Virgin Islands Disclosure of Distribution Agreement, Services Agreement and Tax Sharing Agreement

Description

How to fill out Disclosure Of Distribution Agreement, Services Agreement And Tax Sharing Agreement?

Have you been inside a position that you will need documents for possibly company or person functions virtually every time? There are tons of legitimate file web templates available on the Internet, but locating versions you can trust is not straightforward. US Legal Forms offers thousands of type web templates, much like the Virgin Islands Disclosure of Distribution Agreement, Services Agreement and Tax Sharing Agreement, which can be composed to satisfy state and federal requirements.

Should you be previously acquainted with US Legal Forms website and possess a merchant account, basically log in. Next, you are able to acquire the Virgin Islands Disclosure of Distribution Agreement, Services Agreement and Tax Sharing Agreement design.

Should you not offer an profile and need to start using US Legal Forms, follow these steps:

- Find the type you want and ensure it is to the correct metropolis/state.

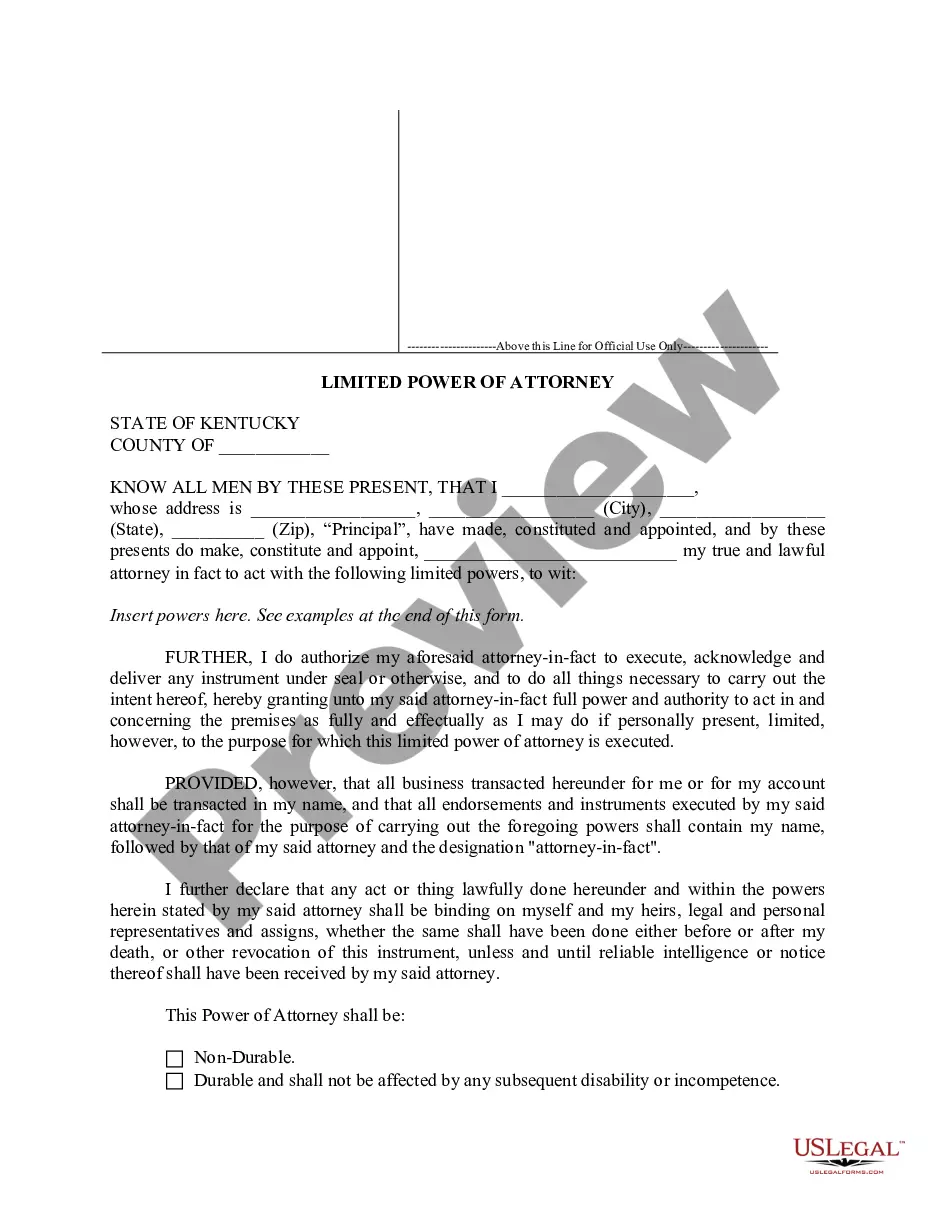

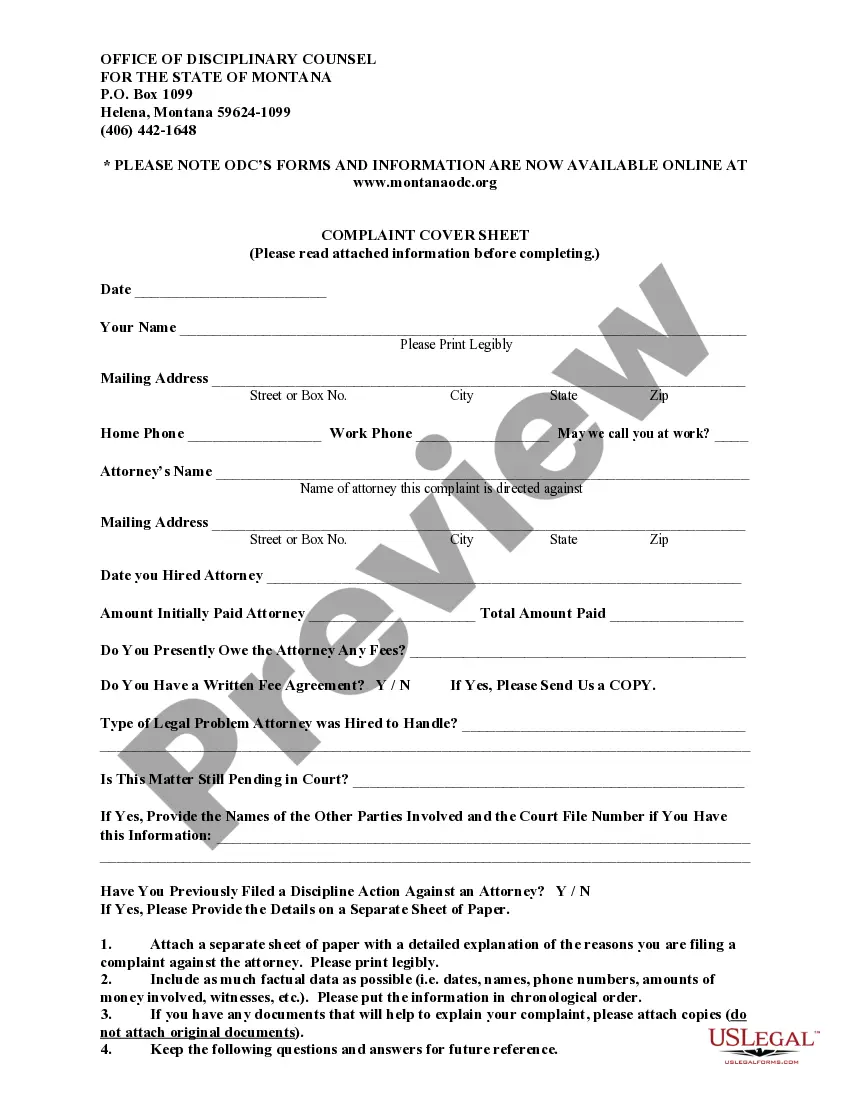

- Take advantage of the Review option to analyze the shape.

- Look at the description to actually have selected the correct type.

- In case the type is not what you`re looking for, use the Lookup field to obtain the type that fits your needs and requirements.

- If you discover the correct type, click Acquire now.

- Pick the costs program you want, submit the specified details to produce your money, and pay for your order using your PayPal or Visa or Mastercard.

- Decide on a hassle-free document file format and acquire your duplicate.

Find every one of the file web templates you may have bought in the My Forms menu. You can get a further duplicate of Virgin Islands Disclosure of Distribution Agreement, Services Agreement and Tax Sharing Agreement anytime, if needed. Just select the required type to acquire or produce the file design.

