This due diligence form is a detailed summary to be completed for each acquisition or divestiture agreement performed within the company regarding business transactions.

Virgin Islands Acquisition Divestiture Merger Agreement Summary

Description

How to fill out Acquisition Divestiture Merger Agreement Summary?

Selecting the optimal official document format can be challenging. Clearly, there are numerous templates accessible online, but how do you discover the official form you need? Utilize the US Legal Forms website. This service offers an extensive range of templates, including the Virgin Islands Acquisition Divestiture Merger Agreement Summary, suitable for both business and personal purposes. All forms are reviewed by experts and comply with federal and state regulations.

If you are already registered, sign in to your account and click on the Download button to acquire the Virgin Islands Acquisition Divestiture Merger Agreement Summary. Use your account to browse through the official forms you have purchased previously. Go to the My documents tab of your account and download another copy of the document you need.

If you are a new user of US Legal Forms, here are simple steps you should follow: First, ensure you have selected the correct form for your state/region. You can review the form using the Preview button and examine the form description to confirm it is the right one for you. If the form does not meet your expectations, utilize the Search field to locate the suitable form. Once you are confident the form is appropriate, click the Buy Now button to acquire the form. Choose the pricing plan you want and enter the necessary information. Create your account and pay for the transaction using your PayPal account or credit card. Select the document file format and download the official document template to your device. Complete, edit, print, and sign the obtained Virgin Islands Acquisition Divestiture Merger Agreement Summary.

US Legal Forms boasts the largest collection of official forms where you can explore a variety of document templates. Utilize the service to download professionally crafted paperwork that conforms to state regulations.

- Ensure you have selected the correct form for your specific area.

- Utilize the Preview button to review the document.

- Check the form description for accuracy.

- Use the Search field if needed.

- Click the Buy Now button to finalize your purchase.

- Choose your preferred pricing plan and provide necessary information.

Form popularity

FAQ

To register a business in the U.S. Virgin Islands, start by choosing your business structure, which could be LLC or corporation. You'll then need to file the necessary documents with the Department of Licensing and Consumer Affairs. Using platforms like USLegalForms can simplify this process, ensuring you meet all the requirements efficiently while staying informed on the Virgin Islands Acquisition Divestiture Merger Agreement Summary.

Denmark relinquished control of the Virgin Islands in 1917, driven mainly by strategic decisions during World War I. The United States sought to prevent German expansion in the Caribbean, which prompted Denmark to sell the islands. This transaction significantly influenced the current legal landscape, including the Virgin Islands Acquisition Divestiture Merger Agreement Summary.

The Dutch sold the Virgin Islands primarily due to economic reasons and changing imperial interests. By the 18th century, the islands were becoming less profitable for colonial powers. This shift eventually allowed Denmark and later the United States to establish control, shaping the historical context of the Virgin Islands Acquisition Divestiture Merger Agreement Summary.

The takeover code for the British Virgin Islands (BVI) outlines the regulations governing the acquisition of companies within its jurisdiction. This framework aims to ensure fair treatment of shareholders during the acquisition process. Understanding this code is essential for navigating the Virgin Islands Acquisition Divestiture Merger Agreement Summary effectively.

The U.S. acquired the Virgin Islands from Denmark in 1917, primarily due to strategic interests during World War I. This acquisition aimed to enhance U.S. naval capability in the Caribbean. The transaction is detailed in what is known as the Virgin Islands Acquisition Divestiture Merger Agreement Summary, which outlines the terms of the transfer. Understanding this historical agreement provides insights into the ongoing legal and economic frameworks governing the islands today.

The four main types of mergers and acquisitions include horizontal, vertical, conglomerate, and market extension mergers. Each type serves different strategic purposes, such as increasing market share or diversifying products. It is important to relate these concepts to the Virgin Islands Acquisition Divestiture Merger Agreement Summary for clarity during the negotiation process.

