Virgin Islands Employee Evaluation Form for Nanny

Description

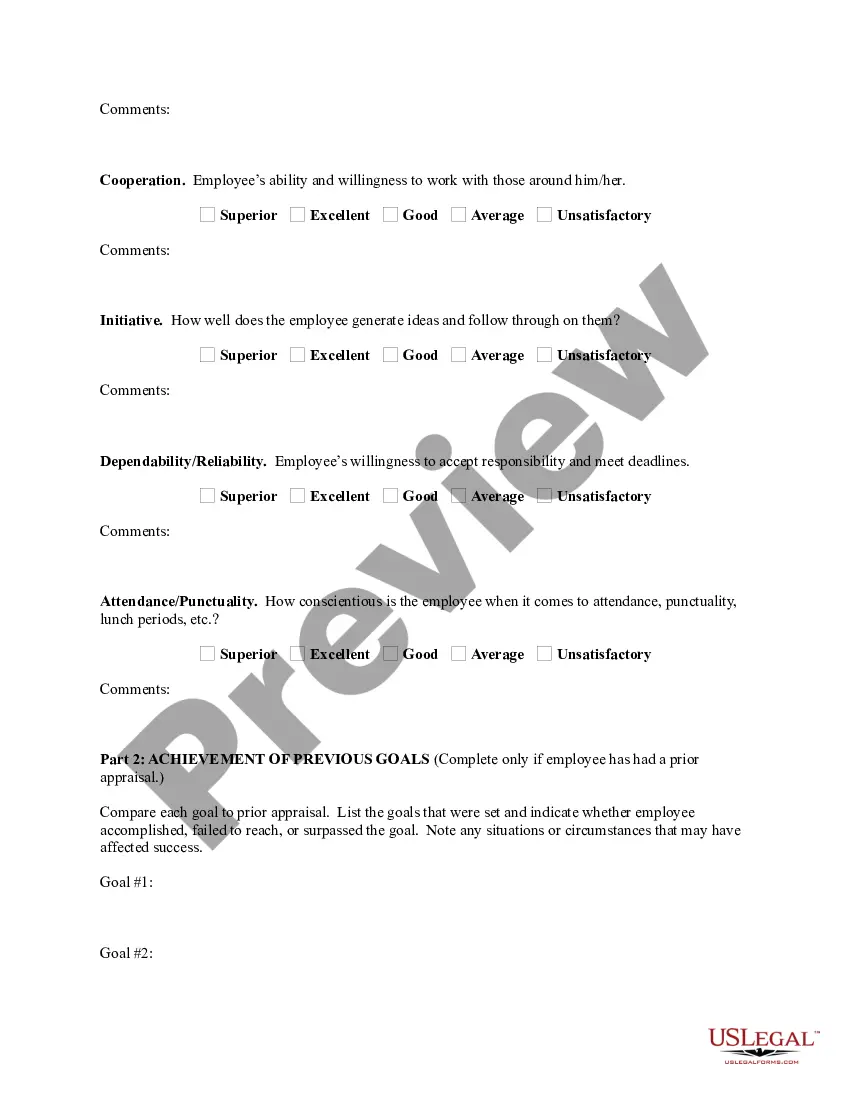

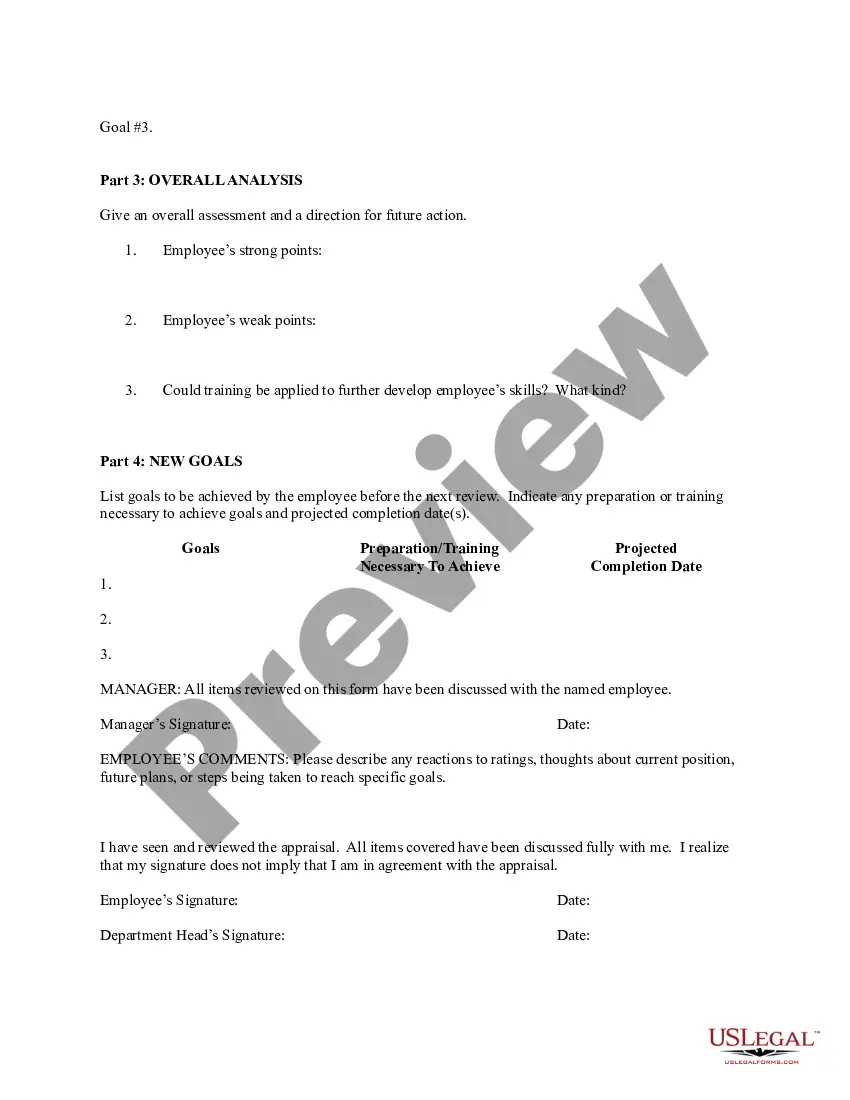

How to fill out Employee Evaluation Form For Nanny?

It is feasible to invest hours online searching for the legal document template that meets the federal and state requirements you need. US Legal Forms offers a vast array of legal forms that are assessed by experts.

You can easily download or print the Virgin Islands Employee Evaluation Form for Nanny from this service.

If you have an account with US Legal Forms, you can Log In and click the Obtain button. Subsequently, you can complete, edit, print, or sign the Virgin Islands Employee Evaluation Form for Nanny. Every legal document template you acquire is yours permanently.

Complete the payment process. You can use your Visa or Mastercard or PayPal account to pay for the legal document. Choose the format of the document and download it to your device. Make modifications to the document if necessary. You can complete, edit, sign, and print the Virgin Islands Employee Evaluation Form for Nanny. Download and print a multitude of document templates through the US Legal Forms website, which offers the largest selection of legal forms. Utilize professional and state-specific templates to meet your business or personal needs.

- To obtain another copy of any acquired form, go to the My documents tab and click the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions below.

- First, ensure that you have selected the correct document template for the state/city you choose. Review the form details to confirm you have selected the right form.

- If available, utilize the Review button to view the document template as well.

- If you need to find another version of the form, use the Search area to locate the template that fits your needs and requirements.

- Once you have found the template you want, click Acquire now to proceed.

- Choose the pricing plan you prefer, enter your details, and register for an account on US Legal Forms.

Form popularity

FAQ

Box 2 Shows the total federal income tax withheld from your paycheck for the tax year. Include this amount on the federal income tax withheld line of your return (Form 1040, line 25a).

