Virgin Islands Vacation Carryover Request

Description

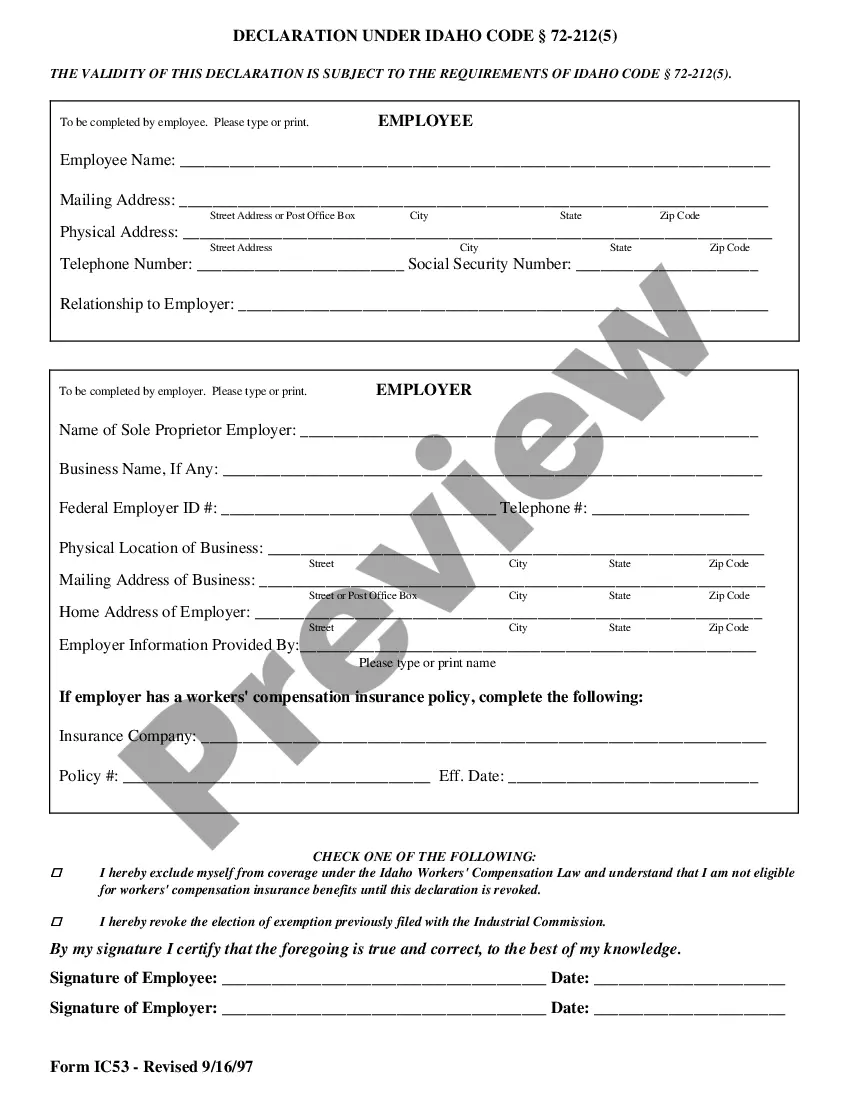

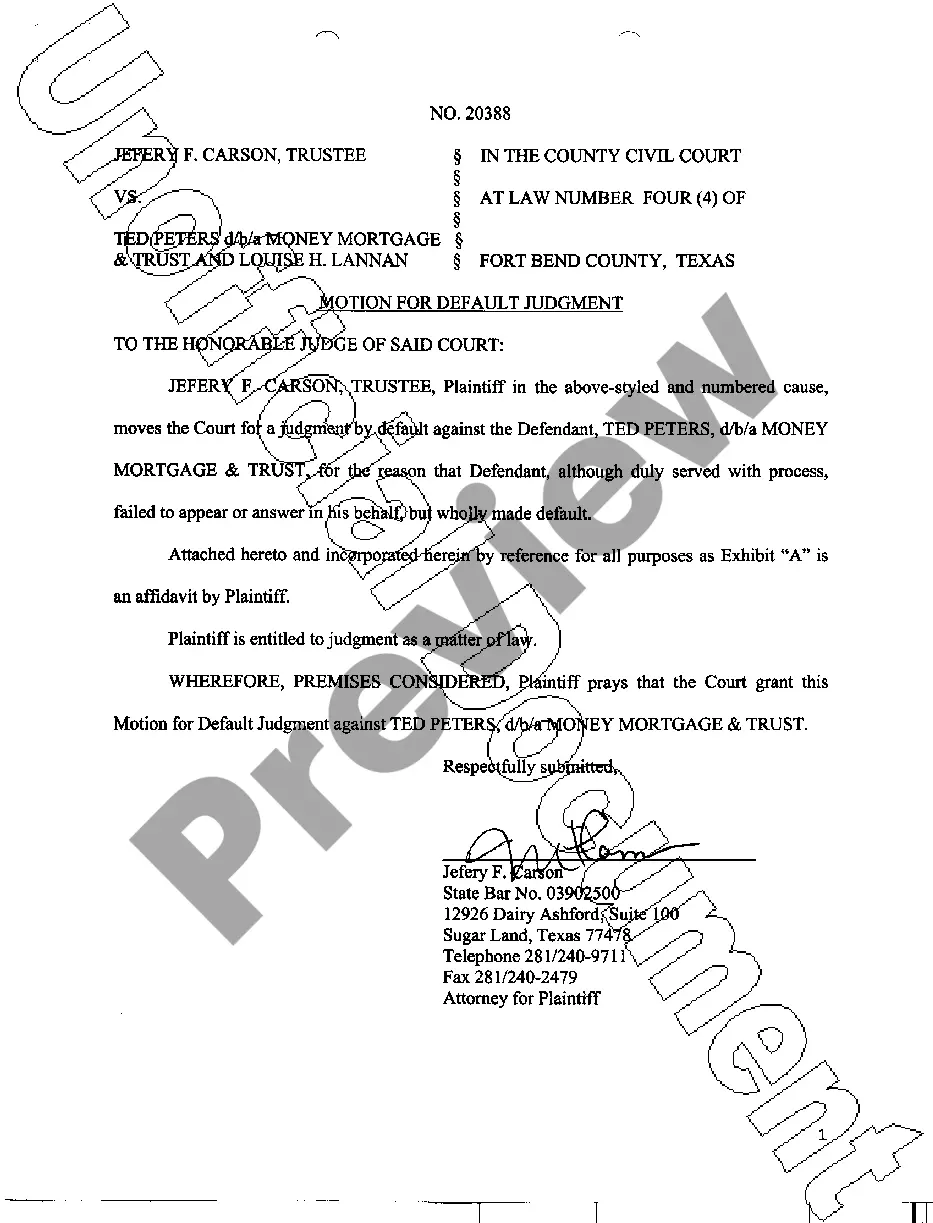

How to fill out Vacation Carryover Request?

If you need to total, acquire, or print authentic document templates, utilize US Legal Forms, the largest repository of legal forms, which is accessible online.

Take advantage of the site’s user-friendly search to locate the documents you need.

A variety of templates for business and personal reasons are arranged by categories and titles, or keywords.

Step 4. Once you have found the form you need, click on the Get now button. Choose the payment plan you prefer and provide your information to register for the account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Use US Legal Forms to find the Virgin Islands Vacation Carryover Request with just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click on the Obtain button to access the Virgin Islands Vacation Carryover Request.

- You can also retrieve forms you previously purchased in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have chosen the form for the correct city/state.

- Step 2. Use the Preview option to review the form’s contents. Don't forget to check the summary.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find other templates in the legal form library.

Form popularity

FAQ

How to Complete the New Form W-4Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number.Step 2: Indicate Multiple Jobs or a Working Spouse.Step 3: Add Dependents.Step 4: Add Other Adjustments.Step 5: Sign and Date Form W-4.

Form W-2 shows an employee's gross wages and withheld taxes. It can also include other information such as deferred compensation, dependent care benefits, contributions to a health savings account, and tip income. If you paid an employee during the year, you must complete a Form W-2.

9 Form InstructionsLine 1 Name.Line 2 Business name.Line 3 Federal tax classification.Line 4 Exemptions.Lines 5 & 6 Address, city, state, and ZIP code.Line 7 Account number(s)Part I Taxpayer Identification Number (TIN)Part II Certification.

