Virgin Islands Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company

Category:

State:

Multi-State

Control #:

US-214LLC

Format:

Word;

Rich Text

Instant download

Description

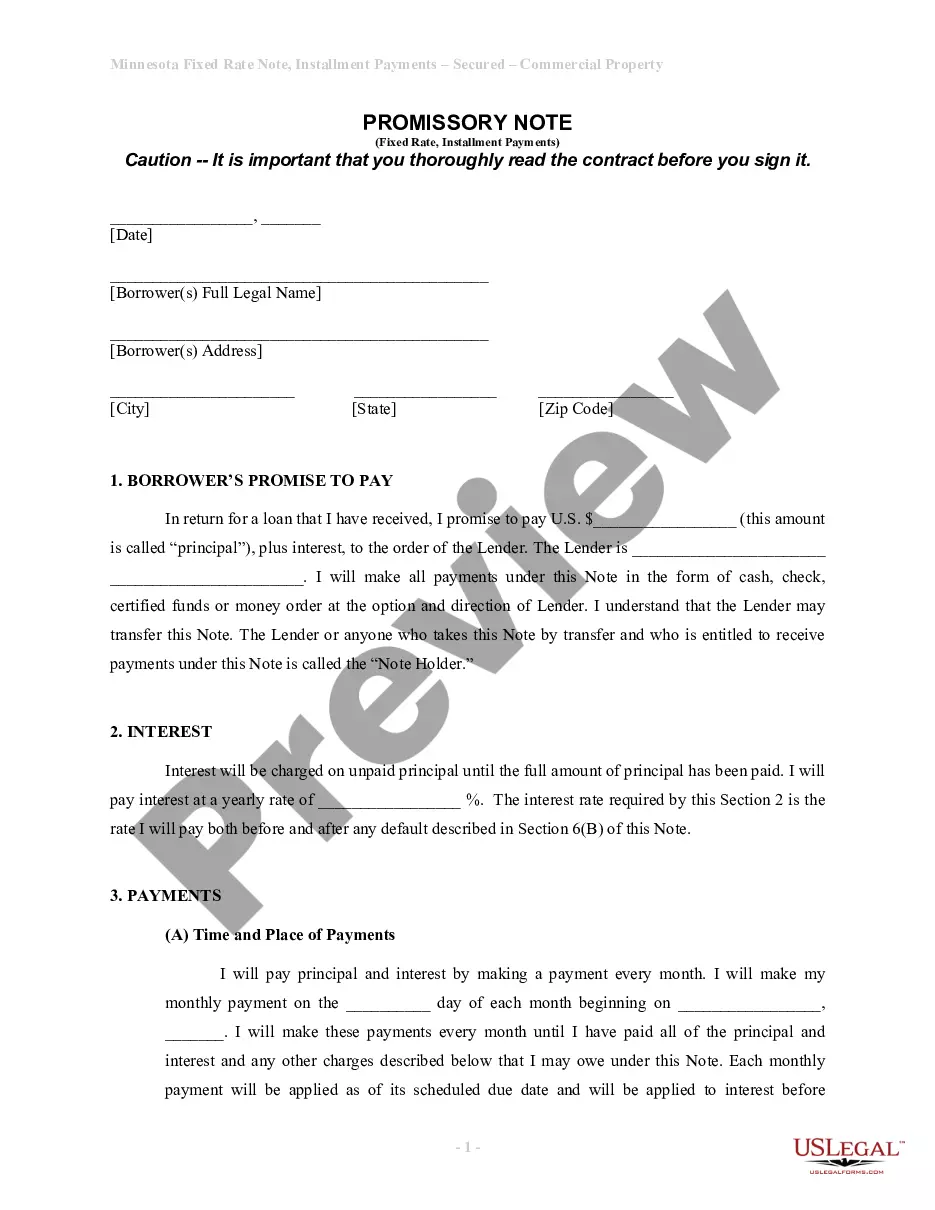

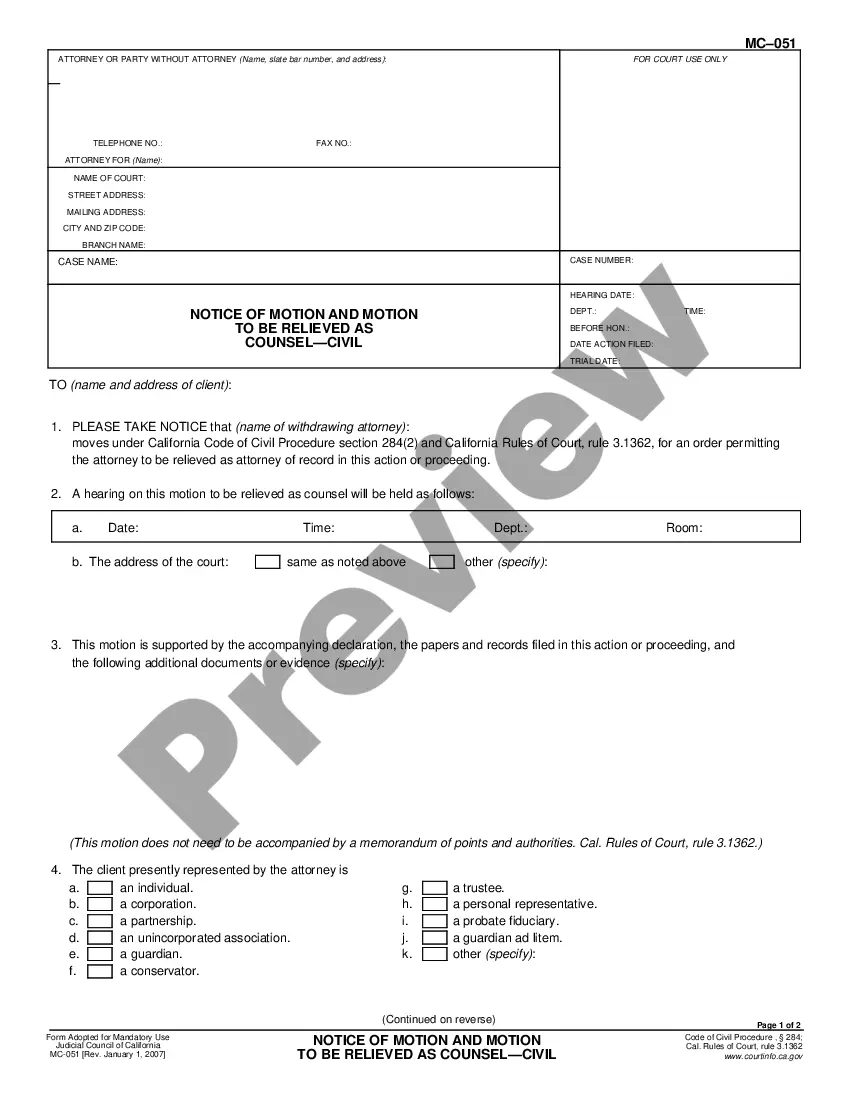

This form is a Resolution of Meeting of LLC Members to specify the amount of annual dispusrements to members of the company.

How to fill out Resolution Of Meeting Of LLC Members To Specify Amount Of Annual Disbursements To Members Of The Company?

It is feasible to spend hours online searching for the official document template that satisfies the federal and state requirements you need.

US Legal Forms provides thousands of legal templates that are verified by experts.

You can download or print the Virgin Islands Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company from this service.

If available, utilize the Preview button to review the document template as well.

- If you already have a US Legal Forms account, you can Log In and click the Download button.

- Then, you can complete, modify, print, or sign the Virgin Islands Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company.

- Each legal document template you acquire is your personal property indefinitely.

- To retrieve another version of any purchased form, navigate to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms site for the first time, follow the simple steps below.

- First, ensure that you have selected the correct document template for the region/city of your choice.

- Review the form summary to confirm that you have chosen the appropriate template.