Virgin Islands Assignment of Profits of Business

Description

How to fill out Assignment Of Profits Of Business?

Are you presently in the situation where you require documents for some organization or individual that you utilze nearly every day.

There are numerous legal document templates accessible online, but finding reliable versions isn't straightforward.

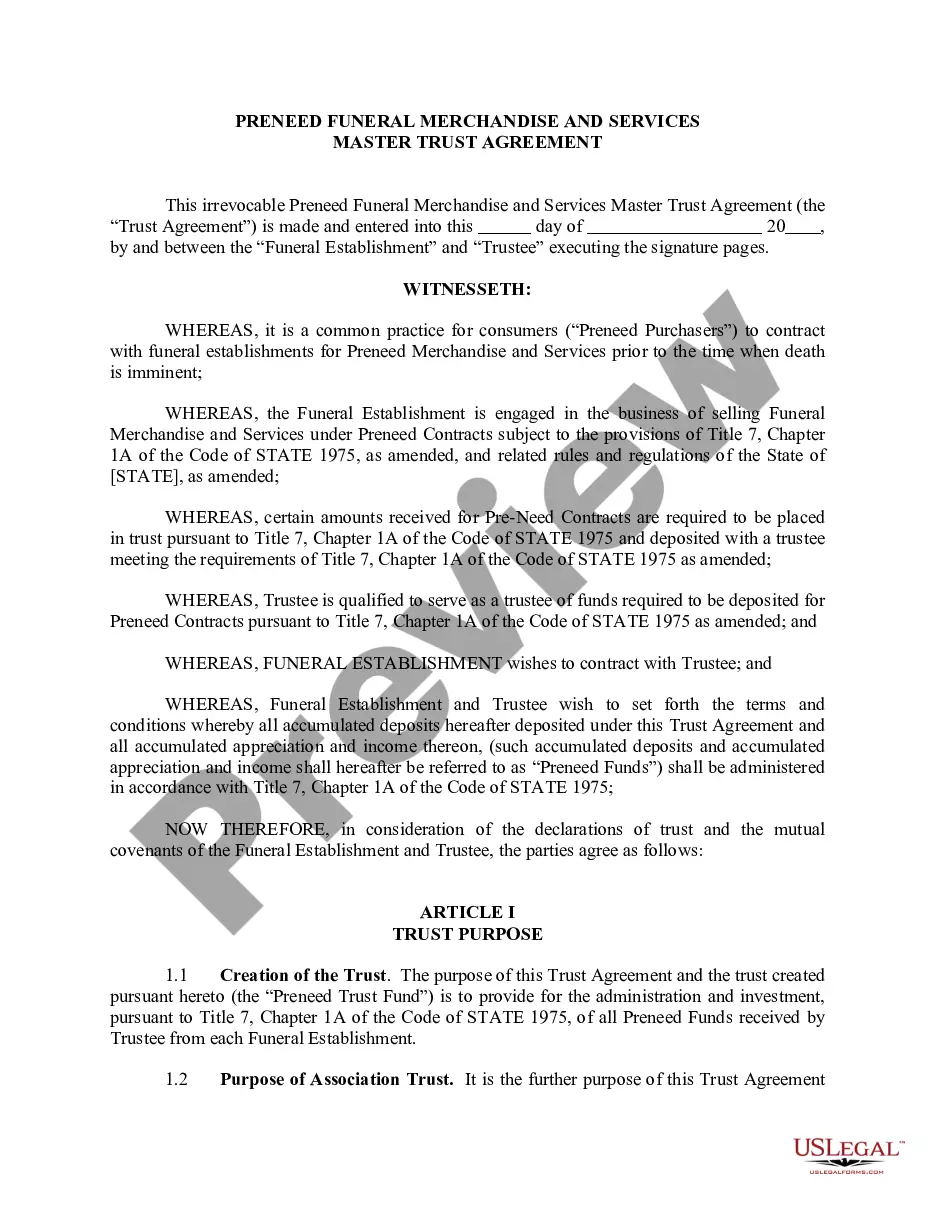

US Legal Forms offers thousands of form templates, including the Virgin Islands Assignment of Profits of Business, which is designed to meet state and federal requirements.

Once you find the correct form, click on Purchase now.

Select the payment plan you want, provide the necessary details to create your account, and pay for the order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Virgin Islands Assignment of Profits of Business template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/state.

- Utilize the Preview feature to review the form.

- Check the details to confirm that you have selected the correct form.

- If the form isn’t what you’re looking for, use the Search field to find the form that meets your needs and requirements.

Form popularity

FAQ

BVI companies are listed on the World's leading international stock exchanges. They are recognised as efficient, tax neutral vehicles, for use accessing international capital in financial centres from London and New York to Singapore and Hong Kong.

Company law in the BVI is designed to provide maximum flexibility; companies are permitted to undertake any lawful act or activity, and there are no corporate benefit restrictions. Further, the BVI does not impose capitalisation rules or impose any general maintenance of capital requirements.

A BVI Business Company may be incorporated as a company limited by shares, a company limited by guarantee (with or without authorisation to issue shares), an unlimited company (with or without authorisation to issue shares), a segregated portfolio company and a restricted purpose company.

Tourism, trade, and other services are the primary economic activities, accounting for nearly 60% of the Virgin Island's GDP and about half of total civilian employment. The islands host nearly 3 million tourists per year, mostly from visiting cruise ships. The islands are vulnerable to damage from storms.

Ideal Benefits and Incentives. Benefits for businesses in the EDC program can include up to 90% reduction in corporate income tax, 90% reduction in personal income tax, and 100% exemption on business property tax. Goods manufactured in the Virgin Islands may gain duty-free, quota-free entry into the United States.

The U.S. Virgin Islands uses a mirror system of taxation, also known as the Mirror Code, meaning that USVI taxpayers pay taxes to the Virgin Islands Bureau of Internal Revenue ("BIR") generally to the same extent as U.S. taxpayers would under the Code to the U.S. Internal Revenue Service.

The main advantages are: (a) total absence or minimum levels of taxation; (b) confidentiality, due to no sensitive personal information available on public file; (c) corporate flexibility: no paid-up capital requirements, no requirement to state operational objects, minimum conditions on directors and shareholders,

Economy. The U.S. Virgin Islands economy is based primarily on tourism and other services. The leading sectors in employment are government service; trade, encompassing personal, business, and domestic services including tourism; manufacturing; and finance, real estate, and insurance.

Tourism. The tourism industry is the main industry, generating a substantial portion of the GDP and much of the islands' employment. Nearly 3 million tourists per year visit (2013 data), most arriving on cruise ships. Some 93 percent of tourists are from other areas of the US.

Tax year and filing requirements There is no requirement for BVI companies to submit a tax return since there is no corporation tax in the BVI.