Use US Legal Forms, the most comprehensive selection of legitimate kinds, to conserve time as well as avoid faults. The assistance offers expertly created legitimate file web templates which you can use for a range of functions. Make a merchant account on US Legal Forms and begin making your daily life a little easier.

Form popularity

FAQ

A SPA should specify the sale price for the shares, specify the currency and timescale for the sale, and list any other conditions like staged payments. Usually, payment is made in cash, although sometimes the buyer may offer the seller some of its shares, or issue loan notes to the seller.

Below is a basic distribution agreement checklist to help you get started: Names and addresses of both parties. Sale terms and conditions. Contract effective dates. Marketing and intellectual property rights. Defects and returns provisions. Severance terms. Returned goods credits and costs. Exclusivity from competing products.

Data sharing agreements set out the purpose of the data sharing, cover what happens to the data at each stage, set standards and help all the parties involved in sharing to be clear about their roles and responsibilities.

A distribution agreement, also known as a distributor agreement, is a contract between a supplying company with products to sell and another company that markets and sells the products. The distributor agrees to buy products from the supplier company and sell them to clients within certain geographical areas.

The following is a checklist of factors to be considered when drafting a distribution contract: terms and conditions of sale; term for which the contract is in effect; marketing rights; trademark licensing; geographical territory covered by the agreement; performance; reporting; and.