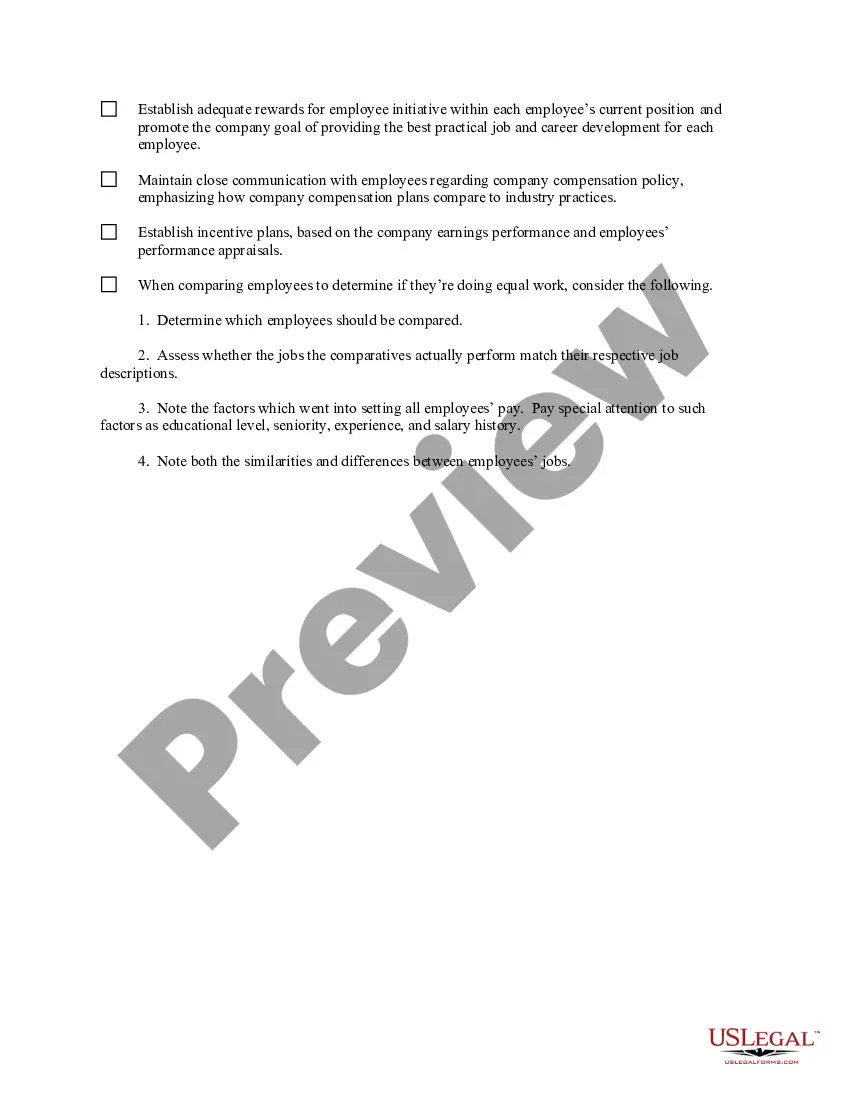

Virgin Islands Equal Pay Checklist

Description

How to fill out Equal Pay Checklist?

If you desire to be thorough, acquire, or print out official document formats, utilize US Legal Forms, the top selection of legal templates, which are accessible online.

Take advantage of the site’s straightforward and user-friendly search to locate the documents you require.

Numerous templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. After identifying the form you need, click the Purchase now button. Choose the pricing plan you want and enter your information to register for the account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment.

- Use US Legal Forms to find the Virgin Islands Equal Pay Checklist in just a few clicks.

- If you are currently a US Legal Forms user, Log In to your account and click the Download button to retrieve the Virgin Islands Equal Pay Checklist.

- You can also access forms you previously stored in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct state/city.

- Step 2. Use the Review method to examine the form’s content. Don’t forget to read the details.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal document template.

Form popularity

FAQ

The minimum wage in the U.S. Virgin Islands stands at $10.50 per hour. This rate is part of ongoing efforts to ensure fair pay for workers in the region. For those looking to ensure they're adhering to local wage laws, the Virgin Islands Equal Pay Checklist is an excellent tool to assist in compliance.

As of now, the Caribbean country with the highest minimum wage is Aruba, boasting a minimum wage of about $12 per hour. This figure can change, so it is wise to stay updated. The Virgin Islands Equal Pay Checklist is a great resource for understanding how our minimum wage compares within the Caribbean context.

In the Virgin Islands, the overtime law generally requires employers to pay employees 1.5 times their regular rate for hours worked beyond 40 in a week. This law is crucial for ensuring fair compensation for hard work. For compliance tips, using the Virgin Islands Equal Pay Checklist is highly recommended.

The average wage in the Virgin Islands fluctuates based on industry and occupation. As of recent data, wages vary, but they often hover around the national average. For those seeking to align their compensation with local standards, the Virgin Islands Equal Pay Checklist provides essential insights.

Currently, no state in the United States pays a minimum wage of $20. However, the Virgin Islands has a dynamic approach towards wages and is continually evaluating its compensation structure. It's essential to consult the Virgin Islands Equal Pay Checklist to understand local wage standards and ensure compliance.

Yes, living in the Islands may offer various tax advantages, including lower personal income tax rates. Additionally, certain businesses might benefit from tax incentives that can enhance their profitability. For more tailored information, consider using the Virgin Islands Equal Pay Checklist, which can help you identify potential benefits relevant to your situation.

Form 8689 needs to be mailed to the IRS center designated for your region. This ensures that your tax information is properly filed and recorded. Consulting the Virgin Islands Equal Pay Checklist will provide valuable insights on preparing and submitting Form 8689 correctly.

To file taxes in the Islands, you must complete the appropriate tax forms based on your income type. You can file online or mail your forms to the local tax authority. Using tools like the Virgin Islands Equal Pay Checklist can simplify this process and ensure you include all necessary information.

2 Islands refers to the tax form that employers in the Virgin Islands must issue to their employees. This form reports annual wages and the amount withheld for taxes. Understanding how to read your 2 Islands is essential for anyone looking to maintain compliance with the Virgin Islands Equal Pay Checklist.

Filing taxes in the US Islands requires you to understand local tax regulations. You will need to gather your income documents, such as your W-2 forms and any other income statements. The Virgin Islands Equal Pay Checklist can guide you through the necessary steps to ensure compliance with both federal and territorial tax obligations.