This is a due diligence contract provision that a company will provide reimbursement for any losses that the director may incur in business transactions.

Virgin Islands Director Favorable Director Indemnification Agreement

Description

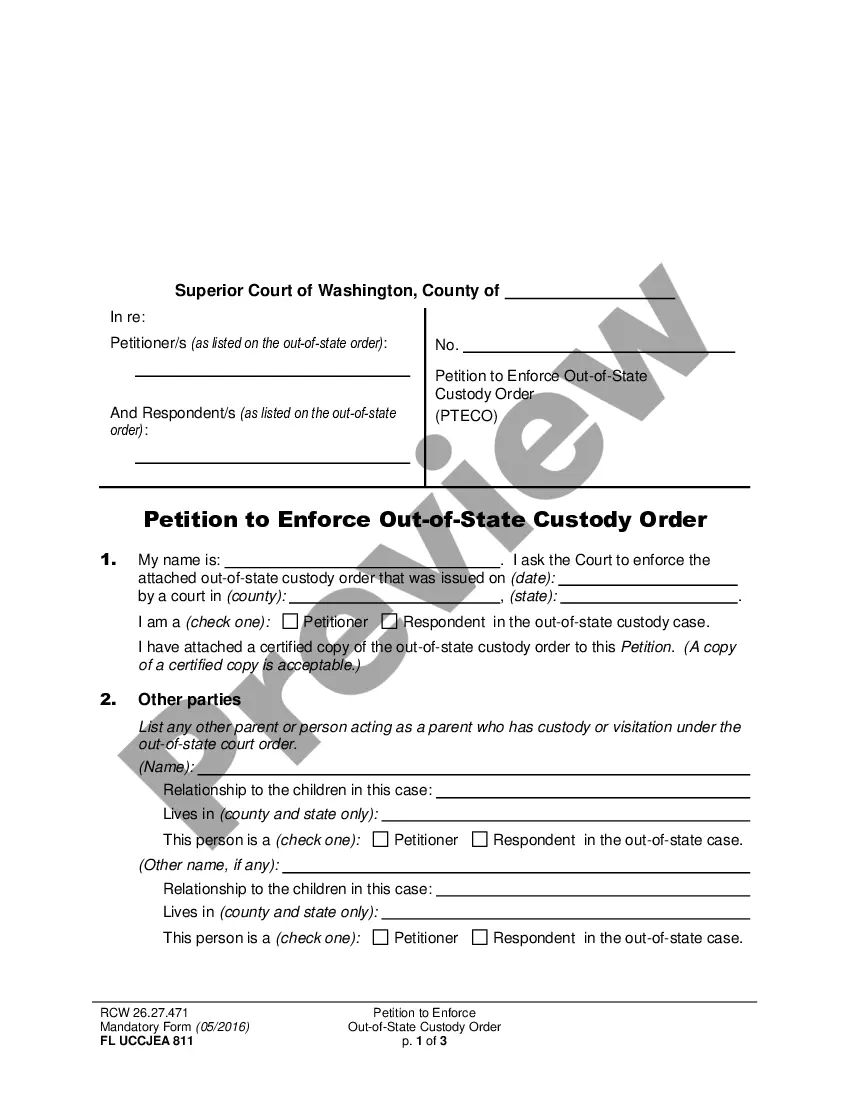

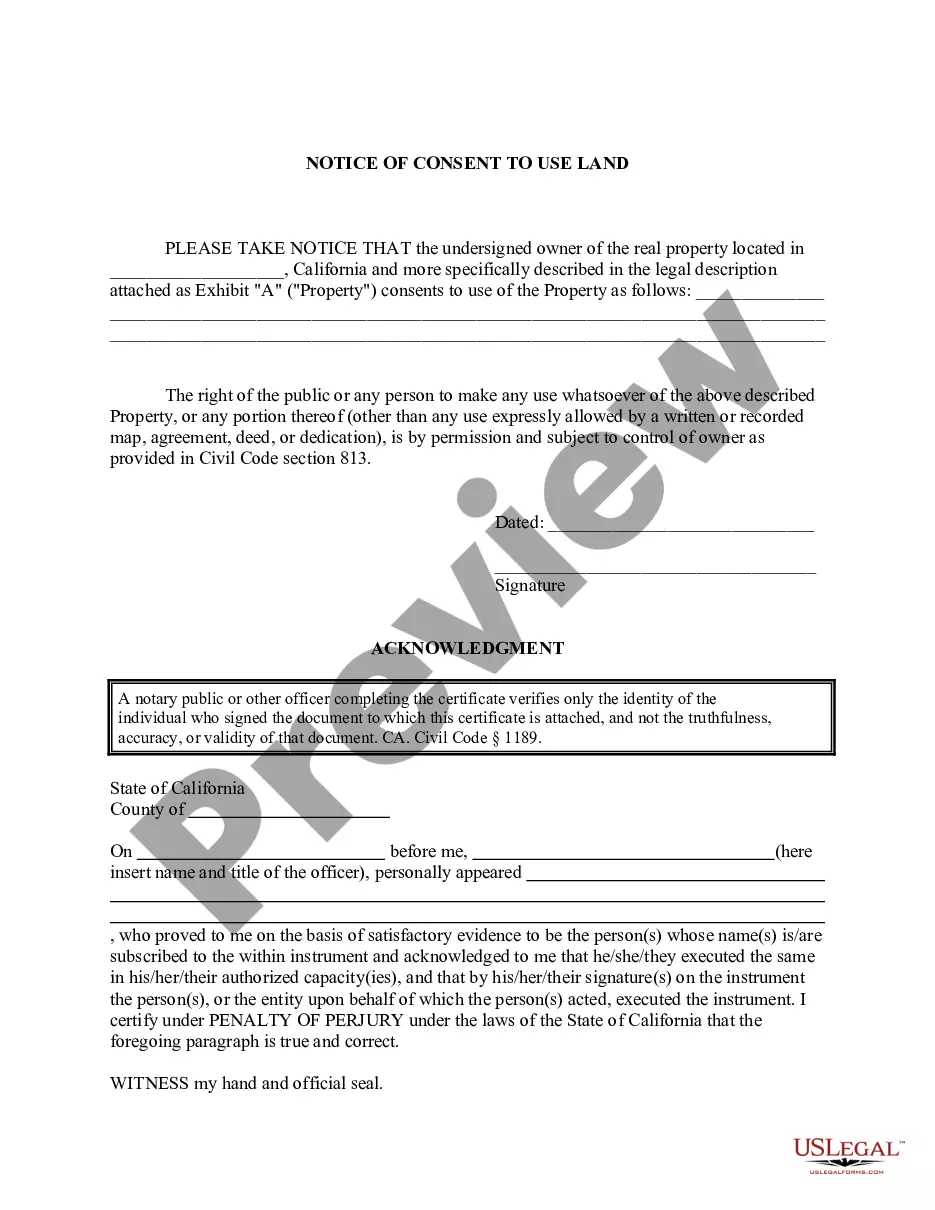

How to fill out Director Favorable Director Indemnification Agreement?

US Legal Forms - one of the largest repositories of legal documents in the United States - offers a diverse selection of legal templates available for download or printing.

Through the website, you can access thousands of documents for business and personal use, organized by categories, states, or keywords.

You can obtain the latest documents, such as the Virgin Islands Director Favorable Director Indemnification Agreement, within moments.

Review the form details to confirm that you have selected the correct template.

If the form does not meet your requirements, utilize the Search bar at the top of the page to find one that does.

- If you already hold a monthly membership, Log In to acquire the Virgin Islands Director Favorable Director Indemnification Agreement from the US Legal Forms collection.

- The Download button will appear on each template you view.

- You have access to all previously saved templates in the My documents section of your account.

- If you are using US Legal Forms for the first time, here are simple steps to get started.

- Ensure you have selected the appropriate form for your jurisdiction/area.

- Click the Preview button to view the content of the form.

Form popularity

FAQ

The tort claims act in the Virgin Islands allows individuals to seek compensation for wrongful acts committed by the government or its employees. This legal framework provides a structured process for filing claims, ensuring that victims have avenues for redress. Understanding this act is essential for anyone considering a Virgin Islands Director Favorable Director Indemnification Agreement, as it clarifies potential liabilities. As a legal resource, USLegalForms can guide you through the nuances of this act and help you make informed decisions.

Yes, a company can indemnify its directors through a Virgin Islands Director Favorable Director Indemnification Agreement. This type of agreement protects directors from personal liability arising from their decisions made in good faith while managing the company. By offering this protection, companies can encourage experienced individuals to serve on their boards. This assurance fosters better governance and enhances the overall stability of the organization.

Indemnification and directors and officers insurance serve different purposes, though they both protect company leaders. A Virgin Islands Director Favorable Director Indemnification Agreement provides direct protection for directors against legal expenses and liabilities they may incur while serving on the board. In contrast, directors and officers insurance offers a broader policy that covers various risks, including wrongful acts. It is important to understand both options to ensure comprehensive protection for your leadership team.

