Virgin Islands Software as a Service Subscription Agreement

Description

How to fill out Software As A Service Subscription Agreement?

If you wish to be thorough, secure, or obtaining legal document templates, utilize US Legal Forms, the foremost collection of legal documents, accessible on the web.

Employ the site's straightforward and user-friendly search to locate the forms you need.

A variety of templates for business and personal purposes are organized by categories and states, or keywords.

Every legal document template you acquire is yours for a long time.

You will have access to every form you downloaded within your account. Navigate to the My documents section and select a form to print or download again.

- Use US Legal Forms to access the Virgin Islands Software as a Service Subscription Agreement with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to obtain the Virgin Islands Software as a Service Subscription Agreement.

- You can also access forms you previously downloaded in the My documents section of your account.

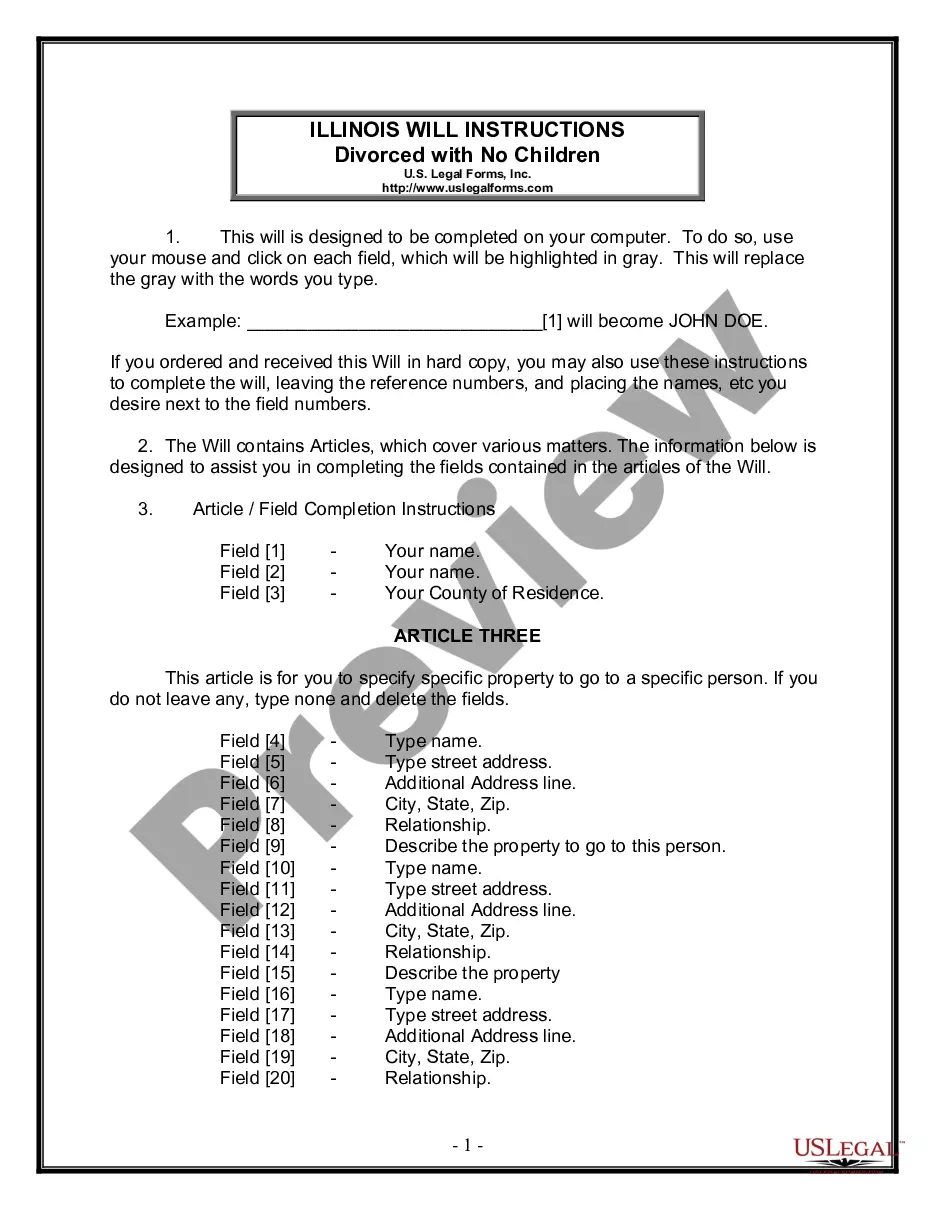

- If you are using US Legal Forms for the first time, follow the instructions outlined below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Utilize the Review option to examine the content of the form. Make sure to read the description.

- Step 3. If you are not satisfied with the type, use the Search field at the top of the screen to find other variations in the legal document template.

- Step 4. Once you have located the form you require, click on the Purchase now button. Choose the pricing plan you prefer and enter your details to register for an account.

- Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction.

- Step 6. Select the format of the legal document and download it onto your device.

- Step 7. Complete, modify, and print or sign the Virgin Islands Software as a Service Subscription Agreement.

Form popularity

FAQ

Share purchase agreement (SPA) a legally binding agreement. This agreement is important as it contains all the terms and conditions relevant to the sale. A company executes a Share subscription agreement (SSA) in case of a fresh issue of shares.

A subscription agreement is an agreement that defines the terms for a party's investment into a private placement offering or a limited partnership (LP). Rules for subscription agreements are generally defined in SEC Rule 506(b) and 506(c) of Regulation D.

A Share Subscription Agreement (SSA) as the name indicates is related to subscription of new shares of the company by a set of existing or new shareholders. Points to note: SSA is executed when a company is raising an investment from investors in lieu of shares issued by the company to the investors.

The major difference between a Share purchase agreement and a share subscription agreement is that in a Share purchase agreement the consideration is credited into the account of the seller of the share (who is generally an investor or promoter of the company) who wants to sell his stake in the company.

Contents of this subscription agreement It is a private document which is not provided to the Companies and Intellectual Property Commission (CIPC). This document sets out the new shares that must be issued to the series seed shareholders.

A shareholders' agreement (sometimes referred to in the U.S. as a stockholders' agreement) (SHA) is an agreement amongst the shareholders or members of a company. In practical effect, it is analogous to a partnership agreement.

Subscribed share capital refers to any capital raised through subscribed shares. Put simply, it's the value of all the shares that investors agree to purchase during a new issuance. Subscribed shares are a certain amount of stock that investors promise to purchase during an offering, usually through an IPO.

A company executes a Share subscription agreement (SSA) in case of a fresh issue of shares. A shareholders' agreement (SHA) is a contract that contains the rights and obligations of the shareholders in a company.

A subscription is a type of contract, and, therefore, the remedies for its breach are the same as those for breach of contract and include damages and SPECIFIC PERFORMANCE.

A subscription line, also called a credit facility, is a loan taken out mostly by closed-end private market funds, in particular by private equity funds. The loan is secured against a fund's investors' commitments, generally without recourse to the actual underlying investments in the fund.