Virgin Islands Charitable Pledge Agreement - Gift to University to Establish Scholarship Fund

Description

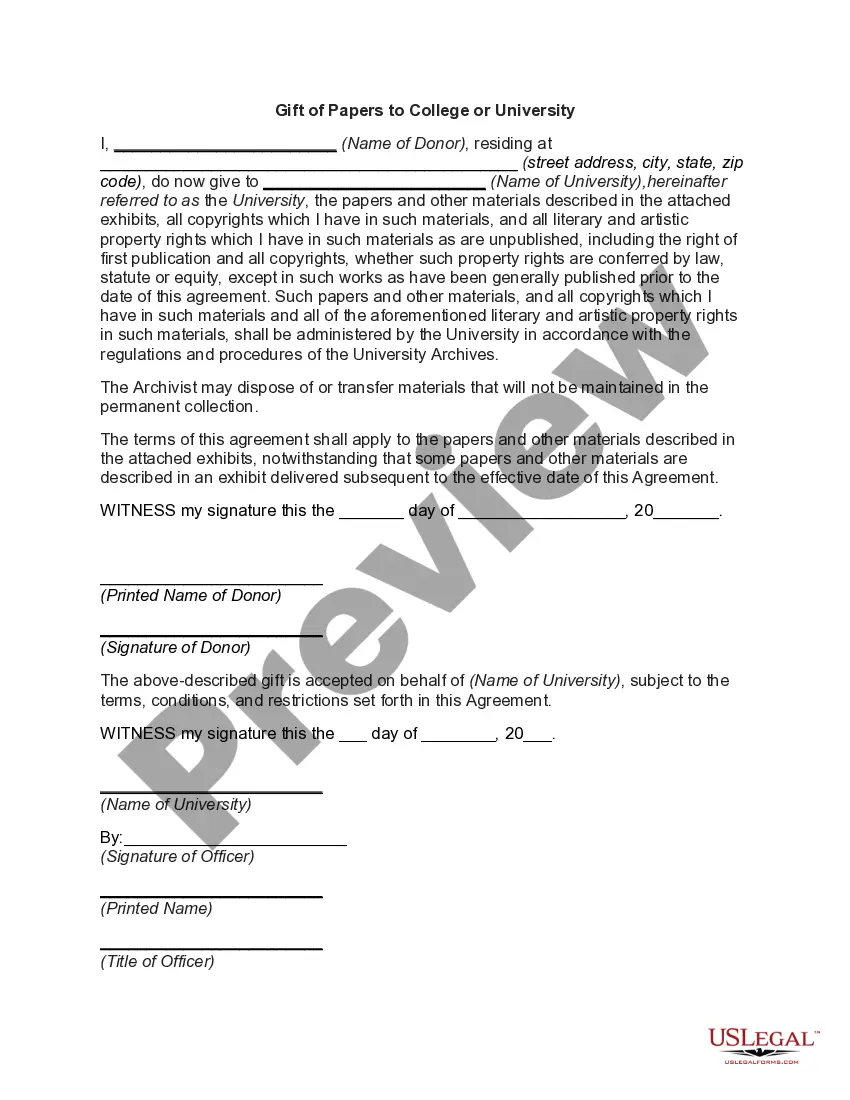

How to fill out Charitable Pledge Agreement - Gift To University To Establish Scholarship Fund?

Selecting the appropriate authorized document template may be challenging. Clearly, there exists a multitude of designs accessible online, but how can you find the official form you require? Utilize the US Legal Forms website.

The service offers countless templates, such as the Virgin Islands Charitable Pledge Agreement - Gift to University to Establish Scholarship Fund, which can be used for business and personal needs. Each of the forms is vetted by experts and complies with state and federal regulations.

If you are already registered, Log In to your account and click the Download button to acquire the Virgin Islands Charitable Pledge Agreement - Gift to University to Establish Scholarship Fund. Use your account to browse the legal forms you have previously purchased.

Choose the pricing plan you want and enter the required information. Create your account and pay for your order using your PayPal account or credit card. Select the file format and download the legal document template to your device. Complete, edit, and print and sign the received Virgin Islands Charitable Pledge Agreement - Gift to University to Establish Scholarship Fund. US Legal Forms is the largest repository of legal forms where you can access various document templates. Utilize the service to obtain professionally crafted documents that meet state requirements.

- Navigate to the My documents section of your account and retrieve another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps for you to follow.

- First, ensure you have selected the correct form for your locality/region. You can review the form by using the Review option and reading the form description to confirm this is indeed the right one for you.

- If the form does not meet your specifications, use the Search area to find the appropriate document.

- Once you are confident that the form is correct, click on the Get now button to acquire the form.

Form popularity

FAQ

Pledge agreements can be legally binding, depending on their content and local laws. The Virgin Islands Charitable Pledge Agreement - Gift to University to Establish Scholarship Fund typically outlines specific terms and conditions, making it enforceable in many situations. However, it is wise for donors to consult with legal professionals to understand the implications of their agreements fully.

A pledge agreement serves to formalize a donor's commitment to provide financial support over a specified period. In the context of the Virgin Islands Charitable Pledge Agreement - Gift to University to Establish Scholarship Fund, this document ensures that the terms of your contribution are clear and respected. It builds trust between the donor and the institution while also outlining the intended use of the funds, thereby enhancing accountability.

University scholarships are often funded by a combination of private donations, government grants, and institutional resources. Donors, including alumni and community leaders, can make a substantial impact by establishing scholarships through mechanisms like the Virgin Islands Charitable Pledge Agreement - Gift to University to Establish Scholarship Fund. This arrangement allows contributors to support students directly, facilitating their education and future success.

Starting your own scholarship fund involves several steps, beginning with determining the funding source and scholarship criteria. Utilize the Virgin Islands Charitable Pledge Agreement - Gift to University to Establish Scholarship Fund to formalize your commitment and ensure legal compliance. Partnering with an established university can streamline the process and provide valuable resources. Be sure to promote your scholarship fund to reach deserving students and make a meaningful impact in their educational journeys.

A charitable pledge agreement is a formal commitment to donate a specified sum to a charitable purpose, such as establishing a scholarship fund. In the context of a Virgin Islands Charitable Pledge Agreement - Gift to University to Establish Scholarship Fund, this document outlines how your contributions will be used to support education. It ensures transparency and accountability, benefiting both the donor and the recipient organization. Using this agreement safeguards your philanthropic intentions and aligns them with the needs of the community.

The IRS has specific rules governing scholarship programs, particularly concerning tax-exempt status and eligible expenses. Under the Virgin Islands Charitable Pledge Agreement - Gift to University to Establish Scholarship Fund, your contributions can qualify for tax deductions as long as they serve educational purposes. It's crucial to ensure that scholarships are awarded based on merit or financial need, fulfilling regulations for eligibility. Consulting with a tax advisor can help you navigate these rules properly.

Setting up a charitable scholarship fund begins with defining your goals and the criteria for awarding scholarships. You can use a Virgin Islands Charitable Pledge Agreement - Gift to University to Establish Scholarship Fund to ensure your donations meet IRS guidelines and benefit eligible students. Additionally, consider partnering with a reputable university to manage the fund effectively. This collaboration can enhance the impact of your scholarship and ensure a smooth process.