The primary purpose of an indemnification agreement is to protect directors and officers from personal liability arising from their role in the company. A Virgin Islands Director Favorable Director Indemnification Agreement serves not only to reassure directors but also to promote transparency and accountability within the organization. By clearly defining the terms of indemnification, such agreements foster a positive relationship between a company and its leadership.

Yes, a BVI company can appoint a corporate director, which can be beneficial for various strategic reasons. However, it is essential to consider the implications in conjunction with a Virgin Islands Director Favorable Director Indemnification Agreement, as corporate directors also require protection against liabilities. Using a well-structured indemnification agreement ensures that all directors, whether individual or corporate, are adequately safeguarded.

Yes, a director can be indemnified, provided the conditions in the indemnification agreement are met. Generally, a Virgin Islands Director Favorable Director Indemnification Agreement allows for indemnification as long as the director acted in good faith and in the company’s best interests. This assurance encourages qualified individuals to take on director roles, knowing they have legal protection.

A director indemnification agreement is a specific type of contract that outlines a company's commitment to defend and reimburse its directors for expenses related to legal proceedings. This Virgin Islands Director Favorable Director Indemnification Agreement ensures that directors do not have to bear the financial burden of legal actions related to their corporate duties. It fosters a safer environment for corporate governance by promoting responsible decision-making.

A company cannot indemnify its directors in situations where they have committed intentional misconduct or illegal actions. Under a Virgin Islands Director Favorable Director Indemnification Agreement, indemnification is void if the director knowingly violated the law or acted with gross negligence. Understanding these limitations helps companies create comprehensive policies that still protect their leaders while adhering to legal obligations.

A director indemnity agreement is a legal document that protects corporate directors from personal liability for actions taken in their official capacity. This Virgin Islands Director Favorable Director Indemnification Agreement allows organizations to reassure their directors that they will be defended against potential legal claims. Such agreements are essential in encouraging experienced professionals to accept board positions, knowing their interests are safeguarded.