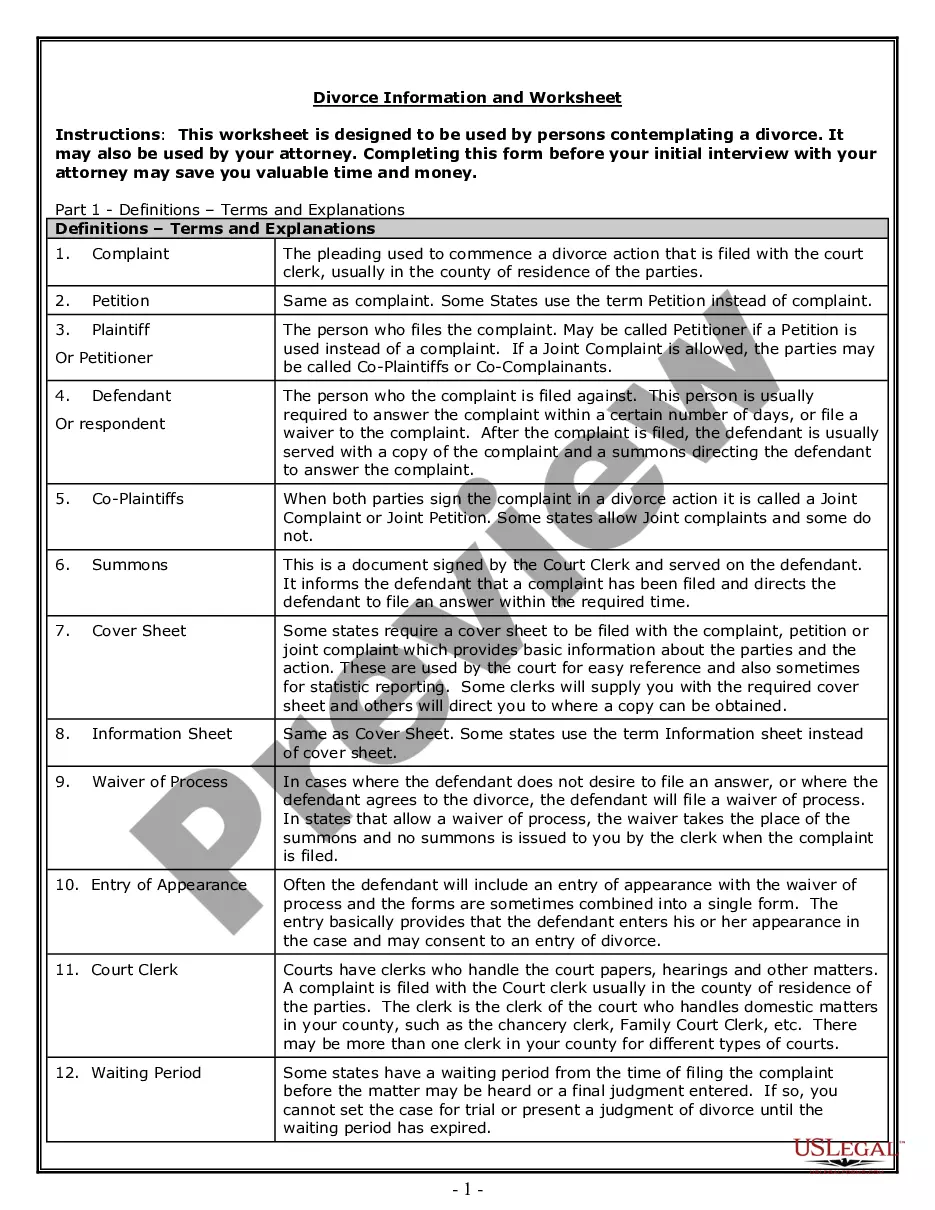

In merger and acquisition processes, essential steps include preparation, strategic planning, due diligence, negotiation, and integration. Each step contributes to a comprehensive understanding of the involved parties and the value exchange. By accessing resources from a platform like uslegalforms, you can efficiently draft and manage your Virgin Islands Acquisition Divestiture Merger Agreement Summary.

The 10 steps in mergers and acquisitions typically include strategy development, target identification, due diligence, valuation, deal structuring, negotiation, integration planning, execution, monitoring, and post-merger evaluation. Each step demands careful attention to detail, particularly when drafting the Virgin Islands Acquisition Divestiture Merger Agreement Summary. Effective management of these phases increases the likelihood of a successful outcome.

To transfer shares in a BVI company, the shareholders must execute a share transfer form, which should clearly outline the details of the transfer. This action may also require updating the company's register of members to reflect the new ownership. For those navigating the Virgin Islands Acquisition Divestiture Merger Agreement Summary, understanding share transfer procedures is crucial.

One key step in performing a merger or acquisition is conducting thorough due diligence. This process involves evaluating financial records, contracts, and other pertinent documents to identify potential risks and opportunities. Understanding these elements helps ensure that the Virgin Islands Acquisition Divestiture Merger Agreement Summary reflects the true value and condition of the target company.