Virgin Islands Management Stock Purchase Plan

Description

How to fill out Management Stock Purchase Plan?

If you need to full, acquire, or printing lawful file web templates, use US Legal Forms, the most important selection of lawful varieties, that can be found on the Internet. Use the site`s simple and convenient research to obtain the paperwork you want. Different web templates for enterprise and individual uses are categorized by groups and suggests, or keywords and phrases. Use US Legal Forms to obtain the Virgin Islands Management Stock Purchase Plan with a couple of click throughs.

When you are currently a US Legal Forms customer, log in for your bank account and click the Acquire option to have the Virgin Islands Management Stock Purchase Plan. You may also entry varieties you formerly downloaded in the My Forms tab of your respective bank account.

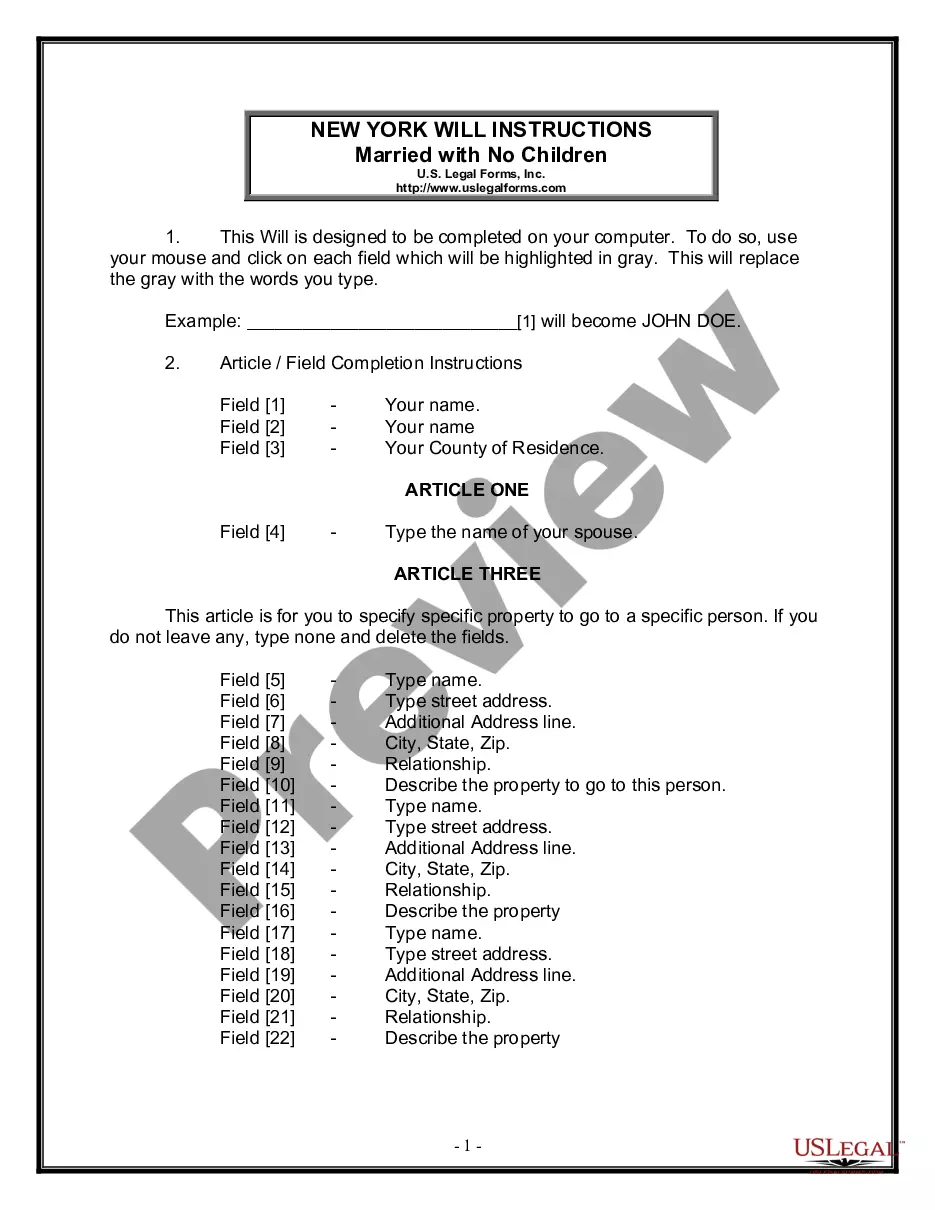

If you use US Legal Forms the first time, follow the instructions below:

- Step 1. Make sure you have chosen the form to the correct area/region.

- Step 2. Take advantage of the Preview choice to examine the form`s content. Never neglect to read the explanation.

- Step 3. When you are unhappy with all the form, use the Search field near the top of the display screen to find other models of your lawful form web template.

- Step 4. After you have located the form you want, go through the Get now option. Pick the costs program you like and add your accreditations to register on an bank account.

- Step 5. Approach the financial transaction. You can use your charge card or PayPal bank account to accomplish the financial transaction.

- Step 6. Pick the format of your lawful form and acquire it on your own system.

- Step 7. Total, edit and printing or indication the Virgin Islands Management Stock Purchase Plan.

Each lawful file web template you get is your own property eternally. You may have acces to each and every form you downloaded within your acccount. Select the My Forms portion and pick a form to printing or acquire again.

Contend and acquire, and printing the Virgin Islands Management Stock Purchase Plan with US Legal Forms. There are many expert and status-distinct varieties you can utilize for your personal enterprise or individual needs.

Form popularity

FAQ

With employee stock purchase plans (ESPP), when you leave, you'll no longer be able to buy shares in the plan. Depending on the plan, withholding may occur for months before the next pre-determined purchase window.

Yes. The payroll deductions you have set aside for an ESPP are yours if you have not yet used them to purchase stock. You will need to notify your plan administrator and fill out any paperwork required to make a withdrawal. If you have already purchased stock, you will need to sell your shares.

In this situation, you sell your ESPP shares more than one year after purchasing them, but less than two years after the offering date. This is a disqualifying disposition because you sold the stock less than two years after the offering (grant) date.

If a participant withdraws from the ESPP, the accumulated payroll deductions will be paid to the participant as soon as administratively possible and no further payroll deductions will be made for the participant for such offering period.

If you leave your company while enrolled in their employee stock purchase program, your eligibility for the plan ends, but you will continue to own the stock the company purchased for you during employment.

If you are risk-averse, you might consider selling your ESPP shares right away so you don't have overexposure in one stock, particularly that of your own employer. ESPP shares can put you in an overexposed position. If the stock value goes down, you may suffer losses and in extreme cases, even lose your job.

An employee stock purchase plan (or ESPP) can be a very valuable benefit. In general, if your employer offers an ESPP, we think you should participate at the level you can comfortably afford and then sell the shares as soon as you can.

They can only report the unadjusted basis ? what the employee actually paid. To avoid double taxation, the employee must use Form 8949. The information needed to make this adjustment will probably be in supplemental materials that come with your 1099-B.