How to fill out Form W-2Box A: Employee's Social Security number.Box B: Employer Identification Number (EIN)Box C: Employer's name, address, and ZIP code.Box D:Boxes E and F: Employee's name, address, and ZIP code.Box 1: Wages, tips, other compensation.Box 2: Federal income tax withheld.Box 3: Social Security wages.More items...?

2 tax form shows important information about the income you've earned from your employer, amount of taxes withheld from your paycheck, benefits provided and other information for the year. You use this form to file your federal and state taxes.

If you have wages reported in box 16, box 17 will show the total amount of state income taxes withheld during the year.

Employers must file Form W-2, the IRS Wage and Tax Statement, for each employee who receives at least $600 in wages from your business, even if you did not withhold any income, Medicare or Social Security tax, though you would have had to withhold income tax if an employee did not claim an exemption from withholding on

Form W-2, also known as the Wage and Tax Statement, is the document an employer is required to send to each employee and the Internal Revenue Service (IRS) at the end of the year. A W-2 reports employees' annual wages and the amount of taxes withheld from their paychecks.

9 Form InstructionsLine 1 Name.Line 2 Business name.Line 3 Federal tax classification.Line 4 Exemptions.Lines 5 & 6 Address, city, state, and ZIP code.Line 7 Account number(s)Part I Taxpayer Identification Number (TIN)Part II Certification.

How to fill out Form W-2Box A: Employee's Social Security number.Box B: Employer Identification Number (EIN)Box C: Employer's name, address, and ZIP code.Box D:Boxes E and F: Employee's name, address, and ZIP code.Box 1: Wages, tips, other compensation.Box 2: Federal income tax withheld.Box 3: Social Security wages.More items...?

Box 17: State Income tax This amount represents the total of state income taxes withheld from your paycheck for the wages reported in Box 16.

How to Complete the New Form W-4Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number.Step 2: Indicate Multiple Jobs or a Working Spouse.Step 3: Add Dependents.Step 4: Add Other Adjustments.Step 5: Sign and Date Form W-4.