Form W-2, also known as the Wage and Tax Statement, is the document an employer is required to send to each employee and the Internal Revenue Service (IRS) at the end of the year. A W-2 reports employees' annual wages and the amount of taxes withheld from their paychecks.

The No Lapse Rule Under IRC Sec 7701(b)(2)(B)(iii) if after departing and terminating U.S. tax residency in one calendar tax year, a nonresident alien returns to the U.S. and resumes U.S. tax residency (under SPT) at any time during the subsequent calendar tax year, the intervening period between non-residency and

How to fill out Form W-2Box A: Employee's Social Security number.Box B: Employer Identification Number (EIN)Box C: Employer's name, address, and ZIP code.Box D:Boxes E and F: Employee's name, address, and ZIP code.Box 1: Wages, tips, other compensation.Box 2: Federal income tax withheld.Box 3: Social Security wages.More items...?

The six-year rule allows for payment of living expenses that exceed the CFS, and allows for other expenses, such as minimum payments on student loans or credit cards, as long as the tax liability, including penalty and interest, can be full paid in six years.

The No Lapse Rule Under IRC Sec 7701(b)(2)(B)(iii) if after departing and terminating U.S. tax residency in one calendar tax year, a nonresident alien returns to the U.S. and resumes U.S. tax residency (under SPT) at any time during the subsequent calendar tax year, the intervening period between non-residency and

How to fill out Form W-2Box A: Employee's Social Security number.Box B: Employer Identification Number (EIN)Box C: Employer's name, address, and ZIP code.Box D:Boxes E and F: Employee's name, address, and ZIP code.Box 1: Wages, tips, other compensation.Box 2: Federal income tax withheld.Box 3: Social Security wages.More items...?

Employers must file Form W-2, the IRS Wage and Tax Statement, for each employee who receives at least $600 in wages from your business, even if you did not withhold any income, Medicare or Social Security tax, though you would have had to withhold income tax if an employee did not claim an exemption from withholding on