Virgin Islands Approval for Relocation Expenses and Allowances

Description

How to fill out Approval For Relocation Expenses And Allowances?

Are you in a position where you require documents for either corporate or individual activities almost every business day.

There are numerous reliable document templates available online, but finding ones you can trust is challenging.

US Legal Forms offers thousands of template documents, including the Virgin Islands Approval for Relocation Expenses and Allowances, which are designed to comply with federal and state regulations.

Select a suitable document format and download your version.

Access all the document templates you have acquired in the My documents section. You can obtain another copy of the Virgin Islands Approval for Relocation Expenses and Allowances at any time if needed. Just select the required document to download or print the template.

Utilize US Legal Forms, the most extensive collection of legitimate templates, to save time and reduce errors. The service offers professionally crafted legal document templates that can be utilized for various purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Virgin Islands Approval for Relocation Expenses and Allowances template.

- If you don't have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the document you need and ensure it is for the correct city/state.

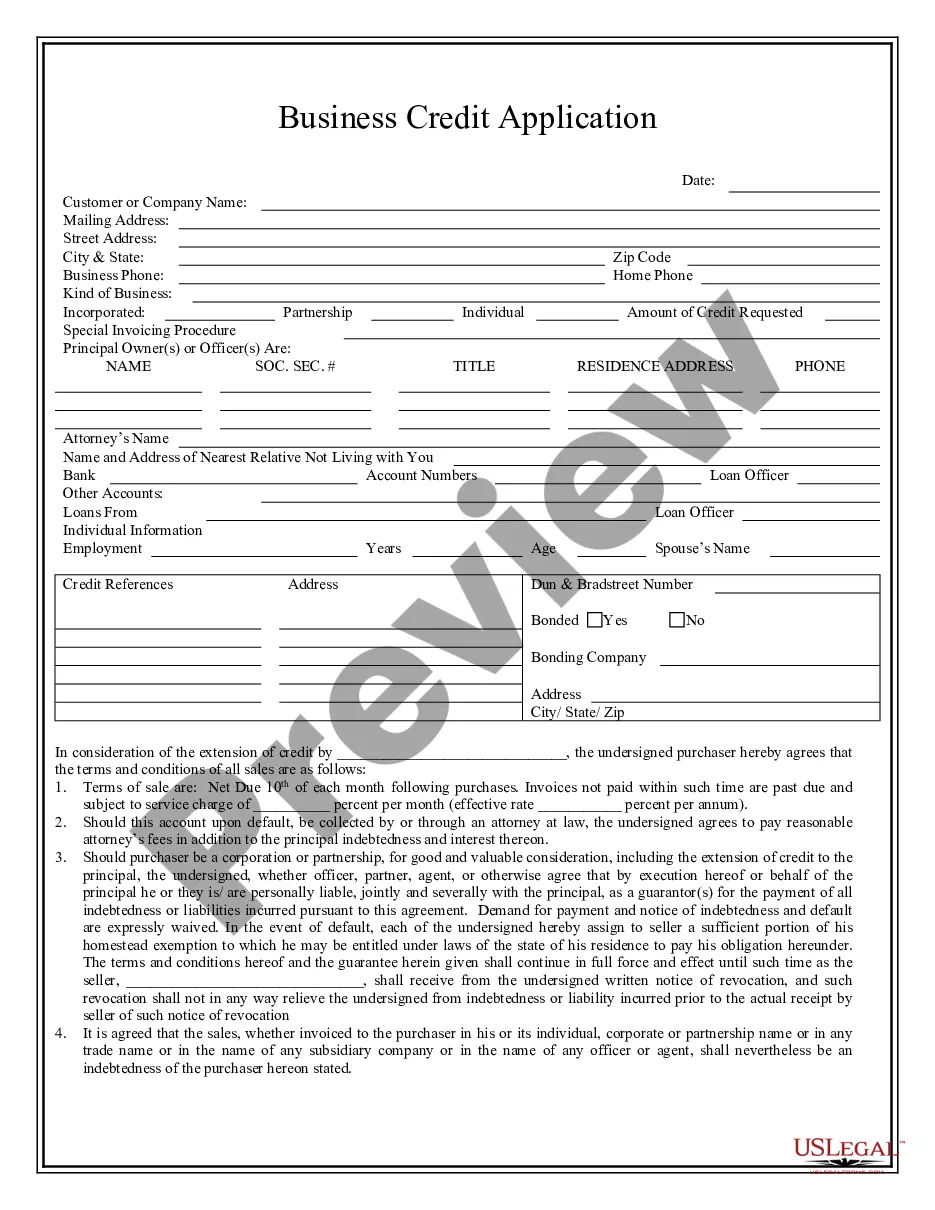

- Use the Review button to examine the document.

- Check the description to make sure you have selected the correct document.

- If the document is not what you need, use the Search box to find the document that matches your needs and requirements.

- Once you find the right document, click Acquire now.

- Choose the pricing plan you want, fill in the required information to create your account, and pay for your order using your PayPal or credit card.

Form popularity

FAQ

Eligibility for a relocation allowance typically extends to employees who are officially relocating to the Virgin Islands for work purposes. Employers may define specific criteria, including duration of employment and relocation distance. Understanding these requirements is crucial for benefiting from the Virgin Islands Approval for Relocation Expenses and Allowances.

You can deduct the expenses of moving your household goods and personal effects, including expenses for hauling a trailer, packing, crating, in-transit storage, and insurance. You can't deduct expenses for moving furniture or other goods you bought on the way from your old home to your new home.

To qualify, reimbursements or payments must be for work-related moving expenses that would have been deductible by the employee if the employee had directly paid them before Jan. 1, 2018.

Transport, accommodation or meals provided to an employee and family members as a consequence of an employee being required to permanently or temporarily relocate his or her usual place of residence to perform employment duties.

Official Government Travel is either related to: Temporary duty away from the official duty station (TDY), A change of official duty station, a "relocation" which entails a Permanent Change of Station (PCS), or first duty assignment, or. Local travel in and around the official duty station.

The JTR prescribes travel and transportation allowances authorized for DoD civilian employees. The JTR is the Department's implementing guidance for the Federal Travel Regulation (FTR), (reference (d)), issued by the General Services Administration (GSA).

There's a lot of research out there about the average relocation cost, but a package can range anywhere from $2,000 to $100,000. How much you want to spend on an employee relocation package is entirely up to you and your company.

These include: The cost of packing, crating and transporting household goods of the employee and family. This includes cars and pets. The cost of connecting or disconnecting utilities.

Relocation assistance refers to a business benefit where a company offers an employee help in moving to a new city or state in order to work for that company. This can include reimbursement for any moving costs, temporary lodging and travel expenses.

The short answer is yes. Relocation expenses for employees paid by an employer (aside from BVO/GBO homesale programs) are all considered taxable income to the employee by the IRS and state authorities (and by local governments that levy an income tax).