification RMA Under Home Affordable Modification Program HAMP. This can simplify the process and ensure you provide complete information.

Getting approved for a loan modification can vary depending on your individual circumstances. While some homeowners find the process straightforward, others may face challenges based on their financial situation. It is essential to provide accurate documentation and a clear explanation of your hardship. Using the Virgin Islands Request for Loan Modification RMA Under Home Affordable Modification Program HAMP can help streamline the process and improve your chances of approval.

To qualify for a loan modification, you typically need to show financial hardship. This can include job loss, medical emergencies, or other situations causing difficulty in making your mortgage payments. Lenders often look for proof of income and expenses to evaluate your eligibility. The Virgin Islands Request for Loan Modification RMA Under Home Affordable Modification Program HAMP is designed to assist homeowners facing such challenges.

The loan modification process generally begins with submitting an application to your lender under the Virgin Islands Request for Loan Modification RMA Under Home Affordable Modification Program HAMP. Once your application is received, the lender will review your financial situation, assess your eligibility, and may request additional information. If approved, your terms will be updated, and you'll receive a new payment schedule. Throughout this process, you can rely on resources like USLegalForms to provide guidance and ensure your application is thoroughly prepared.

Applying for a loan modification involves several steps under the Virgin Islands Request for Loan Modification RMA Under Home Affordable Modification Program HAMP. First, gather all necessary financial documents, including income statements and tax returns. Next, contact your lender to request a loan modification application, complete it thoroughly, and submit your documents for review. Using platforms like USLegalForms can streamline this process, helping you ensure that all paperwork is completed accurately.

To qualify for a loan modification, you must meet certain criteria set by the Virgin Islands Request for Loan Modification RMA Under Home Affordable Modification Program HAMP. Typically, you need to demonstrate financial hardship, provide documentation of your income and expenses, and prove that you have the ability to make the modified payment. Your lender will also require information about your mortgage and any other debts.

Various factors can disqualify you from a loan modification under the Virgin Islands Request for Loan Modification RMA Under Home Affordable Modification Program HAMP. These may include insufficient income to make modified payments, failure to provide required documentation, or having a mortgage that exceeds the maximum loan limit. Additionally, if you have previously been denied for a loan modification or your financial situation has not significantly changed, you may also face disqualification.

To request a loan modification, you first need to gather your financial documents and then reach out to your lender. Clearly state your need for assistance and mention the Virgin Islands Request for Loan Modification RMA Under Home Affordable Modification Program HAMP as a potential path. This approach helps your lender understand your situation and opens the door to potential relief.

To request a mature modification on your loan, start by contacting your loan servicer directly. Clearly communicate your financial situation and express your interest in the Virgin Islands Request for Loan Modification RMA Under Home Affordable Modification Program HAMP. They will guide you through the specific documentation and steps needed to initiate the process.